At The RideShare Guy, we teach you the best times to drive, how to earn bigger tips, and how to avoid rookie mistakes.

You might be asking yourself the following questions about Uber pay:

- How much does Uber pay?

- How much do Uber drivers make on a single ride?

- How much do you make as an Uber driver overall?

In this article, we’ll answer all of those questions and more!

How Much Does Uber Pay?

In our experience, you can earn up to $50 per hour with Uber depending on your location and strategies. Many Uber drivers make between $15 and $25 per hour.

The difference between a typical earner and a higher earner comes down to how the driver takes advantage of Uber’s driving promotions. The other important factor is the city or town where you’re driving.

Drivers in our audience often share their earnings. Here are two representative examples from 2022:

Tayshawn Price: “I drive full time and I average about $25 dollars an hour.”

Ed Booth: “Part-time weekend driver here. 5 years experience in the Boston market. I’ve been tracking on spreadsheets since the beginning of the year and my current average for the whole year is $42.24/hr.”

Driving on Uber’s platform is certainly one of the best gig jobs.

Related:

Uber New Driver Guaranteed Earnings

Uber’s new driver-guaranteed earnings are super simple. Sign up to drive with Uber, and complete the number of required trips within the time period and location stated (you’ll see it in your Uber driver app).

You’ll be paid the difference if you earn less than your guarantee for your first trip. Tips don’t count toward your guaranteed earnings – those are extra and you get to keep them!

Here are 3 examples of how guaranteed earnings work along with current rates (as of June 2022):

- Earn at least $2,680 in Boston when you complete 200 trips or deliveries.

- Earn at least $2,400 in Nashville when you complete 200 trips or deliveries.

- Earn at least $1,940 in Miami when you complete 200 trips or deliveries.

How Is Uber Pay Calculated?

Before passengers request a ride, they are quoted an upfront price, and your pay is based on the mileage and time it takes to get from the pick-up point to the destination.

Let’s say a passenger takes a ride from Santa Monica, CA to LAX and the ride takes 30 minutes and comes out to 8.9 miles. In order to calculate your payout, we’ll need the current rates in Los Angeles, which are $0.28/minute and $0.80/mile.

Additionally, there’s a $4.14 marketplace fee (this amount is different for every city) the passenger pays that goes straight to Uber and estimated surcharges of $4.85. So the cost to the passenger looks like this:

- $6.50 minimum fare

- $8.40 = 30 mins. X $0.28/min

- $7.12 = 8.9 miles x $0.80/mile

- $4.85 = estimated surcharges

- $4.14 = Marketplace Fee

The total fare paid by the passenger for this ride will be $24.51. But the driver will receive a different amount. In order to calculate the driver’s cut, we need to subtract the marketplace fee ($4.14) and Uber’s commission (around 25%).

- $20.37 = $24.51 – $4.14 (Driver’s Gross Pay)

- $5.09 = 25% x $20.37 (Uber’s commission)

- $15.28 = $20.37 – $5.09 (Driver’s Net Pay for this ride)

As you can see, the Uber passenger paid $24.51 for this ride, but the driver ends up with a payout of $15.28 for about 30 minutes of work.

Uber Upfront Pricing

Upfront pricing has been the new norm for earnings for drivers in California since 2019, and Uber announced in 2022 that they are rolling out this feature in other markets as well.

With upfront pricing, drivers will start seeing what the estimated fare will be as well as pick up and drop off locations, which have previously been undisclosed to drivers before acceptance. Also with this change, fares will be based on the base fare, time, and distance rates, along with real-time demand. Essentially, upfront pricing decouples the price drivers are paid from what the passenger pays.

Because of these changes, it’s also going to give drivers different priorities while on the road. With upfront pricing, Uber is also “rebalancing” the rates, making shorter rides more profitable and longer rides less so.

If you’re in a smaller market, you will tend to have longer rides with longer pickup times than those in larger markets. So, this rebalancing may hurt some drivers and help others. However, you’ll need to test out your market at different times of day or night to see what times and locations are best for you.

Related:

- Uber Announces UPFRONT PRICING For DRIVERS And Pay Changes!!

- My Experience with Uber’s UPFRONT PRICING for Uber Drivers in Minneapolis

What About Uber Surge Pricing?

As a driver, Uber surge pricing is your new best friend. Surge pricing happens when there is high passenger demand and low driver supply. During busy times like Friday and Saturday nights and commuting hours, you will typically see a red surge on the map.

Any ride you give on surge will have a surge multiplier, and you’ll receive the surge amount multiplied by the regular fare. So if we look at the ride from above and add a 2.0x surge multiplier, what happens to the driver payout?

- $21.12 = $10.56 x 2.0 surge multiplier

As you can see, the driver’s income doubled in this example, but the driver doesn’t have to do any additional work. Fortunately, a 2.0x surge is pretty common during busy times.

Average Uber Driver Pay Rates

Below is a breakdown of Uber drivers average pay rates:

How Much Money Do Uber Drivers Make Per Hour?

In the majority of markets, on average, most Uber drivers will make in the $15-$20/hr range.

According to research done by Uber, they’ve found Uber driver pay is around $19 per hour. Average Uber pay is around $30 in markets like NYC and Los Angeles, with NYC Uber drivers making around $30 per hour, and drivers in LA making around $28-32 an hour.

The goal of an Uber driver is to always be moving with a passenger in the car, but that doesn’t always happen. There are times when you won’t be making any money, including the following:

- Waiting for a ride request.

- Driving to pick up a passenger.

- Waiting at the pick-up point for your passenger to come outside.

In our experience, you can earn up to $50 per hour with Uber depending on your location and strategies. While many Uber drivers make between $15 and $25 per hour, the difference between a typical earner and a higher earner comes down to how the driver takes advantage of Uber’s driving promotions. The other important factor is the city or town where you’re driving.

How Much Do Uber Drivers Get Paid in a Week?

According to the drivers we’ve surveyed, a majority of them work 10 hours a week and make around $200-$300/week.

Most full-time drivers are earning around $600-$800/week but I know many drivers who routinely top out at $1,000/week (or more!) due to the many bonuses, guarantees, and promotions that Uber offers to incentivize drivers to hit the road.

So if you’re a brand new driver, not only will you receive a sign-up bonus for signing up to drive with Uber, but you could also earn promotional pay and further bonuses once you get started.

You can make more with Uber by driving at the right times.

How Much is an Uber Driver’s Salary Per Year?

We actually built a model of a full-time driver in Los Angeles and found the average full-time driver will earn just under $42,000 a year (gross earnings).

Can drivers earn $100,000 a year? It’s definitely possible! Check out our article on how you could potentially earn $100,000 or more as an Uber driver.

How Much Does Uber Pay Per Mile?

The answer to this question varies by market and has changed over the years.

From a self-reported list compiled on Reddit in 2021, it can range anywhere from $0.54/mile (Orlando, FL) to $1.55/mile (Pismo Beach, CA).

The entire list provided on Reddit averages $0.817 per mile. You can check your local rate card when you’ve signed up to drive.

How Much Do Uber Drivers Make Per Ride?

How much Uber drivers make per ride depends on a lot of factors, specifically how far the passenger wants to go. A single ride could pay as little as $2 if someone is going down the street, or $100+ if someone is driving across town in traffic.

In general, you’ll earn around $5 for a single Uber ride, but you could improve those numbers by driving strategically, taking advantage of incentives, and driving during the busiest times of the day.

That said, promotions can play a huge part in your Uber driver pay! Just take a look at this driver from Phoenix, who made over $4k, mainly thanks to promotions.

How Does Uber Pay?

Drivers are paid once a week, or they have the option of cashing out their earnings daily for a small fee.

But how is pay broken down for drivers?

Let’s say a passenger takes a ride from Santa Monica, CA to LAX and the ride takes 26 minutes and comes out to 8.5 miles. In order to calculate your payout, we’ll need the current rates in Los Angeles, which are $0.28/minute and $0.80/mile. Additionally, there’s a $3.00 marketplace fee (this amount is different for every city) the passenger pays that goes straight to Uber. So the cost to the passenger looks like this:

- $7.28 = 26 mins. X $0.28/min

- $6.80 = 8.5 miles x $0.80/mile

- $3.00 Booking Fee

The total fare paid by the passenger for this ride will be $17.08. But the driver will receive a different amount. In order to calculate the driver’s cut, we need to subtract the booking fee ($3.00) and Uber’s commission (around 25%).

- $14.08 = $17.08 – $3.00 (Driver’s Gross Pay)

- $3.52 = 25% x $14.08 (Uber’s commission)

- $10.56 = $14.08 – $3.52 (Driver’s Net Pay for this ride)

As you can see, the Uber passenger paid $17.08 for this ride, but the driver ends up with a payout of $10.56 for about 26 minutes of work.

However, Uber is also trying upfront pricing in several markets. The main takeaway is upfront pricing decouples the price drivers are paid from what the passenger pays.

Do Uber Drivers Get Paid Tips?

Yes, Uber drivers now get tips. Unfortunately, this is still not common according to most drivers we speak to.

Should you ask for tips? Drivers say you can – but do so at your own risk! Personally, I’ve found asking for tips does actually increase the number of people tipping.

However, other drivers have shared that some passengers get angry when you mention tipping, or they ‘promise’ to tip but never do.

Basically, you can hope for a tip but don’t expect one.

Uber Sign-Up Bonuses

When Uber first started, they offered sign-up bonuses to their drivers. Typically it was expected that the driver would complete a certain number of trips and a specified time period and they would get a bonus at the end.

Now, Uber offers guarantees. It’s a similar concept, but instead of receiving a set amount at the end of completing the trips, the driver gets a guaranteed amount. Let’s say the guaranteed amount was $1,000. If the driver only earned $800 by completing those trips, Uber would send them the difference of $200, giving the driver guaranteed earnings of $1,000.

How Much Are An Uber Driver’s Expenses?

Since Uber drivers are 1099 independent contractors, you are responsible for all of your own expenses. Fortunately, there aren’t a lot of costs to getting started and once you’re driving, taking care of your car will be your only real expense.

Drivers are responsible for gas and maintenance, and your biggest cost as a driver is going to be gas since you’re going to be driving a lot of miles.

Most new drivers are surprised at just how many miles they’ll put on their car, but to give you a good estimate, a full-time driver doing 40-50 hours a week will probably put 1,000 miles a week on their car.

That’s one of the reasons why you see so many Toyota Prius’ driving around, but you don’t have to drive a Prius in order to be a profitable driver. Any fuel-efficient 4-door sedan will work on UberX, and sometimes passengers enjoy not riding in a Prius.

To help, we broke down the best cars for rideshare drivers here.

Other Uber driver expenses include:

- Auto insurance

- Car lease/payment

- Tolls

- Repairs and maintenance

- Cell phone bill

- Car wash

- Parking and permits

Example of a Rideshare Driver’s Expenses

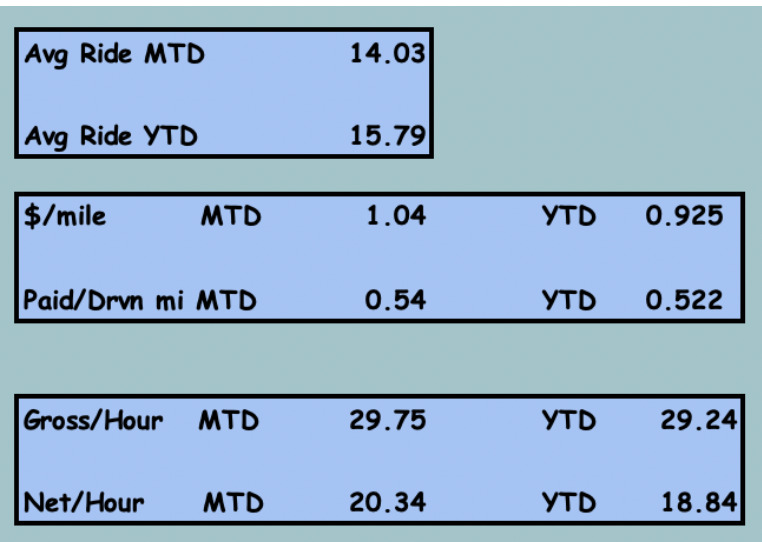

Kelly C. is a Philadelphia rideshare driver who has been tracking his income and expenses studiously for the past few years. Kelly actually created a detailed spreadsheet that helps him track everything from the number of rides he does and the time he spends online, to the mileage and how much the trip costs.

He fills in the spreadsheet weekly to come up with monthly summaries like this one below that includes how much each ride pays on average along with how much he makes per hour:

Kelly uses TripLog to track his mileage and Quicken to track his rideshare expenses then he adds this data to his spreadsheet.

“My biggest expenses is gas but I use GasBuddy which gives me a 5% credit at Sears which I use for oil changes and other non-complicated auto expenses. I work Wednesday through Sunday usually in the afternoon and use the destination filter at times.”

For more ways to save money at the pump, check out our top recommendations for the best gas apps to save you money.

In November 2019, Kelly earned a gross income of $4,909 by driving for Uber and Lyft. He drove 4,722 miles and his expenses included:

- Gas: $624

- Auto Maintenance/Services: $608

- Car: $110

- Materials and Supplies $18

- Taxes and Licenses: $40

- Other Business Expenses: $232

- Car Depreciation: $326

Does Uber Pay for Gas?

Historically, Uber has not paid for drivers’ gas costs. However, in March 2022, Uber announced it would temporarily levy a surcharge on passengers to help pay for drivers’ gas costs!

How much you’ll earn per ride varies per market (between 45 and 55 cents).

Learn more about Uber’s fuel surcharge:

⭐️ Never pay full price for gas again. Save up to 62¢ per gallon. Click here to download the Upside app. Use promo code RSG25 in the Upside app for an extra 25¢/gal signup bonus on your first fill-up. Combined with the savings in the app, you’ll save up to 62¢/gal!

How Much Does Uber Take from Drivers?

One somewhat complicated part of estimating an Uber driver’s potential earnings is Uber’s varying take rate. Uber doesn’t ‘just’ take 20-25% anymore, as the price between what the passenger pays and what the driver received is no longer coupled.

To find out what your take rate could be, here’s what you need to know:

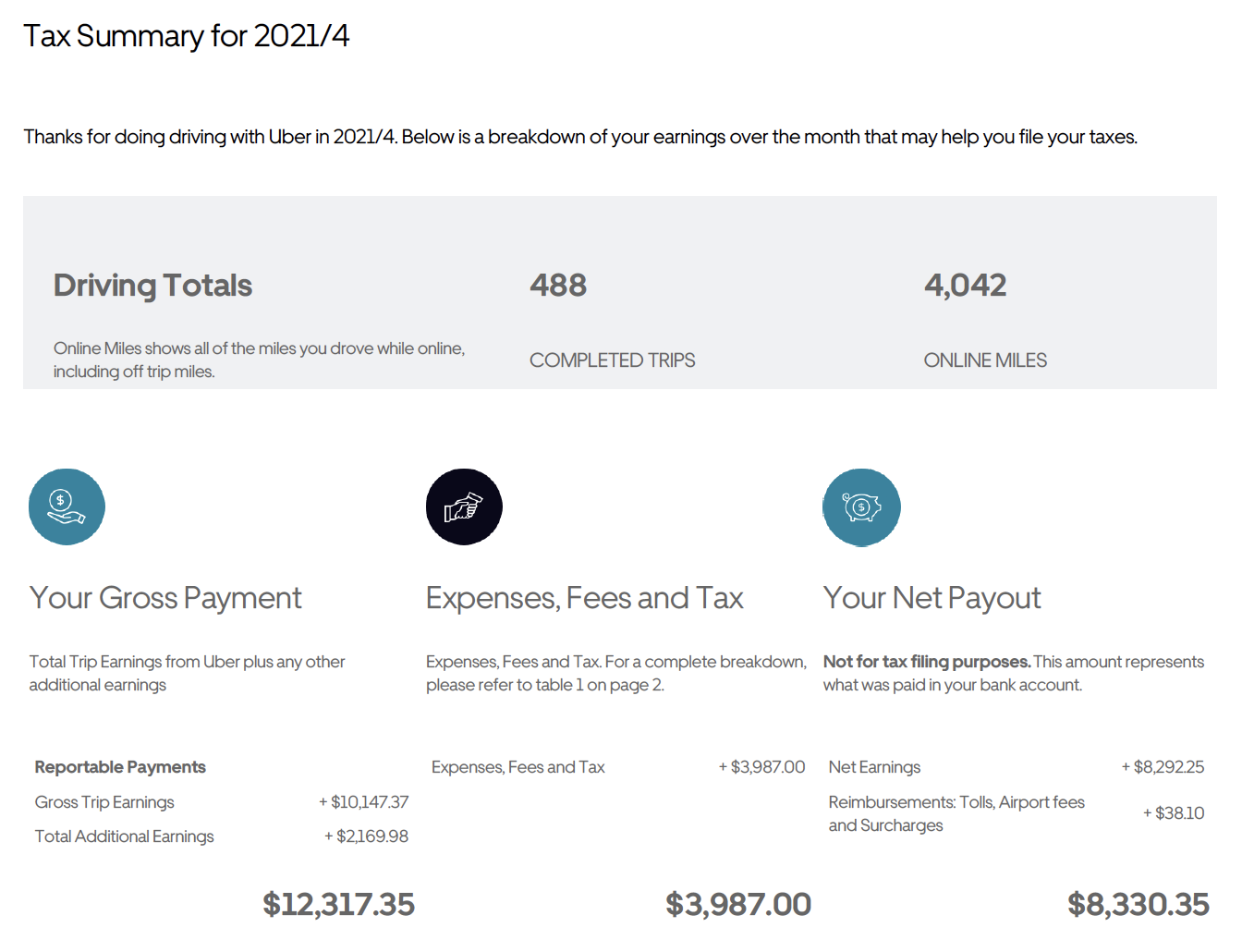

Each month you receive a monthly tax summary for what you’ve earned. It shows what your net income was, your gross income and the expenses (which includes Uber’s fees.) You also get the same thing at the end of the year that shows your totals for the year.

Here’s an example of what that summary will look like:

In this case, this is a tax summary for April 2021. To calculate the take rate, you take the Expenses, Fees, and Tax and divide that number by Your Gross Payment:

- $3,987 / $12,317.35 = 0.323 or 32.3%

For this RSG Reader, Uber took 32.3% of their earnings for the month of April. Keep in mind, it is not a “flat rate” that Uber will take. It will vary from ride to ride and from market to market. It also seems to depend on how long the ride is and how far you were from pickup.

If you don’t have access to your monthly tax summaries (you can find it in your Driver Dashboard), you can also calculate this information ride-over-ride.

For your individual rides, you’ll need to go into your earnings and click on the ride in question. Again, you’ll need two numbers: Paid to Uber and Customer Payments. The reason for this is because the “Customer Payments” is equivalent to Your Gross Earnings, or what you would have earned if Uber hadn’t taken their cut.

For example, on a minimum fare this driver recently completed:

- Paid to Uber = $4.57

- Customer Payments = $7.98

This calculation would be the same as above. You take Paid to Uber and divide that by Customer Payments. This would make Uber’s take rate 57.2%. While that seems awfully high, it all seems to average out over the long run to be much lower.

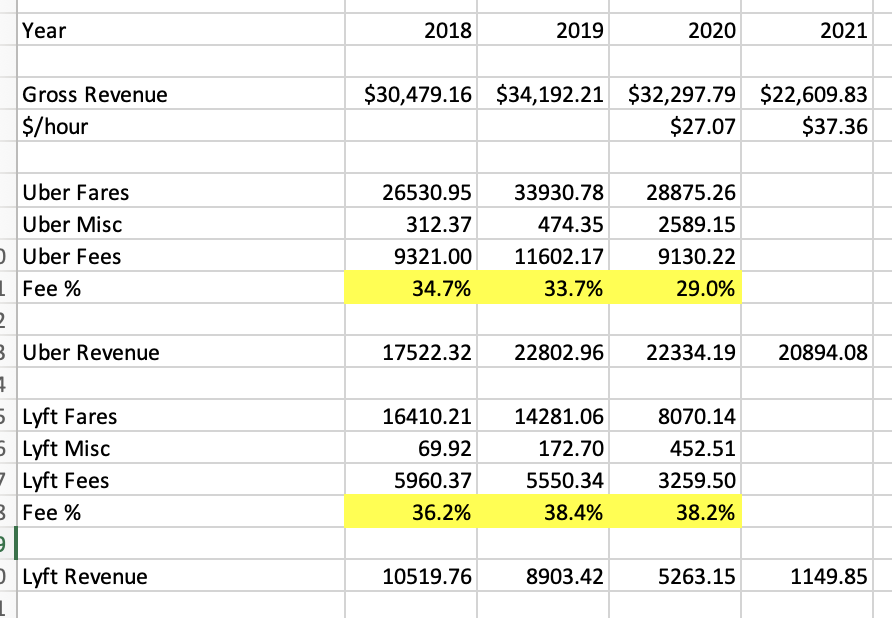

One RSG reader sent us information from their 2018, 2019 and 2020 tax summaries that show it’s been fairly consistent over the years, and was actually a little lower in 2020 than in the previous two years.

In fact, between Uber and Lyft, it seems like in their case, Lyft takes a larger portion overall.

This driver’s market is State College, PA, and they tend to do a lot of shorter trips.

How Much Uber Drivers Make in Major Cities

How much can you make with Uber? It depends on your city, but basically, the busier or more tourist-friendly your city is, the more chances you have for earnings.

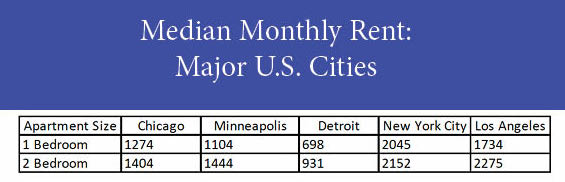

Something to keep in mind when looking at earnings by city is also the cost of living by city. Here’s a chart showing the cost of renting an apartment in a handful of major cities in the U.S. from 2022:

Source: Apartment List

If drivers are working full-time in any of these markets, the cost of living is an important factor in making sure they can earn enough to make a living and cover basic expenses.

How much an Uber driver can make in Chicago

Earn at least $2,660 in Chicago when you complete 200 trips or deliveries.

A study was conducted on the earnings of drivers in and around Chicago. As reported by Edward Ongweso Jr, from Vice, the study states that rideshare drivers are earning less than minimum wage when you take expenses and taxes into consideration.

Ongweso reported, “In 2019 the minimum wage was $13 an hour, but the average driver earned $12.30 an hour, according to the study. In 2020, the minimum wage was $14 an hour but drivers only earned $13.62.”

One Reddit user pointed out a flaw in the study. They said, “I don’t understand why they include taxes when calculating how much rideshare drivers make. Employees pay taxes too, but they never subtract those when deciding if an employee is making minimum wage!”

Some drivers on the thread found the numbers lower than they expected would be accurate, but they admittedly do not drive in the Chicago area.

One Chicago driver commented, “I drive in Chicago from time to time and the ONLY time I get 21.00 an hour is when I’m working Friday/Saturday nights when there isn’t a pandemic. No joke I can make 300 in 6-8 hours then but otherwise it is something like 9. The minimum wage in Chicago is $10, so anecdotally, it checks out but that is just my experience.”

How much an Uber driver can make in Los Angeles

Earn at least $2,480 in Los Angeles when you complete 200 trips or deliveries.

How much you can earn in Los Angeles partially depends on how dedicated you are as a driver as well as what strategies you put into practice.

On weekdays, a good early bird strategy is to be close to the hill that divides West L.A. from the San Fernando Valley by 5 am. If you catch an airport run, you can get back to West L.A. in time for the morning rush hour.

As with most markets, there are more airport runs on Mondays, Tuesdays, Fridays, and red-eye flight drop-offs and pick-ups are plentiful on Sunday evenings from LAX.

Of course, weekends are the most lucrative time to drive for either Lyft or Uber in Los Angeles. Early in the evening, you can catch rides from the San Fernando Valley, South L.A., or Silverlake, going to West L.A.

During busy hours, if you are a top driver, you can make $40 GROSS per hour driving Lyft and Uber in Los Angeles. However, it’s more reasonable to expect to make $15-$20 GROSS per hour when driving full time for Lyft and Uber.

As you learn your way around the city, you’ll become more efficient and should be able to earn up to $25 per hour or more consistently. Also, part-time drivers who earn the most tend to drive during the busiest weekday hours or weekends only. So don’t expect to drop the kids off at school and earn a living doing rideshare in L.A.

How much an Uber driver can make in Seattle

Earn at least $3,160 in Seattle when you complete 200 trips or deliveries.

Effective in 2021, Seattle now requires a minimum wage for rideshare drivers. To match the city’s minimum wage, Uber drivers are now required to earn no less than $16.69 an hour for all trips started within Seattle.

Kurt Schlosser from GeekWire reported that Uber must now pay drivers at least $0.56 per minute when there is a passenger in the vehicle plus a per mileage rate.

KUOW reporter, Joshua McNichols shared a self-report from a Seattle driver saying they’d seen an increase in pay since the minimum wage was introduced.

The driver stated, “Before, sometimes they pay you $2.97 for very short trips. But starting in January, in Seattle the minimum payment is $5.00. It’s a big change.”

True earnings changes will be hard to determine until this minimum wage has been in place for a few months.

Aarian Marshall from Wired reported on two studies that were done in relation to driver earnings in Seattle that came to vastly different conclusions. One said $23.25 an hour and the other $9.73 an hour were the average driver earnings.

The study that came to a conclusion of $23.25 an hour excluded times when drivers went on their apps and logged off before a ride was given to them, stating these are not “working hours”. It also excluded some car insurance and other car-related expenses.

The other study based their conclusion on an online survey of more than 6,500 licensed Seattle rideshare drivers during one week in December of 2019.

The first study calculated driver expenses at around $0.19 a mile versus the survey-based study that claimed driver expenses were closer to $0.52 a mile.

How much an Uber driver can make in NYC

In 2019, Venessa Wong from BuzzFeed reported that drivers in NYC were earning more than $16 per hour.

This pay was calculated after a cap was added on the number of rideshare vehicles allowed on the roads based on demand. New York City also “set a pay floor of $17.22 an hour, after expenses, for ride-hail drivers.”

Before these changes, it was estimated that driver pay was closer to $14.22 an hour in NYC.

How much an Uber driver can make in Atlanta

Earn at least $2,340 in Atlanta when you complete 200 trips or deliveries.

Atlanta drivers we spoke to about what it’s like driving for Uber in Atlanta said they can earn $15-20 an hour as UberX drivers, but up to $30-40 an hour as premium drivers.

Of course, the only downside of this is Premier vehicles are typically more expensive vehicles, with increased vehicle costs. You can check out our Uber vehicle marketplace if you’re looking for a vehicle to drive with Uber and Lyft.

One thing to keep in mind as an Atlanta rideshare driver? Atlanta is home to five major sports teams, including the Braves (baseball), Hawks (basketball), Falcons (football), Dream (WNBA) and Atlanta United (soccer). What does this mean for you? Almost throughout the entire year, there’s likely some sort of sporting event going on in Atlanta!

How to Make the Most Money on Uber

We spoke with several high-earning Uber driver to get some advice for new drivers. Here are their top tips:

1. Know your territory—don’t rely on GPS

It may seem obvious, but the better you know your area, the better off you’ll be. Uber driver John suggests to always have three options for getting out of bad traffic. Know which exits you can take or side roads you can use to get around large traffic jams. Your passengers will appreciate not sitting in traffic for 40 minutes longer than they need to be.

Along these same lines, another Uber driver named Jim said, “I never use Uber or Lyft navigation because they stink.”

A third Uber driver we spoke to, Chuck, added, “My advice to drivers in general would be to study your market in order to optimize your earnings. Learn the busy times and places, events, etc.”

Finally, Uber driver Brian also mentioned that during your first few weeks of driving, you should accept as many rides as you can and drive full days to learn the patterns of where you want to drive.

2. Be fast/efficient, but don’t speed

Uber driver Leon said to get passengers where they need to go quickly, but safely. Your passengers will likely not rate you well or give you a tip if you’re speeding and making them feel unsafe by weaving in and out of traffic.

A personal experience I had as a passenger was a driver who was going consistently 15 to 20 mph over the speed limit and going much faster than anyone else on the road. It was a longer trip, so I’m sure he was just trying to finish it quickly so he could get back to it after dropping me off, but I did not feel safe. I think that’s the only time I’ve ever not tipped my driver.

John also recommends not speeding when you’re driving your car for personal reasons. Since you still have the trade dress in your windows, you are representing Uber and Lyft. You can get in trouble if you cut someone off or speed and the other person records your information and the fact you work for Uber and Lyft.

3. Offer your expertise

This can have many different definitions. If a passenger is visiting the area and asks for things to do, be prepared with suggestions. If you’re a life coach by trade, offer a “free session” while you’re driving your passengers to their destination.

If it’s a large tourist area, you may even want to suggest lesser-known activities and restaurants that they wouldn’t likely find on their own to give them a true experience of your area. However, Tom cautions, “It’s ok to carry a conversation, but you have to pay attention to what’s going on around you, too.”

Other Ways to Maximize Earnings

Here are more ways to maximize your earnings while driving for Uber:

Join a referral program

Promoting cash back and shopping apps like Rakuten is another easy way for Uber and Lyft drivers to make more money while driving. Click here to sign up and get started promoting Rakuten. You can also print out these cards to hand out to your passengers, encouraging them to sign up for Rakuten with your referral code.

Upside is another cash back app that saves you BIG on gas. Use promo code RSG25 for an extra 25 cents back per gallon.

Every rideshare driver should not only be using the Upside app (if it’s available in your area), but they should also be promoting it to their passengers because you get a sign up bonus when you refer someone AND you earn money every time your referral buys gas using the app!

See how Upside works in person here:

Maximize your tax deductions

To make more money with Uber, begin maximizing your deductions during tax season. Start by reading our ultimate tax guide for rideshare drivers. In this guide we cover everything that rideshare drivers should know when it comes to taxes, including the best software and tools to use to keep track of everything.

Use a mileage-tracking app

To get the most out of your tax deductions, you’ll need a mileage tracking app. In our mileage tracking app review, we cover the best free mileage tracking apps that will accurately record you mileage while you drive for Uber and Lyft, so you can just pull up the data and plug in some numbers during tax time. Easy!

Uber Cheat Code: 3 Steps to Decide If a Trip Is Worth It

Not sure if it’s worth it to take a trip as an Uber driver? Veteran Uber driver and The RideShare Guy contributor Sergio walks us step by step through his thought process!

Sergio says play chess, not checkers. Do NOT accept every request.

Sergio looks at 3 main factors.

- Pay

- Time the trip will take

- Where he’ll end up based on the destination

Let’s go through specific examples.

And if you haven’t already, join our free email newsletter. We’ll keep you on top of the latest earnings strategies!

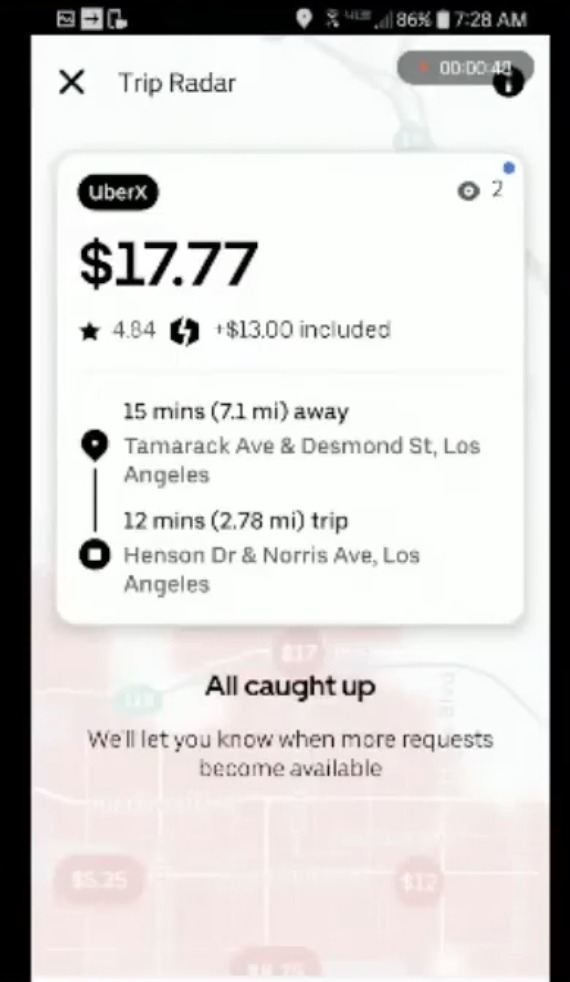

Example 1: $17.77 for 27 minutes

Sergio comments, “This is a decent trip. Although it’s a long pickup, I still do it. But without the $13 where would this trip be? That’d be $4.77 or 10 miles and 27 minutes.”

Note how Sergio isn’t just looking at the pay. He’s also very aware of the TIME this trip will take!

According to Sergio’s math, he is roughly being paid $17.77 for about half an hour of driving.

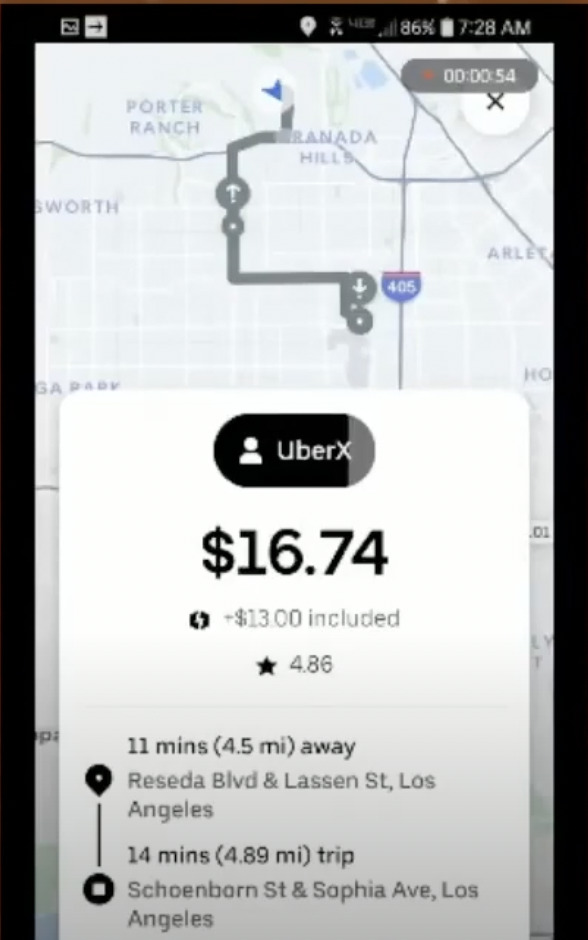

Example 2: $16.74 for 25 minutes

Sergio reasons, “I would do this trip just for the fact that it’s keeping me where I’m

at, near my house. I know the address, and I know the zip code. The down arrow is the drop-off point. It’s taking me to an area that’s business rush hour, morning rush hour schools… people going to work… it’s going to be surging there as well so I can probably pick up a very

similar trip.”

But Sergio warns us, “You take the $13 out people… please do your math, that’s $3.74.

I’m getting paid for 25 minutes and almost nine miles. Nine and a half miles of my life.”

The RideShare Guy YouTube Manager and Uber driver Chris sums it up nicely,

“This just goes to show you need to know your area. You need to know your market. Because you’re going to be able to strategize better. (this is a big text call out that highlights this section.)

You’re going to be able to see a ride come in and say, look, this is a good ride and it’s where I want to go.

Or you can say, this is a good-paying ride but it’s NOT where I want to go because now I’m going to have to either deadhead back (no passenger in the car) or whatever it might be.”

Sergio gives an example of a $19.33 ride he would AVOID:

“If you accept everything because you saw $19.33 for 25 minutes, it’s fine, but if this was taking me to Santa Clarita which is way up North, I wouldn’t have taken it.”

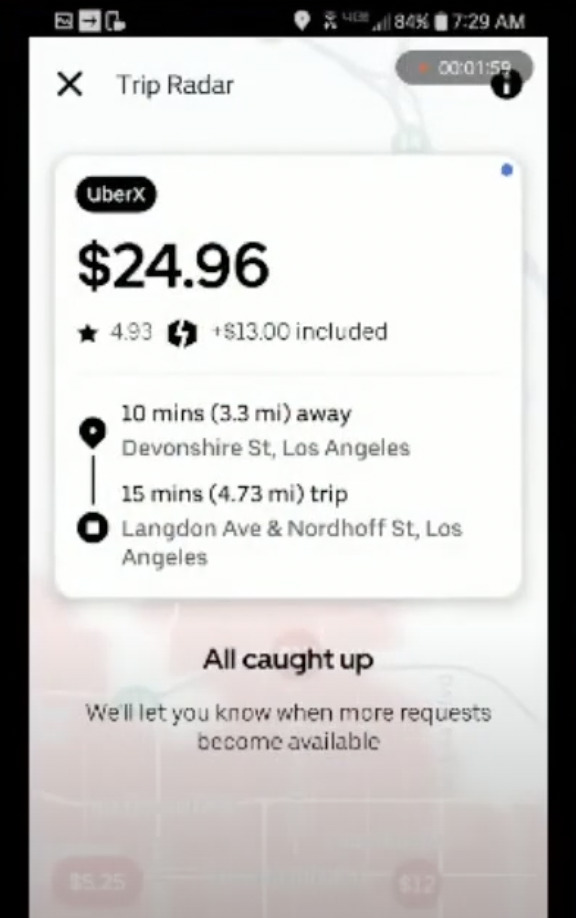

Example 3: $24.96 for 25 minutes

Sergio didn’t hesitate here! “Definitely a doable trip. I 100% would take it. No brainer.”

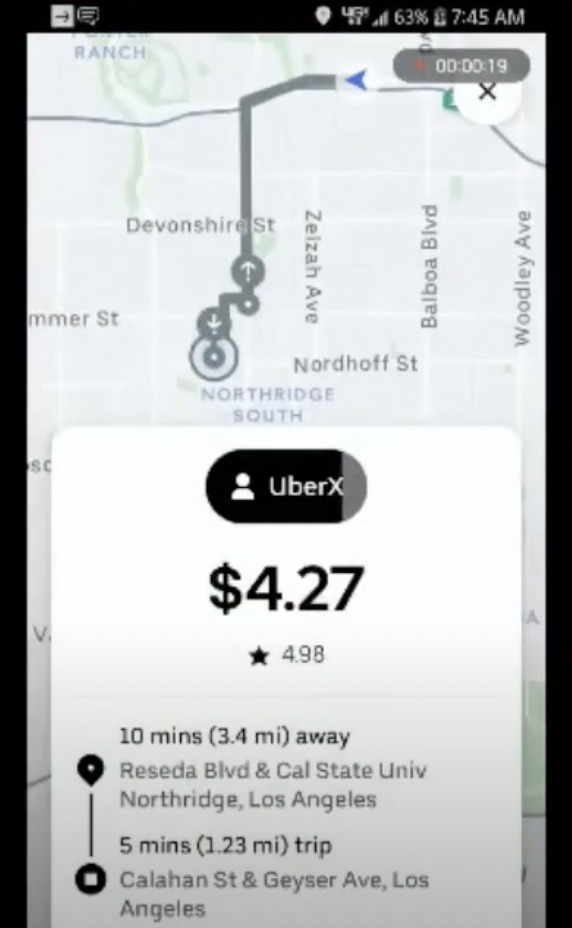

Example 4: $4.27 for 15 minutes

Sergio doesn’t like this offer, “No go. I wouldn’t touch this trip. I don’t need to drive three miles to pick somebody up that’s going a mile for $4.27. It’s not gonna happen.”

Uber Driver Secrets

Want to know how the top drivers maximize their earnings while on the road? Here are some additional secrets from Uber drivers.

Take Advantage Of Promotions

Every week Uber sends me a promotion, and as of publishing, these range from an extra $20 to $100 for 20 to 70 rides.

Promotions are determined by a number of factors, including your market, how long it’s been since you’ve driven, and more. However, drivers we’ve spoken to have said they’re regularly earning $40+ in markets like Los Angeles, Las Vegas, and other big cities.

On Facebook, we even had one commenter say, “If you count quest bonuses I’m closer to $50 an hour on average over the last three months.”

One shared a screenshot of their earnings:

This shows an average of $47.79/hr using the online time and about $49/hr using their engaged hours.

There are also promotions that are time-sensitive. For instance, in my area most Friday nights through Sunday afternoons, Uber will offer me a consecutive trip bonus. If I do a certain number of rides in a row without turning off, they’ll give me a bonus ranging from $5 to $20.

You may also receive a time-sensitive bonus like the one Harry received in Los Angeles: $100 for 3 rides!

Another promotion is surge, which is when there is high demand in an area and not enough drivers. In these cases, Uber or Lyft offer additional money to get you to do it. In my area, it’s usually about an extra $1, but I’ve seen it as high as an extra $5. Just open the app and you can see where it’s surging the most right on the map.

The best thing to do to make the most amount of money with promotions is to combine as many as possible at the same time.

If you have a quest to do 20 rides, do it at a time that you’re more likely to get a surge and a consecutive bonus. Combining all 3 will drastically increase how much you make while you drive.

Drive and Deliver in the Same Uber App!

Here at The Rideshare Guy, we are huge fans of using multiple apps at the same time. My favorite option for delivery? Uber Eats.

Best of all? No need to app switch! You can drive and deliver all in the same Uber Driver app.

If you’re not already delivering, just go to Preferences in the Uber app and you can turn delivery on and start getting requests right away.

My strategy is to give some rides with the Uber app, then when I get close to a busy area with lots of restaurants, turn on Uber Eats deliveries for any pings.

Why do I check for Uber Eats deliveries if I’m already Ubering? Uber Eats typically has drop offs that are close by, so I’m usually guaranteed not to be taken too far out of my ‘drive zone’ when I make a delivery.

Driving and delivering is a little trial and error, but once you get the hang of it, you’ll never go back to just doing one!

Follow Local Events

No matter where you live, there is something going on in your town. Whether it’s a concert, sport event, comedian, new movie coming out, or a food truck rally, it (literally) pays to be in the know.

Picking up a local paper is a quick and easy way to see what’s going on. You could also go to your town’s website and see if they have a calendar, or better yet an email list you can sign up for that will let you know what’s going on and when around your town.

Once you have that information, you can choose to drive when people will be heading to those things. If the concert starts at 7, start driving around 5 to get people in town heading to the concert.

Also look for what time the event will end, and drive in that area at that time to get those who have finished the event and need to go home.

Is Driving for Uber Worth It?

If you’re wondering whether or not Uber is worth it, remember that you probably won’t be able to make a full-time income driving for Uber just by working 40 hours a week.

However, if you want your Uber income to supplement work you’re already doing, be an awesome side hustle for extra money, or just want to earn money while you’re in between jobs, going to school, or caretaking, then we can say, unequivocally, “yes, driving for Uber is worth it!”

Click here to sign up to drive for Uber!

Want to read more? Download the free Uber driver training guide PDF.