As rideshare drivers, it’s important to carry the right kind of rideshare insurance. Having rideshare insurance can save you money (and time) if you get into an accident as a driver. Senior RSG contributor Jay Cradeur highlights a new product by ESurance called ShareSmart for California rideshare drivers below.

If you are going to be a rideshare driver for Uber and/or Lyft, then you are going to need to get some good rideshare insurance. If you are only using your personal auto insurance policy, you run a big risk of experiencing a financial Armageddon.

Personal auto insurance policies don’t cover you when you are driving for Uber and Lyft. If you were to get into an accident while rideshare driving, there is a good chance your personal automobile insurance provider will reject your claim outright because you were not honest about your driving activities. Therefore, if you are a rideshare driver, you need to get rideshare insurance.

Recently, ESurance launched a rideshare insurance product called ShareSmart for California drivers only. I’ll take a look at what it is, how it works, its cost and more below.

What is Esurance?

One company that deserves your attention is Esurance. Esurance was founded in 1999 and became one of the first insurance companies to sell policies directly to consumers over the internet. Before Esurance, all insurance business was transacted using in-person meetings or phone calls.

Esurance grew in popularity and was eventually purchased by their current owner, Allstate. Five years after its launch, Esurance began an advertising campaign featuring a character named Erin. In total, 30 advertisements were made with this character before the campaign was retired.

Getting a Quote

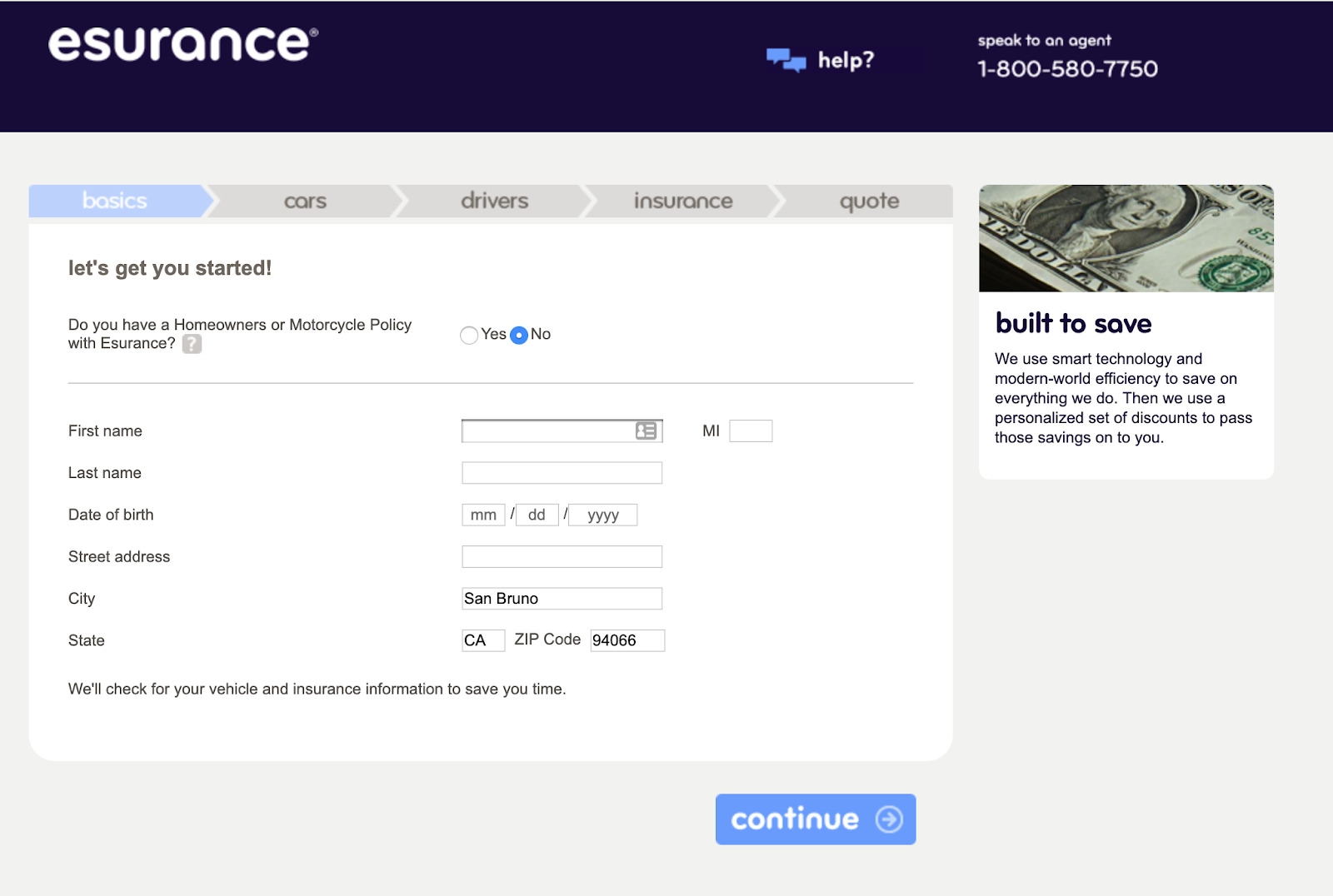

Getting a quote was far more difficult than I would have imagined. I will share a short cut with you that will save you a good amount of time.

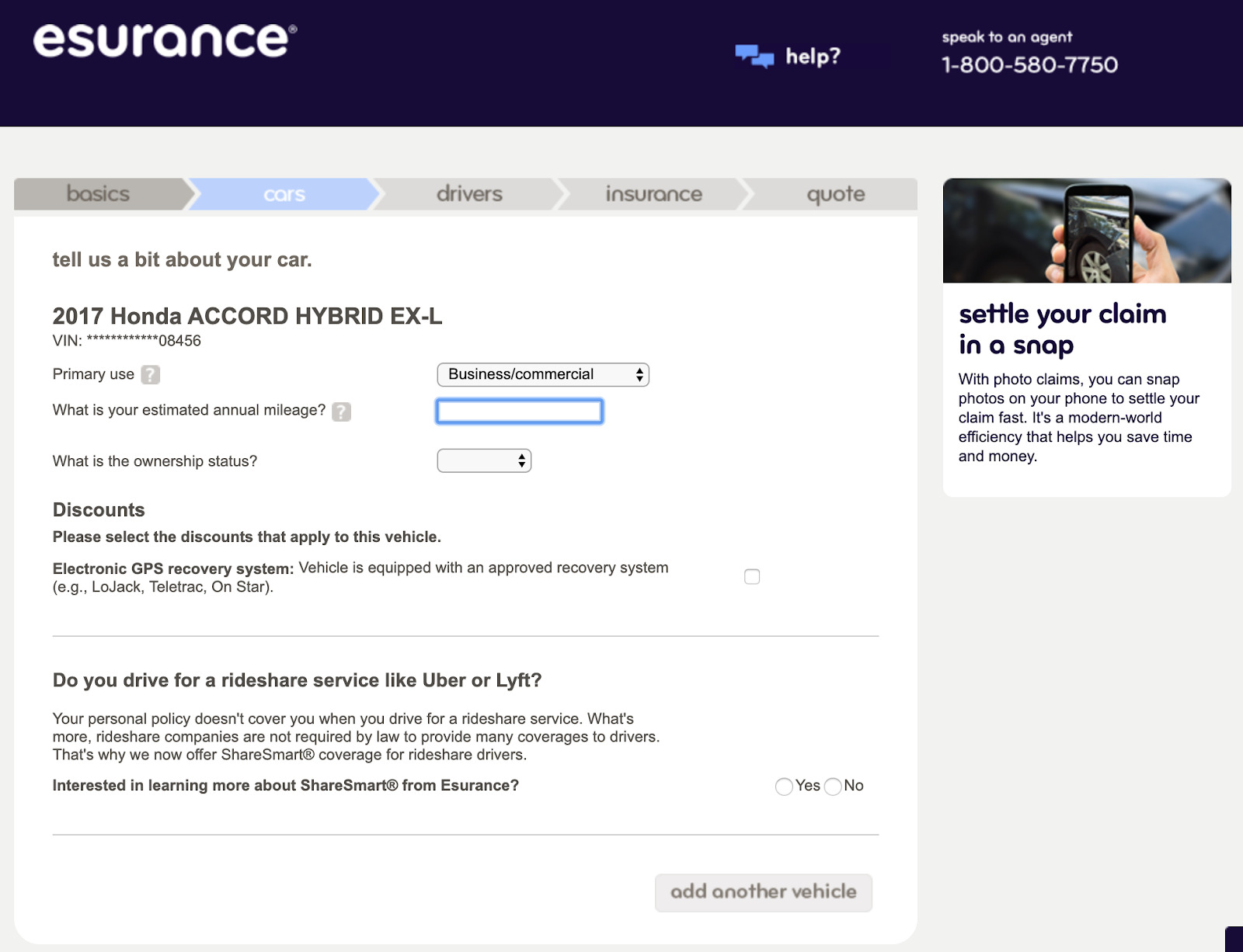

The process I went through was to go to the Esurance website and fill out a series of forms. My intention was to get a quote online so I could compare the Esurance prices to my current rideshare insurance policy with Geico.

Illinois drivers – try OptOn for insurance! OptOn is a rideshare driver insurance app that you only pay for when you are actually using it. It’s easily one of the most flexible rideshare insurance policies that requires only four hours of commitment and charges cents per mile with three policy types (Primary, Preferred, and Premier).

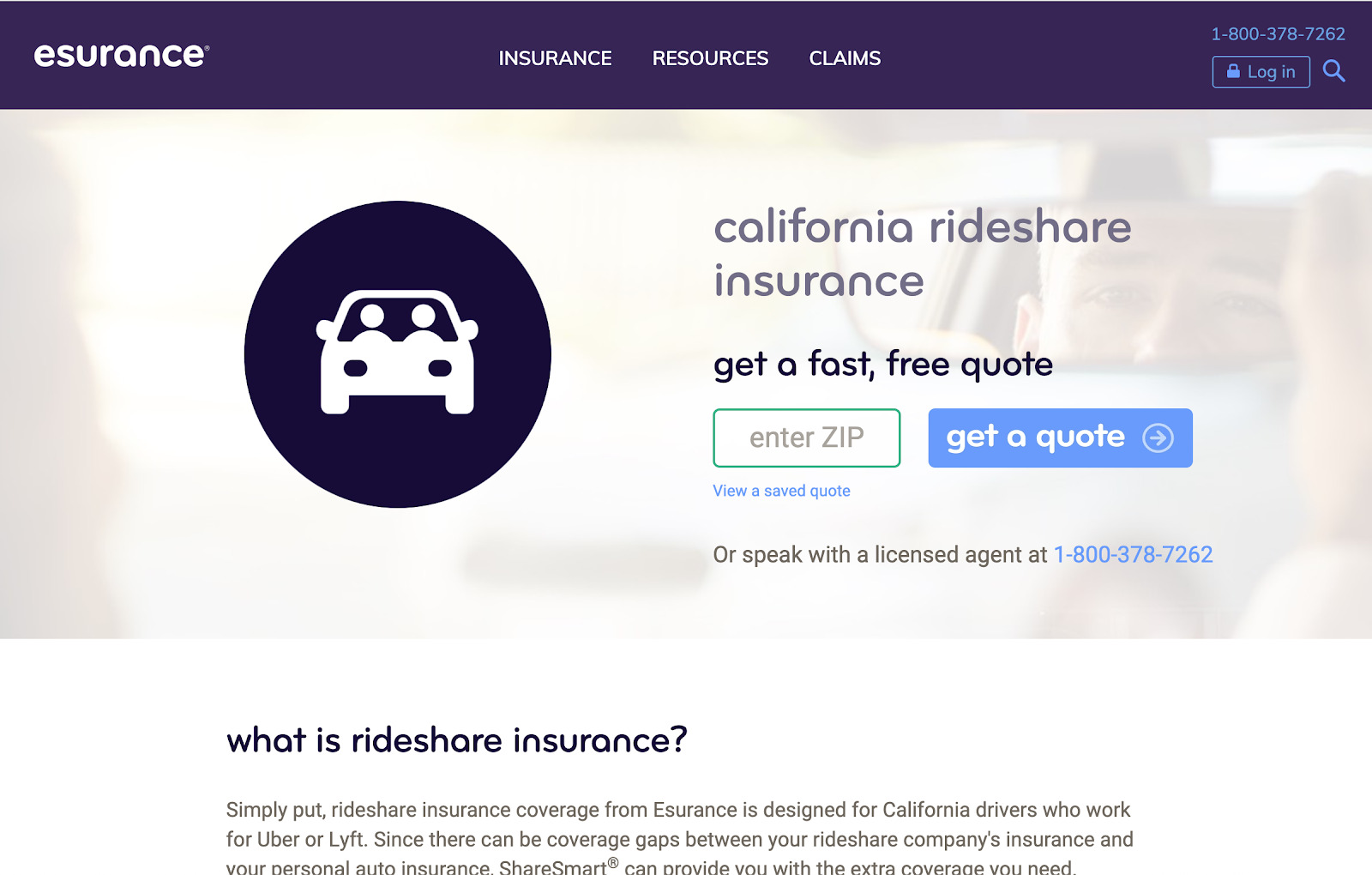

Home Page

The first thing to notice is the rideshare insurance product is currently only available in California. California, with Los Angeles and San Francisco, is a huge market. Esurance plans to expand to other parts of the country as the rideshare market continues to grow.

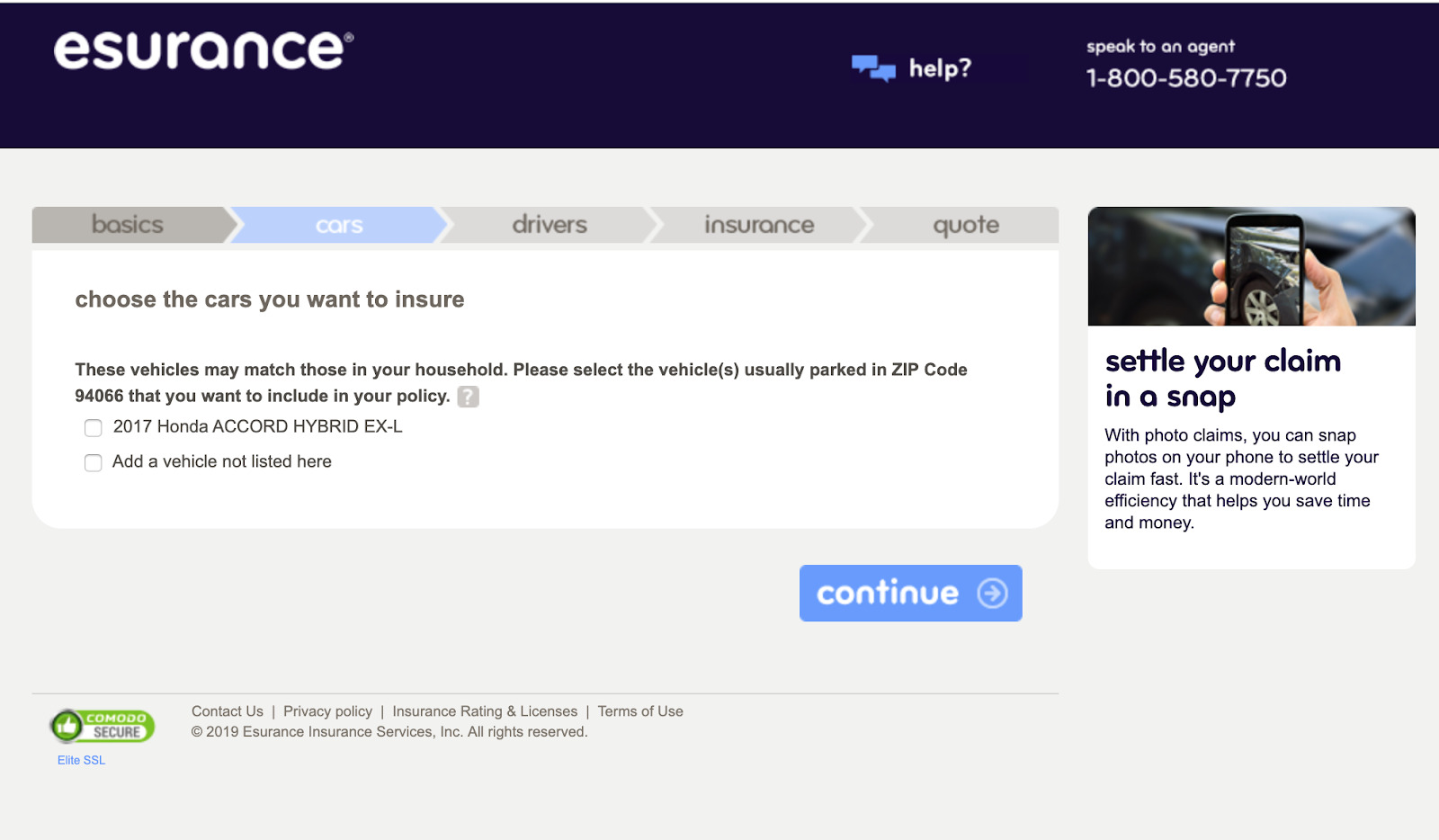

Many Forms I Filled Out To Get A Quote

Waiting For And Receiving A Phone Call from Esurance

After completing all the forms, I had to wait for an agent to call me to review my information and give me a quote. As I completed the forms on a Sunday, I had to wait until Monday. I spoke to a woman and confirmed that I wanted to get a quote for rideshare insurance. She then transferred me to a second woman who also confirmed that I wanted rideshare insurance. She then transferred me to a man who was to be an agent who could actually get me a quote.

Once he and I began to speak, he told me that his company (not Esurance) does not provide rideshare insurance. As you can imagine, I found this to be an incredible waste of time and it left me wondering how two women did not understand the words “rideshare insurance!” The man told me someone would call me back within 24 hours.

Skip Online. Call Esurance Direct.

No one called me. I called back and was told that I could only be referred once every 30 days so I could not be processed. At that time, I looked at the Esurance website and called directly to speak with an Esurance agent. The number is 1-800-378-7262.

I spoke with an agent named Luis and he was very helpful. He asked me all the questions I had answered on the online form and then emailed me two quotes.

What is Esurance Share Smart?

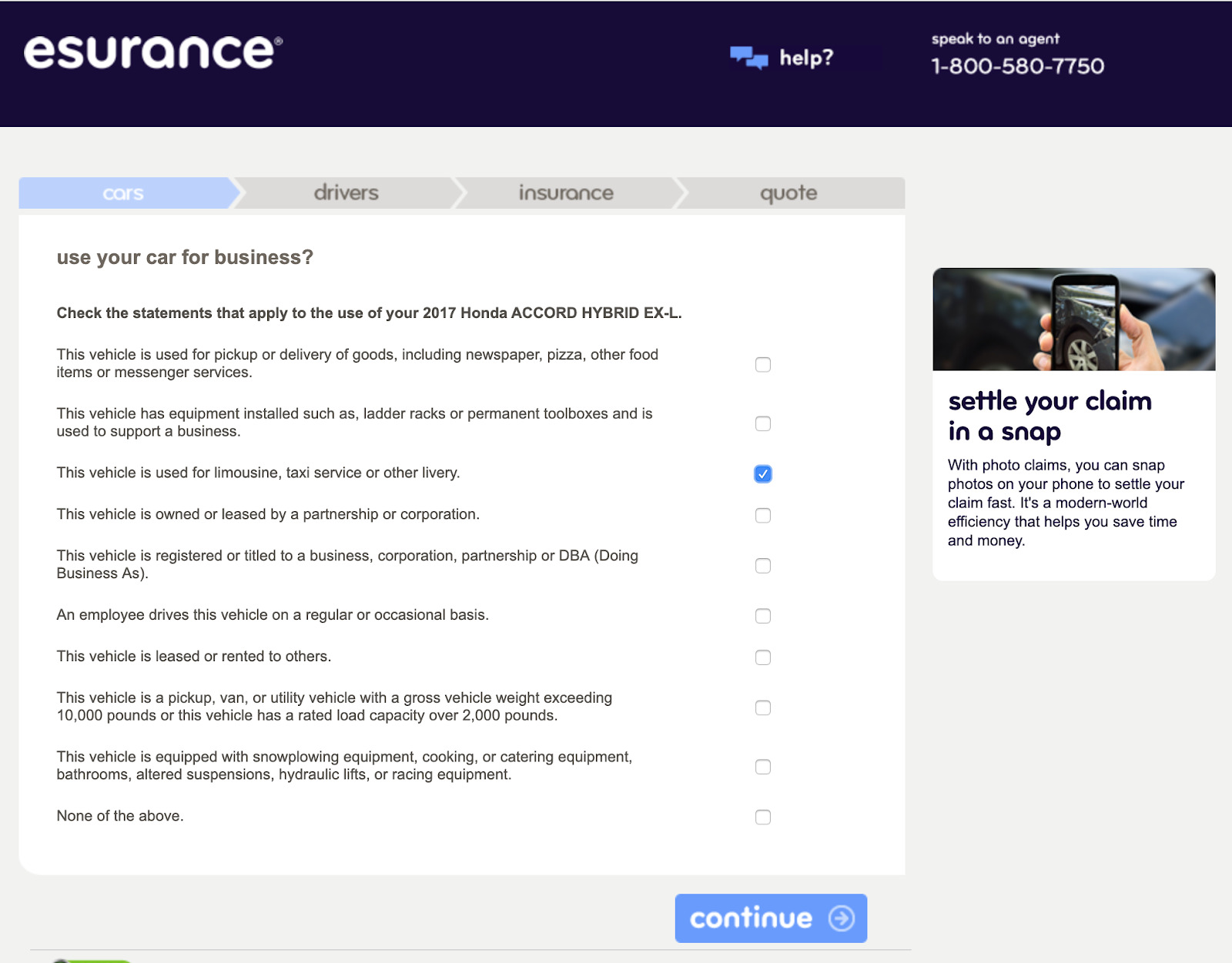

This graphic from the Esurance website is very helpful in explaining the Share Smart rideshare option.

You can purchase three different options:

- Personal auto insurance only or

- Personal insurance with the Share Smart rideshare coverage or

- Share Smart separately (on top of your current policy)

How Do Esurance Prices Compare To Geico?

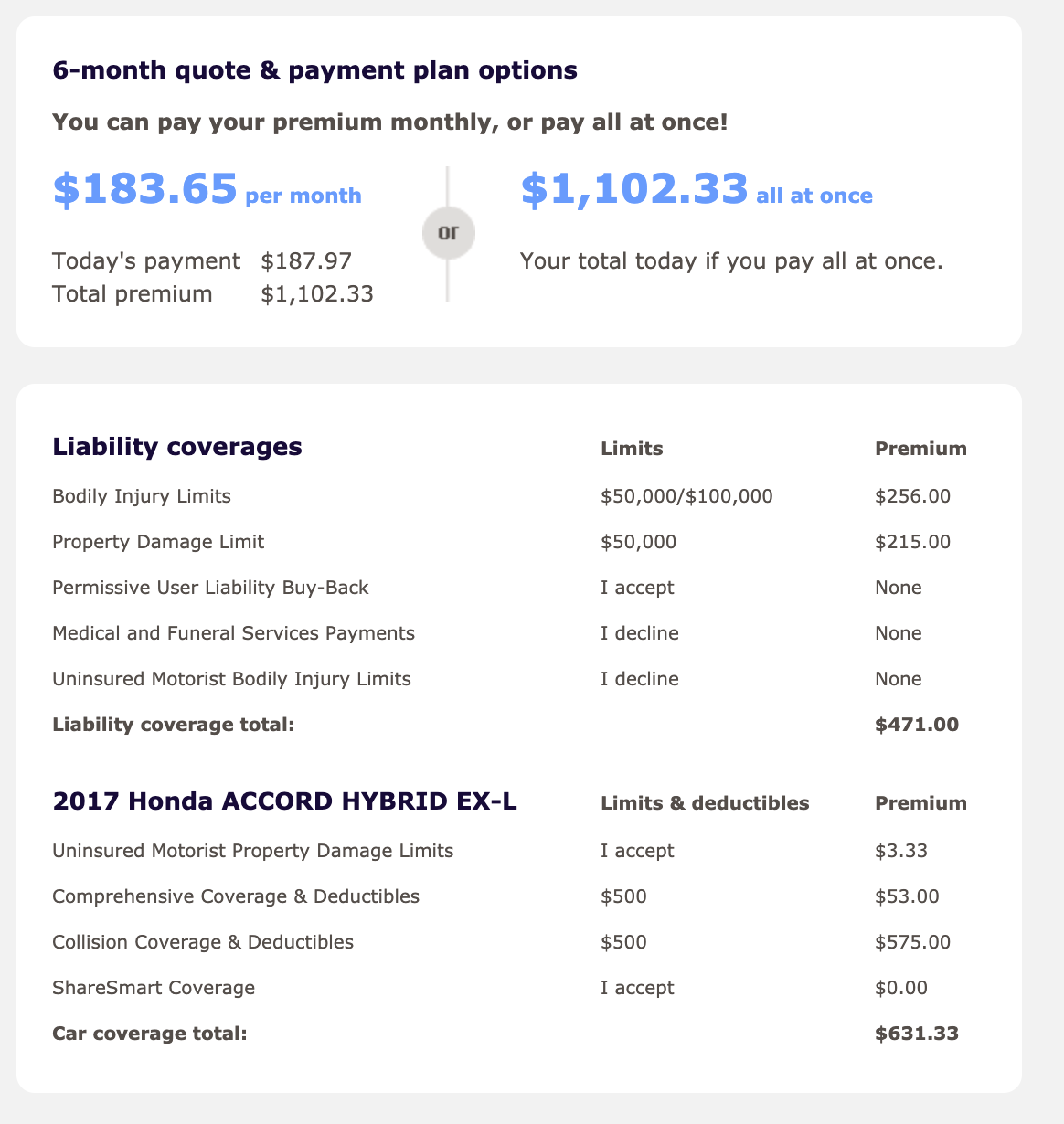

For comparison purposes, I got a quote for Personal Insurance with the Share Smart addition. Here is the quote from Esurance:

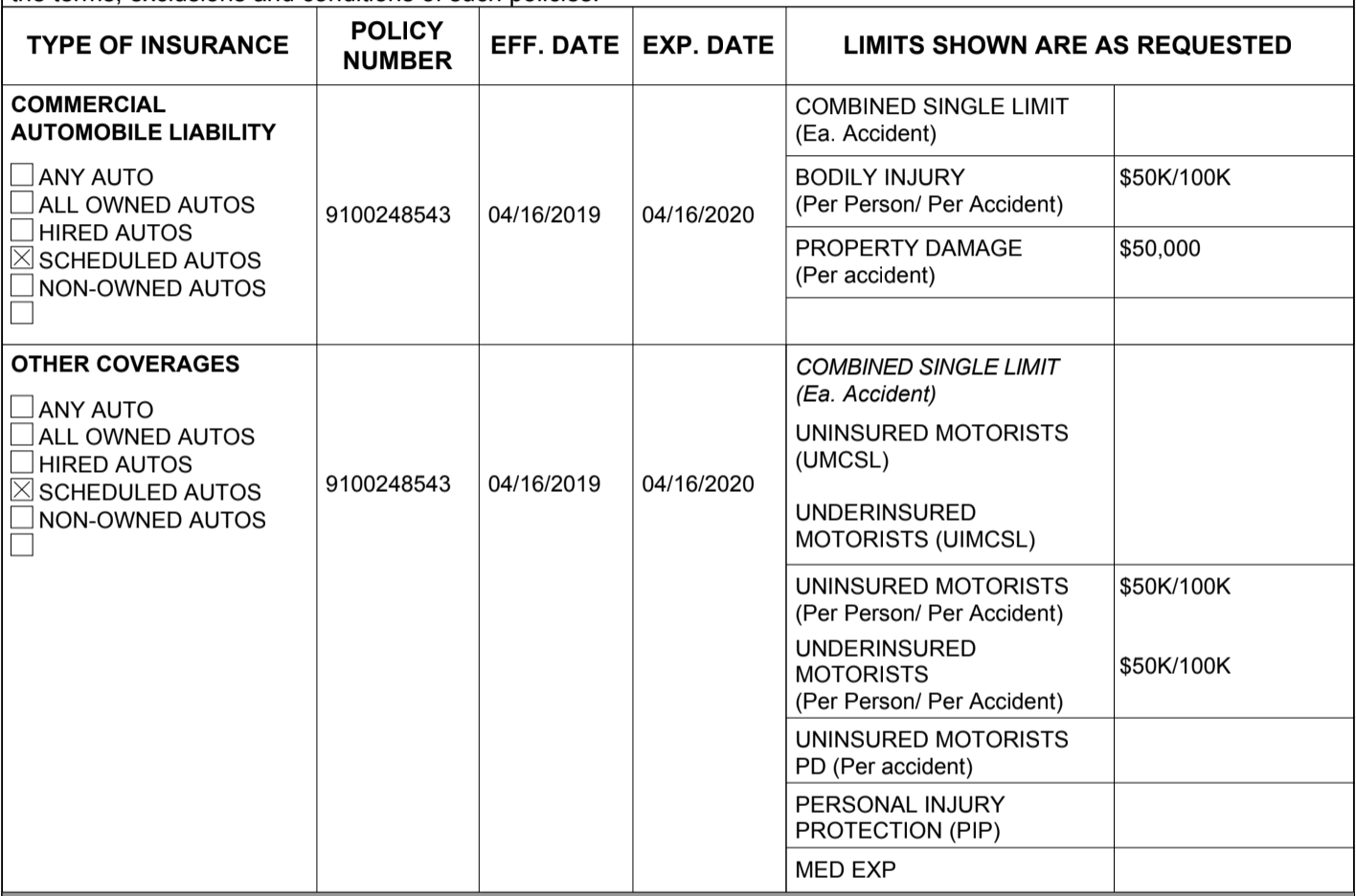

Here is my current policy from Geico:

My monthly payment for Geico is $148. Esurance shows a monthly payment of $183. I am saving $35 each month with Geico on the premium alone.

In addition, Geico is partnering with Lyft to give drivers a 25 cents per ride bonus which can add up to an extra $100 discount each month. It looks like I will stay with Geico as I am saving a minimum of $100 per month. The Geico – Lyft partnership is a sweet deal, especially since I do almost 100% of my driving for Lyft.

But everyone’s situation is different, so as always, we recommend getting multiple quotes from multiple providers.

Key Takeaways

My first recommendation is that you bypass the online system and call Esurance directly. Talk to a human being. You will get a quote much faster.

Second, just because my Esurance policy was more expensive than a competitor, it does not mean the same will be true for you. Get at least three quotes from different companies and then you can make an educated decision.

Third, be sure to get two quotes from Esurance, one full rideshare coverage, and one for the ShareSmart coverage added to your current personal auto policy.

And finally, get educated on the details of rideshare insurance. You should know what Periods 1, 2 and 3, means. Protect yourself from a financial tragedy. Get educated and get insured. You will drive with greater peace of mind and you will sleep better at night. Be safe out there.

Readers, what company do you use for your rideshare insurance policy?

-Jay @ RSG