New York City drivers – are you perplexed by TLC requirements? Wish you could find a good deal from a reputable insurance company? Below, senior RSG contributor Jay Cradeur highlights how INSHUR, an insurance company for NYC drivers, works, how to get started with INSHUR, and what you can expect in terms of customer service.

This post is sponsored by INSHUR but, as always, opinions are our own, and we only report on products and services that are beneficial to drivers. If you’re looking for commercial insurance in NYC and want to get a quote without having to step foot in an office or picking up the phone, check out the INSHUR app. Get a free, easy quote in minutes and receive a $25 Amazon gift card when you enter the Referral Code RIDESHARE.*

Recently, I had to purchase rideshare insurance for my Honda Accord Hybrid. I called three insurance companies and had to tell each of them all my details, my requirements and then, of course, I had to request quotes. It was a hassle and it took up half of my day.

Fortunately for those of you who drive in New York City, there’s an app for that! From my experience, INSHUR makes getting the proper automobile insurance in New York a breeze. Last year, we covered TLC insurance with INSHUR and all of the features INSHUR’s app provides.

Don’t drive in New York City? There are still plenty of insurance options by state – visit our Rideshare Insurance page for more info.

TLC Insurance

Drivers in New York City are covered by a unique type of commercial insurance in order to do rideshare. This commercial insurance is called TLC insurance and is required by the Taxi & Limousine Commission (TLC) to obtain a TLC permit. The TLC permit is required to give your first ride in NYC, which makes commercial insurance expensive and necessary.

Getting a quote for TLC insurance is often a long and painful process. You have to go into an insurance office, fill out some paperwork, and get a quote. Then rinse and repeat if you want to compare policies and costs. It’s something I have absolutely zero desire to do whatsoever, especially in a pandemic.

INSHUR’s app changes that. They’re the first in New York City to let drivers get a quote and sign up for a commercial TLC insurance policy with just an app on your phone.

Regardless of who you decide to use for your commercial insurance, I think at least getting a quote from the INSHUR app is smart. That way you are armed with a baseline on pricing while searching for your next policy. Plus, you can get a $25 Amazon gift card by getting a quote too by using Referral Code RIDESHARE.*

What Is TLC Insurance?

The Taxi & Limousine Commission requires any For Hire Vehicle (FHV) to operate with commercial insurance. It doesn’t matter if you are a career taxi driver or a part-time Uber driver. You’ll need commercial insurance.

NYC TLC insurance must meet the following standards:

- $100k/passenger for first 7 passengers

- $300k/occurrence

- $200k Personal Injury Protection (PIP)

INSHUR’s policies meet all of these requirements and have the added benefit of physical coverage, 3rd liability and personal use all in one simple policy.. Once a driver has obtained commercial insurance, they must provide proof to the TLC to get a TLC license. INSHUR provides the documents you need as soon as you purchase the policy. Once the driver has a TLC license, they can finally begin to give rides.

Although the TLC only requires a driver to have liability insurance, it may be smart to opt for a full coverage commercial policy. In my experience, anyone who spends 40+ hours a week driving a car in New York City is going to eventually run into something or be run into by something.

How Much Does TLC Insurance Cost With INSHUR?

Since the insurance industry in NYC is heavily regulated, you might find that quotes between insurers don’t differ too much. When you purchase a TLC insurance policy with INSHUR, they will allow you to purchase it with a down payment of 15%, 20%, 25%, or 30%. From there, you can make monthly payments on the remainder of the premium, allowing you to be flexible with your finances.

Like all forms of insurance, the costs vary based on some important factors about you in the underwriting process. Common factors include:

- Your driving history

- The value of the vehicle insured

- Age of drivers license

- How long you’ve been driving an FHV

- Age of the driver insured

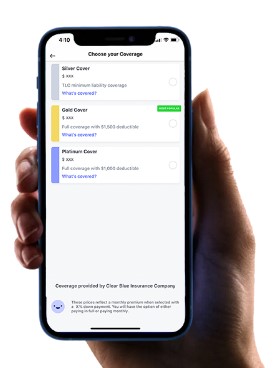

What Levels of Coverage Does INSHUR Offer?

There are 3 options: Silver, Gold, and Platinum

- Silver: Liability only

- Gold: Liability and Physical Damage ($1,500 deductible)

- Platinum: Liability and Physical Damage ($1,000 deductible)

How To Get TLC Insurance With INSHUR

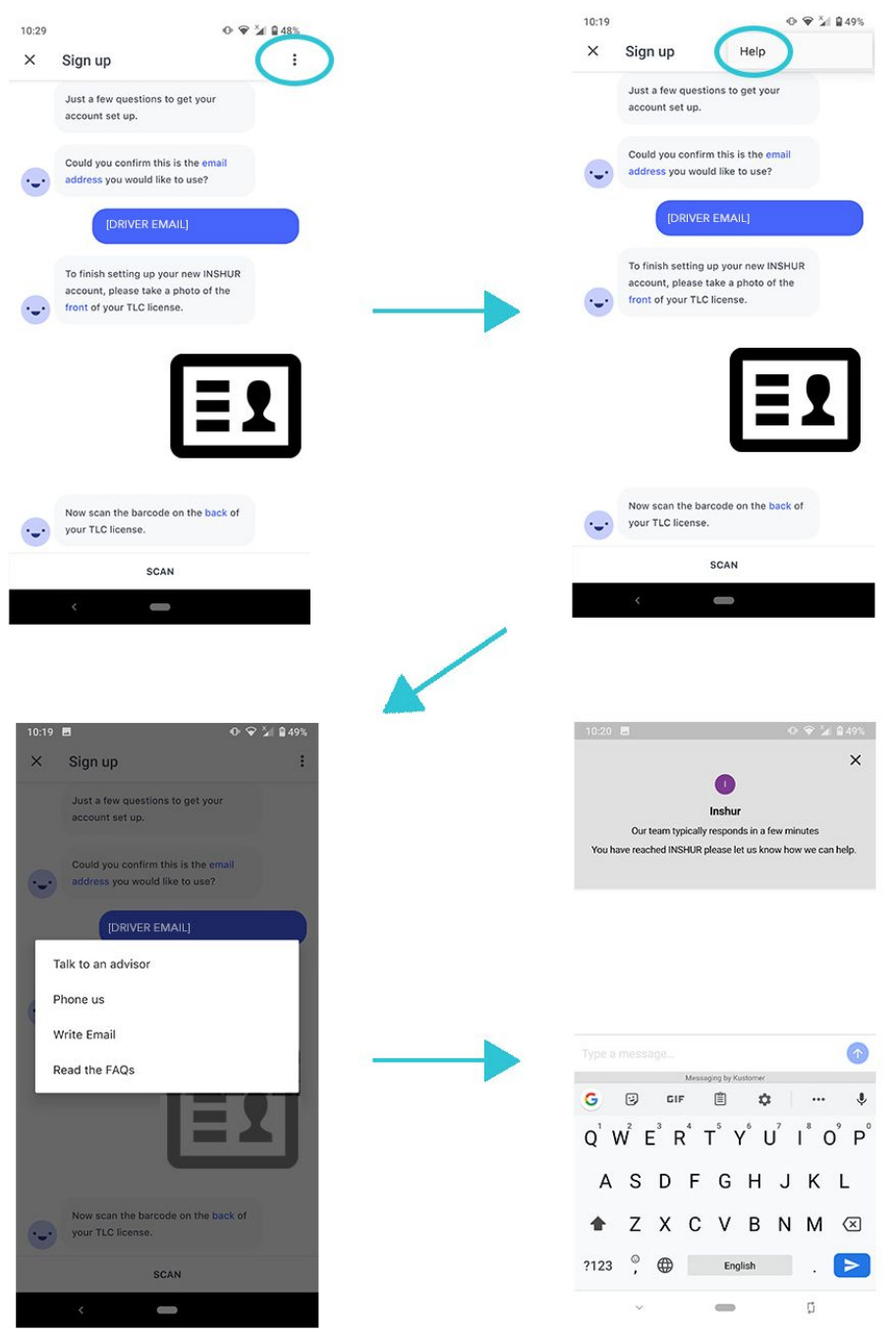

From my experience, and the reviews of thousands of other drivers, getting TLC insurance with INSHUR is really easy and fast. You download their app on either iOS or Android, sign up, and then it will ask you to take a picture of the front and back of your TLC license with your smartphone and ask you some other, simple questions.

Once you answer these questions, the INSHUR app will take you to the policy screen and provide you with pricing for their three levels of plans.

Upon selecting a plan, you will be presented with a payment screen that asks how you would like to pay for the insurance. You can choose to put down a down payment on the policy of 15%, 20%, 25%, or 30% and then pay the remainder as part of a payment plan for the rest of the year.

You can also purchase a policy outright and not have to worry about it again until next year. If you stop driving and need to cancel, INSHUR will refund you on a prorated basis.

After you purchase a policy, INSHUR will ask for some additional documentation to prove that you own the car you are insuring. You will also be provided with all of the relevant policy documents to show the TLC that you meet their minimum insurance requirement.

From my experience, INSHUR definitely helps drivers to get on the road faster, as everything is done within the app. You don’t need to make any phone calls or visit the broker’s office.

Customer Support With INSHUR

One important thing to note about INSHUR is the level of customer support they provide. As it’s an app, you don’t have any contact with a real human unless you need it. The good news is that it’s really easy to do, they have very little waiting times, if at all, and the customer support personnel are really friendly and helpful.

When INSHUR first came on the scene, this was a different story, as you might hear from asking your peers. INSHUR say they grew very quickly in popularity and didn’t have the staff ready to support the number of drivers. But they’ve more than overcome this now, and I’ve only read good things about the support they offer.

If you did need to speak to the support, just click the three dots in the top right-hand corner of the app. They’ll give you the option to call, online chat, or email them.

Filing Claims With INSHUR

The claims filing process is more “traditional” in that you still have to work with people, fill out forms, etc. However, according to INSHUR’s own research of 757 TLC drivers, 74% of drivers who had claimed with INSHUR, said their claims process was “very easy” or “easy”.

INSHUR says they are currently building the ability to file a claim within the INSHUR app in order to bring things in line with their signup process (fast and easy in the app). It’s probably worth pointing out that filing a claim with the other TLC insurance companies is generally a similar and archaic process. Hopefully, you’ll never have to file a claim but if you do, you can do so through the following methods with INSHUR:

- Phone: 866-446-7487 and select option 2

- Email: claims@inshur.com

- Support is provided: M-F, 9AM – 5PM

Key Takeaways

INSHUR is a convenient and speedy way of acquiring TLC insurance and is regulated by the New York State Department of Financial Services (DFS). INSHUR issues policies on behalf of Clear Blue Insurance Company, under license from Munich Re, who according to INSHUR is “one of the most financially secure insurance companies in the world”.

INSHUR also tells me they are working on a way to file claims from within their app via uploading pictures and forms in case of an accident.

Additionally, INSHUR raised an additional $9 million dollars from investors, so they’re going to be around for a while, and now we know they at least have the money to invest in their claim filing infrastructure.

I definitely think it is smart to request a quote from INSHUR through their app, especially if you are beginning your annual search for commercial insurance and want to compare pricing. It will give you a baseline of what kind of coverage you can expect and for what price.

Plus, you can get a $25 Amazon gift card when you get your quote and enter the Referral Code RIDESHARE*.

You may find that they are indeed the cheapest and best option for you. They often have the most competitive quotes for drivers and many are pleased to find INSHUR is the best option for them. They are especially useful if you have a need to renew your insurance ASAP after waiting until the last minute. It’s also good to note that you can purchase a policy at any time, so even during the weekend if you find yourself without insurance and unable to work, INSHUR allows you to get it immediately and not lose out on revenue. INSHUR does an excellent job of signing you up and getting you the documents you need to get on the road.

New York City drivers can download INSHUR and get a TLC insurance quote using our link.

Readers, how did the TLC commercial insurance process go for you? Would you have preferred an easier method, like INSHUR, to get commercial insurance?

-Jay @ RSG

*T&Cs apply, click here to read them.