What happens when your rideshare lease is over? Should you purchase the car, move on, or try something else? Senior RSG contributor Jay Cradeur shares his experience with ending a rideshare lease.

There are a few key items on which a rideshare driver must focus. First is the skill required to maximize your revenue. I am talking about your driving strategy: when to drive, where to drive, which bonus to go for, etc.

The second key item is keeping your expenses as low as possible. To that end, how you handle your decision about your car will dramatically impact your bottom line.

Recently I had a decision to make about my 2013 Toyota Prius. The 3-year lease was up. I could buy the car, or, I could let the car go and secure a new car. This article will look at the various factors that all rideshare drivers should consider when it comes to car selection.

Need a car? Head over to our Vehicle Marketplace for more options!

Lease vs. Purchase

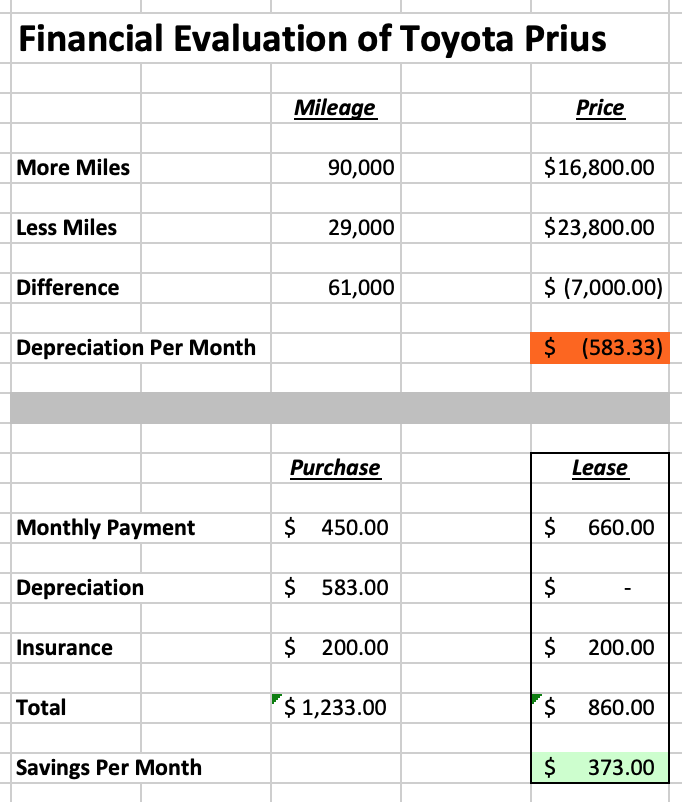

Three years ago, this was a decision I had to make. I broke out the numbers. The key factors were the monthly price of the car and the impact of depreciation. If you buy a car, you will pay less per month, however, you will also be losing value rather quickly due to the high number of miles we drive.

Related: Should You Rent or Buy a Car for Uber? We Did the Math!

If you lease or rent a rideshare car through Uber or Lyft’s programs, you will pay more per month but will be losing less each month in depreciation. My decision at the time was to lease through Xchange. I had committed myself to be a full-time driver. This is the type of analysis I did at the time.

I obtained mileage and sales price figures by looking at a similar year, make and model Toyota Prius on the website Car Gurus. We can see here if you are going to be a full-time driver, it makes sense to lease your vehicle from Uber or Lyft and take advantage of unlimited miles.

A full-time driver will add approximately 1,500 miles per week or roughly 60,000 per year adjusting for vacations. In one year, a driver would be looking at a savings of over $4,400. If you are a part-time driver, then it makes more sense to purchase your vehicle as you would not be incurring tremendous depreciation.

The Lease Is Up

Recently, I started to get phone calls from a company called Digital Dog. They are an auto recovery company hired by Xchange Leasing that comes and picks up cars and sells them at auction. They wanted to schedule a date to pick up my car.

Not sure about what I wanted to do, I scheduled the pick up for four weeks down the road. Now I had to decide what to do.

A New Set Of Numbers, A New Set Of Issues

I had to consider a few different issues. First, my Toyota Prius now had 220,000 miles. I did a quick search on the Kelley Blue Book website and learned that my car had a value of $2,500.

I then called Xchange Leasing to see if I could purchase the car for the current blue book value. I was disappointed to hear that Xchange Leasing was not in the negotiation business. They told me that my only option was to purchase the car for $5,000, which was the amount designated in the original lease agreement.

While I realize that $5,000 is still a low price for a Toyota Prius, I simply could not justify paying twice what the car was worth. I also knew that the car needed new shock absorbers, struts, and brakes, which would cost another $1,500 or so. I also did not know when the Prius would need another major repair, or when the battery would need to be replaced.

While this was going on, Uber announced the Fair Car Rental program. This program puts you in a car with unlimited miles and full insurance coverage for $202 per week. This is comparable to what I was paying for my Toyota Prius at a $149 car lease plus $50 for insurance.

This sounded like a good deal. On top of that, for just 70 trips in a week, Uber would pay me $185 toward the price of the car. I have documented my trials and tribulations in getting started with a Fair car, but now that the hard work is done, I am content with the program.

Final Decision

Recently, Digital Dog came and took my Prius away. It was a great little car.

It is remarkable how attached I can get to my cars. It only makes sense. How much time do we drivers spend in our cars?

Let’s say I drove 40 hours a week for 45 weeks for 3 years. That is 5,400 hours or 225 straight days, or 7.5 straight months in that car with over 20,000 different people and interactions. No doubt, I will miss that car, but I will always have the memories.

Sticking with the Fair Rental Car Program

Once I started to drive the Hyundai Elantra with Fair, I immediately noticed an improved sense of luxury and comfort compared to my old Prius. The Elantra is quiet and smooth and fast.

These are the qualitative factors that can sometimes overwhelm the quantitative factors. Why buy a Mercedes Benz when a Ford Fiesta will do the same job? Feel, status, drivability, and comfort also contribute to one’s decision to pick one car over another.

Fortunately for me, I was able to get a car I wanted to drive which was also the most financially prudent.

Read more about Jay’s experience with Fair here.

Summary

Do your own numbers. Your situation will be different than mine. The make and model of your car will impact your numbers. The number of miles you expect to be driving will affect your numbers. Your specific lease and purchase numbers will affect your numbers.

Then there are the non-number considerations. What type of car do you want to drive? Which one makes you feel the best? What is more important to you, quality of drive or saving as much money as possible?

These are all the questions that go into an automobile purchase decision. I hope that by sharing my own decision process, you will have a better time making your own decision. Be safe out there.

Looking for more rental car options to drive for Uber and Lyft? Visit our vehicle marketplace.

-Jay @ RSG