Looking for an online tool to help you manage your finances, plan for tax time, and save for the future? With all of the choices out there, it’s easy to get overwhelmed. However, one wealth management tool stands above the rest: Personal Capital. RSG contributor Chonce Maddox-Rhea breaks down who Personal Capital is best for, its pros and cons and move in this Personal Capital review below.

Bottom line: When it comes to managing your finances, there are a lot of tools to choose from. Personal Capital has been around for a while and earned its reputation as an easy-to-use cash flow and wealth management tool and app.

Most features are free to use and Personal Capital would be great for anyone looking to track their net worth and grow their money strategically over time.

Get started with Personal Capital using our referral link here.

What is Personal Capital?: How Personal Capital Works

Personal Capital is a popular, free personal finance tool that helps you track your expenses and manage your net worth. A lot of people compare Personal Capital to Mint, but Personal Capital offers more advanced features, in my opinion, especially if you’re looking to track your net worth.

I like to think of Personal Capital as a cross between budgeting software and investment tracking software. You can set a budget, track your cash flow and pay bills, but you can also plan your savings and investments as well.

Personal Capital is great to use because many of us (myself-included) get so caught up in working and earning money that we forget to save and build wealth. When you think about it, why are you really working?

I’m sure all of us want to be able to provide for our families and meet basic needs. But it’s also important to plan for the future and improve your level of financial stability.

Personal Capital is a modern tool that can help you keep track of all your financial goals and monitor your progress.

Getting Started

Signing up for Personal Capital is easy. Just click the blue ‘get started’ button in the upper left corner. Then start by entering your name, email, and password to start your account.

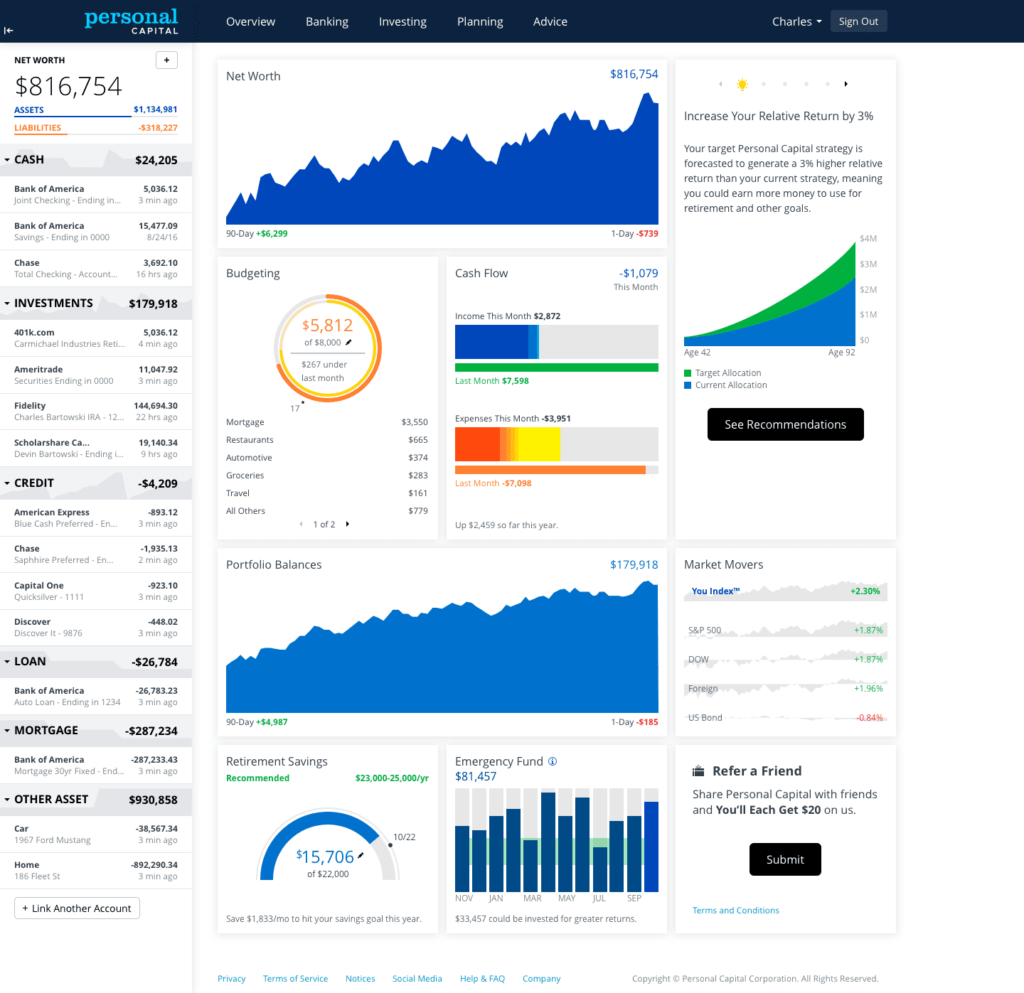

To get the most out of Personal Capital, you’ll want to connect your bank and other financial institutions. Try to add as much information as you can because this will help their technology be able to automatically calculate your net worth. Your net worth is just liabilities (debts) minus what your assets are.

I’ve been using Personal Capital for several years now and connect my checking account, savings accounts, retirement accounts and even my PayPal account since something I receive client payments via PayPal. I also have my mortgage balance and any other debt or loan accounts connected as well.

Personal Capital will track your balances and update your net worth as your situation changes. For example, if you make a $500 credit card payment, your liabilities will be reduced by $500 in the app or dashboard view.

Here’s a view of what the dashboard looks like along with the app. As you can see, the net worth is displayed in the upper left corner along with a break down of your assets, liabilities, and balances for all your accounts.

Personal Capital’s Wealth Management Service

Personal Capital’s Wealth Management Service is an advisory service for investment portfolios over $100,000. Instead of hiring a financial advisor, you’d get access to their advisory team and receive a full evaluation with an investment strategy that is specific to your needs.

There are benefits to this service like

- Expert retirement planning

- Cash flow and spending insights

- Automatic rebalancing

- Advice on other investments such as your 401(k), stock options and 529 college savings

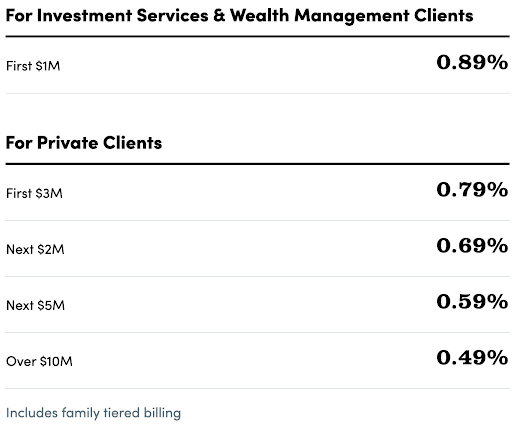

There’s an all-inclusive fee for Personal Capital’s wealth management service based on a percentage of the assets managed. Users with a balance over $100,000 will pay 0.89% and users with a balance over $1 million will pay 0.79% to 0.49%.

Personal Capital Features

Even if you don’t have a six-figure net worth just yet, you can still get a lot of benefits out of Personal Capital’s other tools. Plus, they’re free. Here are some of the tools I’ve been using on the platform for the past few years to help manage my finances.

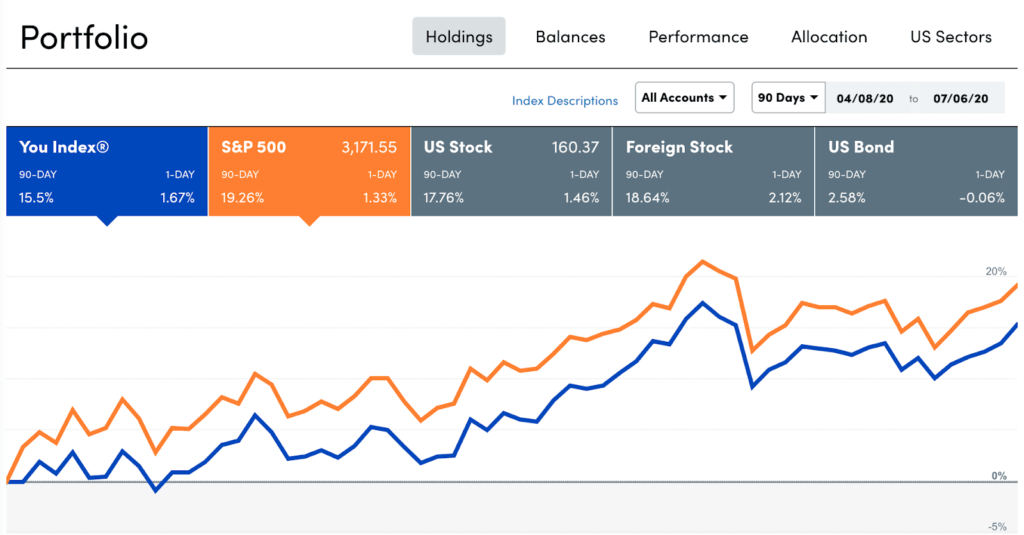

Portfolio Analysis

The portfolio analysis shows you how your investments are doing. I use a robo-advisor called Betterment which automatically invests in the market for me based on my goals.

To be honest, I never really paid attention to which stocks I owned or how they were doing but this feature puts everything all in one place.

I also invest my spare changes in an app called Acorns each month, so I connected this to Personal Capital too and it tracks how this investment is going as well.

Another interesting thing to notice with the portfolio analyzer tool your stock to bond ratio. I choose to invest more heavily in stocks since I don’t mind taking the risk and it will be a long time before I retire.

While stocks represent a portion of ownership of a company, bonds are loans that you fund to a company and they pay them back with interest. Right now my portfolio has a lower percentage of bonds, and I’m okay with that.

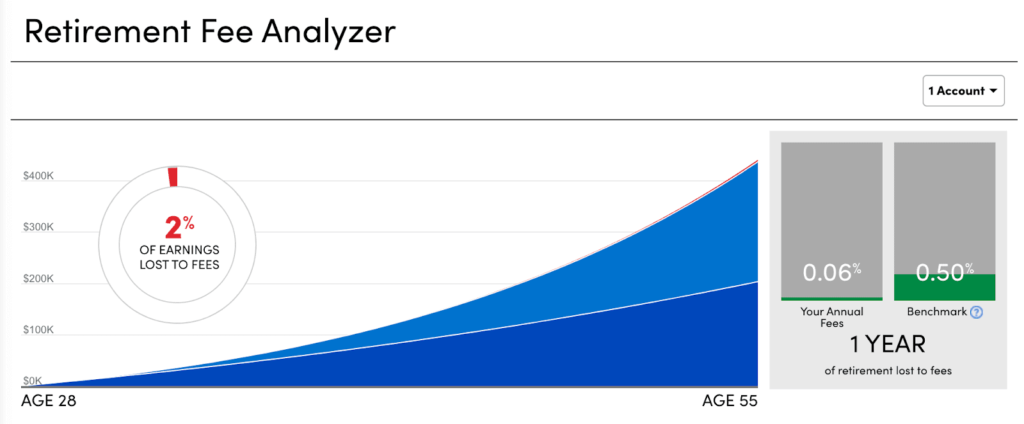

Fee analyzer

If you really want your money to start working for you, it’s important to limit any management fees you may be paying. Financial institutions charge annual fees on mutual funds and other assets.

Over time, these fees add up and can reduce your savings amount. Right now, it looks like my fees are pretty low so that’s a good thing.

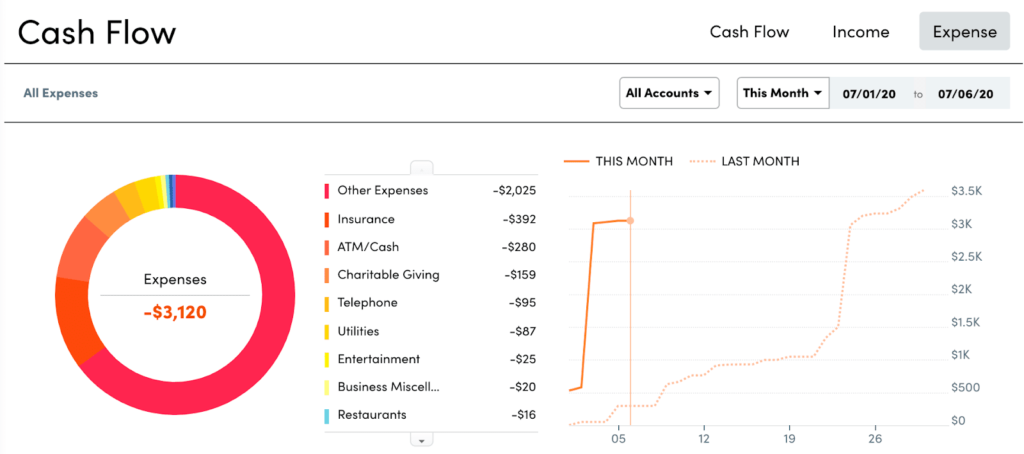

Cash Flow

Under the Banking tab, you’ll find Personal Capital’s Cash Flow feature. You can use this feature to see exactly where your money is going and track your income as well.

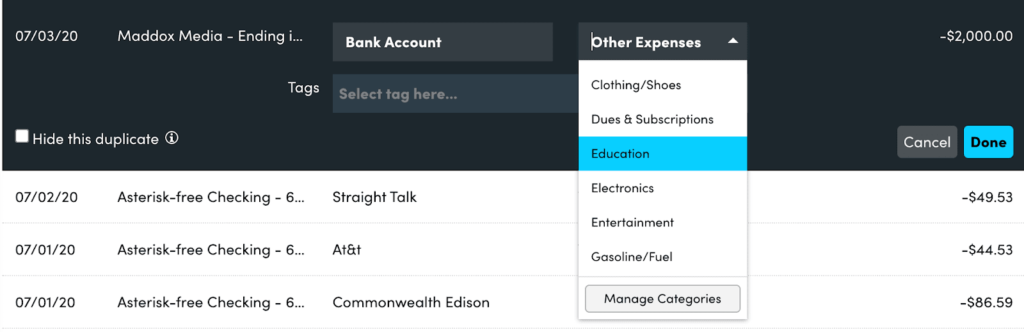

Personal Capital will try to automatically categorize your expenses, but if they can’t they’ll place them in the ‘other’ category. You may have to manually categorize your transactions if they don’t get it right.

Hopefully, over time, you will have less manual work to do once you create your initial budget categories.

Track Your Net Worth

I already talked a little about how Personal Capital helps you track your net worth. Just connect all your financial accounts and the system will automatically deduct your liabilities from assets.

If you’re a homeowner, you can add your address, and they will pull up Zillow’s estimated value of your home. Don’t forget to add your car as an asset, too! While vehicles are often a depreciating asset, it still holds value and can be sold or leveraged for liquid cash.

Use this tool to track your net worth over the past month, 90 days, or the past year.

Personal Capital’s Retirement Planner

Personal Capital’s Planning tab is all about planning your retirement. Set your own retirement goals by determining how much you wish to spend in the future. Be sure to uncheck the box that says ‘estimate from spending history’ if you want to set your own monthly spending amount during retirement.

For example, I estimate I’ll spend a lot more now than I would during retirement. When I retire, I expect my mortgage to be paid off and not to have any kids who need my financial support.

Once you add your retirement goal, Personal Capital will automatically update their projections and tell you how much you’d need to save.

Their Investment Checkup tool is a great free alternative to the Wealth Management Service if you’re just looking to learn more about your portfolio and see how you can cut fees and grow your investments.

Is Personal Capital Free?: Personal Capital Pricing

If you’re not using the Wealth Management tool, Personal Capital is free to use for tracking your net worth, budgeting and managing your cash flow, planning your retirement and monitoring other investments.

Once you have a $100,000 portfolio, you can enroll in the optional Wealth Management service. Personal Capital also charges management fees for private clients with high net worths of over $1 million.

Additional Services Offered by Personal Capital

Still on the fence about trying out Personal Capital? Here are a few other free services I like using that you may find helpful too.

Bill Payments

Personal Capital will help you track when bills are due for the account you connect on the platform. If you have a credit card minimum payment, for example, you get a reminder of when that bill is due and can make it as paid when the transaction is completed.

Emergency Fund

If you go to the Planning tab, you’ll see the Savings Planner tool that allows you to track your retirement savings and your emergency fund savings as well.

Personal Capital will recommend an emergency fund goal based on your monthly expenses. As we all know, having emergency savings to fall back on in tough times is so important so be sure to get use out of this feature.

Debt Paydown

Personal Capital promotes the idea that your ability to save is heavily impacted by not only your take-home pay but also your amount of debt, and I agree.

Once you connect all your debt accounts, go to the Debt Paydown tab in the Planning section to track your debt payoff and get strategy recommendations.

Personal Capital Reviews

Personal Capital has been a great app to use over the years, and I like how they’ve made improvements steadily over time. I know in the past, I’d struggle with connecting my accounts (and keeping them connected) but luckily this issue has been resolved and the platform is pretty user-friendly.

It may sound like a complex tool to use given all their features but I like how they organize and explain everything so it’s actually been pretty easy to navigate.

Is Personal Capital Safe?

When it comes to using financial apps and tools, you may be wondering how safe it is to share your personal information with Personal Capital. I took a look at their privacy policy, which explains what information they collect and why they collect it.

Personal Capital also uses AES-256 encryption which is the highest standard of encryption available along with two-factor authentication. They also have strict internal access controls which means employees don’t have access to your login credentials.

Overall, Personal Capital is a pretty secure site and they will not sell or share private information about your financial accounts with others.

What Personal Capital Lacks

While I like most of Personal Capital’s features, I’d say they are much stronger in the investing and retirement department than the budgeting and cash flow arena. Their budgeting tool is basic, but doesn’t provide a way for you to reconcile your account to make sure all transactions are accounted for.

You also cannot import your data, so when you connect a financial account, you must just rely on the information that gets populated automatically.

Who is Personal Capital Good for?

Personal Capital is a good option for anyone who’s serious about investing and setting goals for retirement.

If you have a 6-figure net worth, you’ll qualify for their wealth management tool but you don’t need a big portfolio to take advantage of some of their wealth-building and management tools.

Pros and Cons of Personal Capital

Pros:

- Majority of features are free

- Track all your financial accounts in one place and set retirement goals

- There’s also an app

- Check fees for your investments to reduce them

- Easy to use

- Automatic updates and reporting

- The fees for their advisory management services are lower than most other brokers

Cons:

- Must have a high net worth to use the Wealth Management Tool

- No option to import data

- Budgeting tool could be a little better

Is Personal Capital Right for You?

Only you can truly answer this question and it all depends on what your financial goals are right now.

Personally, I like how you can manage everything in one place. Yes, this tool is geared more toward tracking your net worth and investing in your future.

However, you can still track your spending, build your emergency fund and track debt payoff as well even if these features are pretty basic. Since Personal Capital has so many free features, you may want to at least give it a try and see how you like it.

Get started with Personal Capital using our referral link here.

Personal Capital Alternatives

There are many alternatives to Personal Capital, but the two that you may want to consider are Quicken and Mint.

Mint is also free but it’s geared more toward budgeting, savings and tracking your spending. Mint does have more budgeting features but they don’t offer nearly as many of the investing and retirement planning features that Personal Capital offers.

Quicken is a paid money management software but it offers wealth management features like investment tracking, market comparisons as well as the general budgeting and expense tracking features.

Summary

Personal Capital is one of the best wealth management tools around and they continue to grow and improve. Whether you’re looking for an app or software, Personal Capital provides both options and makes it easy to manage your finances with or without a professional advisor.

Readers, what do you think of using a wealth management tool like Personal Capital? Do you currently use any budgeting or wealth management software?

-Chonce @ RSG