I just found out about a new rideshare insurance company, so I decided to get a quote to see how their coverage compares to my current coverage. And wow, was I impressed with the coverage and cost savings.

As a reminder, Uber and Lyft require drivers to have personal insurance, but personal insurance won’t cover you during period 1 (app on, waiting for a request).

So, as Harry mentions in his book, it’s a good idea to get rideshare insurance. And as you’ll see, you can even save money by getting rideshare insurance.

Voom’s tagline is ‘Insurance made for rideshare drivers.’ I went through the process, and it was easy to sign up, link accounts, and customize coverage.

And while insurance rates always vary depending on the state and the driver, in my case, Voom was actually cheaper than my regular personal insurance with State Farm.

So today, I’m going to break down the sign-up process for Voom, explain the different tiers of coverage, and show you the results. We are big fans of Voom over here at The Rideshare Guy, and Harry recently came on as an advisor for the company.

If you sign up for Voom using one of our affiliate links, we may be compensated. So, as always, it’s a great way to support the site.

How to Sign Up

Start by going to Voom’s website and entering your basic information. You can choose to sync to your existing driver accounts or skip syncing and just get a quote. When you sync your existing driver account, Voom will track your commercial mileage so you can get the best rates.

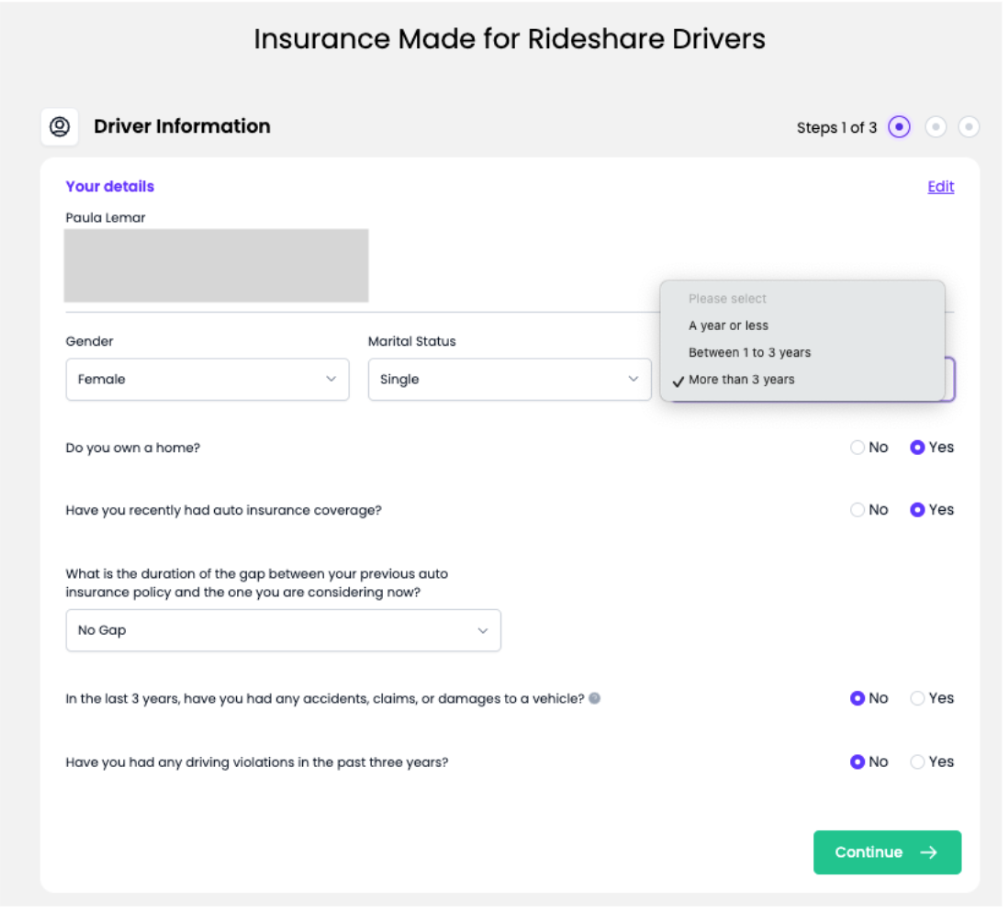

When you skip syncing and just get a quote, you have to add your driver information, such as gender, marital status, driving experience, etc.

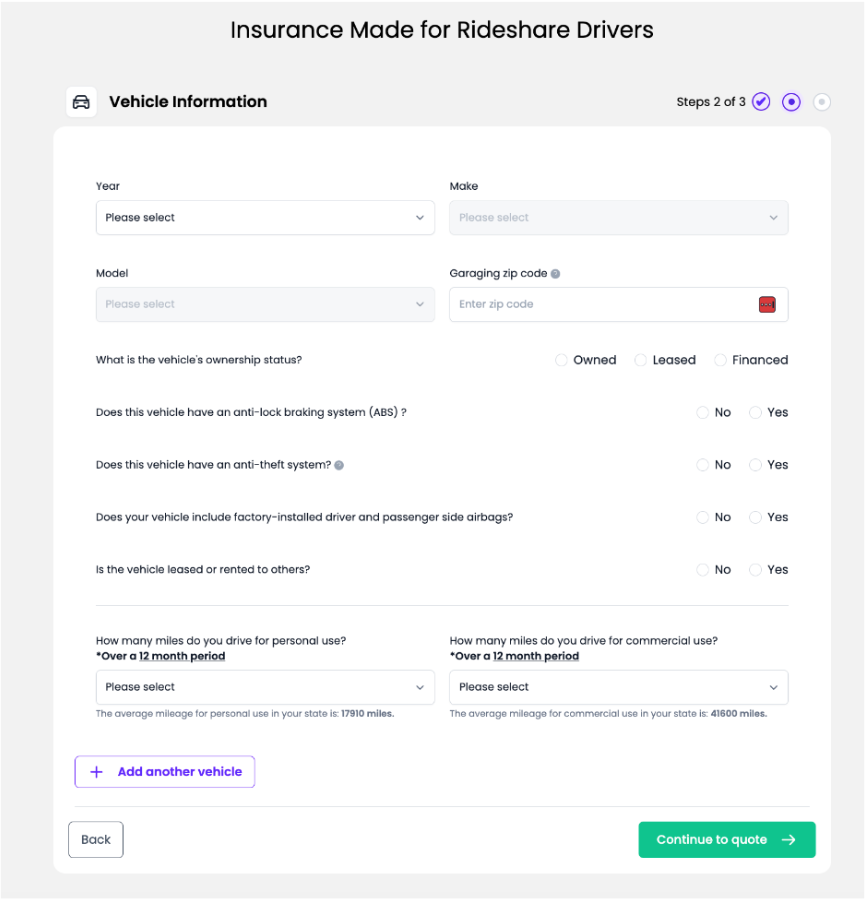

Then you’ll enter your vehicle information as well as an approximation of how many miles you drive for personal use versus commercial use (rideshare driving, delivery, etc).

For the sake of this article, I did multiple options for personal versus commercial and broke it down for you in the coverage section below.

From that information, they extrapolate an Essential, Extended, and Customizable quote for you to choose from.

Tiered Coverage

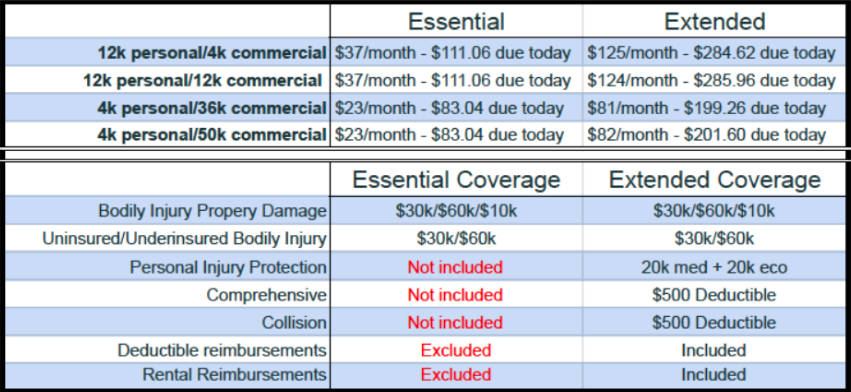

This chart shows the coverage available on Voom if you stated you had 12k personal miles/4k commercial, 12k personal/12k commercial, 4k personal/36k commercial, or 4k personal/50k commercial miles.

You can see that Voom really only charges you more for higher personal miles since, during commercial times, you get most of your coverage from rideshare platforms.

The cost of the ‘Extended’ coverage for 4k personal miles and 50k commercial is only $1/month more than 4k personal miles and 36k commercial.

Vooms checks on your mileage to ensure you’re only paying for the coverage needed. The dollar amounts you see are my monthly cost and what would be due today if I were to change from State Farm to Voom.

I have it broken down by the mileage and tiered options Voom offers, as well as what those cover.

Please Note: The amount due today includes two months of coverage as well as a small processing, underwriting, and installment fee.

Reminder: You can always switch to a new insurance provider at any time and cancel your old policy. In this case, your old insurance company will send you a pro-rated check for the remaining period you already paid.

On top of the Essential and Extended coverages, you can customize your coverage by changing the deductible (all the way up to $5k) and adjusting the policy and vehicle coverages.

For the sake of this article, I just went with what Voom automatically calculated for me when I changed my mileage information.

Voom Deductible Buy Down

One perk that Voom offers drivers is that while driving for your preferred rideshare platform, you’ll be covered by that platform’s policy; however, you have the added benefit of having a deductible gap coverage.

Remember, both Uber and Lyft will cover you during Period 2 (en route to a rider) and Period 3 (rider in the car), but there is a $2,500 deductible if you get into an accident (regardless of who’s at fault).

If you get the extended coverage option above, you can have a $500 deductible instead of a $2,500 deductible in the event of an accident while driving for Uber/Lyft. This is a $2,000 savings and one of the best parts about Voom rideshare insurance, in my opinion.

Tracking Miles

With Voom, you log into your rideshare platforms via Voom to track your commercial mileage. When you do a mileage check in, the extraneous mileage would then be considered your personal miles and your coverage may be adjusted at that time to suit your current coverage needs.

Voom is currently available for eligible drivers on Uber and Lyft’s platforms. Check back to see if others have been added or if the list has changed.

Coverage by Platform

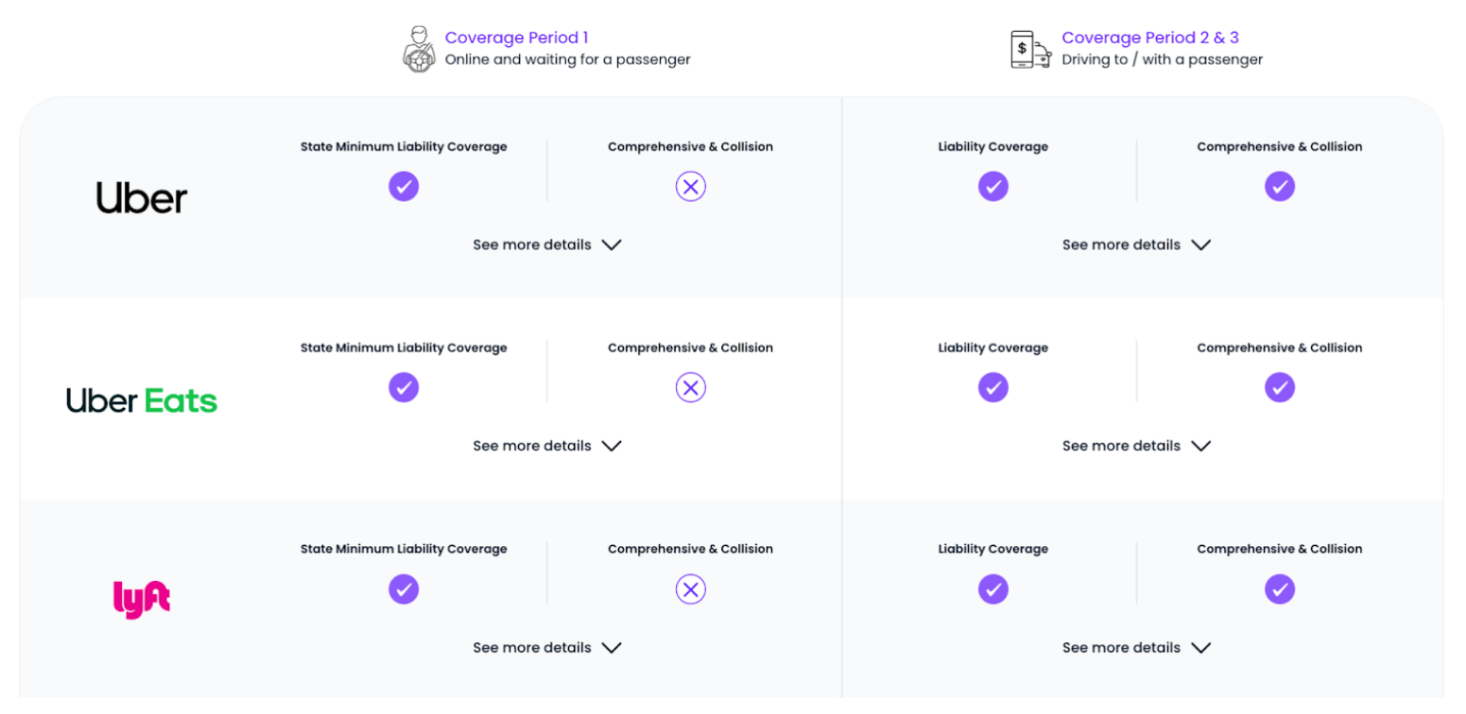

Uber and Lyft provide $1 million in liability coverage during Periods 2 and 3 and comprehensive collision, but as mentioned, there is a $2,500 deductible. There is a big coverage gap though during Period 1 where drivers don’t get any collision coverage and much lower liability limits.

Voom has a nice chart on its site that breaks down the platform’s coverage so you know where there are gaps with your current coverage.

How Does It Compare to My Insurance?

I currently have regular personal insurance through State Farm, and I do not have a rideshare endorsement added, though from what I remember, that would add approximately $15 a month to the coverage I’ve outlined below.

But it turns out, State Farm is more expensive than a Voom extended coverage policy, assuming I would drive around 12,000 personal miles per year.

At State Farm, my total 6-month premium is $1009.94 or $168.32 a month. That includes similar bodily injury and property damage and a higher $1000 deductible.

With Voom, I can get a $124/month extended coverage policy that will let me drive 12,000 personal miles and 12,000 commercial miles per year and a lower $500 deductible.

So, it seems like a no-brainer to switch to Voom instead of State Farm.

There is one perk that my insurance with State Farm covers that isn’t mentioned in Voom’s quote that you might want to inquire about.

That is emergency roadside assistance. When you’re stranded, you’ll want to make sure you know what your coverage options are. I also get discounts for being a good driver with State Farm.

Driver Takeaways

I do wish the customizable area had even more options, and I wish there was an option between Essential and Extended because Essential seems very limited in coverage. Granted, I’m sure that’s the purpose of the customizable tab—you can choose what coverage you want included or not.

Voom is currently available in Arizona, Colorado, Georgia, Maryland, Minnesota, Nevada and Tennessee, but it is expanding. View availability and join their waitlist here.

Also, I’m not the most diligent driver, so I have no idea how many personal miles I put on my car versus commercial coverage. From the sounds of it, Voom will ask you for updated mileage information as you go, so even if you guess upfront, you can give more accurate information later and adjust your coverage as needed.

Overall, Voom seems like an easy-to-use and reasonably affordable option for rideshare drivers. It’s worth checking out to see if you can save compared to your current car insurance.

FAQ

Delivery drivers? No

What about other states? See our rideshare ins marketplace.