In this article, we examine the cost to rent a vehicle for Uber & Lyft versus the cost to purchase a vehicle.

How many miles do you put on your car while rideshare driving? As more drivers track their miles, they’re beginning to find out, in some cases, that they’re putting a ton of miles on their cars.

Some drivers are deciding it’s better to rent a car and not worry so much about mileage than to put that wear-and-tear on their vehicles.

But are they really a good long-term commitment? Or is it cheaper to rent a car than it is to purchase one and pour maintenance and miles into it? Let’s find out!

Renting vs. Owning a Car for Rideshare Driving

Let’s use a driver in Los Angeles who drives about 45 hours a week using different cars. He earns $42,200 a year in fares (after commission and before expenses) and put 51,707 miles on the car each year as a function of earning those fares.

Using this, I compare the costs to operate a vehicle for rideshare between 3 different options:

1. Renting With Lyft Express Drive

I chose to use Lyft’s Express Drive as an example because it offers a unique “Rental Rewards” program.

It’s a special thing from Lyft where if you provide a certain number of trips each week, you’ll get refunded all or most of the cost of the rental.

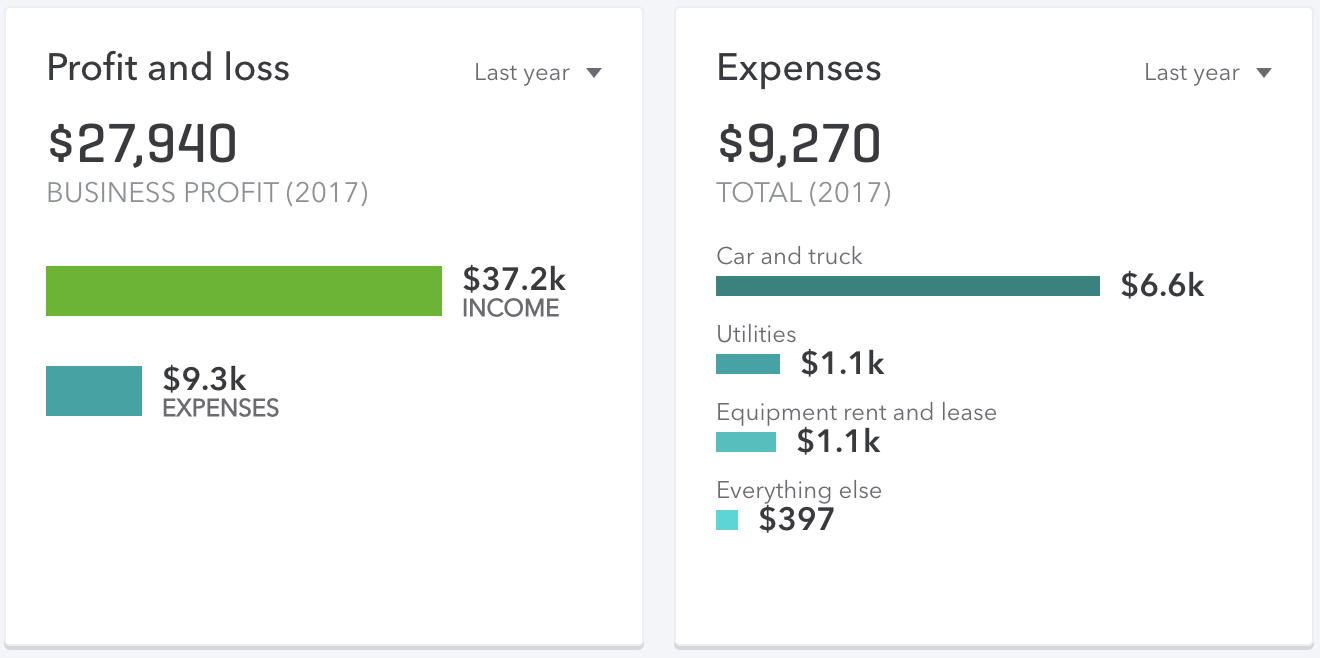

Using Express Drive “locks” you into the Lyft platform and disqualifies you from most extra earnings incentives like Power Zones and Power Driver Bonus. This results in slightly lower gross earnings of $37,200 throughout the year.

Lyft’s Express Drive offers a Rental Rewards program that will eliminate or greatly reduce the cost to rent each week for drivers who complete a minimum number of rides each week.

These numbers assume that our full-time driver fails to meet the ride requirements for rental rewards six times a year.

However, someone who never hit the “Rental Rewards” bonus could theoretically see costs as high as $9,386 in rental fees per year!

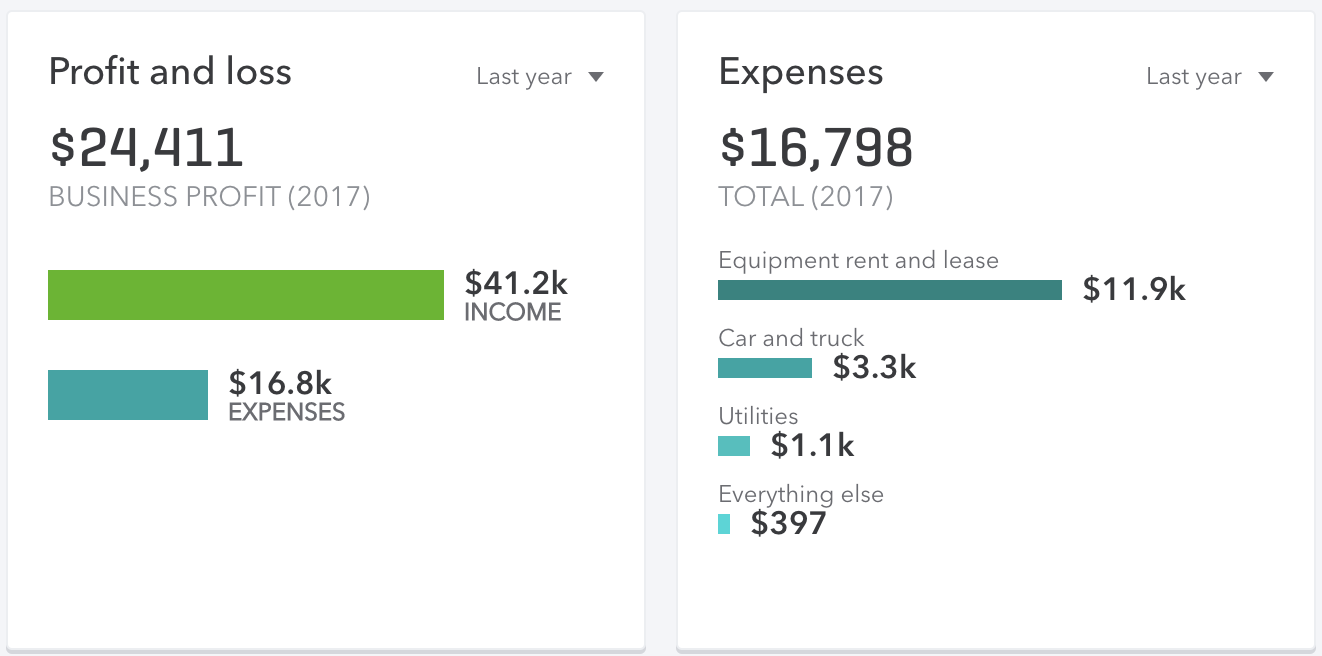

2. Third-Party Rental Companies For Uber

Most of these companies charge between $40 to $50 a day for their rentals after insurance and fees.

For example, renting a 2012 Prius through Hyrecar for 280 days (this assumes our driver takes an average of 1.6 days off a week) would cost $11,926.30 before gas, and cleaning costs.

That doesn’t include the cost of getting to and from your rental (aka switching costs).

One silver lining to using a 3rd party rental company though is that it allows you to drive for Uber, and most other on-demand services while still collecting bonuses like Uber Quest.

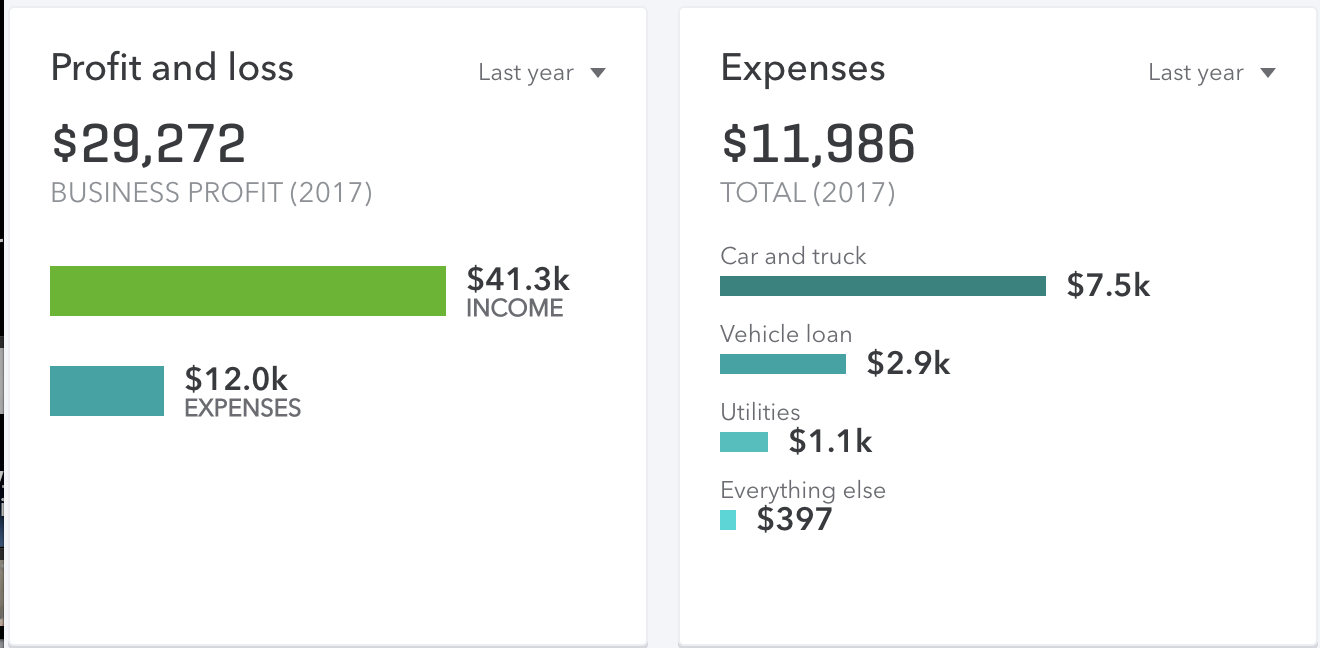

3. Financing a 2012 Prius for Uber or Lyft

We found a 2012 Toyota Prius for sale in Los Angeles at Galpin Toyota for $13,995.

It had 66,523 miles on the odometer. We assume our driver financed this Prius at 3.59% APR with a $1,500 down payment and a loan term of 60 months.

This makes the payment come out to $253 per month.

How Much Does Your Interest Rate Really Affect Financing Costs?

Costs can vary a lot based on the % APY of an auto loan.

For example, the same loan with the same terms but with 10% APR costs an additional $470 in the first year of ownership and would up the monthly payment from $253 to $294.87 a month.

You can calculate the details of any given loan for any given car using this Auto Loan Amortization Calculator.

What About Traditional Leasing?

If we ran a traditional lease through this simulation our driver would owe around $8,000 in over-mileage charges on top of the other costs. I’d show you a graph of that but it’d be NSFW and pixelated.

The only time you may get away with it is if you are already leasing a car that you rarely use and that you expect to turn in far, far below the mileage limit.

For example, my grandma could probably get away with it because she leases a Lexus 300 IS F Sport AWD that she drives 4.3 miles to work every day and the lease allows for like 10,000 miles a year.

Maybe I should borrow that Lexus for some Select/Lux driving… 😂

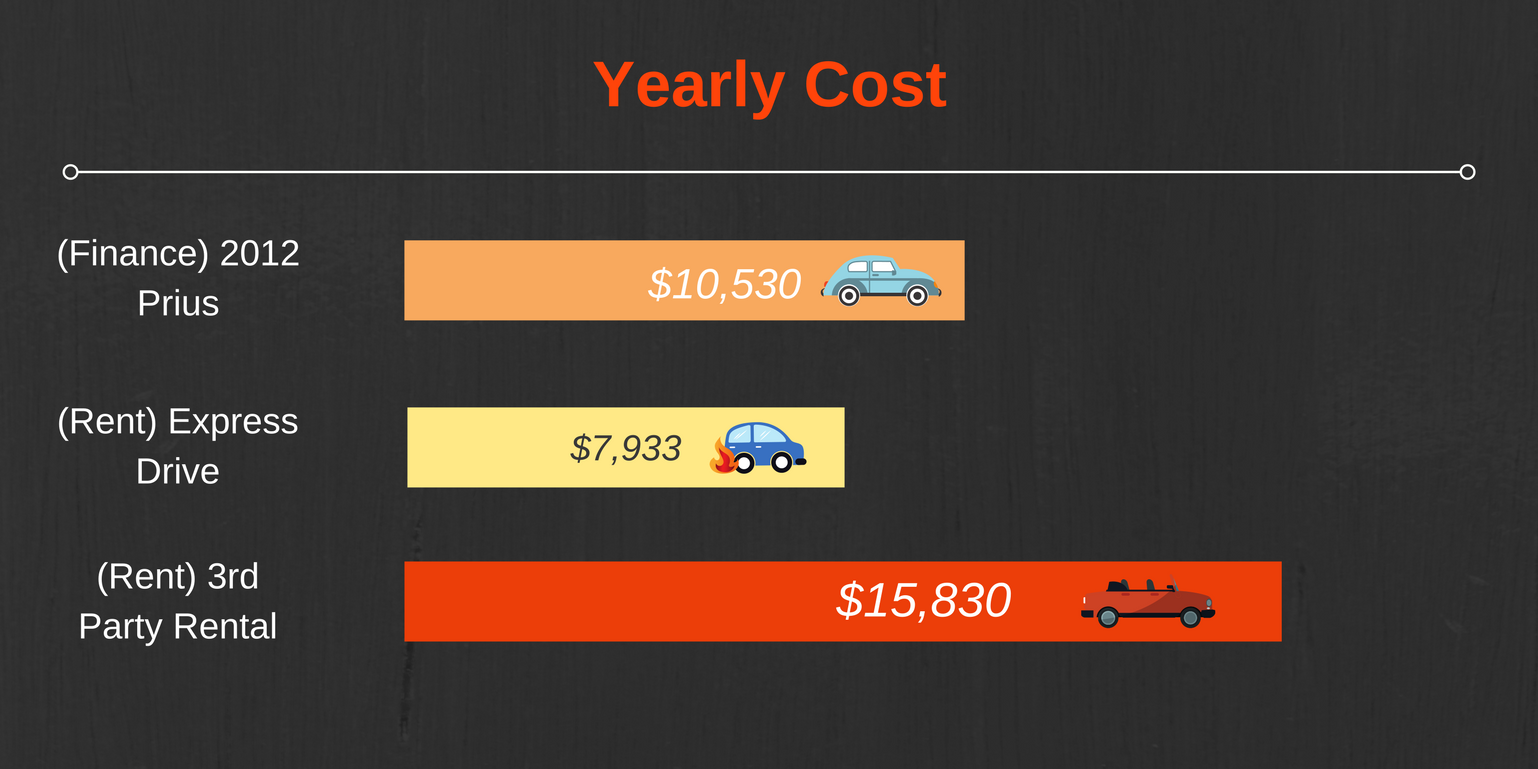

Yearly Costs Summarized and Compared

- Financing a 2012 Prius: $10,530

- Renting with Lyft Express Drive: $7,933

- 3rd Party Rental Company: $15,830

Your Financial Situation Is Unique

Every driver, market, and vehicle is different. There is an endless combination of variables when it comes to calculating the best car for driving in the gig economy.

The only way you will truly know your own numbers is if you track them yourself using one of the best mileage tracker apps.

Renting Has A BIG Tax Disadvantage

So far, I’ve only covered the cost to operate before taxes.

However, when you rent property for business use, you can only deduct the actual costs of renting that equipment for your business. This applies to your vehicle rental as well.

This also means you cannot take that juicy $0.655/mile IRS Standard Mileage Deduction!

Renters can deduct their costs to rent plus their actual driving expenses like gas and road services. Even then, they can only deduct the portion of the rental use that was for business.

However, if you own (or lease) your vehicle, you can still take the Standard Mileage Deduction for all those business miles, which in our case would result in a whopping $33,868.08 tax deduction!

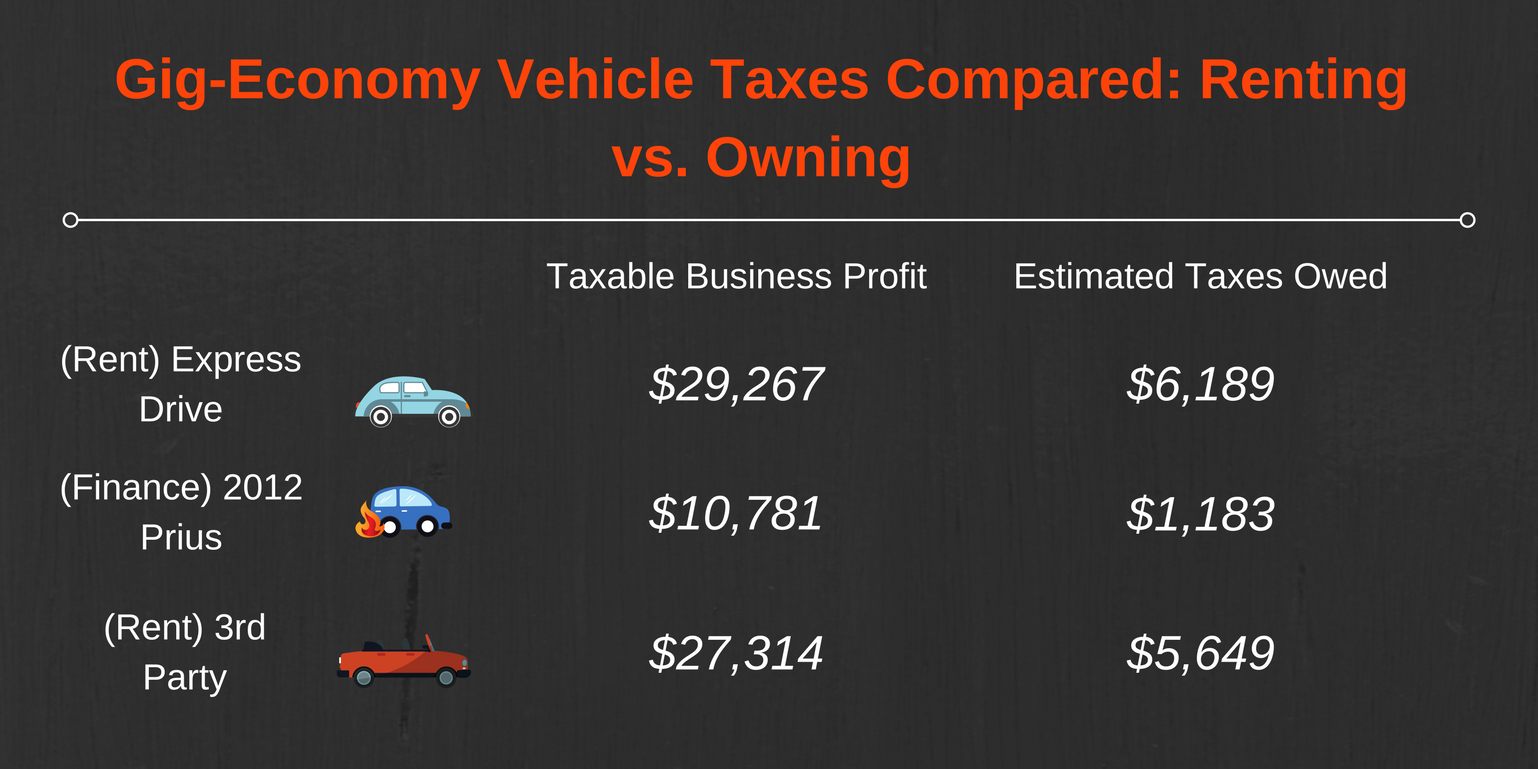

Gig-Economy Vehicle Taxes Compared: Renting vs. Owning

Taxable Business Profit / Estimated Taxes Owed:

- Express Drive Chevy: $29,267 / $6,189

- (Own) 2012 Prius: $10,781 / $1,183

- (Rent) 2012 Prius: $27,314 / $5,640

Our conclusion, owning your rideshare vehicle can result in paying FAR LESS in taxes if you put a lot of business miles on it and take the IRS Standard Mileage Deduction.

Final Earnings After Expenses & Taxes

Gross – Expenses – Taxes = Profit

- Express Drive: $37,200 – $9,270 – $6,189 = $21,741

- (Own) 2012 Prius: $42,200 – $11,986 – $1,183 = $29,031

- (Rent) 2012 Prius: $42,200 – $16,798 – $5,640 = $19,762

So, Is Renting a Card for Uber Worth It?

Overall, in the situations we laid out, renting a car for Uber is not always worth it. You will be able to profit more money at the end of the year if you are able to finance an affordable qualified vehicle with a good interest rate.

But you have to make sure you get the right car, and if you are just trying to get your foot in the door to rideshare driving and cant purchase a car quite yet, renting can help you get started.

Getting The Right Car Makes All The Difference

As a rideshare driver, there’s only so much you can do to control how much you earn. However, one thing you’ll have complete control over is how much you spend on your car.

If there is anything we can take away from this exercise, it’s that getting into the right car is probably the most important part of getting set up as a rideshare driver. Making the wrong choice could cost you $9,269 a year!

Our “test” driver worked the same hours, on the same days, and drove the same amount of miles throughout the year in Los Angeles. His choice to rent or own his car meant a difference of $9,269 in take-home pay for 2017.

Related:

Renting Can Get Your Foot In The Door

Renting isn’t all bad. If you need a job and really can’t get into a new loan right now (for whatever reason) then renting can lend you a hand in getting back on your feet.

If you do so, I recommend taking the following approach:

- Rent for as short a time as possible.

- Record every. single. penny. (and mile)

- Make a budget to purchase the cheapest rideshare car you can.

- Use Lyft’s Express Drive, read their T&S, and hit their Rental Rewards program every week.

- Purchase the cheapest Japanese 4-door, 4-cylinder that qualifies for Uber.

Renting is also very useful for casual drivers or those who are getting their toes wet before making a larger commitment to drive in the sharing economy. I highly recommend using a rental before buying a car as a new Uber driver to make sure you like the gig first.

Related: