Harry here. A lot of drivers have different reasons for driving, but one thing that Uber and Lyft can be great for is paying off debt. Today, Senior RSG Contributor Christian Perea shares some tips and resources on how he uses rideshare income to tackle credit card and student loan debt.

Most Uber drivers have debt in one form or another. In fact, the median household has $2,300 in debt. But nobody wants debt. So how do we get rid of debt while driving for rideshare?

Even though none of us will really get rich driving for companies like Uber or Lyft, I still think there are plenty of opportunities and strategies to pay down some or even all of your debt. This is especially true if you use the on-demand economy to supplement your income on top of a full time job; it’s a little bit like getting extra credit each week. If you are a full-time driver, it can be tougher because you are likely already doing a lot to make the most money on Uber, but at least you still have the option to work as many more hours as you’d like.

I Paid Off My Credit Cards Using Uber and Lyft in 2015

In January of 2015, I was a full-time Lyft and Uber driver. Uber had just cut prices (again) and I was feeling pretty demoralized.

I also happened to be at a point where I had maxed out my credit cards. After working a low-paying (but fulfilling) job for two years, I had $4,000 in credit card debt. I have never been a big fan of carrying debt, even if it’s a low interest student loan. Since the credit cards had the highest interest rate (16%+) they were first in line to get paid down.

So I decided I would start setting aside $100 or $200 a week to pay off my credit cards as I drove for Uber. I figured ANYTHING was better than nothing. So even if it’s just $20 a week, give it a shot and see how good it can feel.

It may sound strange, but by the third week I felt a lot better about the situation and it really motivated me to go further. I began really examining my expenses, packing a lunch, and making sure that I drove efficiently. By the end of the month I was sending an extra $500 a week with ease.

It also helped that I had no social life at the time to distract me since I was driving full-time with the mission of shaping up my finances. Sometimes you have to make sacrifices to pay off debt, but they will be worth it.

Starting Small

The challenge of paying off your debt can seem daunting at first. Perhaps even anxiety-racking. So where do you start?

If you pop onto any personal finance blog or forum, there will be a lot of opinions on what you should do to get started. Most say you should build an emergency fund. Some say you should attack high interest debt first. Regardless of what people say, you should just do something. Even if it’s small at first. Anything is better than nothing.

I needed a victory so I picked what annoyed me the most AND what was costing me the most: credit cards.

Build An Accurate Picture Of Your Finances

Once I started making progress on the credit cards I found myself a little more obsessed with going further. I had student loans from college, a car that I had financed as a driver at $25,000, and a few other smaller credit lines. So there was obviously still a long way to go. This required me to outline my finances and get a high level view.

I used Personal Capital and my credit card’s ‘free credit score feature’ to link all of my accounts and see where I was. I saw that my credit score had recovered a lot from lowering my credit card debt, since it was no longer at 100% utilization. Personal Capital ended up being really important because it allowed me to get a high level view of my net worth so I could track my progress and see what I needed to prioritize.

Prioritize Your Debt By Interest Rate

Every debt is different. I suggest prioritizing your debt based off whatever has the highest interest rate and tackling it in that order, especially if you have credit lines that are above 10% APR. For me that started with credit cards, but it could be different for you. What is important though is realizing that simply making the minimum payment will result in you paying a lot more in interest over the life of the loan.

Bookmark All Of The Pages For Your Debt

Every finance company has its own page that you use to pay them. Often all of the different pages, passwords, usernames, etc. can make it annoying to go and check that a payment was received or to see how much in interest you are paying. Make it easier to keep track of your progress by putting all of them into a single bookmark/folder, or sign up for a service like Personal Capital that will aggregate the info for you. You’ll still have to log on to make extra payments.

Increase Your Car Payment by 30%

If you buy a new car for Uber or Lyft, you will quickly find that the value of your car will depreciate much faster than you can pay it off. This especially rings true for drivers who got a new car under less than ideal credit conditions. If your car loan has a high interest rate, you might even want to consider making it your number one priority to pay off because you don’t want to end up with a useless car that you still owe $10,000 on at 16% interest. In most cases you will want to pay your minimum payment as one payment, and then have the rest applied to the “principle” only of the loan.

If you lease your car through Xchange or another provider then this might not apply to you. However, it’s still pretty smart to save as quickly as possible for a cheap car that you will own. The point is, you should be doing something about that depreciation factor before it’s too late. I always send an extra 30% towards my car loan every month. When the balance was higher, I actually would send more. This has prevented me from being underwater on my car.

Refinance Your Car Once Your Credit Doesn’t Suck

A lot of drivers desperately got into a car loan at 10%, 15%, 20% or more interest. These loans are going to make your life miserable if they are not doing so already. As soon as your credit is good and you have managed to pay off enough PRINCIPLE from that high interest auto loan, you should refinance at a lower rate ASAP!

Increasing Your Rideshare Income

If you already have a full-time job that pays the bills, then driving for Uber and Lyft is a little bit like earning extra credit. If you are a full-time driver it can be a lot harder to increase your income because you are probably already working during the best hours.

Have Discipline/Put in The Hours

There were times I would spend half of the week sleeping in and missing the morning rush. Other times I would just be burned out or discouraged after driving for a few hours and only making $30 when it was slow. The thing is, if you stay disciplined and work the hours you commit to, then you will always make more money.

Diversify Platforms

If it’s slow out there you should always be able to run multiple platforms. It also helps to work each platform against each other based on their promotions or hourly guarantees.

Related Article: Latest Sign-up Bonuses

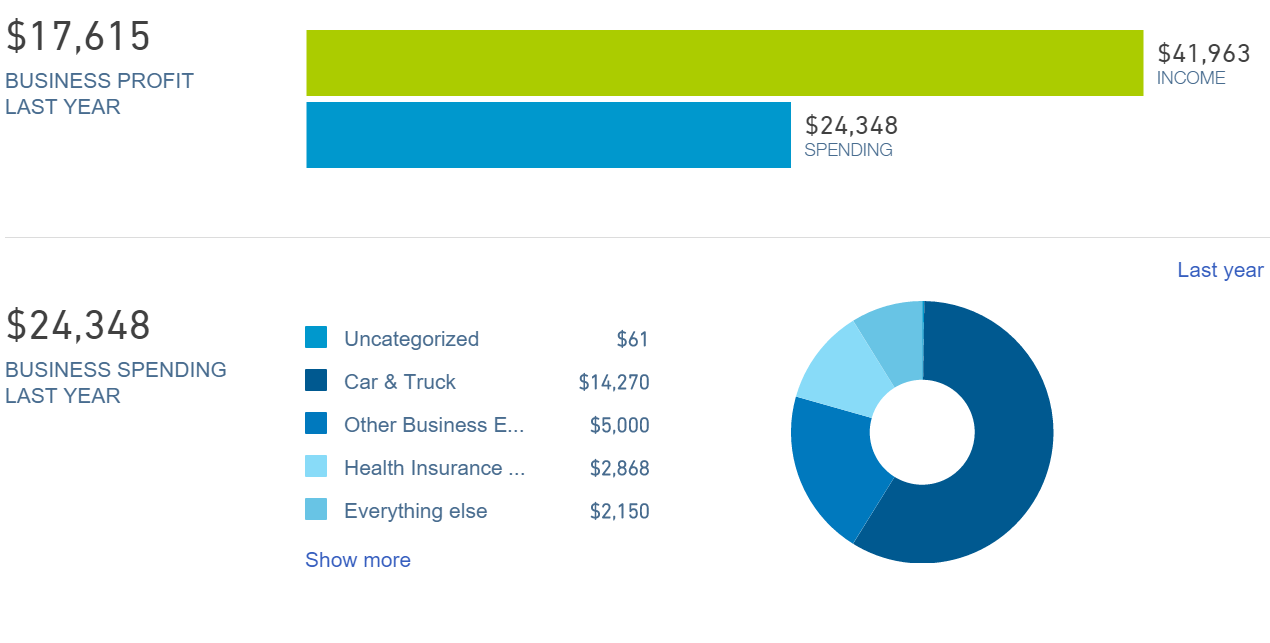

Figure Out Your Profit and Loss As A Driver Using QuickBooks Self-Employed

You can also use a product like QuickBooks Self-Employed to figure out your profit and loss as a driver. It will help you identify where you can spend less throughout the week as a driver since you will be tracking your expenses as they occur. You can run custom reports on your expenses, income, take pictures of receipts in real-time, track your mileage, and then have it all ready for your Schedule C during tax time.

Tracking your operational costs is an important part of driving for Uber or Lyft since if you don’t know your expenses, you don’t know how much money you are making. End of story.

An Entire Guide To Tracking Your Rideshare Expenses: HERE

Lowering Your Rideshare Expenses

Many drivers think they can simply “drive more” next week to pay their bills. This is a dangerous pitfall that many make. The concept of driving 70 hours a week for 4 weeks to get ahead is unrealistic for everyone. Further, I have witnessed the drivers who spend that much time on the road end up really encountering a lot of trouble in their personal lives, mental health, physical fitness, and overall happiness. Maybe you have tried it before and failed. The good news is that you can eliminate a lot of your driver expenses simply by accurately recording and analyzing them.

When you spend 70 hours a week logged in, you will get into an accident within 3 months. Now all of that hard work was for nothing.

Eliminate $200 in Expenses

I found that I was spending about $300 a month at 7-11! Even worse, I knew it was bad every time I went in there for my energy drinks and a protein bar but would easily say to myself “just today”. Well apparently all of those “today’s” added up to $300 a month (sometimes more).

When we have been driving for 8 to 10 hours, it may seem really tempting to go with the path of convenience and hit the drive-thru or spring for a meal out in the city. It may not seem like much each day, but it really adds up at the end of the month.

Pack a Lunch

This relates to what I mentioned above. I was eating out a ton, and every time I did it another $10 would disappear from my bank account. I did this twice a day on average. I was making between $150-$250 a day, so it didn’t seem like a big deal at the time. However $20 a day multiplied by 30 days is an extra $500 you can spend on eliminating debt while also eating healthier.

There is even a multiplier effect with packing a lunch, because if you eat better, you will have more energy on the road.

Minimize Tax Liability

Generally, businesses (FYI, you are a business if you drive for a rideshare service) only pay taxes on the profit that they earn. The less profit you make, the less in taxes you will likely pay.

This breaks down yet again to tracking your mileage and expenses as a rideshare driver. If you track all of your mileage and expenses correctly, you can avoid paying a lot more in taxes at the end of the year on your rideshare income. This of course helps you pay down more debt because you won’t have to mail a check to Uncle Sam next April for 1/3rd of your Uber fares when receive their 1099.

The Result

In the end you will have better credit and lower your expenses by getting rid of a big chunk or all of the debt you have to repay. It might not come next week, but it can still get there. Remember that every time you are paying off some of your debt, you are saving yourself a lot of money in future interest payments and shortening the time it will take to get you to a life of freedom and tremendously less stress.

Readers, what do you think of paying down your debt by driving for rideshare or other delivery companies?

-Christian @ RSG

Save

Save

Save