The only thing constant right now for independent contractors is the constant navigation of current government bureaucracies, searching for funds that may or may not exist. Senior RSG contributor Jay Cradeur shares what it’s like navigating the various unemployment options for drivers, including money from the CARES Act, Pandemic Unemployment Assistance (PUA) and more below.

More information on Uber driver unemployment and how the virus is impacting drivers here.

This coronavirus pandemic has been with us for two months and I don’t know many gig workers who have seen a dime of unemployment.

It is a very stressful time. When your primary source of income has been taken away and you can not provide for your family, it is very difficult to maintain a positive frame of mind.

Recent developments, however, are encouraging and I will cover those in this article.

Stay up to date on all the latest unemployment news, funding sources, and our experience navigating it all by signing up for the RSG newsletter here.

Historically, unemployment benefits were only for employees, and only if an employee was released from employment (not if they quit). Benefits lasted 26 weeks and would stop either after this time or once the employee found another job.

Employee or Independent Contractor

Rideshare drivers are both employees and independent contractors depending on which state you work. Drivers in California, New Jersey, and New York are legally classified as employees. Drivers in the other 47 states are classified as Independent Contractors (ICs).

Uber and Lyft and some of the delivery companies are vigorously fighting against the employee classification because it will significantly increase their driver expense.

The Coronavirus Aid, Relief, Economic Security (CARES) Act

On March 27, 2020, the CARES Act was signed into law. What made this law rather monumental is the unemployment benefit recipient list includes Independent Contractors, but it also provides an additional 13 weeks of coverage (to a new total of 39 weeks) and includes an additional $600 per week for the months of April through July (16 Weeks at $600 – $ 9,600).

However, this created a new problem for all state governments. How do ICs apply when they do not have an employer who will verify their earnings?

Uber and Lyft have not been forthcoming with their driver’s earnings, even though it would dramatically speed up the driver payout process.

No, instead, as is customary for Uber and Lyft drivers, we are figuring it out ourselves while the government plays catch up.

Confused about applying for unemployment benefits or how the CARES Act can help you? Lyft has a resource page you can view here.

Phase 1 – Applying For Unemployment Benefits

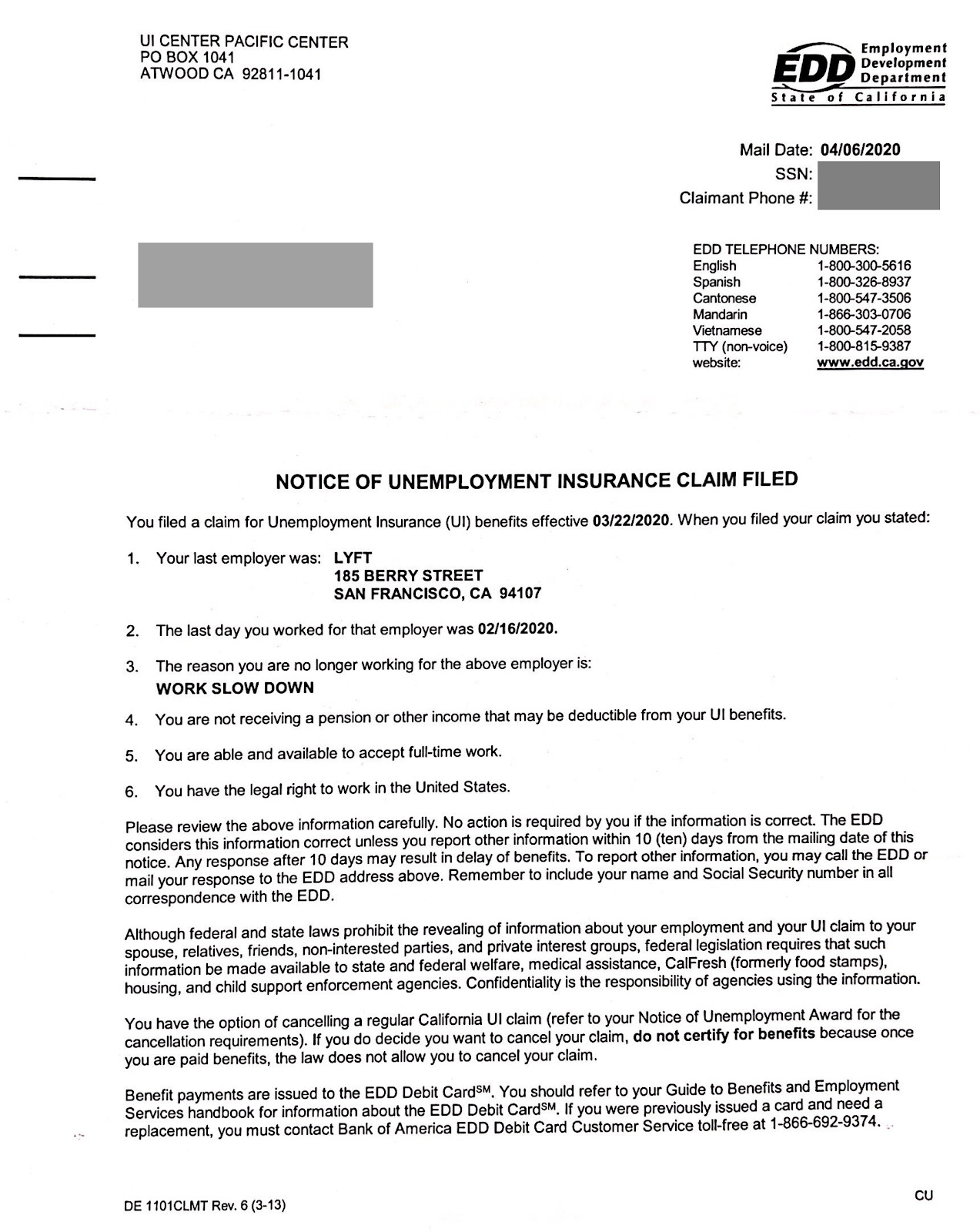

The first thing a driver could do is apply for standard unemployment. Even though we know the state unemployment office will not have any data to support our claim, we can at least get the ball rolling.

This is exactly what I did in mid-March. I applied online.

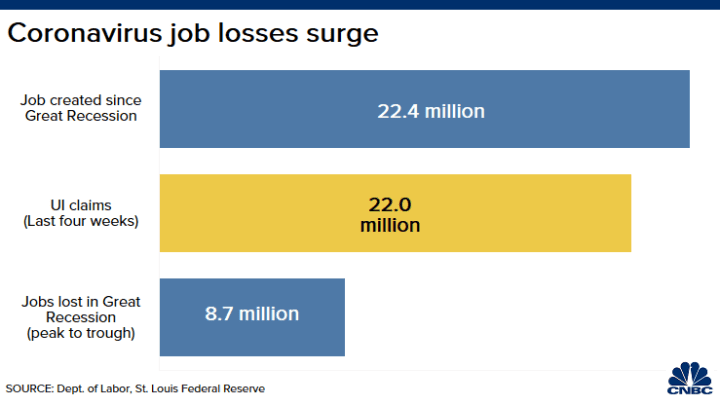

I was not alone. As of the writing of this article, over 22 million people have applied for unemployment due to the COVID-19 Pandemic in just the last four weeks.

No one expected their original independent contractor unemployment claim to bear fruit. It would not be possible since the unemployment office does not have any hard data (like 1099s or pay stubs) to support our claim.

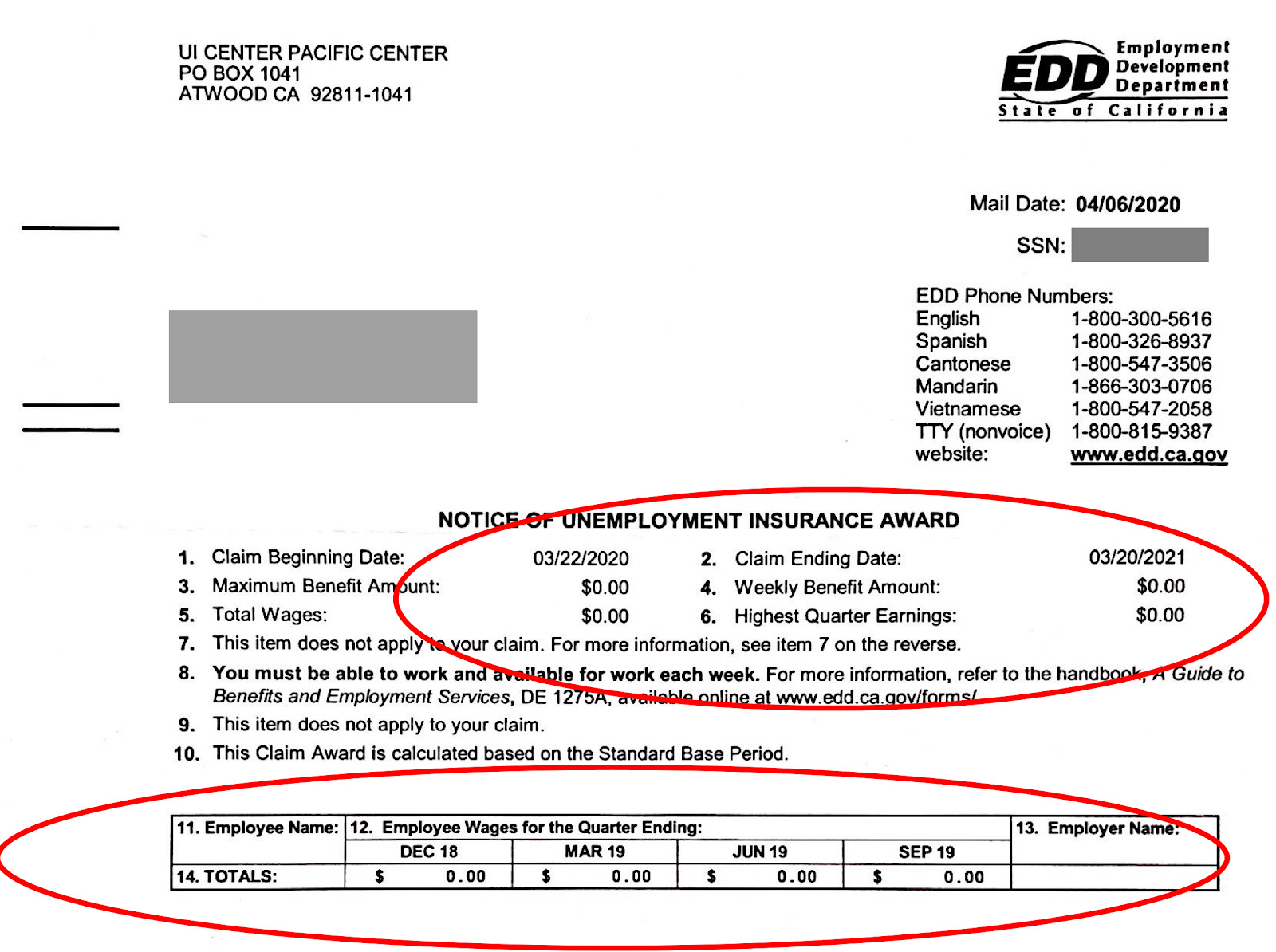

Therefore, many of us received a letter in the mail that stated our benefits would be zero. Nada. A big fat goose egg.

And here we see the second page with benefits of zero:

Creation of the PUA – Pandemic Unemployment Assistance

Rather than try to integrate independent contractors with employees, the government created the Pandemic Unemployment Assistance (PUA) in order to handle the incredible volume of jobless claims coming from gig workers.

Some states have been quicker to set up protocols for independent contractors than others (like California and New York). While we have not heard of anyone getting unemployment benefits as an Uber or Lyft driver just yet, we have heard that drivers have been able to indicate they are an independent contractor when applying for benefits.

Other states have been slower to respond. I recommend you check out your state’s unemployment website every day. This is what I have been doing in order to stay on top of the latest developments.

Phase 2 – Filing an Appeal

I created a video last week (see below) demonstrating how I responded to the letter I received from the state claiming I was entitled to zero in benefits.

If this happened to you, you will want to file an appeal. This will be your chance to provide the unemployment office with your 1099s as proof that you did work as an independent contractor and are entitled to benefits.

You can find your appeal document by Googling “Unemployment Benefits Appeal Form” and then the name of your state. You will need to complete that form and provide proof of your earnings.

For those of us who drive for Uber or Lyft, all the 1099s are available on their respective websites.

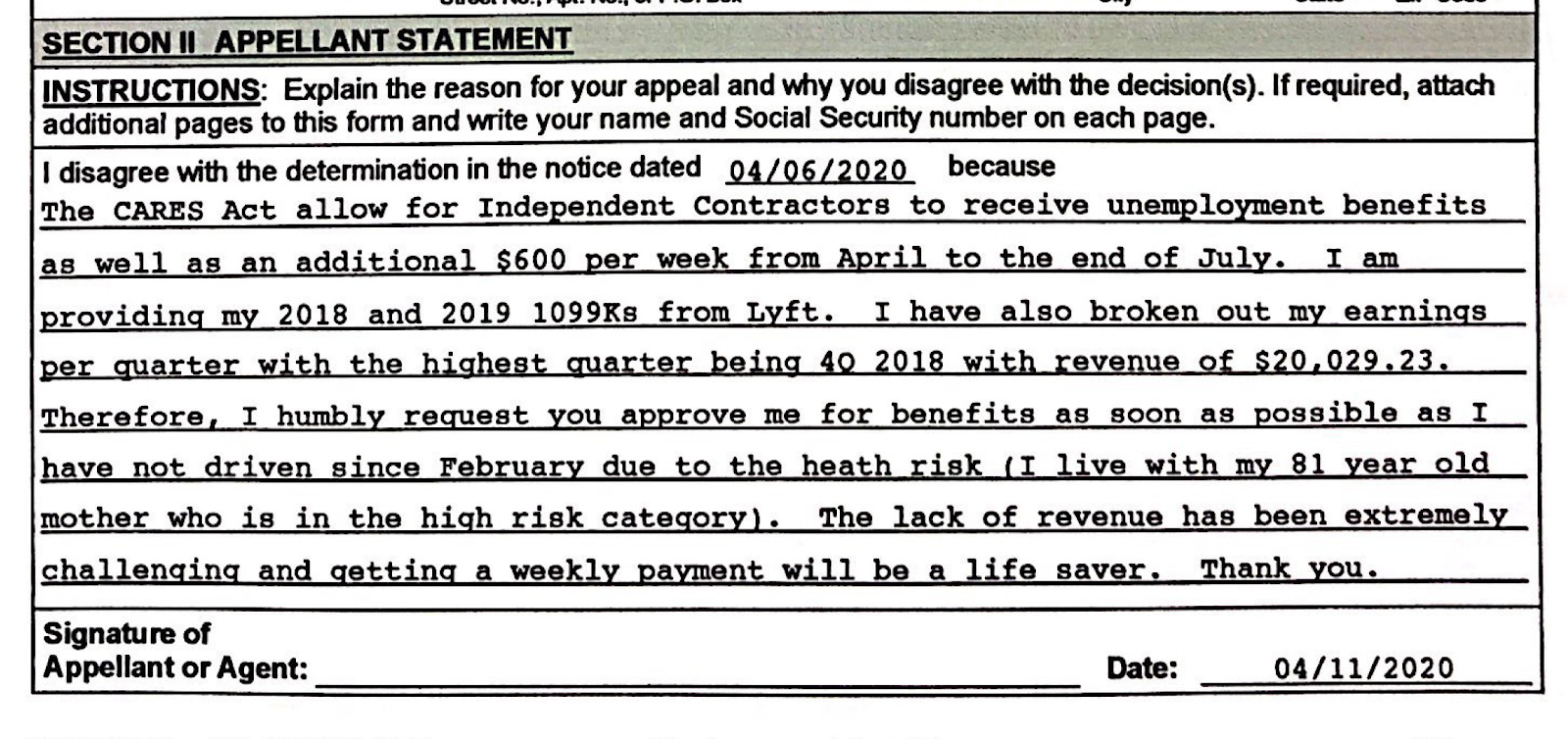

You will also have an opportunity to explain why you are appealing. Here is the verbiage I used on my account:

“The CARES Act allow for Independent Contractors to receive unemployment benefits as well as an additional $600 per week from April to the end of July. I am providing my 2018 and 2019 1099Ks from Lyft. I have also broken out my earnings per quarter with the highest quarter being Q4 2018 with revenue of $20,029. Therefore, I humbly request you approve me for benefits as soon as possible as I have not driven since February due to the health risk (I live with my 81 year old mother who is in the high risk category). The lack of revenue has been extremely challenging and getting a weekly payment will be a life saver. Thank you.”

Phase 3 – Applying Through A Special PUA Website

Just late last week, we learned that the state of California is creating a new website to specifically handle all independent contractor unemployment claims through the PUA.

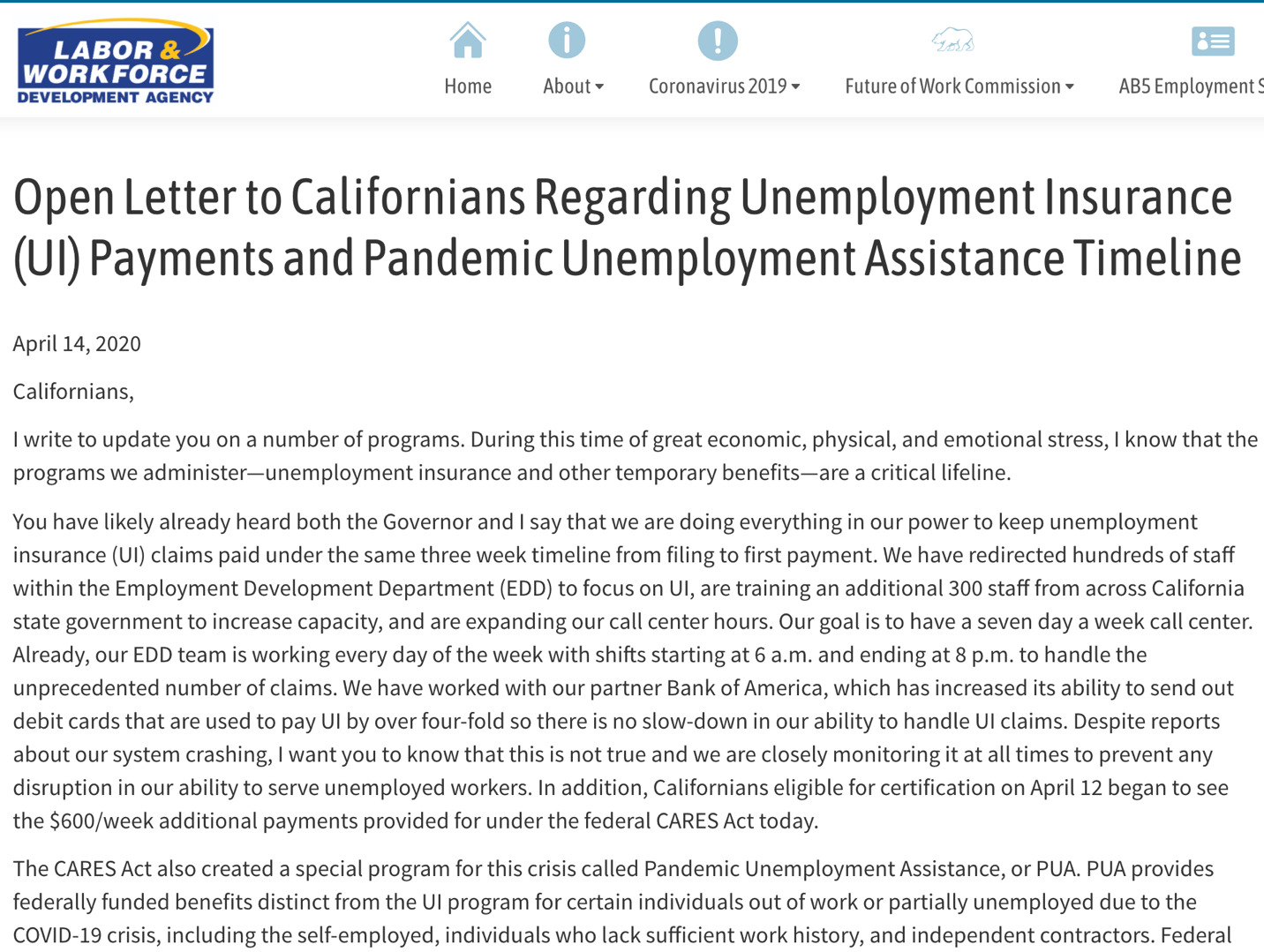

The website is scheduled to go live on April 28 according to the California Employment Development Department (EDD) website. Here is the letter from the Secretary of Labor and Workforce Development, Julie Su:

As we look further down the document, we get this encouraging message:

“This new system will be able to pay individuals within 24 to 48 hours of their application. We need two weeks to create this new technology — set up the system, test it and be able to turn payments around. To be clear, these payments will not take the 3 weeks from application to payment that UI has taken unless the claims do not include all of the information needed; we are working to make it much faster.”

Assuming this all goes to plan, by April 28 we would be entitled to three weeks of $600 per week minimum, or $1,800.

That means before the end of the month (two days after the 28th would be the 30th), those funds should be in our bank accounts. That will be very handy for rent payments and any other end of month bills that are due.

States are scrambling to meet the demand so that their labor force stays strong and we do not descend into what could certainly become one of the greatest economic depressions of our generation.

Key Takeaways

It is an uphill battle for drivers to get these benefits. We have plenty of opportunities to apply for government assistance such as the Economic Injury Disaster Loan (EIDL) grant and the Paycheck Protection Program (PPP) loans.

However, we have not heard of many people having any success. At least, not yet. On a more positive note, it does seem like the wheels of progress are turning slowly toward our unemployment situation. Several states are stepping it up even while Uber and Lyft are uncooperative.

Drivers are struggling, hurting and desperate. I have not driven since February 3rd. We have been at this for two months and we have not seen any unemployment benefits in our pockets.

A friend of mine was laid off from her job due to Covid19. She is already earning the maximum benefit here in California of $1,050 ($450 plus the bonus $600) per week. She fits nicely into the system. Good for her.

I look forward to the day when it is good for us, the rideshare drivers. Be safe out there.

Drivers, what questions do you have about unemployment, PUA and your state government’s programs? Have you received any unemployment assistance?

-Jay @ RSG