It seems pretty obvious: without a car, you can’t be a rideshare driver. But how, when, and what type of car to get for rideshare driving is more complicated, involving money and time. Sounds like you need a car buying guide for Uber/Lyft drivers! In this Throwback Tuesday Classic, senior RSG contributor Jay Cradeur walks us through the steps of what you need to know when you’re considering buying a car for rideshare.

The single most important tool every rideshare driver must work hard to maintain and improve is his or her mind. The more you know, the more you will maximize your revenue. And the better you are at reading your passengers, listening and talking when appropriate, the more “stars and tips” you will receive.

But the second most important tool is your car. You will spend hours and hours driving in your car. How you obtain your car is important as well, lease versus purchase. After renting a car with Fair for a couple months, I recently decided to purchase a car and ran into many opportunities and many roadblocks. This article will share the several potholes you can avoid if you decide you want to make a car purchase.

Looking for a car and don’t want to buy your own? Check out our Vehicle Marketplace.

Why Buy A Car For Rideshare Driving?

During the first three years of my driving career, I was a full-time, hardcore driver. Obviously, to be at 23,700 trips, I was putting the pedal to the metal. I wrote an article about the solid financial reasons to lease or rent a car through Uber or Lyft if you are going to be a full-time driver. Most people don’t consider the depreciation a car experiences when you are a full-time driver. Right now, I think Fair has one of the best programs for drivers so if you’re interested, make sure to read my Fair Uber Review.

However, these days, I am not driving as much. Instead of consistently driving 120 – 170 trips, I am in the 70 – 120 trips per week range. I am also doing some driving for a few other projects which requires a nicer car. The time is right for me to buy a new ride.

Getting Started: Your Uber and Lyft Car Buying Guide

This is what took me the longest time to figure out. For three afternoons in a row, I spent 3 hours each day going down the “car reviews” rabbit hole. If you are not familiar with the term rabbit hole, it means you start looking at something on the internet, and then you get lost in it, going from one article to another, and before you know it, hours of your life have just passed you by.

At first, I thought I wanted a Toyota Prius. After all, the Prius is one of the best cars for Uber and Lyft drivers.

But then I remembered how I did not like the significant road noise, even though I did love the gas mileage at 50 MPG. So then I looked at the Toyota Camry Hybrid. It is a bigger car, much quieter than the Prius, and much easier to find with a moon roof.

However, the Camrys don’t have Apple Play. Apple Play allows you to see your phone on the car display screen. Also, the Camry’s are more expensive with prices in the $30K range. For this to be the best car for Uber and Lyft driving, it needs to have everything a driver needs!

So I kept reading and then came upon an article on the 2017 Honda Accord Hybrid. It gets 50 MPG in the city and has Apple Play.

After all my rabbit hole work, I knew a car that satisfied these requirements would be the best car to drive for Uber and Lyft:

- Great gas mileage (50+ MPG)

- Quiet interior (For listening to podcasts and music)

- Moon roof (I just love the sun and wind on my face)

- Apple Play (It’s a great feature!)

- Black, Blue, Grey color (I prefer these colors)

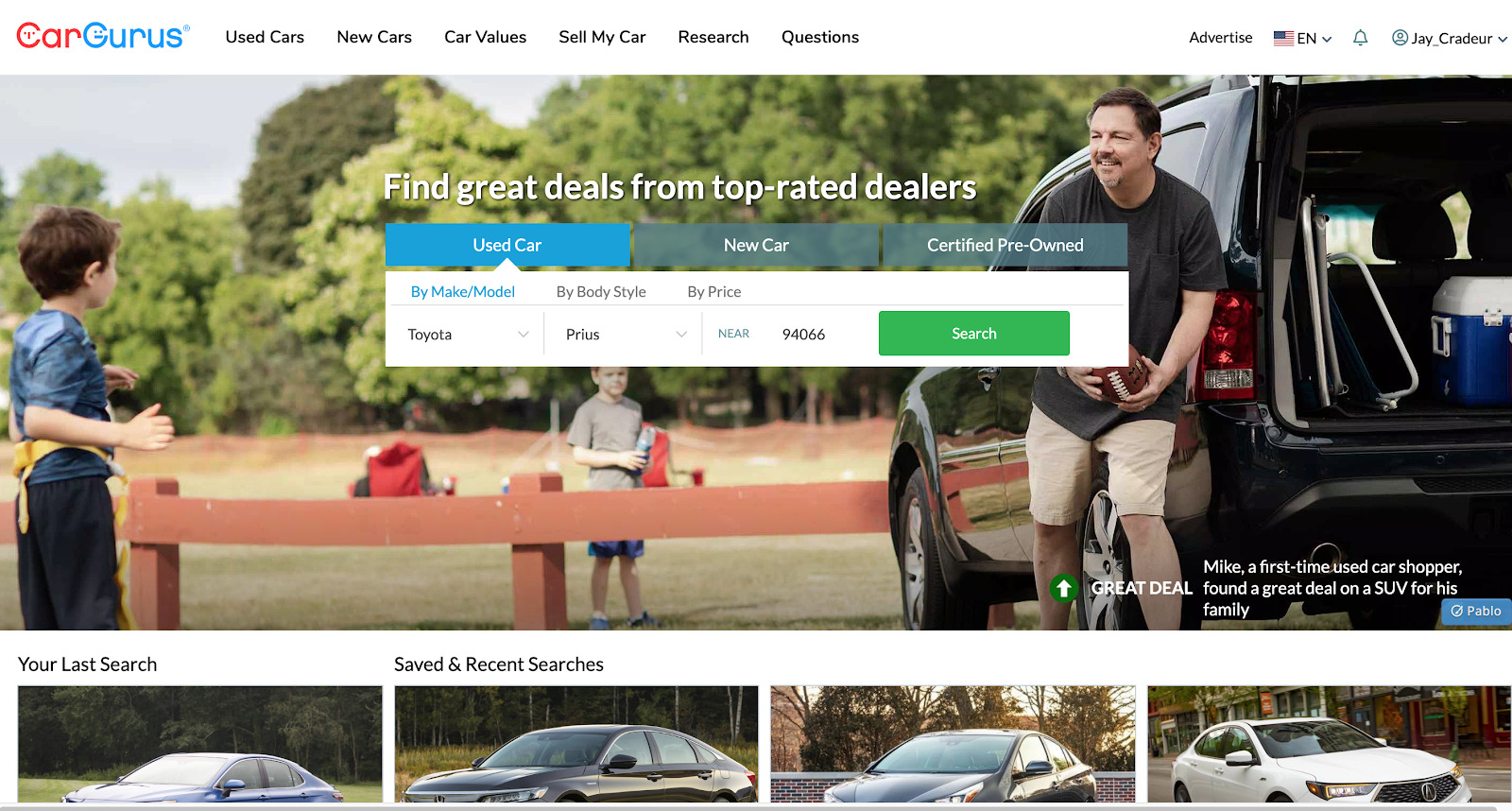

Car Gurus

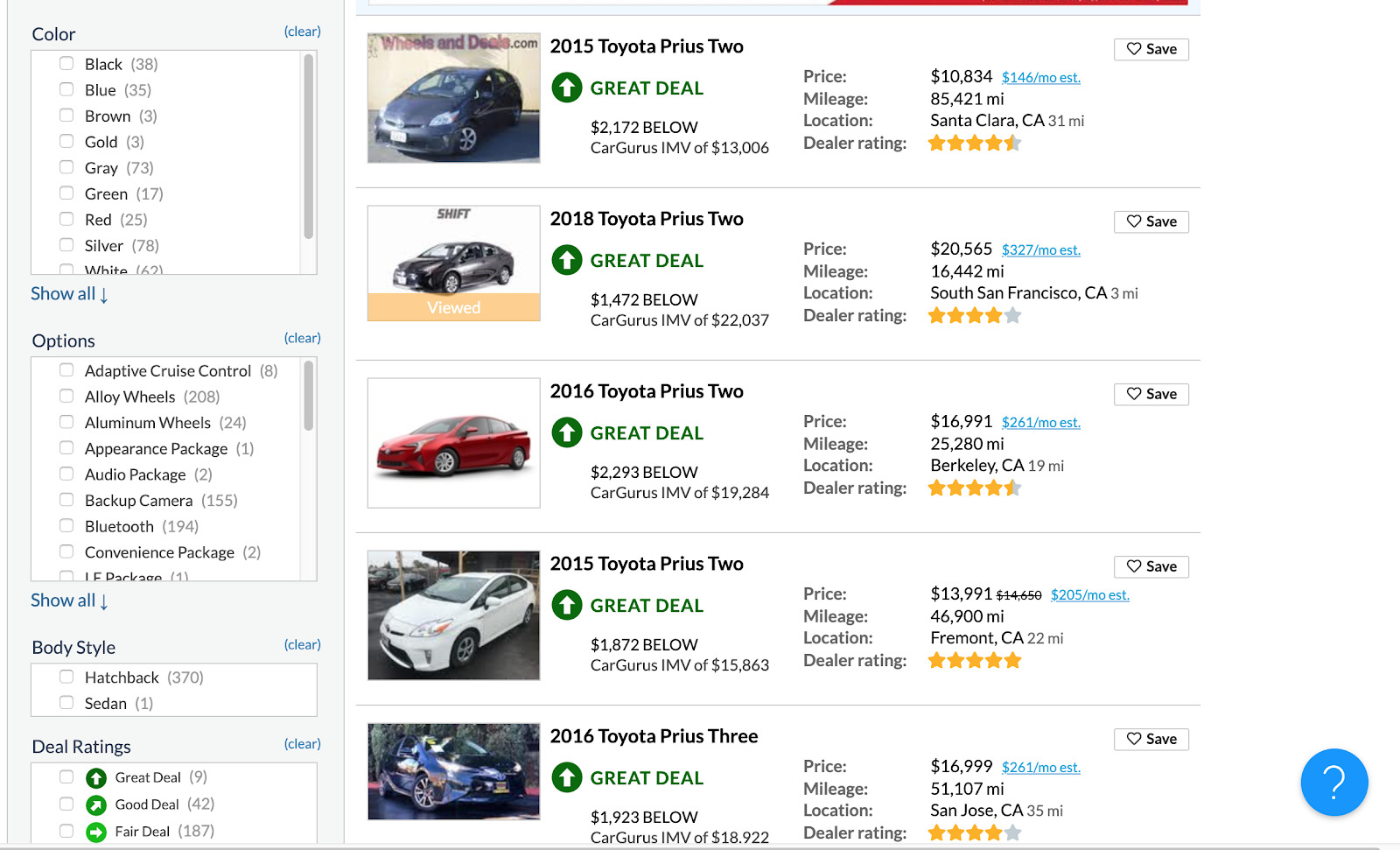

I spent hours on Car Gurus. It is easy to do a search and see lots of cars with your desired qualities. You can see the cars from all over the United States, or limit your search, for example, to a 50-mile radius.

I found that by looking at Car Gurus I became very knowledgeable about cars and the prices. They have a wonderful feature which tells you when a price is a great deal, a good deal, or even a not so good deal.

Since I knew I did not want to buy a brand new car, it was important I got familiar with the pricing. I wanted a car with some miles on it in order to keep the price in the low $20,000s. Most of the cars on Car Gurus are listed by dealerships which you can then contact directly.

Not sure what kind of car you want? Try out different cars as an Uber/Lyft driver by checking out our vehicle marketplace.

Carvana

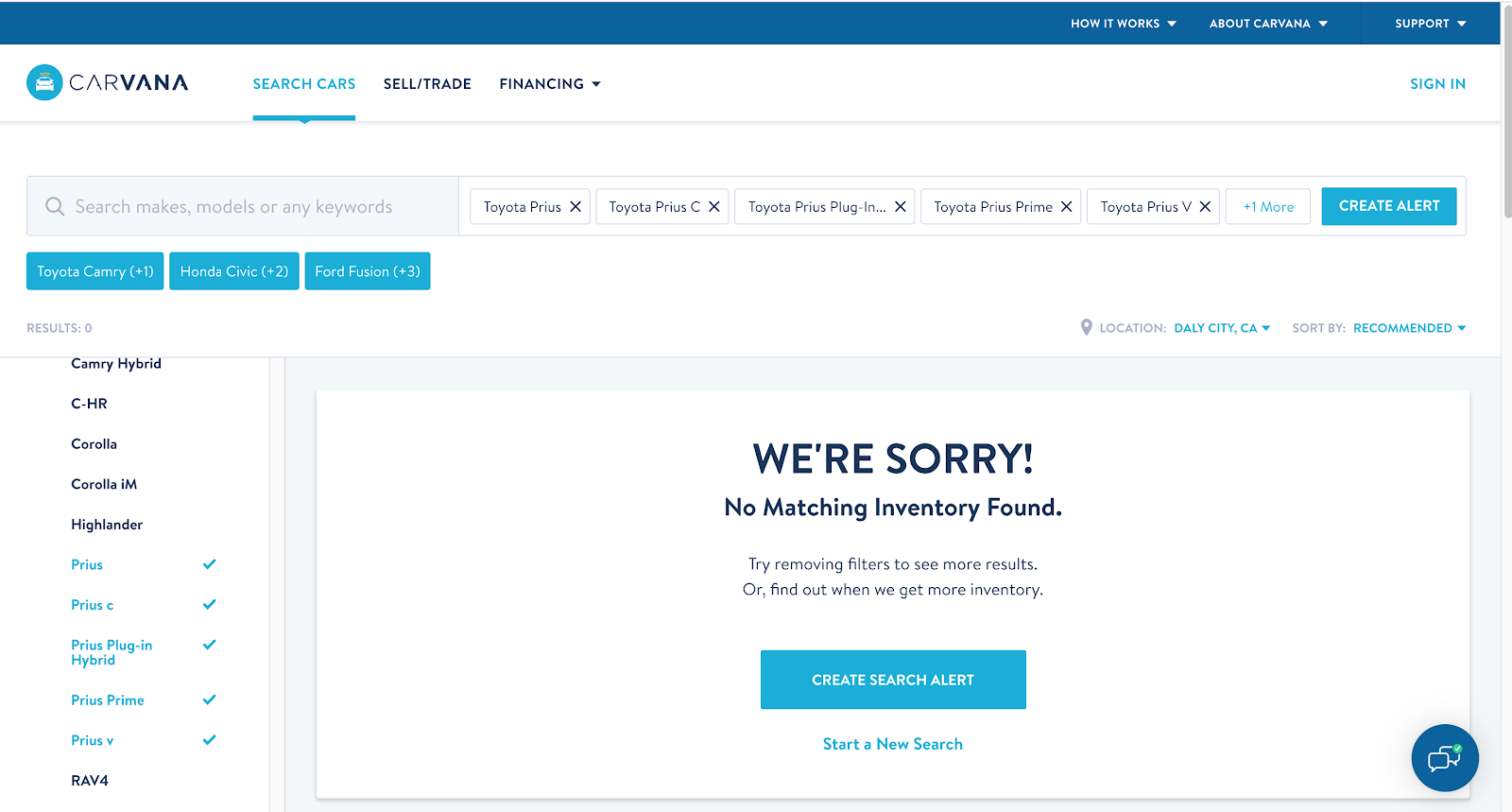

Carvana is a relatively new (5 years) car service that puts a great deal of emphasis on having your car delivered to you.

With Carvana, you look for a car online, find your car and get qualified for a loan – through Carvana. The final step is the car is delivered to your door. You don’t even need to leave your house.

I did not find Carvana to be a compelling program. First, they don’t have a very large selection of cars. As you can see here, there are no listings for a Toyota Prius.

I also want to test drive a car before I make a financial commitment. Carvana does give you time to drive your car after it is delivered and reject it if you don’t like it. However, that seems like a big hassle. I’d rather test drive a car first and then go through all the paperwork. After rejecting Carvana, I checked out another online service.

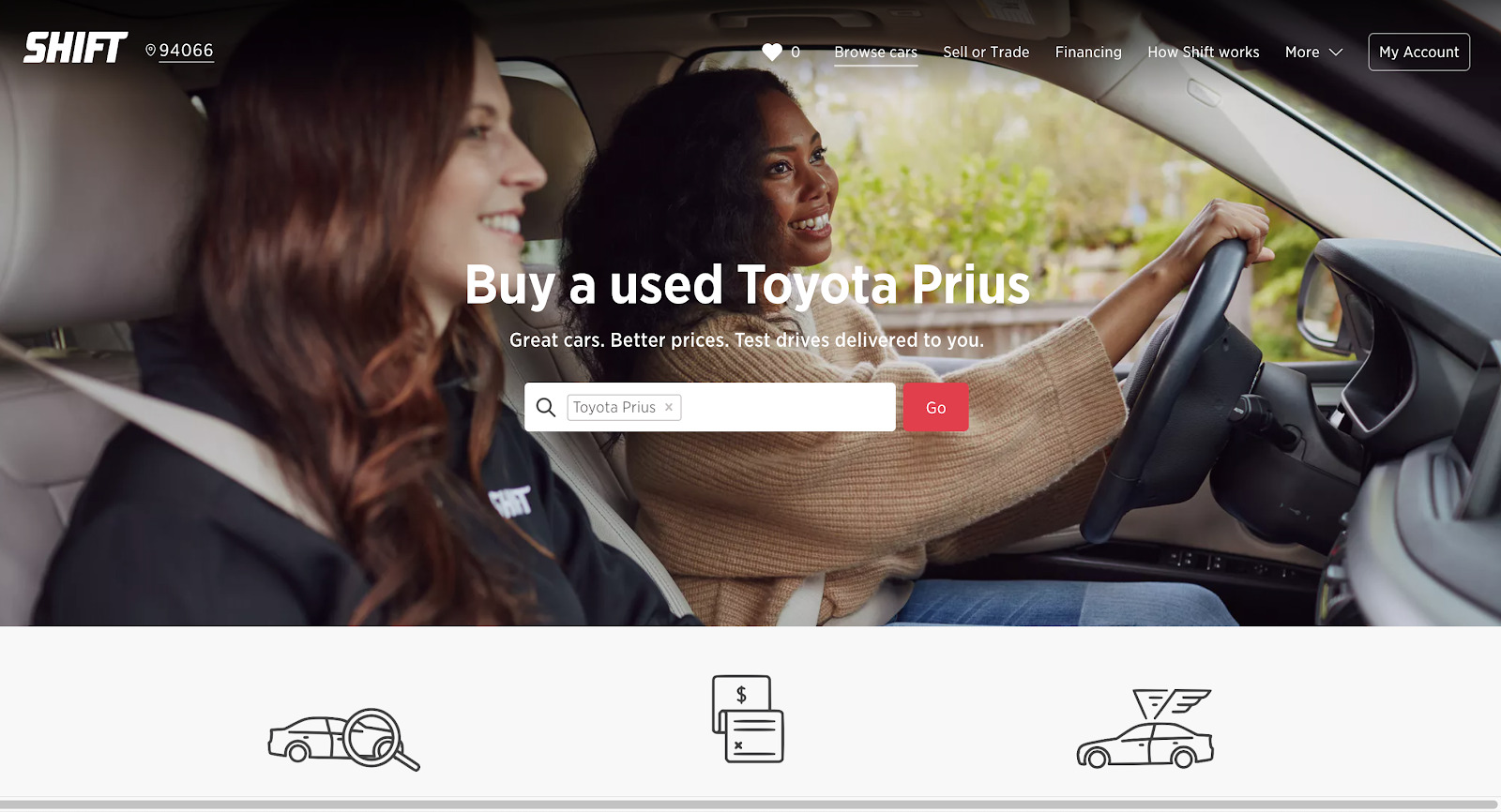

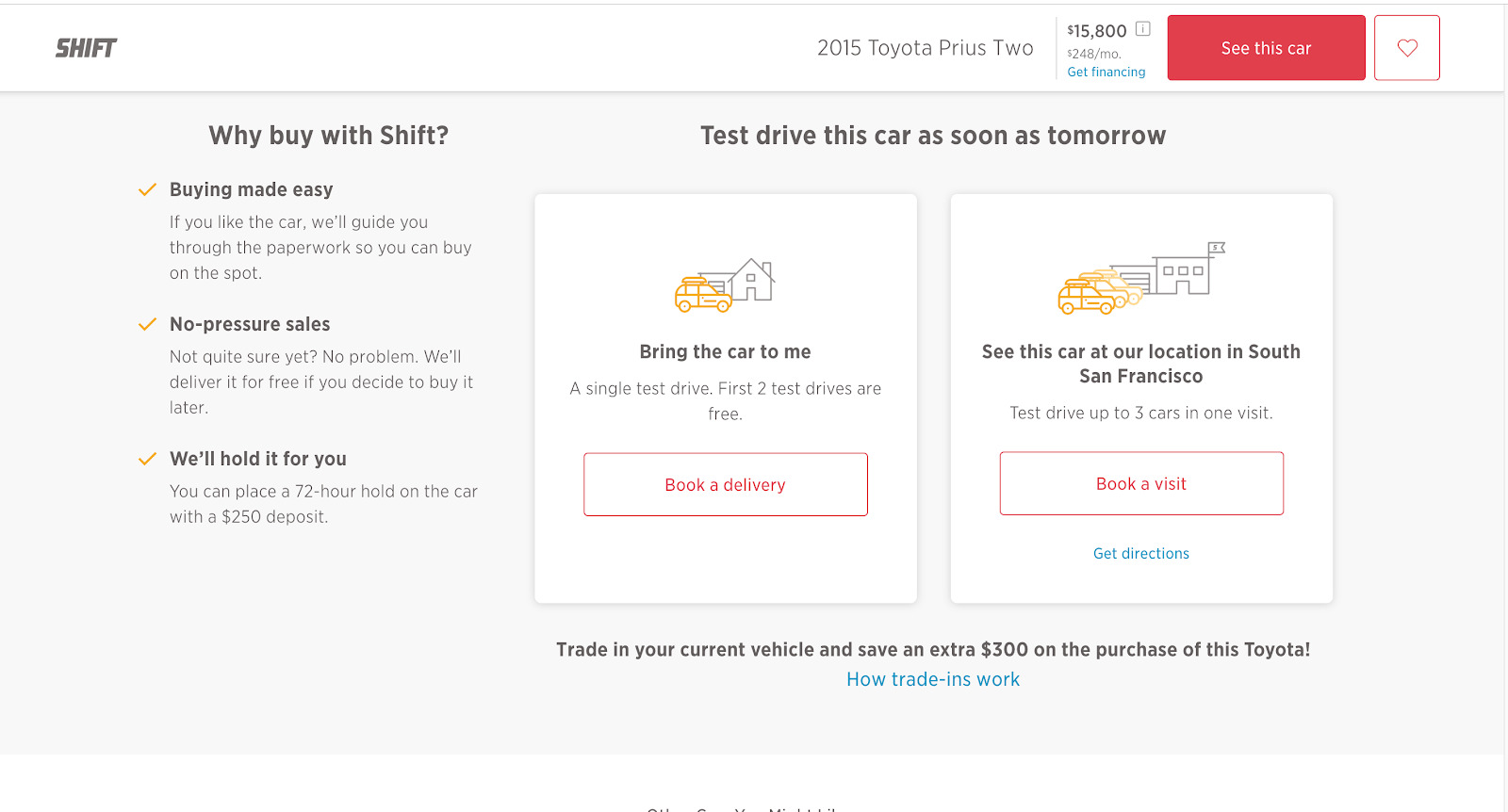

Shift

I liked Shift very much. It is a nice blend between Carvana and a car dealer. You can search online for your car. As you can see here, they have a very good selection of cars.

Once you find a car of interest, you can schedule a test drive. You can either go to one of the Shift sites and drive up to three cars, or Shift will bring a car to you.

Had I not found my car on Car Gurus, I would have moved forward with Shift.

Choosing What Car to Buy for Uber and Lyft

After a while of searching, I knew what I wanted. I wanted a black 2017 Honda Accord Hybrid that I saw on Car Gurus. It had 34,000 miles on it and was priced at $21,000. It was also located at a car dealership just an eight-minute drive from my house.

I went directly to the dealership website and indicated my interest in the car. I authorized the dealership to do a soft credit check. I was contacted on Saturday morning by the General Manager and I requested a test drive at 1:30.

At the dealership, I was met by a very personable Sales Manager. We walked out into the lot and there was my car. It was not perfect. It has a scratch and a few dings – it is a used car.

However, then I drove it and it was a very nice ride. It is much quicker and smoother than the Prius. It was significantly quieter than the Hyundai Elantra I have been driving the past two months. The seven speakers had no problem blasting out Led Zeppelin’s In My Time Of Dying. The sunroof let in the rays, and my experience was complete. This was to be my car as long as I could qualify for the loan.

Ad: Never pay full price for gas again. Click here to start saving today.

Financing A Car to Drive for Uber and Lyft

If you have seen any of my articles or videos on preparing your tax return, you know that we drivers, as independent contractors, can take a huge car deduction at 54.5 cents per mile. While this is great for tax savings, it leaves our annual revenue quite low. This is a problem when it comes to making a big purchase.

A second problem is that most banks and lenders will want to see your tax returns. Since you are an independent contractor, aka someone who is self-employed, you are considered more of a risk than an employed individual.

Third, banks and lenders are hesitant to give rideshare drivers a loan because you will be depreciating the asset (the car) faster than most any other occupation. It is not easy and there are no simple solutions.

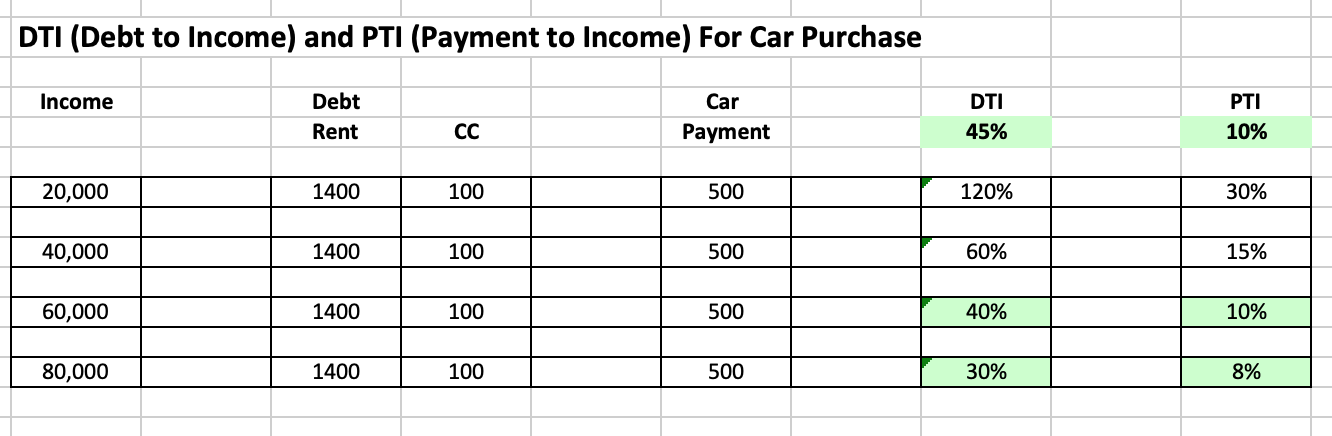

Banks and lenders are interested in two statistics called DTI and PTI. DTI is your Debt to Income Ratio. The PTI is your Payment (Auto) to Income. As you can see in this graph, if I use my tax return income of $20,000 (after all deductions) then my stats are all wrong. The goal is to get your DTI under 45% and your PTI under 10%.

Only at incomes of $60K to $80K or more do my statistics work for a bank. I did not understand this and was turned down by two banks. They both wanted to see my tax returns and that was the end of me.

Don’t qualify right now for financing or don’t want to purchase a car? Check out these car rental and vehicle options.

Find Someone Who Will Work With You

I found it best to work with a car dealer. When you work with a car dealer, you can look someone in the eyes. That salesperson, or sales manager, wants to make a sale. They are going to work hard to prepare your document so that it gets approved.

In my case, I was asked just a few important questions. What is my income before taxes? Since he did not ask me what was on my tax return, I told him I earned $8K per month last year. He also asked me if I had any other work I did besides rideshare driving. I said I did. I told him I worked as a writer and videographer. That was it for the questions.

With all that submitted, I then endured a tortuous one hour wait to meet with finance. I put down $3,000 (which earns me my 75,000 point sign-up bonus on my Am Ex card, good for one round trip ticket to Europe!), I agreed to the loan terms at 6.5% and signed all the documents. I then drove home, took an Uber back to the dealership, and picked up my car.

Getting Hooked Up With Uber and Lyft

I got my insurance sorted out and submitted those documents to Uber and Lyft. I drove my Fair Rental car to the Oakland station and dropped it off. Fair even paid for my Uber all the way back home. Thank you, Fair!

Soon, I will get my 2017 Honda Accord Hybrid inspected and washed and be on the road tomorrow. I even already ordered a new license plate frame for my new podcast, The Rideshare Dojo:

Summary: Your Uber/Lyft Car Buying Guide

Don’t assume purchasing a car as a rideshare driver is an easy process. I tried to purchase my old Toyota Prius for $5,000 and was turned down by two banks for the reasons I laid out above.

It was from those experiences that I learned exactly what the banks look at and require. My strong recommendation is to get a salesperson or sales manager involved. Then you have an advocate with some skin in the game.

Today I am grateful to have a new car and a car loan on my credit report. The sun is shining here in San Francisco and I am off to say Hi to all the nice folks at Uber and Lyft. Have a great day and be safe out there.

Readers, do you have questions about qualifying for financing a car for rideshare? Did you have any trouble purchasing a car as a rideshare driver?

-Jay @ RSG