Are you looking for a faster, smarter alternative to clunky Quickbooks? If you’re looking to be more proactive about your expenses and finances in 2021, you’ll want to check out Cheqbook. Below, senior RSG contributor Paula Gibbins reviews Cheqbook, who it is best for and how it works.

Taxes are a hassle that everyone has to deal with on a yearly basis. However, there are some software companies that do their best to make that time easier on you.

Today we’ll look at Cheqbook, a cheaper alternative to the more well-known Quickbooks, offering services to help automate the way you track your independent contractor-related expenses.

Quick summary:

- Goal of Cheqbook is to help you save money and time by automatically categorizing your expenses

- Geared for contractors and small business owners, like rideshare or delivery drivers

- Get started with Cheqbook using our referral link here!

What is Cheqbook?

Cheqbook is a cloud-based accounting service geared toward small and medium businesses and specifically independent contractors and is headquartered in Hawaii. Their goal is to help people save money by tracking their expenses automatically throughout the year.

In comparison to Quickbooks, Cheqbook is more affordable. As a comparison to free software apps, Cheqbook aims to provide better service.

In addition, Cheqbook will automatically categorize almost all transactions, whereas free and some paid competitors make you ‘tag’ or otherwise tell them what category your $20 expense at Chevron was.

Cheqbook goes beyond tracking expenses to organizing them without your input, saving you time so you can hit the road (or take a break!) instead of sitting and tediously categorizing expenses.

How Does Cheqbook Work?

Cheqbook is set up in a way that is automatically ready for contractors or small-business owners to link their bank accounts and cards, as well as input a list of customers, set up invoices and track/pay bills and expenses.

On their dashboard, you’ll see at the bottom a long list of categories for you to set up as it pertains to you and your business. It includes everything from Cash & Equivalents to Fixed Assets to Income to Cost of Goods Sold and more.

It also has a list of suggested expense subcategories you can choose from. You also have the ability to add your own subcategory to organize it the way you see fit.

To make tracking as easy as possible, you can link your bank accounts and credit cards to track money coming in and money going out.

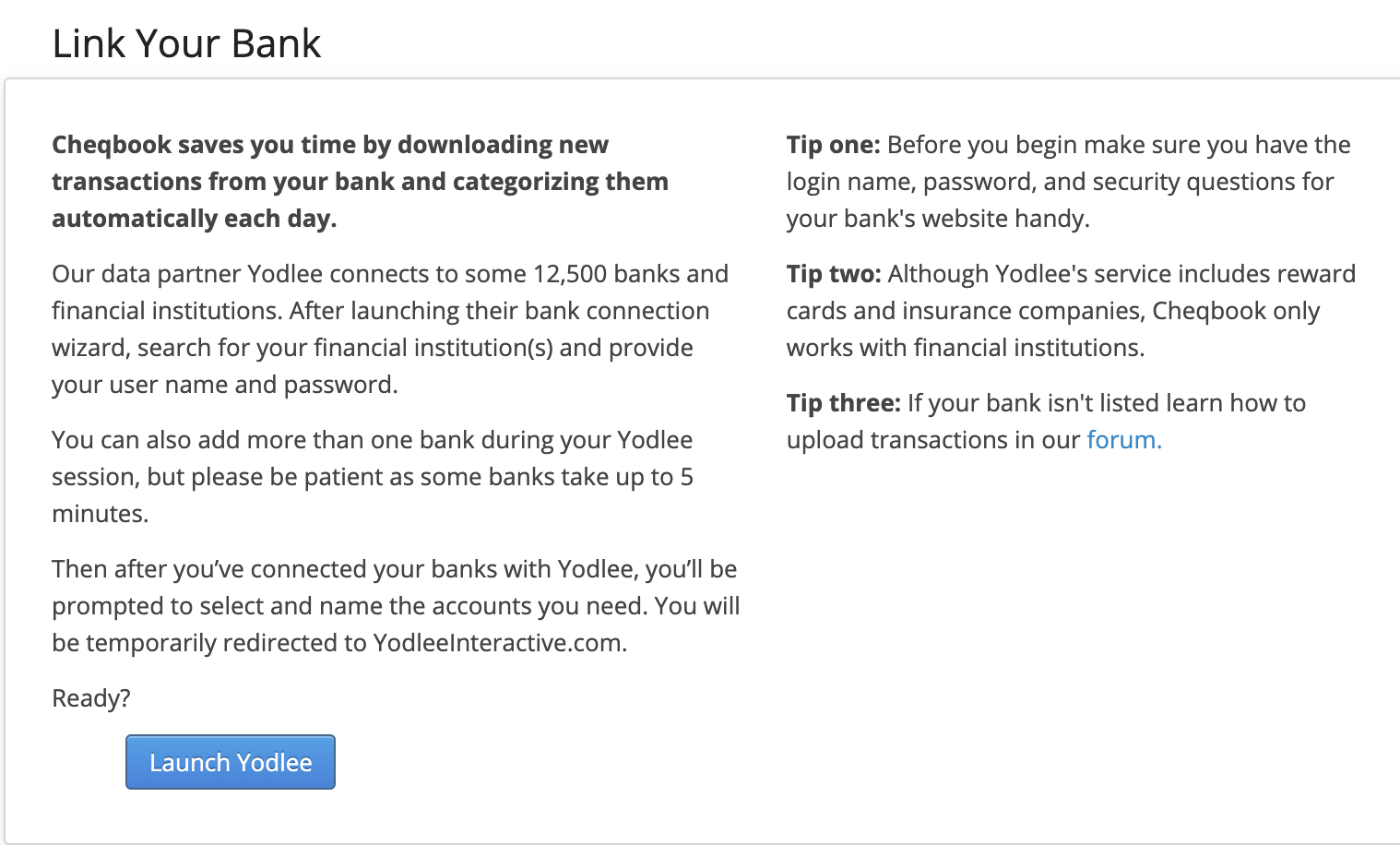

To link your bank accounts, Cheqbook uses a service known as Yodlee, which connects to approximately 12,500 banks and financial institutions. However, if your bank is not found, you can follow Cheqbook’s instructions in their forum for how to upload your transactions.

You’ll need your bank or credit card site credentials including login, password and security question answers in order to link them to your Cheqbook account.

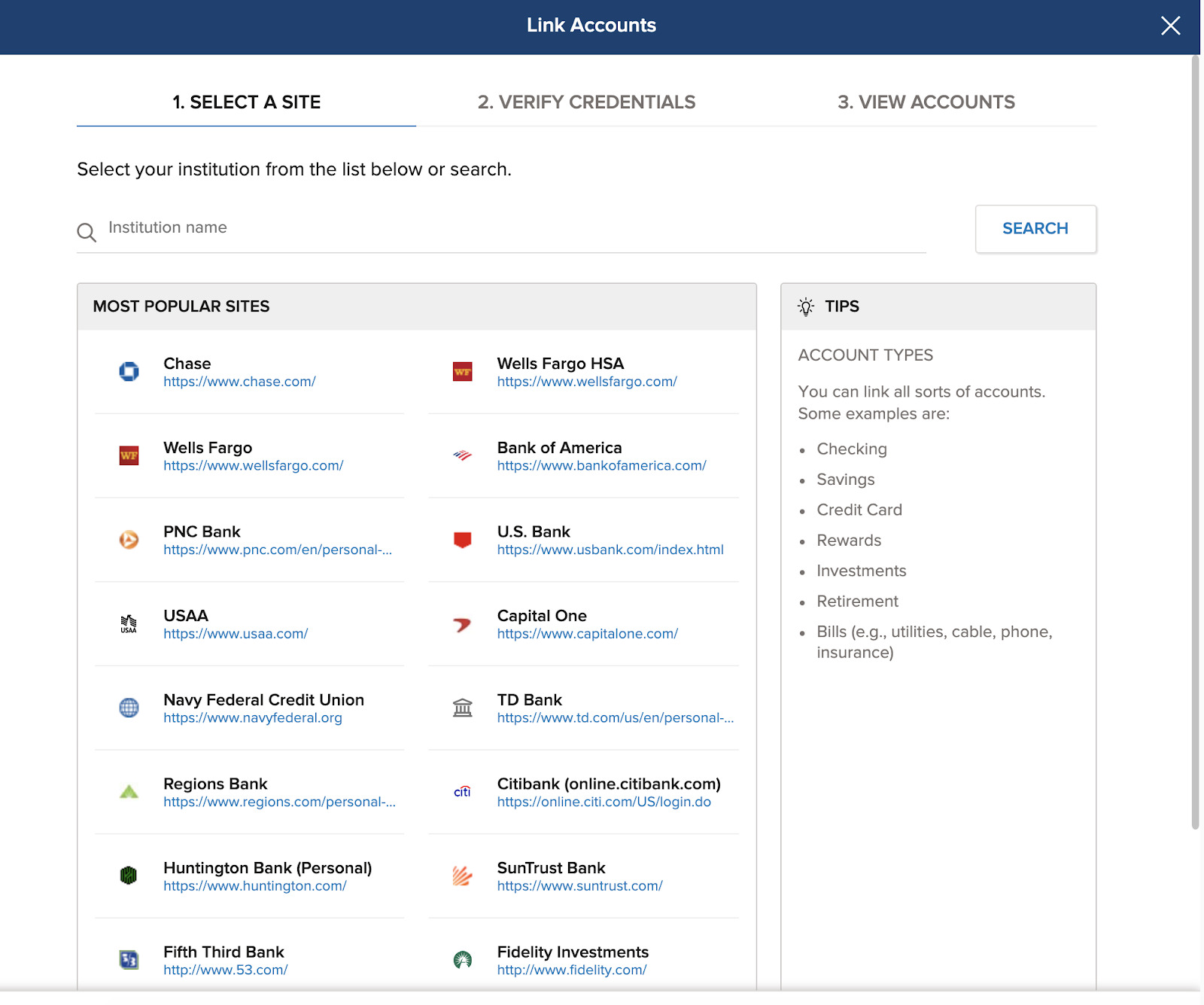

You can scroll to choose your bank or credit card company or you can do a search for the name of the institution.

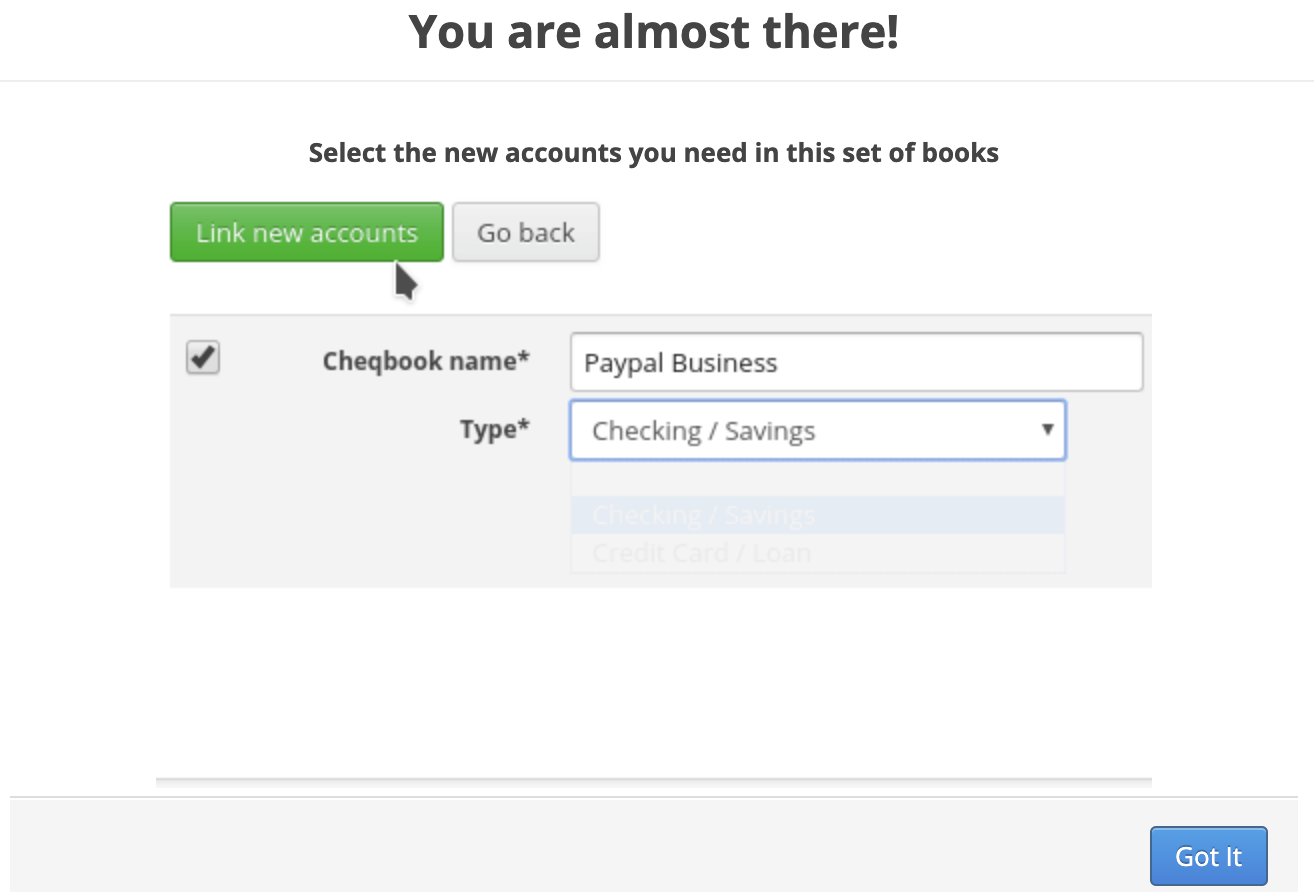

Once you verify your accounts, you will have to link them to your Cheqbook account back on the Cheqbook dashboard.

From there, you’re ready to start tracking! Use the subcategories to funnel your expenses and income into the correct areas. You can set up Cheqbook to automatically categorize your expenses if there are recurring items, such as gas and auto insurance for your vehicle(s).

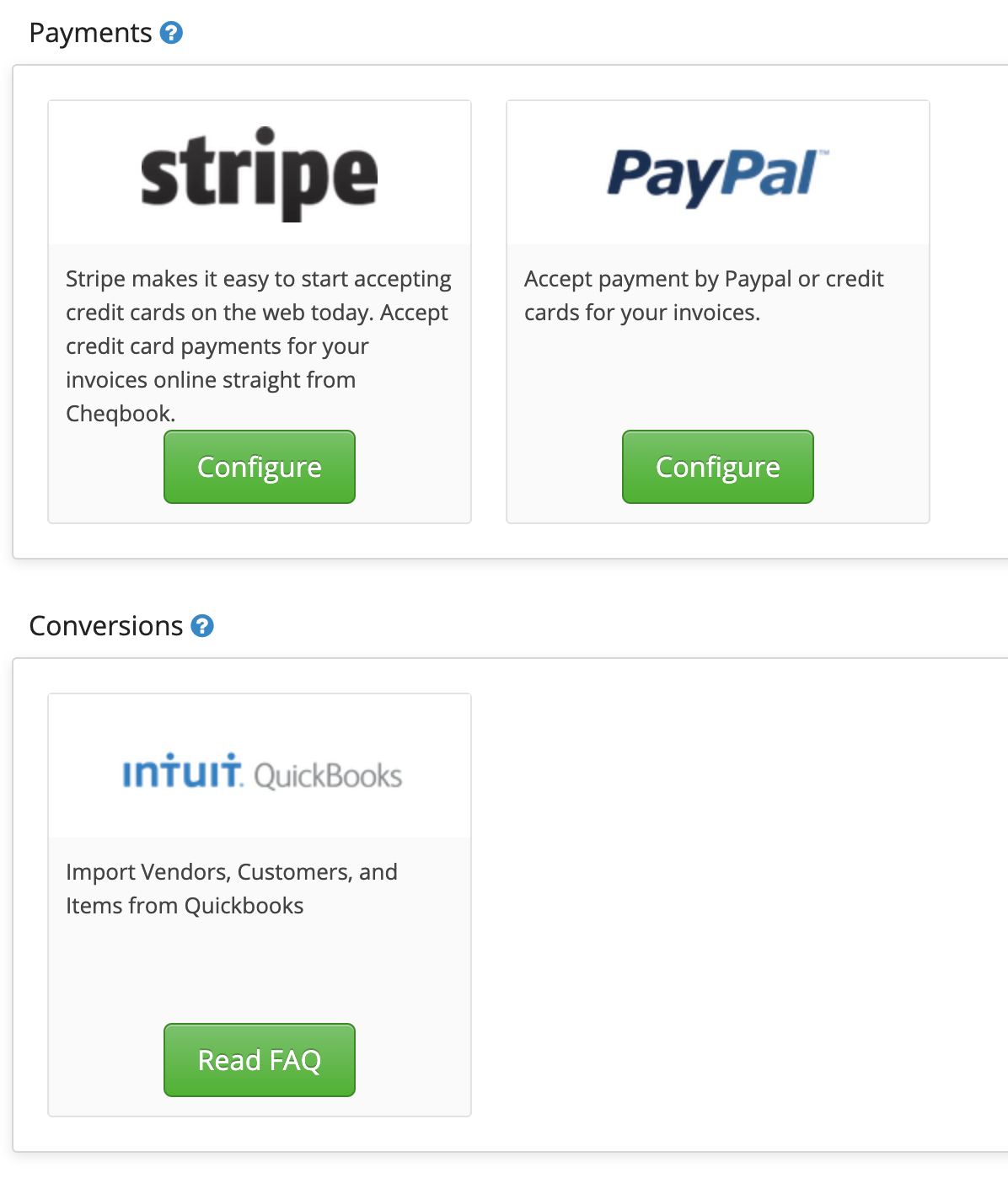

The initial setup should be the most time you’ll spend on Cheqbook. If you’ve used QuickBooks in the past and are transitioning to Cheqbook, they do allow you to import vendors, customers, and items from QuickBooks to help make the transition easier.

Cheqbook also has add-ons for Stripe and PayPal so you can keep all of your sales and expenses tracked.

At the end of the year, you’re able to send all of your information directly to your accountant to make filing a breeze.

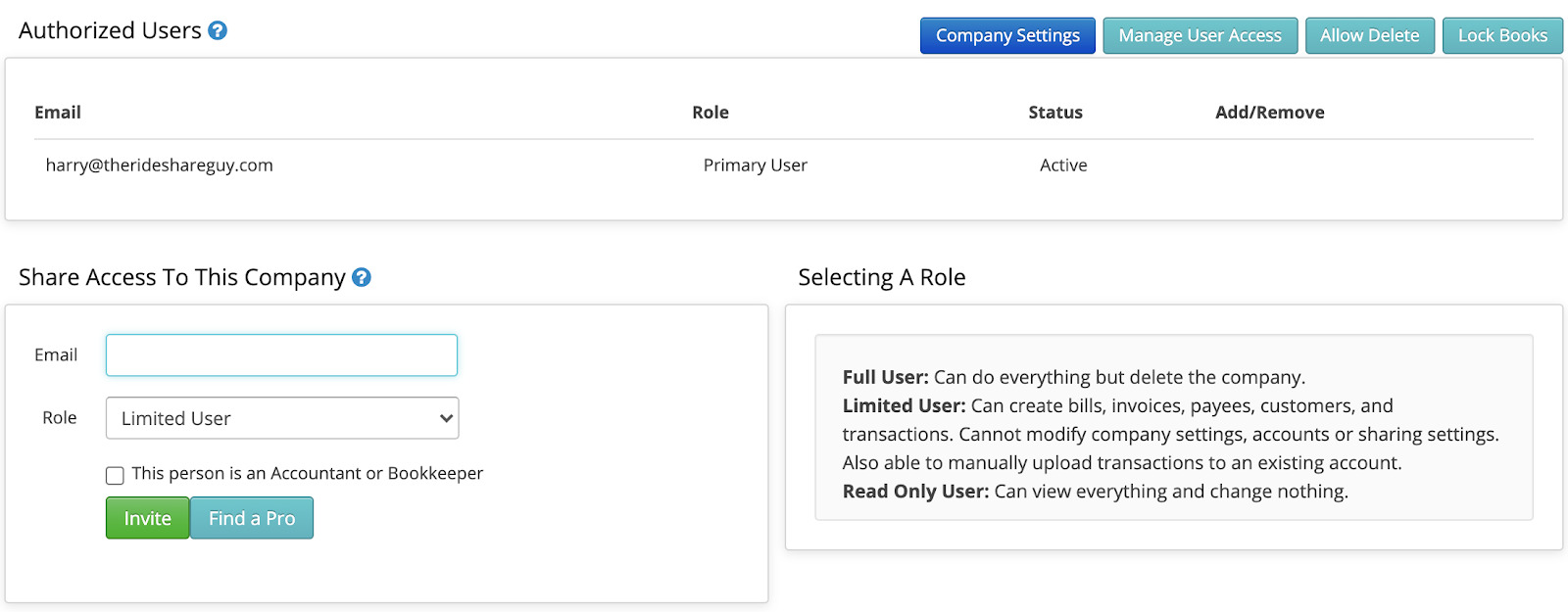

You have the option of how much access your accountant has—full user, limited user or read-only user.

Who is Cheqbook for?

Cheqbook is mainly for independent contractors, small business owners and medium-sized business owners.

Here is a breakdown of the cost of Cheqbook depending on how many companies you own:

- Cheqbook Proprietor starts at $9.87/month (1 company)

- Cheqbook Entrepreneur starts at $19.87/month (5 companies)

- Cheqbook Pro starts at $37.37/month (10 companies)

How to Use Cheqbook

Rideshare drivers and delivery people can use Cheqbook to track their everyday business expenses that you should always be tracking, such as the cost of gas, repairs on your vehicle, your income from Uber, Lyft and all of those other gig-economy apps.

You can also track less common driver expenses, such as your cell phone bill, any complimentary items you have available to customers (such as masks, water bottles, snacks, etc.), the cost of more warmer bags if what you got from DoorDash or Uber Eats is not enough, and more.

Did you accept a 4-hour trip and not have the ability to head back home immediately? You can track your hotel stay as a business-related expense.

For more information on how to use Cheqbook, check out this video on how it works:

If you have any questions as you go, Cheqbook does have a Help section. You can search by question, and they’ll compile links that should help you find an answer, or if that doesn’t help, you have an option to send them a message.

Cheqbook monitors support tickets in real time during business hours, so if you have questions during the day, you can reasonably expect a response that day.

Alternative to Cheqbook

Quickbooks

Quickbooks has a self-employed version that we reviewed that specifically caters to rideshare drivers and people in similar positions. One big upside to Quickbooks is everyone has heard of them. They’ve been around for a while and are a reputable company.

Quickbooks is so well known that many mileage tracker apps are able to upload their tracking information directly into Quickbooks for easy tracking. Or, if you’d prefer to keep it literally all in one place, Quickbooks has a mileage tracker of its own.

On the other hand, Quickbooks doesn’t offer as many features as Cheqbook does, like smart categorization, automation rules, online invoices for customers to view, batch editing of transactions, and a few other features.

How does the cost compare? Quickbooks Self-Employed currently costs $7 a month. To bundle it with the ability to transfer info directly into TurboTax, that currently costs $17 a month.

Cheqbook Reviews

Cheqbook is less known than its competitors, so there aren’t a lot of reviews out there yet. But here’s what I came across:

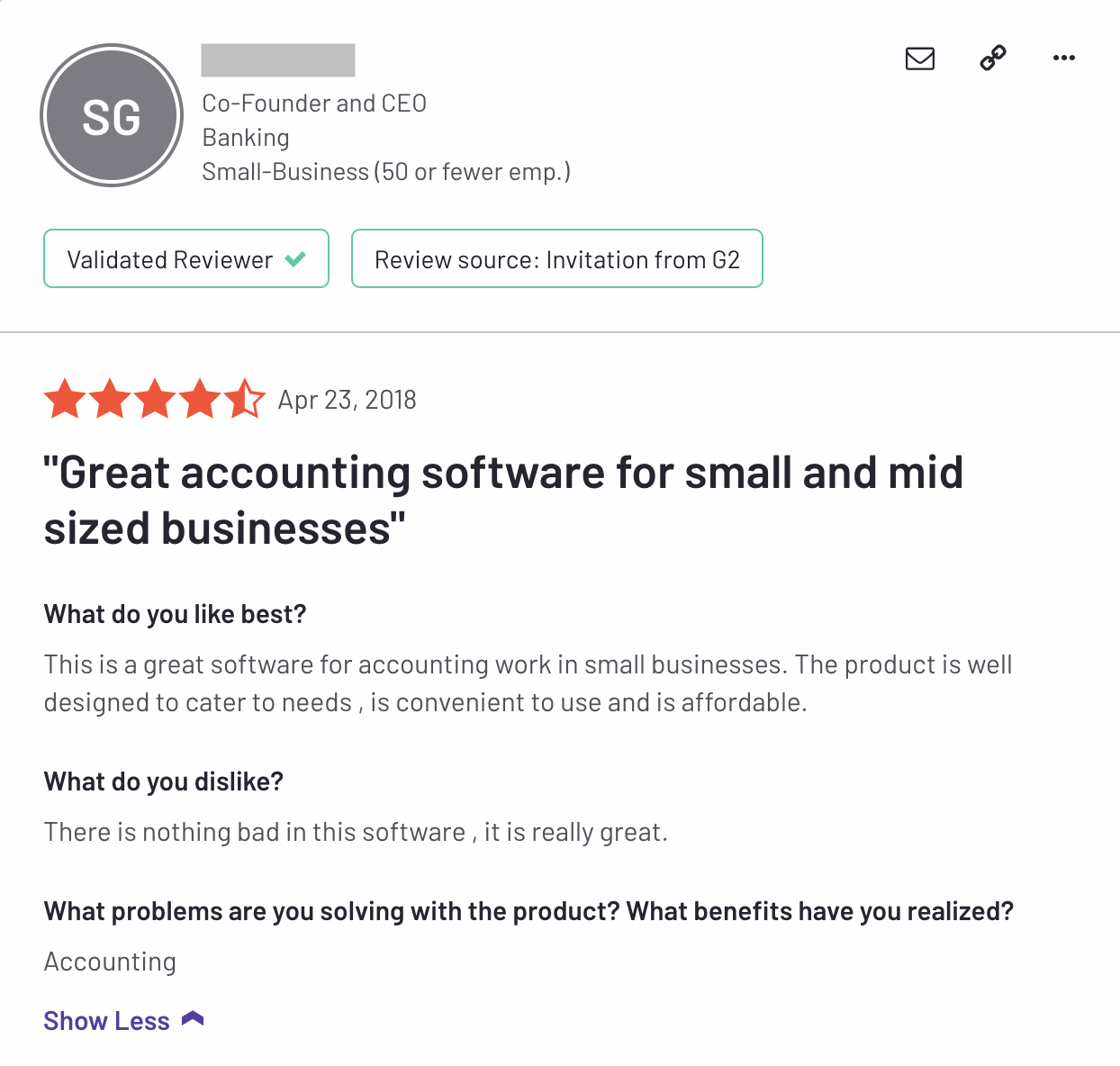

This person gave Cheqbook 4.5 stars out of 5. They liked that it “is a great software for accounting work in small businesses. The product is well designed to cater to needs, is convenient to use and is affordable.”

They listed that there is nothing they dislike about the software.

Another reviewer gave it a solid 5 out of 5 and said, “We have been using Cheqbook for nearly 4 years. We use it for two companies and our own personal finances. While not the cheapest option available, it’s feature set is well worth the price we pay annually for the service.”

While they gave a glowing review, they did have some suggestions for Cheqbook for room for improvement: “I would love the ability to remove or hide unused accounts/categories. One feature that I really liked about Quickbooks was the ability to show a comparison to the prior period like this year to last year. No budget making tool.”

Is Cheqbook Legit?

It is a legitimate software company and has many options that are appealing to rideshare drivers and delivery drivers for tracking expenses.

There are other options that are free, but it seems like Cheqbook is on par with Quickbooks as far as cost of use is concerned and what you’re able to do with it.

Summary

Would I use Cheqbook right now? Right now, probably not. When I log in to Cheqbooks, I get overwhelmed by all of the links on the dashboard for all of the subcategory options. I likely wouldn’t remember which category I chose for basic things. I’d forget if I chose “Insurance” or “Auto Insurance”. I’d forget if I chose “Supplies” or “Gifts – Business” for the water I give out in my car (pre-COVID).

From the sounds of it, you can’t hide or remove categories or subcategories that you’re not using, so to me it feels cluttered.

I’d also prefer if I could track my miles in the same place as my expenses. Or, I’d just use my bank’s free expense tracking option and track my mileage separately. I prefer keeping things as simple and clutter-free as possible.

However, Cheqbook could be a great option for those of you who need more than simple tracking for rideshare or delivery. It’s particularly good for those of you who have multiple side gigs, and need a way to track everything together.

Coming from having used Quickbooks, another pro for Cheqbook is how quick it is to update and check on your accounts, then get out. Managing Editor Melissa Berry always found Quickbooks to be cumbersome, slow, and bulky. Customer service on Quickbooks, according to Melissa’s experience, was subpar.

While I did not reach out to Cheqbook’s customer service while trying out the service, I found the Help section to be useful as well as the ability to easily request more help if needed (by sending a message).

In addition, Cheqbook could be a more affordable alternative to Quickbooks, so if you’re on the fence, check out Cheqbook. Chances are you’ll find more features at a better price point than Quickbooks.

Get started with Cheqbook using our referral link here.

Readers, is Cheqbook something you would be interested in? What do you currently use to track your expenses?

-Paula @ RSG with additional reporting from Melissa Berry