How can Uber and Lyft drivers file for unemployment – and how can drivers get access to funds right now? Senior RSG contributor Jay Cradeur shares how you can get free money through a variety of sources below, including how to file for unemployment, business grants and more.

Every week we learn more about how we as drivers will survive the coronavirus/COVID-19 slowdown. If you are a driver, the $2.2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act has provided some well-earned support, but a lot of the details are still being finalized and it’s very confusing.

If you have questions about unemployment for Uber drivers, stimulus payments, Small Business Administration loans and more, keep reading below. Also, share your thoughts and questions below so we can continue to provide you up to date and useful information.

Quick links:

- The best way to file for unemployment in your state is to Google “Unemployment Application [your state]”

- Denied for unemployment benefits? Here’s how you can appeal for your gig worker unemployment benefits

- The SBA has a grant and a loan program for small businesses

1) Unemployment Insurance – Standard

The CARES Act will pay independent contractors unemployment benefits. Even though Uber and Lyft have not contributed any money to the Unemployment Fund, the Act allocates sufficient funding to cover all ICs.

You can earn these benefits for 39 weeks as long as you remain unemployed and cannot find a job. Each state has a limit as to how much money you can earn per week.

In California, that amount is $450 per week. In New Jersey, that amount is $713. In Chicago, IL, that amount is $471.

The best way to apply for unemployment is to Google “Unemployment Application ___________” and enter your state.

What occupation should I choose when filling out the unemployment form?

What occupation should I choose when filling out the unemployment form?

It depends on what answer is available to you – for me, in California, I chose ‘Airport Delivery Service’.

Some drivers report being able to choose the option for ‘Self Employed’. If you’re able to choose self-employed and are fully self-employed (i.e. not working as a restaurant employee or other type of employee), choose that.

If not, choose the best option available. As of right now, not all state unemployment websites are updated to offer a self-employed option.

2) Unemployment Insurance – $600 On Top Of Standard Benefits

In addition to the standard benefits, the CARES Act provides up to 16 weeks of an additional $600 to help unemployed individuals.

As of today, instructions are still unclear on how ICs are to provide proof of being unemployed or the amount of earnings over the past year.

However, I recommend you go online and apply right away.

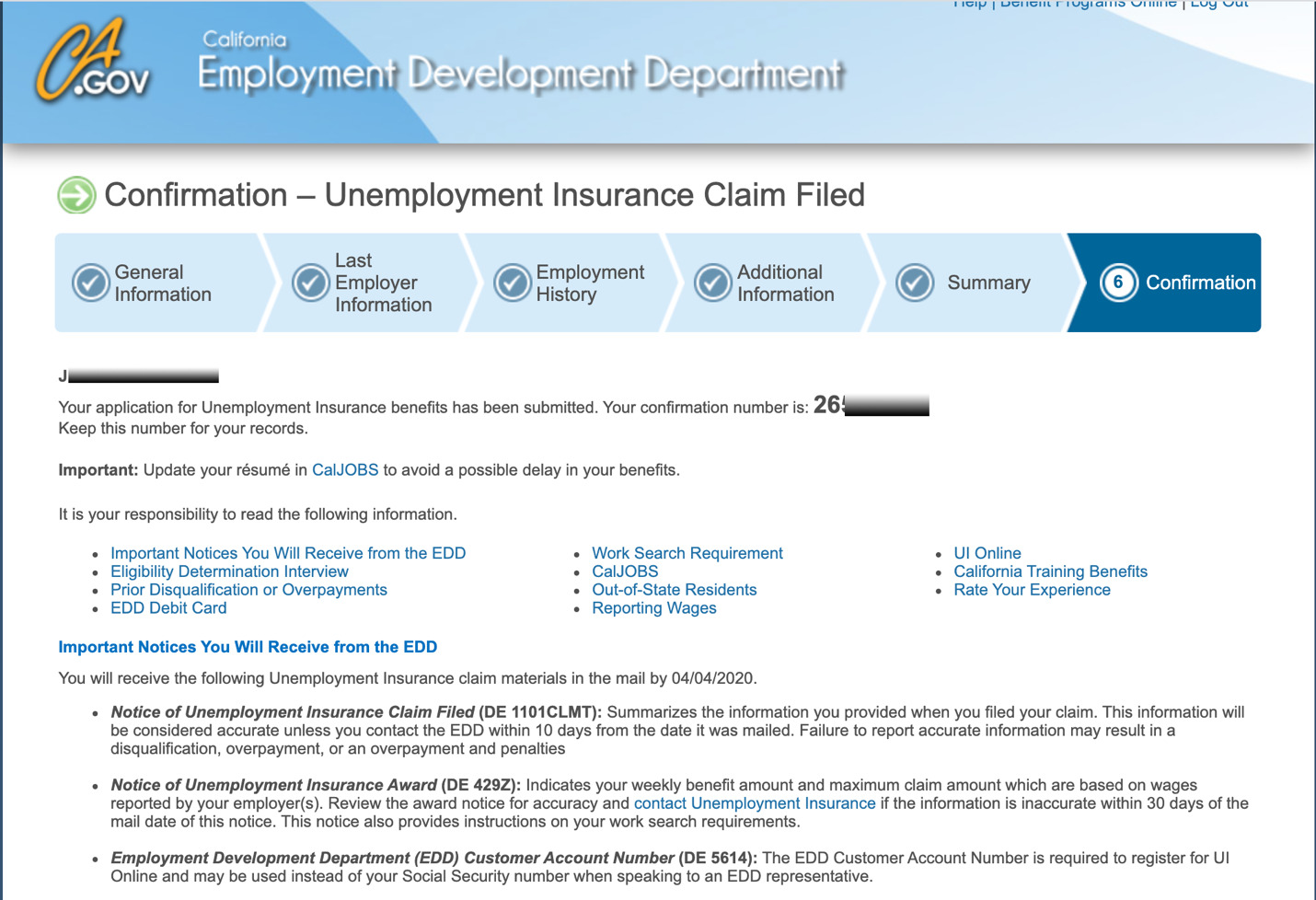

I applied last week and during the application process, I was told that my benefits would begin on the following Sunday. I take that to mean the sooner you apply, the more benefits you will receive.

During the application process, I said that I worked for Lyft. I said that I could no longer work due to “Public Health” reasons. I said I stopped working March 1st when the pandemic kicked into full force.

Once you have completed your application, you will see this screen (In California):

3) $1,200 Stimulus Payment In April

As long as you filed your 2019 taxes and you showed some income from $1 to $75,000, you will receive $1,200 in April.

If you did not file your 2019 taxes yet, then the IRS will look at your 2018 tax return.

If you don’t meet either of those requirements, then I suggest you file your 2019 taxes right away. It may be worth $1,200 to you. The funds will be direct-deposited to your bank account if the IRS has your banking information.

In my case, the IRS does not have my banking information. However, we will be provided instructions on how to get that information to the IRS. This is directly from the IRS website:

“The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.”

What if I receive Social Security benefits?

According to The New York Times, “The Treasury said the I.R.S. would use the information on Forms SSA-1099 and RRB-1099 to generate $1,200 payments to Social Security recipients who did not file tax returns in 2018 or 2019. They will get these payments as a direct deposit or by paper check, depending on how they normally get their benefits, Treasury officials said in a statement.”

This means if you receive Social Security, you will not need to file a tax return if you don’t already do so. You will still get your $1,200 payment.

4) SBA’s Economic Injury Disaster Loan (EIDL) program – $10,000 Grant

A grant is free money. It is different than a loan, which you are usually required to pay back.

The government is now offering $10,000 emergency grants to help small businesses keep afloat.

Check out the video below on how to apply for the EIDL program, and then read our in-depth guide to applying for the Economic Injury Disaster Loan program.

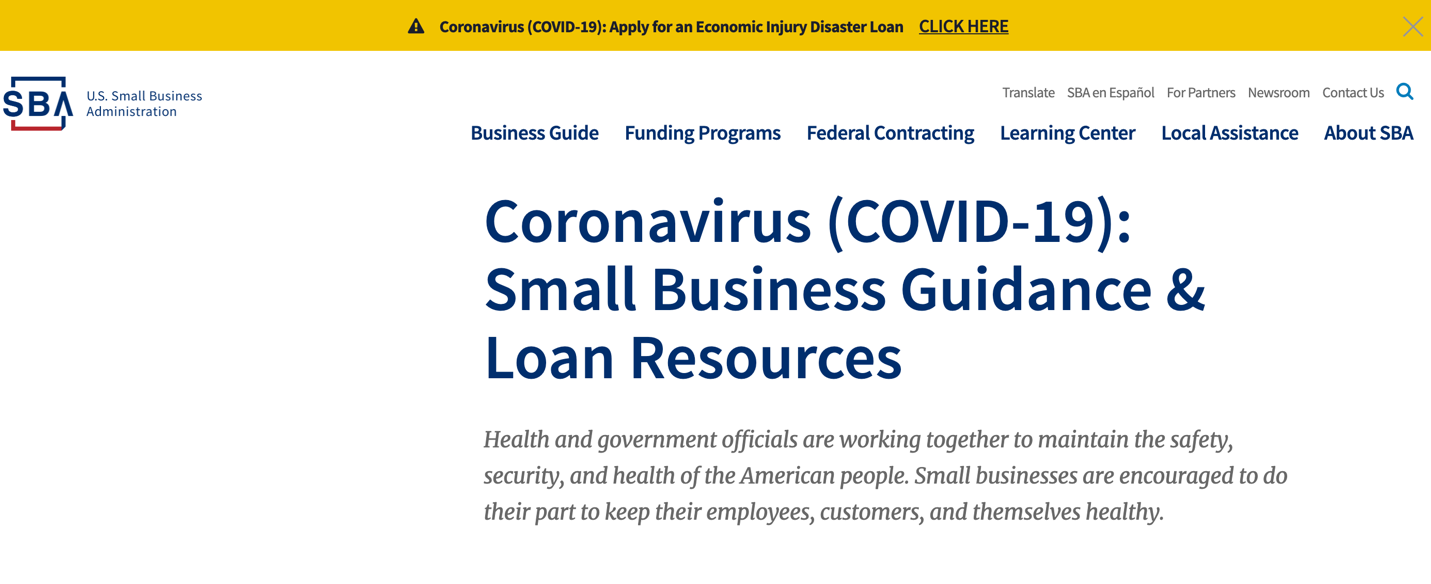

5) Apply for an SBA Loan

There are quite a few options for small businesses that need help. The Small Business Administration (SBA) website has a plethora of options:

Here is the link to the website.

Here is the link to the website.

One of the loans will be forgiven as long as your funds are used to cover payroll payments to your employees. Other than that, most of the loans will require repayment.

6) Uber / Lyft 14 Day Sick Pay

For those drivers who are unfortunate enough to get sick with COVID-19, many of the rideshare companies have promised to pay you for your time away from the road.

We have heard many stories about the availability of the funds. Some drivers have been able to get up to $2,000, while other drivers report they have run into a brick wall, and at this point, have not been able to secure the financial assistance funds.

CNET wrote a good article about the challenges drivers face:

If you are sick and you can prove you have COVID-19, then you can apply and attempt to get the financial assistance promised to you by your respective company.

Uber Work Hub

Uber recently announced the Work Hub, which will now be a part of all Uber drivers’ apps (in the US). The Work Hub is a new way for you to find work, either with Uber or another company.

For instance, if Uber Eats is in your city, you’ll be able to easily turn on delivery requests in the Work Hub. Uber is also accepting signups for Uber Works (connecting people to shift work like warehouse and customer service) and Freight, where drivers get paid for every load they deliver.

In addition to these Uber work opportunities, the Work Hub will also include opportunities like:

- Domino’s pizza delivery

- Shipt grocery delivery

- CareGuide

- and more

Key Takeaways

For the most part, this is great news for all of us. The government has come through for us, although things are going slower than anticipated.

Over 10 million people have already filed for unemployment benefits, cash back apps are becoming more popular than ever, and state websites are crashing left and right. Be patient but be persistent. Pretend you’re trying to get through to an Uber manager – we always recommend patience and tenacity.

Are you applying for unemployment and/or a Small Business Administration grant or loan? What questions do you have about the process that we could answer? Leave them below!

-Jay @ RSG