What would you do if you were offered $1,000 to buy Lyft stock? That’s a question senior RSG contributor Jay Cradeur was recently faced with. Here’s what Jay ended up doing with his $1,000 from Lyft – let us know if you received any money for the Lyft IPO and what you did with it in the comments.

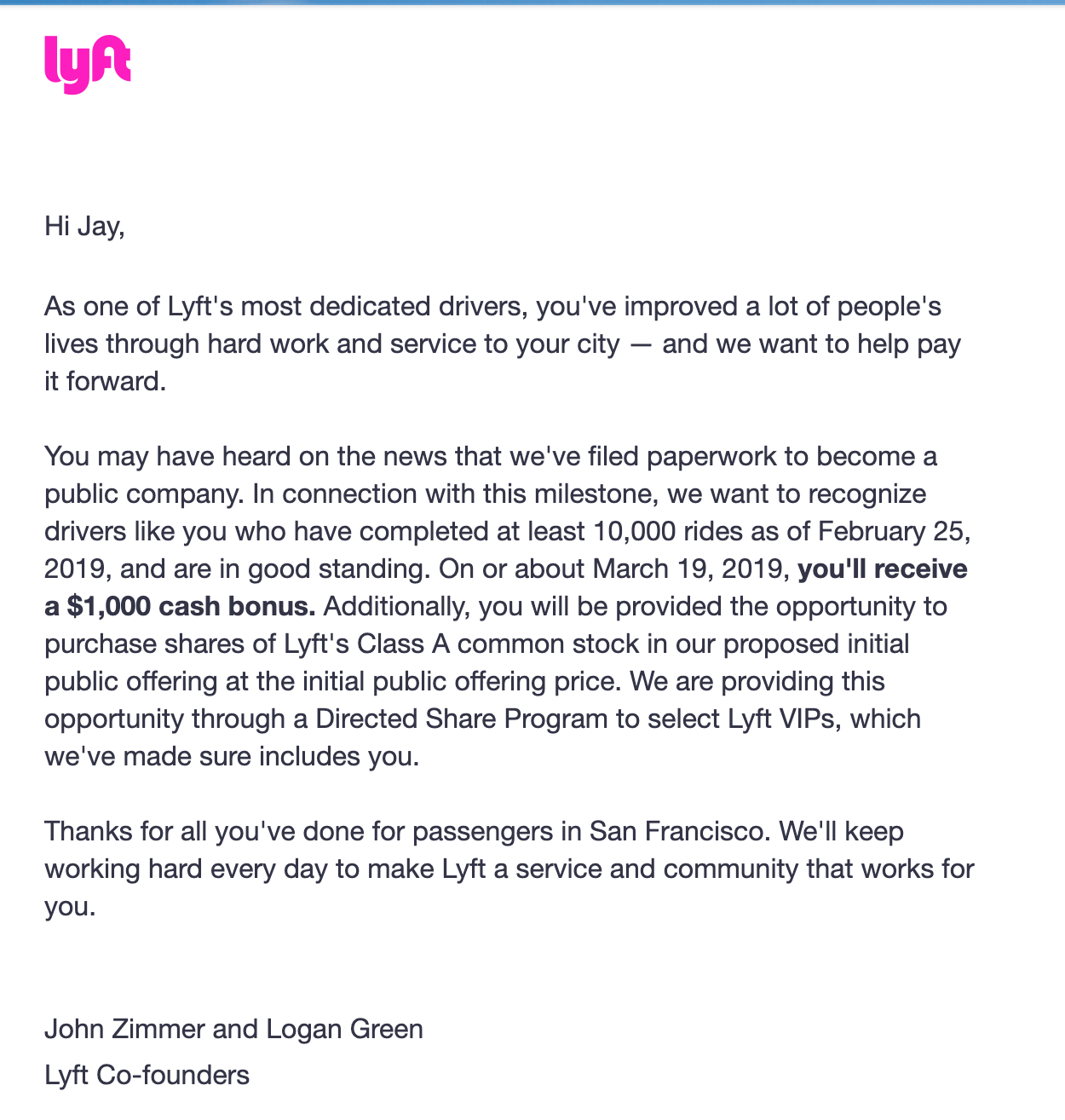

About a month ago, I received notice that Lyft would be giving cash bonuses to its most loyal drivers. And since I had done over 10,000 rides with Lyft, I would be getting a $1,000 cash bonus that I could then invest in Lyft’s pre-IPO shares.

This was all a part of Lyft’s public relations campaign to demonstrate their commitment to the drivers. The intent of the bonus, besides the positive PR, was to foster investment in Lyft’s pre-IPO (Initial Public Offering) stock. I would have the option to use the $1,000 bonus to buy stock in Lyft. What to do?

The Lyft Bonus – A Double-Edged Sword

I am always grateful to receive $1,000 from anyone, so to Lyft I must say “thank you very much!”

I am also a guy who can see a nefarious quality to the bonus qualifications. If you, a driver, gave 9,990 rides for Lyft, you got zilch, nada, nothing, the big ouch! I know what it takes to drive 9,000 rides. It takes years and a huge commitment to Lyft. To make it worse, Lyft offered $10,000 to drivers who completed 20,000. I am right there in the middle with 15,000 rides, yet I only get $1,000.

Clearly, having a tiered bonus structure would have been more equitable. I would be sitting on $5,000, and those of you with 9,000 rides would have $900. But while a tiered bonus structure would have engendered tremendous driver loyalty, it would have been very expensive. Instead, just a few drivers reaped the rewards. In fact, it seems like this bonus was really only for the most loyal and the most veteran Lyft drivers. Not that that’s a bad thing – it’s just the way it is.

If you were a full-time driver and did 100 rides a week and drove 50 weeks a year, it would take 2 years of full-time driving to hit 10,000 rides. Realistically, those numbers are really only doable in San Francisco where Lyft is busy and maybe a top tier city like Los Angeles or Chicago.

I’m not trying to sound ungrateful though. I still feel lucky that I got $1,000 since I was expecting $0 🙂

What To Do – Invest or Take The Money And Run

My first response was to invest in Lyft. This was money I never expected, so why not invest it and see what happens? I know there would be tremendous interest in this IPO and that alone would drive the price up.

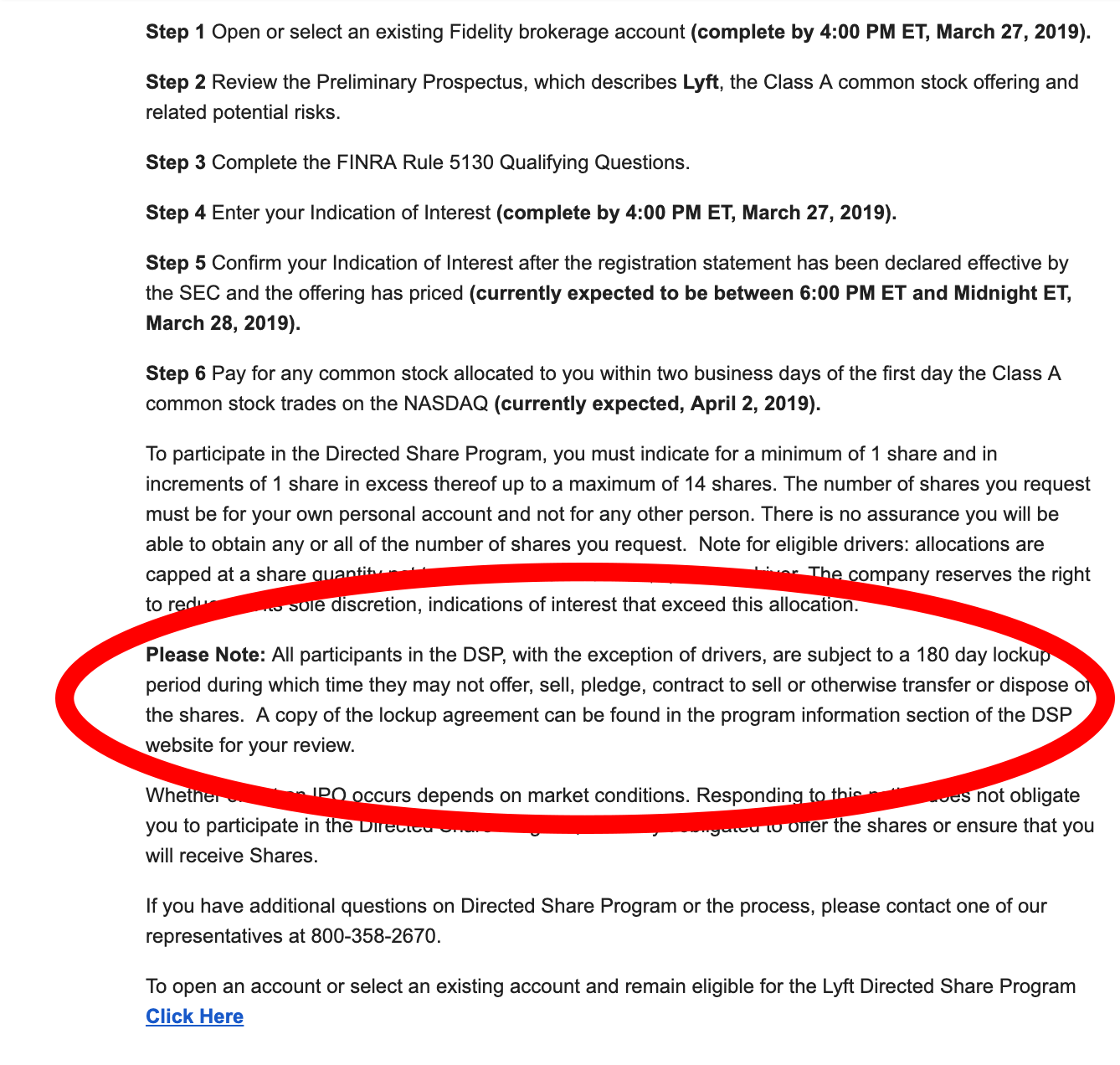

Then I heard that there may be a one to two year “lock up” period which means I would not be able to sell my stock right away. At this point in time, I was opposed to investing.

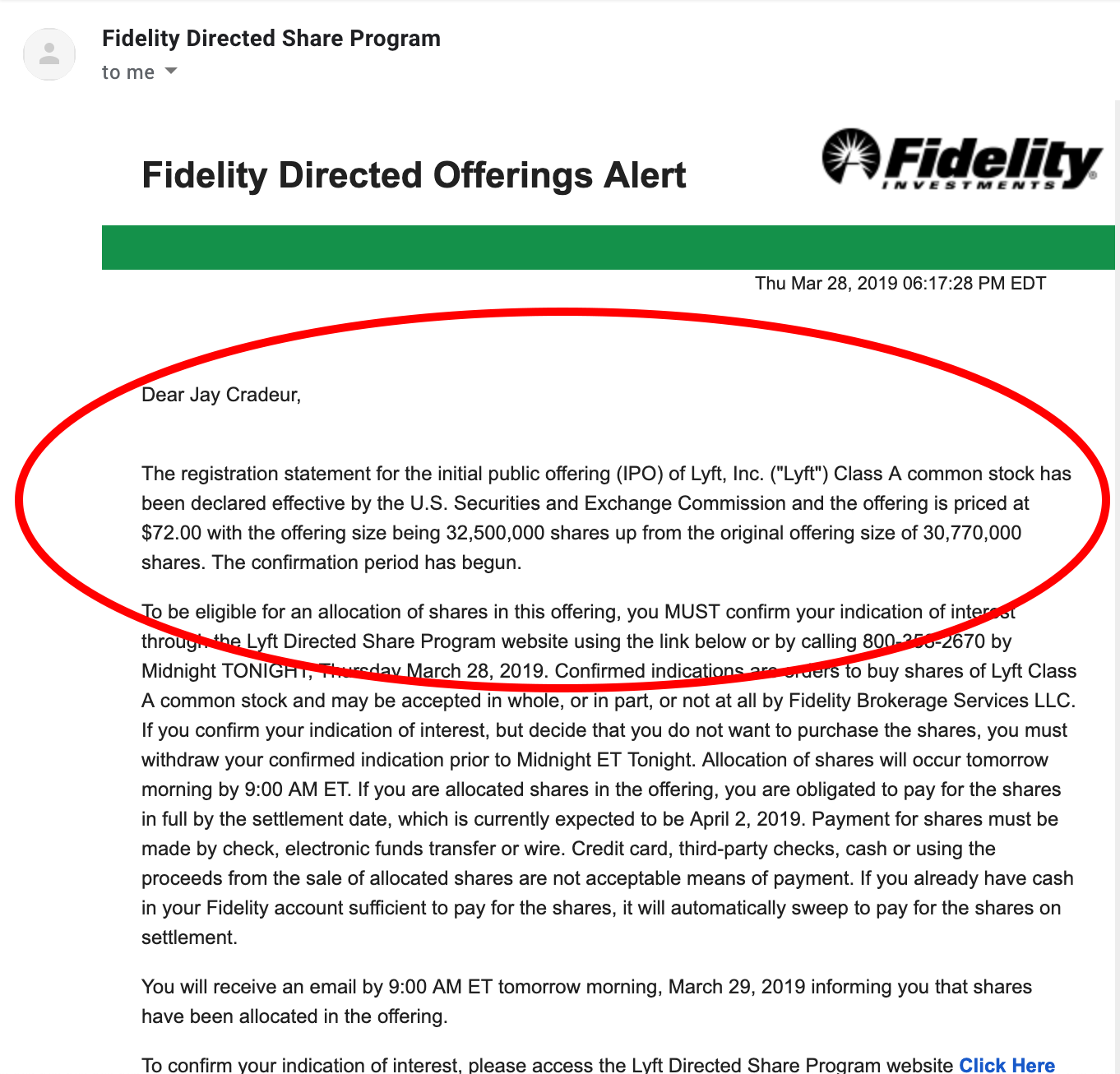

Then I received an email from Fidelity and in the fine print, it states there is a 180 day lock-up period for everyone with the exception of drivers. Boom! I am back in since I could sell the stock ASAP if I wanted to.

Pricing Of The Lyft Stock

Initially, I was told by Fidelity that the pre IPO price for Lyft stock would be between $62 – $68. I would not be able to make a purchase until the price had been determined. The next day, I was notified that Lyft was moving the price range to $70 – $72.

Later that same day, on Thursday, I was notified that the price had been set at $72 and I had until 12 midnight EST to state my intention to buy. I could only buy up to $1,000 so I indicated 14 shares. But I didn’t actually have to pay any money yet.

It was amazing just how last minute the whole process was. I received a flurry of e-mails over the last few days and it was pretty remakable how quickly they ‘went live’.

Stock Market Frenzy

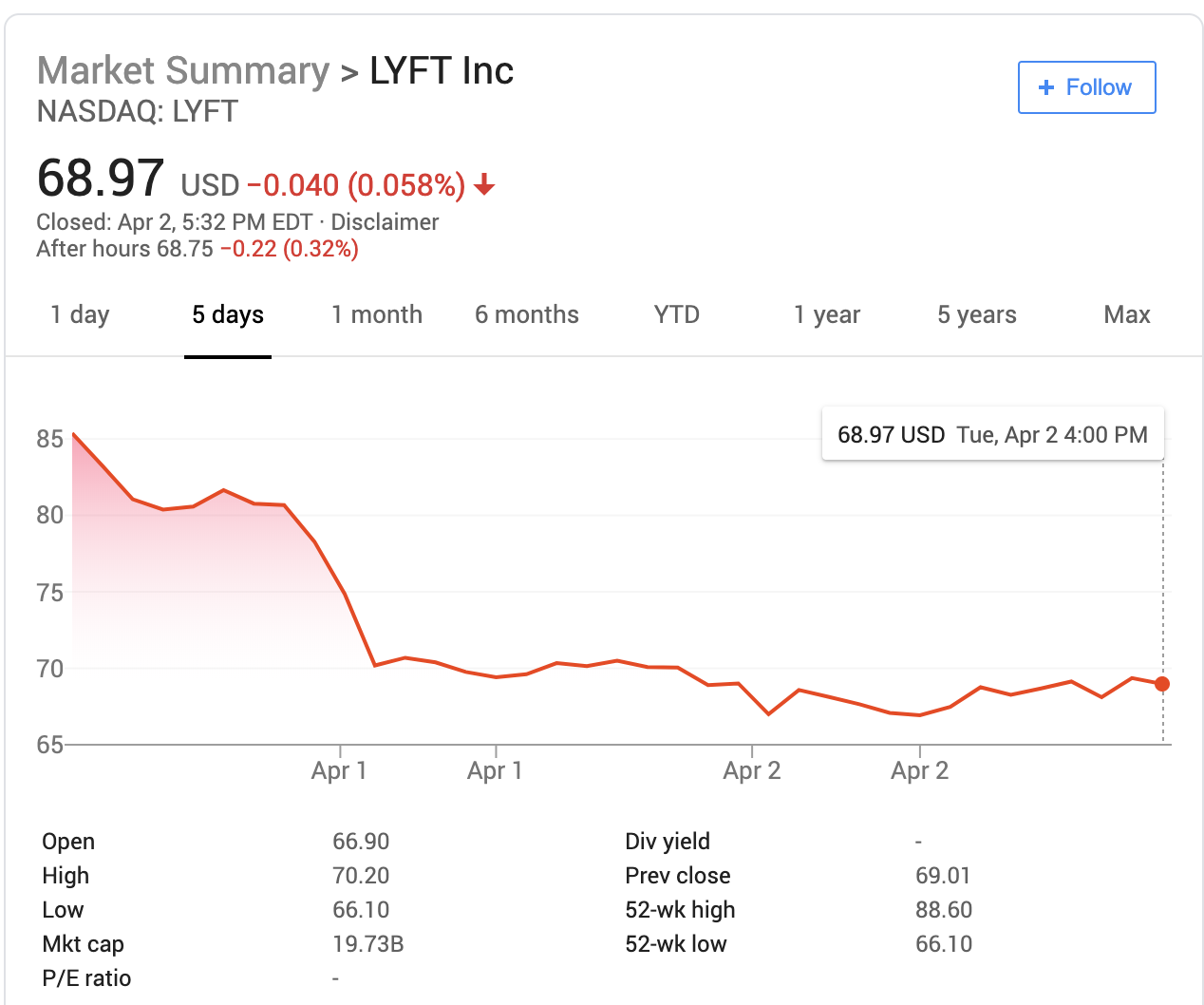

Lyft stock went public on Friday, March 29th, 2019. The stock zoomed up to $86 a share and finished the day just under $80. Jim Cramer, a TV personality who analyzes the stock market, predicted Lyft stock would soar to $100 a share. I hope it does. I am curious to see what happens during Lyft’s first full week in the stock market.

Interviews, Interviews, Interviews

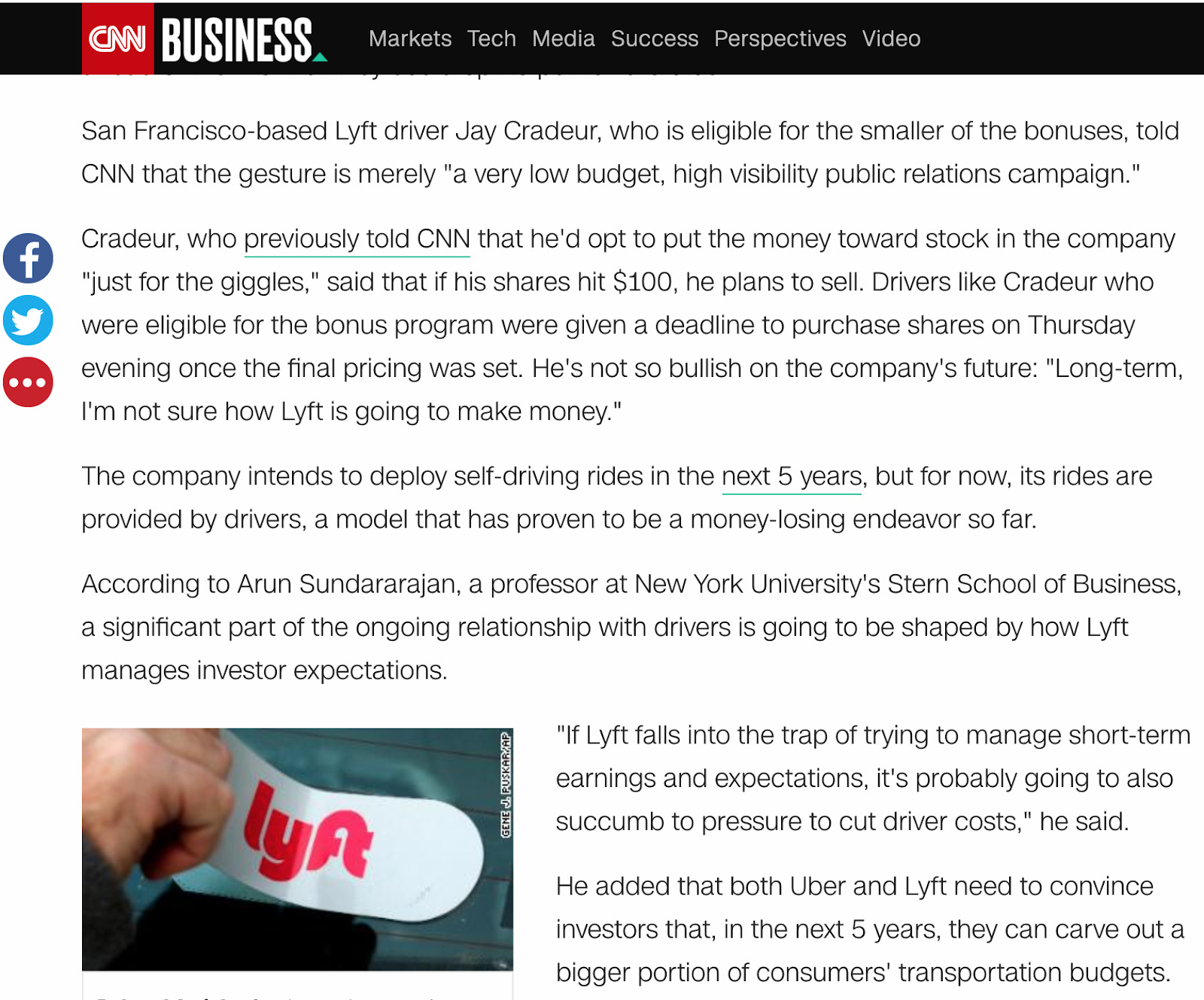

While Lyft was going public, a few news outlets even reached out and wanted to know what I thought about the Lyft IPO and would I or wouldn’t I buy the Lyft stock:

- CNN – Lyft drivers question company’s future as a public company

- Quartz – Lyft drivers definitely aren’t getting rich off the company’s IPO

I even did my first live TV interview for Cheddar Media. I set up a little studio in my home, waited for the first question, and then responded for the next seven minutes. Here for your viewing pleasure is my television debut.

I have been busy answering questions, doing my best to speak authentically and represent rideshare drivers as the good hard working folks we all are.

What Will I Do With My Stock?

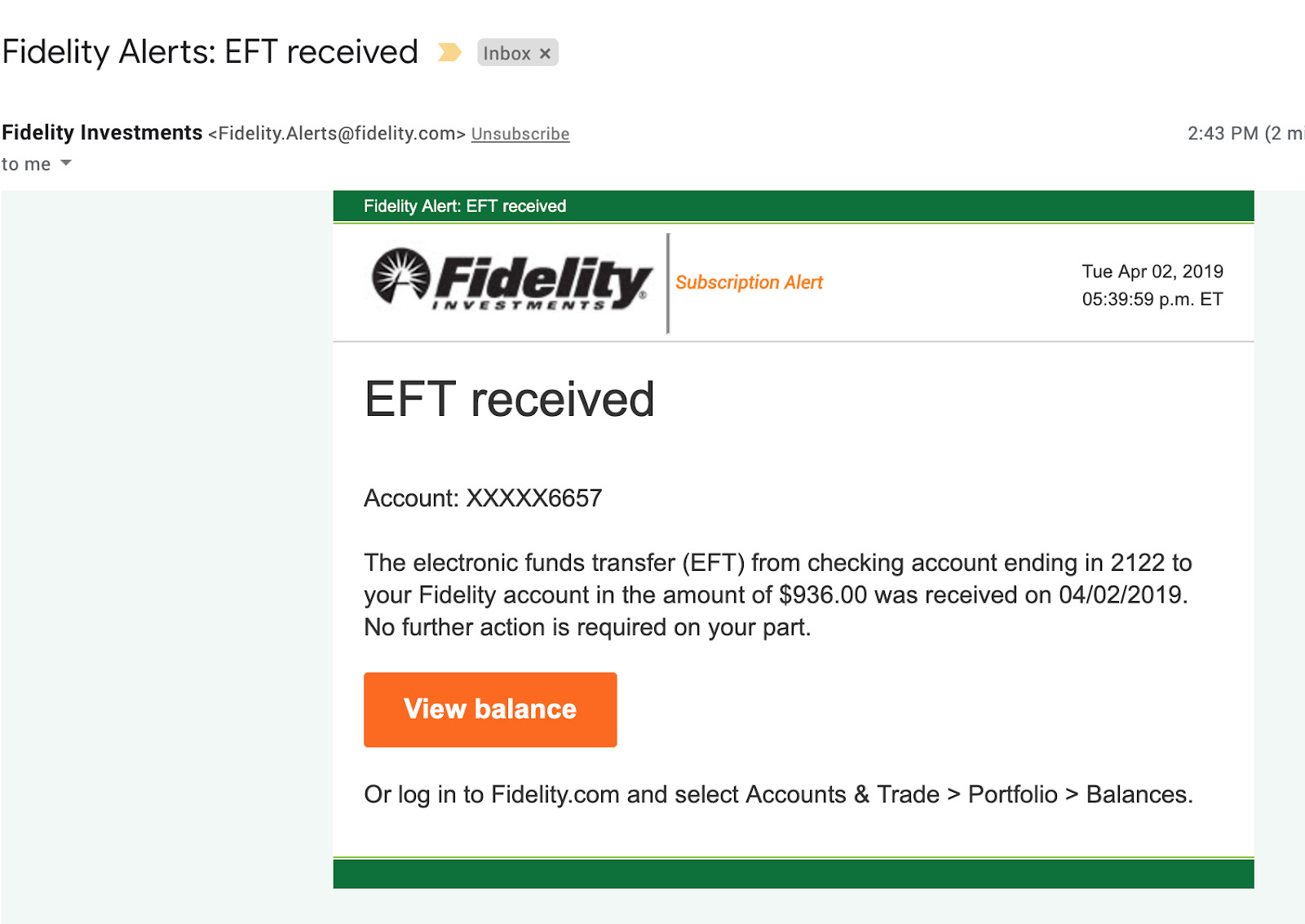

The payment deadline arrived and I made my payment.

It’s official. I own 13 shares of Lyft Stock. Unfortunately, the stock is now worth less than I paid for it. After zooming up to $86 a share, the stock tumbled on Monday to $66 a share and ended today (Tuesday) at almost $69 per share.

I initiated a stop loss sell order at $60 which means if the stock falls to $60 per share, then I want Fidelity to sell it and I will take the loss (maybe Harry will cover some of my losses since he wanted me to buy it so I could write the article 🙂 ). Hopefully, the market adjusts and Lyft stock will rise back up. After seeing how the stock market has given Lyft a luke warm response, I have revised my game plan. Once Lyft stock hits 75, I will sell. I don’t have much faith that Lyft will be able to turn a profit and I feel that is a solid reason to put my money elsewhere. Jim Cramer may have missed the mark on this one!

What’s It All Mean?

It has been an unusual week. Suddenly I am invested in the stock market and I am doing press interviews. Next week will be a normal week. The media attention will die down. I will get back to driving and writing and making videos and creating a podcast. I will return to the health club. And, most definitely, I will keep an eye on my Lyft stock.

My wish is that it hits $75 a share and I sell. I don’t have much faith in Lyft’s ability to turn a profit long term. Even more daunting is the likelihood that in order to turn a profit, Lyft will try to lower their biggest expense, drivers’ commissions. This is yet another reason to get on with your Plan B.

Time is ticking. I can hear those autonomous vehicles revving up. Go out and have a great day. Be safe out there.

Were you offered money to purchase Lyft stock and, if so, did you buy any Lyft stock?

-Jay @ RSG