One of the coolest parts about working in the gig economy in our opinion is that you can literally sign up for a service, be approved the same day(best-case scenario), go do a trip or a delivery and be paid instantly.

How many jobs out there allow you to work whenever you want and cash out the money instantly? It’s one of the reasons why we think everyone should be signed up for at least one gig economy service (DoorDash is a top option right now with our audience) – you never know when you might need to make a quick 50 bucks!

Obviously, there are some downsides to this, but today we’re focusing on the pay since that’s what matters most to all of us right?

We’re going to answer questions like ‘does it cost anything to access your money faster?’ And we’ll dissect pay for each company and find out how frequently you can get paid and how much it might cost you to cash out early.

Also, if you’re a gig company looking for a cool Instant Pay 2.0 option, reach out to Harry directly as we’ve got a new B2B partner that is a game-changer! Instant pay after every single job for no cost to anyone, and the platforms get to rev-share on the interchange fees.

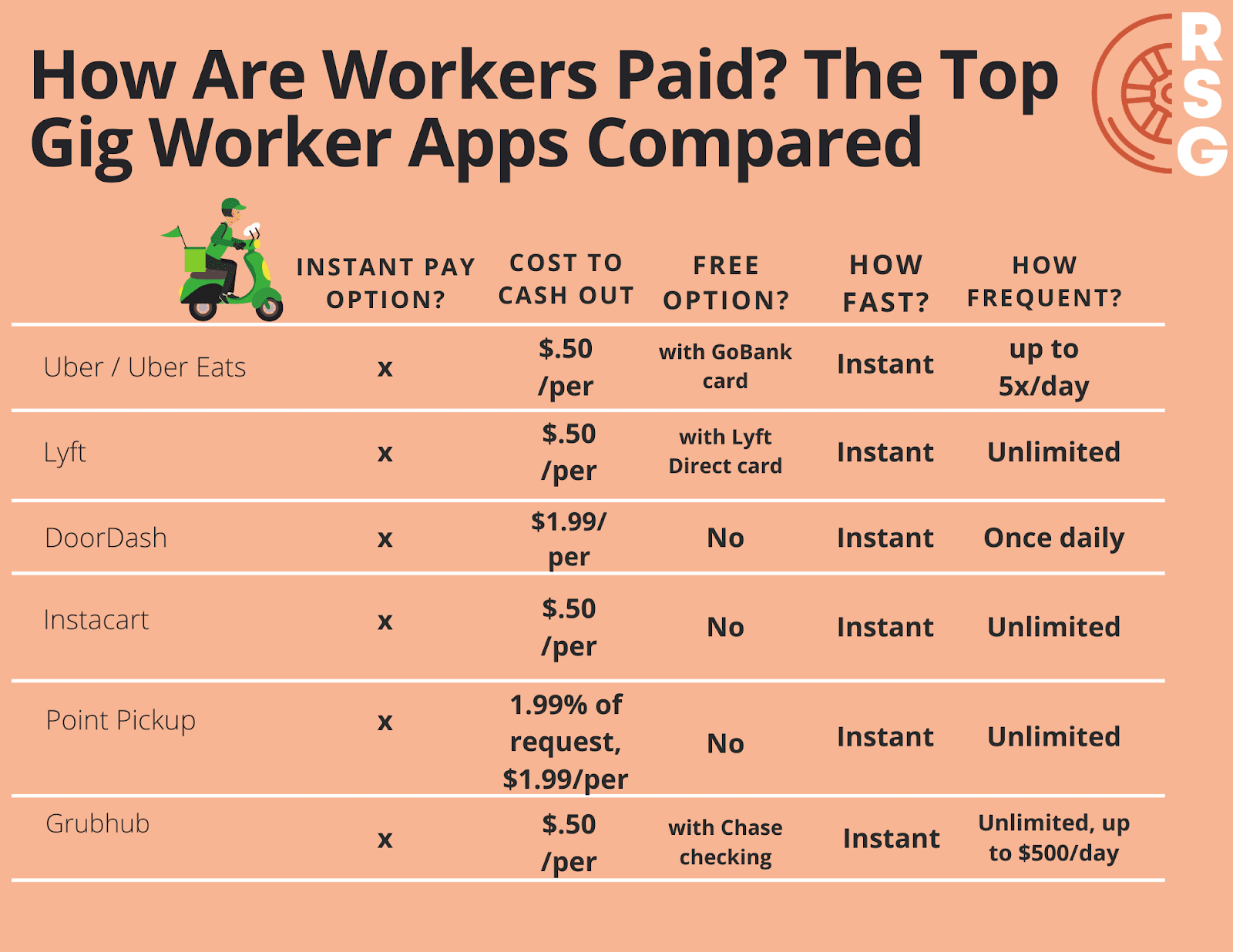

You can see a quick breakdown per platform in this table below, and keep reading for more information:

Breakdown of Pay Per Company

Most of these companies allow you to cash your earnings out the day you earn them, but some will charge you extra.

Others have no quick pay option, but might pay more frequently than once a week. And some might even give you an out when it comes to paying fees.

We’ll start off with common rideshare gigs and move on to deliveries from there.

Uber

Uber is one of the pioneers of the industry, so it’s no wonder they also have options for their drivers to cash out throughout their day. They boast that you can cash out with Instant Pay up to 5 times per day.

That seems a bit excessive since they do charge $0.50 per cash out if you’re using a personal debit card. If, however, you get the Uber Visa Debit Card from GoBank, you can cash out up to 5 times per day without that extra charge.

Under their FAQs, they state, “In most cases, you’ll receive cash in your debit card account right away, but it could take a few business days, depending on your bank.”

To that, our Facebook follower Stacey K.:

“Yeah I think it’s pretty annoying that you have to go Offline on Uber to be able to transfer money to GoBank for free. Especially because they keep track of hourly now. Also the money isn’t immediately in the account on GoBank, sometimes there is a delay and that sucks if you are dependent on using your earnings to pay for gas and such.”

Click here to read more about becoming an Uber driver.

Lyft

Uber’s biggest competitor, Lyft, has similar terms. You can wait for your direct deposit to show up weekly, or you can cash out sooner. Instead of limiting you to 5 times per day, Lyft actually has a program where you can have your earnings deposited after each ride.

Lyft Direct allows you to cash out after each ride is complete with no fees. Express Pay allows you to cash out your earnings, but with a $0.50 fee. Both of these should show up in your account pretty quickly.

Lyft Direct is a newer option Lyft has started allowing, which includes getting a Lyft Direct debit card and bank account powered by Payfare and issued by Stride Bank.

With the Lyft Direct debit card, you can earn 1% on gas and groceries, 4% on dining and 1% on a bonus category that rotates every three months and can include phone plans, pharmacies and more.

On Facebook, our followers shared that they prefer Lyft:

“With Lyft every trip gets automatically deposited into your Stride account…you don’t pay for it, and it’s automatic,” said Jason B.

Click here to learn how to become a Lyft driver.

Via

Via also has a quick pay option. You simply have to register and link your debit card to be able to transfer your earnings and get instant access to them. All you have to do in the app is click on “Get Paid”.

Much like Uber and Lyft, you will be charged a $0.50 fee for the transfer.

According to Via’s website, “Quick Pay enables you to transfer your Blue, Flash Blue, Online mode earnings and tips in real time. We’ll gradually add additional payment types like signing or referral bonuses, special promotions (like guarantees and others), and toll reimbursements. But for now, these will continue to be included in your weekly payments.”

Via also states you can cash out whenever you want. If you haven’t cashed out before Sunday night, those earnings will be directly deposited on Tuesday with your regular weekly earnings.

Click here to learn more about being a Via driver.

DoorDash

For DoorDash, they call it “Fast Pay” and it’s available to any Dasher in the United States. With DoorDash, you can cash out your earnings daily for a fee of $1.99.

In order to participate in using Fast Pay, you’ll need a debit card, not a prepaid card.

They do have some terms that you need to meet before being qualified to use Fast Pay. You must have completed at least 25 lifetime deliveries, been on the DoorDash platform for at least two weeks since activation and you must have your direct deposit bank account set up.

You need to sign up for Fast Pay by clicking on “Set Up Fast Pay” banner in the earnings section of your app. It also takes 7 days to process, so you will need to wait for that period to end before attempting your first Fast Pay cash out.

You can save on Fast Pay expenses using your DasherDirect card.

Click here to learn more about being a Doordash driver.

Uber Eats / Postmates

I’m combining this one since Postmates is now owned by Uber. Uber Eats has the same cashout options as Uber.

Postmates allows cash outs as many times a day as you want with no limitations.

Like many of the others, Postmates charges $0.50 per cash out, otherwise you can wait for your free weekly deposits. For Postmates, you must have a minimum balance of $5.00 before getting the instant pay.

Click here to learn more about being an Uber Eats driver.

Click here to learn more about being a Postmates driver.

Instacart

A full-service shopper for Instacart can utilize an Instant Cashout feature. Like several others, they charge a $0.50 fee to cash out instantly.

You’re able to cash out at any time throughout the day or night.

This feature was rolled out to full-service shoppers in 2019, but at this time, all U.S. full-service shoppers should be able to access the Instant Cashout option.

Click here to learn more about being an Instacart driver.

Amazon Flex

Amazon Flex features a slightly different model than the other delivery options here. Amazon Flex pays its drivers via direct deposit twice a week.

According to their website, “Amazon Flex processes payments on Tuesday and Friday via direct deposit to the bank account you provided during sign-up. You should see payments in your bank account the following day, but due to events like bank holidays, your deposit may be delayed.

If you complete a delivery that is eligible for tips, you will receive payment after all tips have been finalized (about 1-2 days after delivery).”

There is no cash out option for Amazon Flex drivers. However, they do have their own debit card that offers up to 6% cash back on gas purchases, 2% cash back on Amazon.com purchases, and 1% on any other purchases; up to $500 in total cash back per month.

Click here to learn more about Amazon Flex.

Shipt

It appears that Shipt does not offer an instant payout option like many of the others do.

Instead, your earnings as a Shipt delivery driver come once per week via direct deposit every Friday for the work completed the previous Monday through Sunday.

Click here to learn more about Shipt.

Grubhub

Grubhub has a $0.50 fee for each Instant Cash Out transaction unless you use a Chase checking account, in which case the fee is waived.

On their driver support site, Grubhub lists out what earnings are eligible for the Instant Cash Out:

- All delivery payments and tips are available 15 minutes after the delivery is completed

- Grubhub Contribution (available in select markets) will be available the day after they are earned, generally around 12pm (Local Time)

- Adjustment pay may take additional time to be eligible

- For security purposes, Instant Cash Out will not be available for 72 hours after your bank account information has been verified or updated

- If your earnings are currently subject to garnishment, you will not be eligible for the Instant Cash Out feature until the garnishment is satisfied. In this instance, the feature will not appear as an option in your Grubhub for Drivers app

You can use the Instant Cash Out feature as many times a day as you’d like, but there is a limit of $500 a day that you can cash out.

Point Pickup

Point Pickup features a “Pay Me Now” option that allows you to cash out your earnings at any time.

According to their FAQs, “When using Pay Me Now, a small fee is applied to the total requested amount. All Pay Me Now fees are 1.99% of the requested amount with a minimum fee of $1.99.”

They also have eligibility requirements. Point Pickup requires that you have an activated account for at least 30 days, have completed at least 50 deliveries and have a debit card registered with Stripe (no prepaid cards) in order to use the Pay Me Now feature.

Overall, Point Pickup’s program is one of the more restrictive and expensive too.

Click here to learn more about Point Pickup.

Roadie

To get your cash instantly with Roadie, you have to have completed your first gig more than 7 days ago, and delivered a total of 5 gigs. There is also a 5-day waiting period before you’ll have access to the Instant Pay feature for security reasons.

There is a $1.99 processing fee to receive Instant Pay. Roadie doesn’t mention on their site how frequently you can request instant pay.

Click here to learn more about Roadie.

Summary of How Workers Are Paid Across Platforms

While most of these platforms allow instant pay, they all seem to differ in some ways. Some charge extra, unless you link to their credit card. Some charge more than others.

None of these apps even act the same when it comes to how often you can cash out. Some platforms let you cash out indefinitely with no limits, while others let you do it once a week or once per day.

If you want to keep the fees low, the best bet is to allow your direct deposit to come through at the weekly rate without cashing out.

However, if you absolutely need money fast, be sure you know which ones are charging the most and use the option sparingly. If you’re all right with getting a card specific to the platform in some way to avoid fees, it’s a great way to cash out worry-free.

Read next:

How often do you usually cash out of your rideshare or delivery gig? Do you pay extra to cash out early?

-Paula @ RSG