The Rideshare Guy Mobility Report is a monthly piece that explores the world of rideshare & mobility through the lens of its workers. Written by Harry Campbell, author of The Rideshare Guide, and Tom Mourmouras, founder of Naxos Mobility.

The Regulators Strike Back

In the beginning, hot startups like Uber and Airbnb followed cliched Silicon Valley tropes: move fast and break things. Ask for forgiveness, not permission. And though it hurts to hear those phrases now, for many of these fast-moving startups, the bulldozer strategy worked well.

Former Uber CEO Travis Kalanick’s disruptive style made him and his early buddies a lot of money, but eventually proved incompatible with the rest of “society.” Now, Uber 2.0 is led by adults who appear to be running a much tighter ship…all while building scooters and flying taxis where 19th-century Californians once built ships.

Want to get the Mobility Report monthly? Subscribe below!

However, regulators are becoming more savvy. State lawmakers and local governments are fighting back against scooters, and the courts in California are cracking down on gig-economy companies that are misclassifying workers as contractors. In New York, the City, after failing two years ago, was finally able to cap the number of vehicles eligible for service in ridesharing. Apparently, the second time’s the charm!

Three different major crackdowns, spanning coast to coast. It appears that courts, regulatory bodies, and the mayor of the biggest transportation market in the US have all moved to consolidate their power. 2018 will go down as The Year The Regulators Strike Back.

Dynamex v Superior Court

To outsiders, driving for Uber or Lyft may seem like an independent gig. But the truth is that Uber and Lyft control virtually all aspects of the driver’s life and work once they log on. Drivers have no say in rates, and Uber and Lyft have lowered fares to the point where two-thirds of drivers are actually quitting after just six months. Uber/Lyft also use a complicated system of bonuses and incentives to control when and where drivers work.

The companies will fire drivers if their rating falls below a 4.6, with no clear process for drivers to contest false deactivations. Uber doesn’t tell the driver where they are headed until the passenger is seated and the driver starts the ride. Uber and Lyft set the rules for vehicle types and age. Should we go on? Uber and Lyft provide a powerful tool, but the idea that their vast armies of drivers are legitimately independent contractors fails under even the most basic examination.

This past summer, the Superior Court of California revised the rules that are used to classify workers as independent contractors. The ruling makes things difficult for companies to call workers independent contractors, as the workers must “perform work that is outside the usual course of the employer’s business.” Is an Uber driver doing work that is outside of Uber’s usual course of business? If Uber is a tech co. making software, then perhaps. But it’s a stretch.

We asked Shannon Liss-Riordan, co-founder of Lichten & Liss-Riordan, P.C. and reigning queen of class action employment law about the Dynamex ruling:

RSG: How big of a deal is the Dynamex ruling?

SLR: It is a big deal. The California Supreme Court adopted the Massachusetts test for distinguishing employees from independent contractors, and this test has been widely recognized as probably the toughest in the country for companies trying to rely on the independent contractor classification.

RSG: When could Dynamex affect Uber/Lyft’s business in California?

SLR: I think a lot of companies are still figuring out what they are going to do in light of Dynamex. The big hurdle we have faced in our court cases challenging misclassification has been the companies’ use of arbitration clauses to try to limit our ability to pursue class actions and force anyone who wants to challenge the companies’ business models to pursue individual arbitration. So although Dynamex could have a major impact, it may be that pretty much only drivers who sign up for individual arbitration may be able to benefit in recovering damages for wage violations. We have been signing up individual drivers for arbitration to seek those damages.

RSG: Will this ruling set precedent for other states and countries?

SLR: The ruling has gotten a lot of attention, around the country and around the world, and may be used as a model that other states and countries who care about workers’ rights could follow.

RSG: What are the overall trends we are seeing with regulators in the gig-economy space?

SLR: Some regulators have made moves to try to implement employment protections for gig economy workers. Unfortunately, so far, I believe their efforts and results have been mixed.

Shannon Liss-Riordan – Read more about her Uber lawsuit here.

NYC v Uber

RSG has reported extensively on New York City’s policy decision and how it actually benefits drivers who often complain of oversupply. While it won’t do much for congestion, the cap still allows for over 60,000 Uber vehicles to flood the streets of NYC vs the 12,000 current taxi medallions.

But remember: Uber/Lyft will always be somewhat at odds with drivers. Drivers want fewer other drivers on the road, so that supply is low, utilization is high and surge is frequent. Uber/Lyft want driver supply high to keep ETAs down (the #1 metric in the industry), surge down, and prices low. More drivers = lower ETAs = lower prices = more passengers = more revenues.

NYC’s ruling to limit supply is a boon to current drivers but aspiring drivers may be locked out, passengers may pay more for longer ETAs, and Uber/Lyft may see stunted revenue growth.

Scooters v ALL Cities

We promise that scooters will not dominate all of the Mobility Report’s coverage. But damn, they are trendy. On the same day this month, the cities of San Francisco and Santa Monica awarded their much-anticipated scooter permits to a potpourri of companies. SF gave the nod to Scoot and Skip, two newcomers to the current iteration of e-scooters made famous by Bird and Lime. And it seems like SF is punishing Bird and Lime for following the Uber 1.0 playbook / being the first movers / innovating. Scoot and Skip’s respective wins showed that in today’s world, the cities have the last word, even if they don’t always know what they’re doing.

Santa Monica gave Uber (branded as JUMP) and Lyft…and Bird and Lime the green light to launch after a somewhat quantitative assessment (JUMP has a “10” in scooter experience?![]() ). It seemed like the city would give the scooter contract to Uber and Lyft as a punishment to the local first-movers but last minute lobbying seemed to do the trick.

). It seemed like the city would give the scooter contract to Uber and Lyft as a punishment to the local first-movers but last minute lobbying seemed to do the trick.

One of the key differences in scooters today vs. Uber/Lyft’s 2013 launch is that fundamentally, scooters and rideshare are totally different business models. Scooters are wholly-owned fleets managed by gig-economy chargers. Far fewer people are charging company-owned scooters than are driving/maintaining independently-owned cars for Uber/Lyft. Bird is operating a model closer to Avis than to Lyft.

Bird uses contractors for the same reasons Uber does, but the scale is different. An independent Uber car needs a driver at all times before, during, and after a passenger ride. A corporate scooter only needs to be charged and repaired. Since the demand for human labor is so much lower with scooters, the voice of the contracted workers who may be affected by regulation is softer.

Companies would be smart to play ball

Regulators seem to be wise to the old mantras of Silicon Valley. Authorities hold the final say and are held accountable to the citizens, not the companies. The tech cos know how to mobilize their userbases to advocate on their behalf. But cities and courts are no longer intimidated, and they know that as with any issue, there are multiple sides with various supporters. Alliances among interest groups and government regulators have become and will remain the norm.

Entrepreneurs and investors: as finance guys say, Don’t fight the Fed.

Get the Mobility Report delivered to you monthly! Subscribe below:

News + Product Updates

Lyft scoots into Denver

- It’s about time! Having been banished from their home turf in SF, Lyft has begun to scoot in Denver. We wonder if Xiaomi is working on snow tires for their machines. Interestingly, Lyft has hired full-time employees, not contractors (as Bird and Lime have), to charge and rebalance the Denver fleet. Seems like Lyft is going full-corporate in the Scooter Wars: owning the whole stack–hardware, software, and employees. But this could definitely slow expansion plans as independent contractor Chargers have allowed Bird to launch cities rapidly. PS – We heard Bird had a bunch of scooters go missing the night before Lyft’s launch 😉

Lyft scooter = Bird scooter + more flair

The Information slams Waymo

- Waymo has totally controlled the PR cycle until now, pipetting out great performances from CEO John Krafcik, videos of happy, diverse families in what we can only presume are hot Pacificas in Chandler, Arizona, and expertly navigating Uber’s tragic and facepalm-inducing accident AV accident. But Amir’s piece is a must-read. Many of us have been stuck behind a Cruise AV in SF by now, but Arizona-based Waymo has largely remained out of the spotlight of honest-to-goodness investigative journalism. The Information’s piece reveals that Waymo cars are human (robot?), too. They have big issues with unprotected left turns and abrupt stops, just like their rivals.

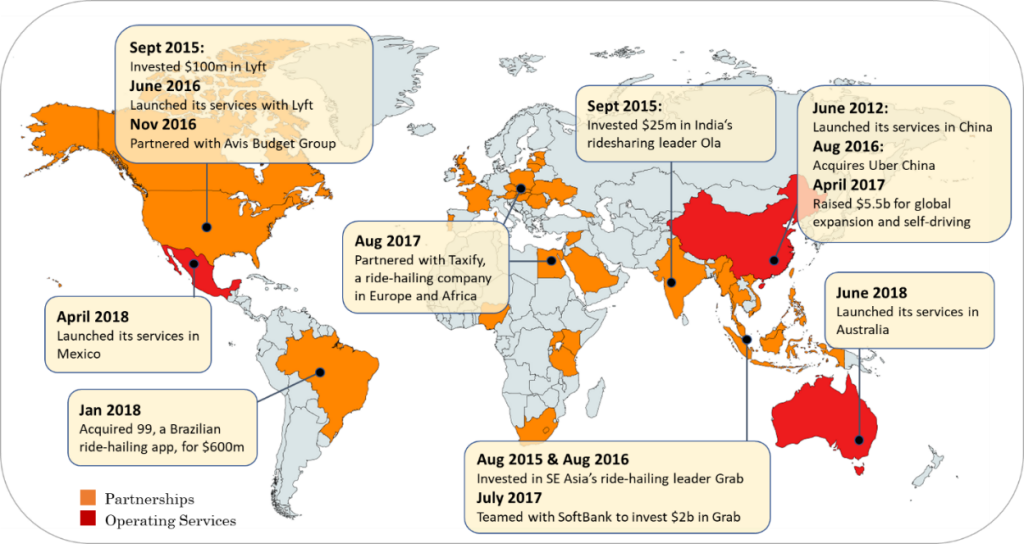

Didi is much bigger than Uber

- It’s important for us to acknowledge our awareness and reporting bias stemming from our location in California. We think mostly about Lyft biting at the heels of a born-again Uber…but the story in the next 2-5 years may be Uber vs Didi (again). Some highlights from Sustainable Transport in China for you to ponder:

- Rides per day | Uber: 15mm | Didi: 30mm

- 2017 total rides | Uber: 4bn | Didi: 7.4bn

- Didi share of trips in China: 2%

- Didi is hard at work in Mexico and Brazil, and has limited stakes in numerous other global rideshare companies. As an investor in both Uber and Didi, it looks like Softbank will have the ultimate say in how these companies partition the global addressable market.

- As per Napoleon Bonaparte: “China is a sleeping giant. Let her sleep, for when she wakes, she will move the world.”

Data-driven

Big rulings like Dynamex always bring the tenuous IC vs W2 debate front and center, but what do drivers think? Surprisingly, nearly 76% of drivers want to be independent contractors although from speaking with tens of thousands of drivers over the years, it’s clear their definition of IC is a lot different than Uber/Lyft’s.

Source: RSG 2018 Driver Survey

Your turn to drive

What do you think of the MobRep? (a.k.a. Mobility Report)? What should we change? What do you want to see next time? If you could ask drivers, chargers and couriers one question, what would it be? Let us know!

-Harry @ RSG