If you’re a rideshare or delivery driver, chances are you have very little protection when it comes to a financial safety net. This is where a company like Kover, which is exclusively for rideshare and delivery drivers, comes in handy. Today, Senior RSG contributor Jay Cradeur reviews Kover, a portable benefits option for drivers, below.

This post is a paid partnership with Kover – you can sign up for Kover here. We only partner with companies we believe are actually helpful to our readers. You can see our affiliate policy here.

Being a gig worker can be absolutely amazing. You can work when you want. You can take off and go on a vacation when you want.

Gig workers experience the ultimate in “freedom and flexibility.” For example, during this pandemic, I am working really hard, writing articles, making videos, and coaching entrepreneurs to build successful online enterprises.

Later in the year, once Americans can travel to foreign lands again, I will hit the road and see some more of the world. This is the gig worker lifestyle.

However, one thing we don’t have working in our favor is a company handling our benefits. We are treated as independent contractors and as such, we don’t have benefits. Instead, we have to make other arrangements.

Recently I was introduced to a company named Kover, a company offering portable benefits to drivers.

This article will share with you how you can have the best of both worlds, freedom and flexibility, coupled with Kover to cover you when you need it most.

Ready to sign up with Kover? Get one month free membership using The Rideshare Guy referral link: sign up with Kover.

What Does Kover Cover?

Learn more about how Kover works in the video below or here on our YouTube channel: Lyft and Uber Drivers Can Now Get Benefits with Kover!

There are four main areas that Kover can provide relief during challenging times for a rideshare or delivery driver.

Hospitalizations

Hopefully you don’t get into a serious accident or suffer from a serious illness. Unfortunately, it does happen and when it does, not only do you have additional expenses, but again, you are in no position to drive and earn.

Obviously, this is extremely relevant right now with the worldwide pandemic raging.

Deactivations

This happens all the time, and sometimes for no reason at all.

I was deactivated by Uber for 6 weeks and in the end, Uber acknowledged it was a “technical glitch.” If I did not have Lyft as a second platform, I would have been unable to drive and earn.

Accidents

It happens. Even when it is not your fault, if you get into an accident and you can’t drive your car, you can’t earn revenue.

Fortunately, in my four-year career, I did not get into any serious accidents. However, I certainly saw a bunch of accidents on the road and some of the cars were mangled and not drivable.

Sick Leave

We get sick. If you get sick and can’t drive, you don’t make any money.

I remember getting very sick during my first year and I had to lie in bed for four days. That was four days of no money.

How Does It Work?

If any of those situations happen to you, Kover will provide income protection.

“You’re constantly on the go. Emergencies happen. With Kover’s Financial Safety Net for Gig Workers, you can protect yourself from unforeseen loss of regular income while accessing a suite of benefits made just for you. Plus, your first month is FREE.”

-Kover Website

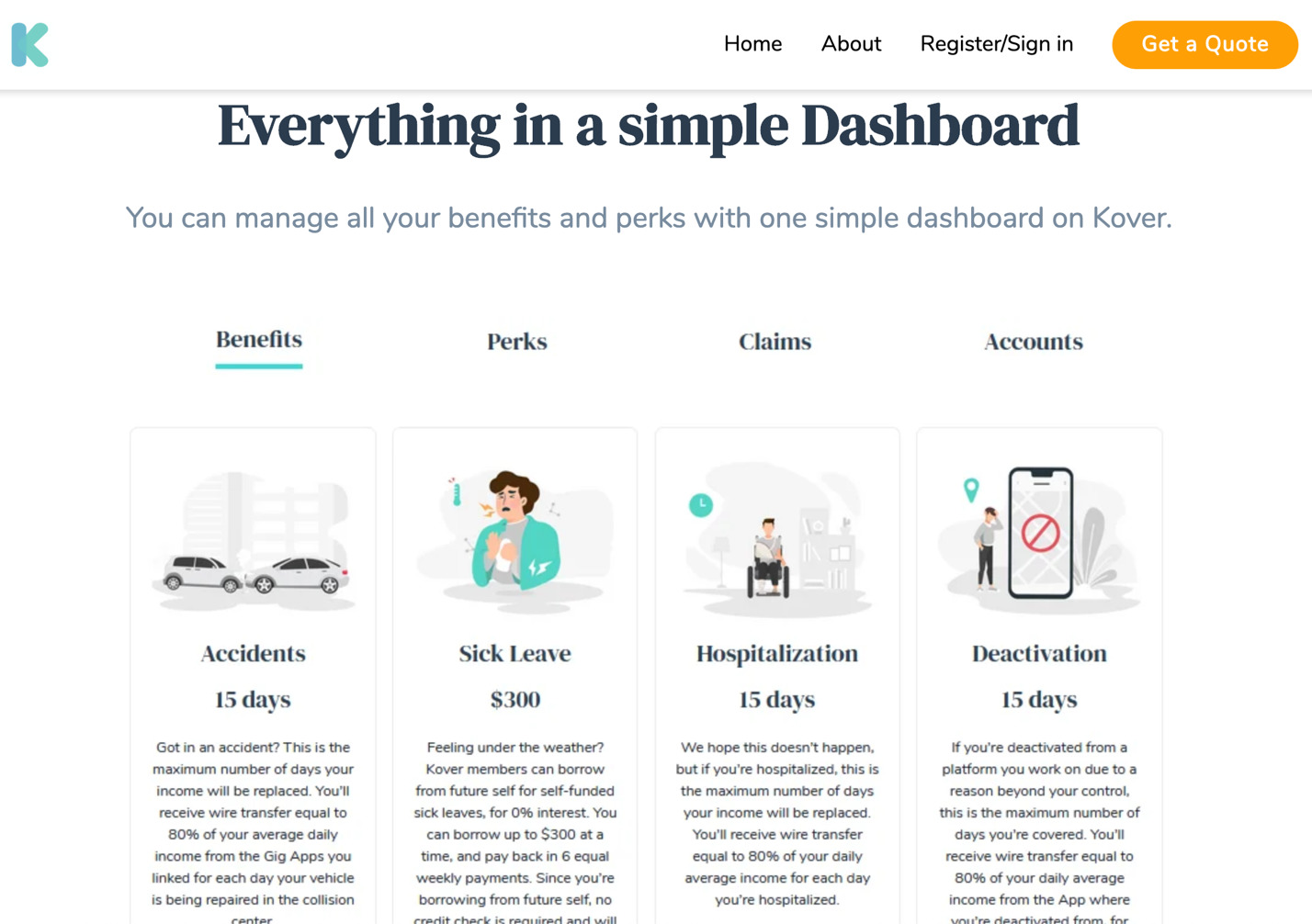

In the case of an Accident, Hospitalization, or Deactivation, Kover will pay you 80% of your regular income for 15 days. That’s pretty good.

When I was driving full time, I was earning $2,000 per week. Therefore if I were to get into an accident and my car needed to be repaired and the work would take 2 weeks, I would get approximately $1,600 per week or $3,200.

Imagine the peace of mind you would feel knowing that if you got into an accident, or you were hospitalized, or you were deactivated, you would be covered at 80% of your normal earnings. I think that would feel really good.

More Benefits of Kover

Kover does offer a few other benefits, or what they call Perks, for being a member. Above, I mentioned the Income Guarantee, where Kover will pay you 80% of your regular income in case of accident, hospitalization or deactivation.

Sick Leave – If you don’t feel well, Kover allows you to borrow from your future self up to $300, so you can focus on getting better. You can pay the borrowed amount back in 6 weekly payments of $50 each. This is a nice benefit but be careful about using it like a payday loan. While Kover doesn’t charge interest or fees, they will terminate or refuse the claim if they identify abuse or fraud.

Sick Leave – If you don’t feel well, Kover allows you to borrow from your future self up to $300, so you can focus on getting better. You can pay the borrowed amount back in 6 weekly payments of $50 each. This is a nice benefit but be careful about using it like a payday loan. While Kover doesn’t charge interest or fees, they will terminate or refuse the claim if they identify abuse or fraud.

24/7 Health – Speak to a health professional 24/7 with a medical professional from their partner, Fonemed. This benefit applies to both yourself and your immediate family members, and are completely free with no deductible.

Legal – Receive complimentary legal consultation with top gig economy lawyers at LegalRideshare. Plus, if you are unfairly deactivated by a platform, LegalRideshare will send a deactivation letter on your behalf, with legal fees paid in full by Kover.

Book-keeping – (Coming soon) View all your gig earnings in one place, with AI-driven analysis to help you earn more by comparing data with other drivers in your city.

How Do You Get Started with Kover?

It’s easy to get a quote. Go to the Kover.ai website and click on the orange Get A Quote button.

You will fill in some information and then indicate what gig company you work for.

I entered Lyft. Then I logged into Lyft through the Kover.ai website and Kover was able to determine my revenue and then quickly calculate a quote.

In my case, the quote was $61 per month. Given the peace of mind I would experience for such a low price, it was an easy decision for me to sign up with them. This is much cheaper than auto insurance, health insurance, and even some cell phone bills.

Remember to sign up using our Kover sign up link – you’ll get one month of membership free!

Key Takeaways

There is quite a bit to like about Kover. You can be a rideshare or delivery driver and provide yourself with a nice level of security should you experience an accident, injury or deactivation. Had this been available to me when I was deactivated by Uber, I could have earned an extra $3,200!

In addition, there are several additional perks. It doesn’t matter which company you work for so you are not tied down in any way.

In fact, the contract is month to month and you can cancel at any time.

Kover takes a small fee for each contract. Any extra funds generated are contributed back into the funding pool and would be used to lower the monthly subscription rates.

In my opinion, Kover has really thought of everything. Check it out yourself. Visit the Kover website and get a quote. I think you will find it just makes good sense. Be safe out there.

Get started with Kover here, and get one month of membership free!

Drivers, if you’re a gig worker, what do you currently do for health coverage, paid time off, etc.? Would Kover be something you would try out?

-Jay @ RSG