Should you buy Uber stock? It’s a question some Uber drivers have been asking since Uber went public in 2019. RSG contributor Tyler Philbrook breaks down the upsides and downsides of investing in Uber and helps you answer the question ‘Should I buy Uber stock’ as well as how to buy if you decide it’s right for you.

Quick links:

- Invest with SoFi – read our SoFi review

- Read more about WeBull at our WeBull review

- Learn more about the Robinhood investing app – Robinhood review

- Learn more about stock buying apps

The day I turned 18 I did two things. First, I walked 2 miles to a Washington Mutual bank and opened a savings account with the little cash I had.

Second, I signed up for an investing account. I think it was with Capital One, but I may be mistaken. I thought I was going to get rich buying and selling stocks. I did make some money from it, but usually spent my profits on silly things.

Many years later, I still look at and buy stocks, though my methods have changed a lot. One stock I keep my eye on, mostly because I work regularly for the company, is Uber.

Yes, you can make money driving for Uber, and now you can also own a piece of the company. But, is it a good decision? How does everything going on in the world affect the decision? And, what will the stock price do in the future? Let’s find out.

Pros and Cons of Buying Uber Stock

First, let’s look at reasons you would NOT want to buy Uber stock.

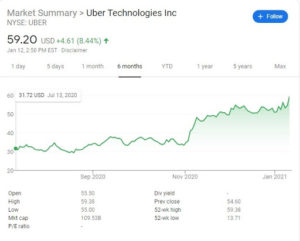

On May 10, 2019, Uber stock opened at $42 a share and for 3 months stayed right in the $40 to $43 range. In August of that year, the price dropped to around $30 and didn’t come back up for over a year until the third quarter earnings in November of 2020.

Essentially, this stock has been around for 17 months, and 15 of those months the stock price has been less than when it started. While it is on the upswing at the moment, it doesn’t seem like a good buy.

Another reason not to buy Uber stock is that the company has yet to make a profit. In fact for every share, they are losing nearly $4.

Uber market close as of January 8, 2021 shows a continued upward swing

My main focus for investing is to get nice dividend checks every quarter, and Uber does not currently have a dividend payment.

However, that doesn’t mean you can’t or even shouldn’t buy stock in Uber.

For instance, even though it’s true they have yet to make a profit, that doesn’t mean they won’t. In fact, turning a profit is one of Uber’s many goals. With the increase of demand for things like UberEats, Freight, grocery delivery, etc., they are definitely pushing in that direction.

Experts are taking note of the success of Uber Eats during the lockdowns throughout the country, and even around the world. They realize that Uber Eats has helped keep Uber Technologies afloat during a turbulent time, and because of this, many recommend investing in Uber Stock.

However, Leo Sun of The Motley Fool, suggests that Uber Eats is “killing the company”. This, he says, is because the food delivery market is oversaturated with many alternatives vying for the top spot.

One reason to buy Uber stock is if you look at it long-term. Rideshare companies as a whole have significantly affected taxi companies by offering competitive prices as well as often being a faster and easier alternative.

Self-driving cars will likely positively affect Uber profits by eliminating the need for drivers.

The biggest reason Uber doesn’t turn a profit at the moment is having to pay their drivers. If they didn’t have to pay us, a lot more of the money consumers spend to get rides would go back to the company itself.

Although self-driving cars may sound like science fiction, we are much closer to that being a reality than people realize.

Uber has taken steps to be one of the forerunners for autonomous cars, allowing them to continue to grow even after having a driver is no longer a necessity.

In Uber’s Q3 2020 quarterly report, it states:

“Despite an uneven pandemic response and broader economic uncertainty, our global scope, diversification, and the team’s tireless execution delivered steadily improving results, with total company Gross Bookings down just 6% year-on-year in September,” said Dara Khosrowshahi, CEO.

“Mobility Gross Bookings nearly doubled from Q2 levels and Delivery surged again to 135% year-on-year growth thanks to an increasing pace of innovation, which saw us launch new industry-leading safety technology; extend delivery offerings into groceries and prescriptions; bring Uber Green to more than 50 cities; and expand both Uber Pass and Eats Pass membership plans.”

On January 11, SoftBank sold $2 billion in Uber stock because of the amount of recovery Uber has seen over the past few months. They still hold about 184.2 million shares that would amount to around $10 billion if sold at the current prices.

Impact of Proposition 22 on Buying Uber Stock

It would be a huge mistake to think that the passing of Proposition 22 in California wasn’t good for Uber, and in turn, the stock price.

On November 3, 2020, Uber’s stock opened at $35.27. The very next day, after Proposition 22 was passed, it opened at $40.66 — more than a 15% increase. In addition, the volume of the stock (how much was purchased) jumped from 16 million to over 100 million.

No matter how you feel about Proposition 22, it has helped Uber’s stock price increase and stay there for several months now.

How to Buy Uber Stock

Buying Uber stock can be as simple or complicated as you make it. You have several options to look at and each will have upsides and downsides for each individual.

First, you have the in-person option. Find a local broker, such as a Fidelity branch or a quick Google search for “stock brokers near me” will find different businesses.

I find when it comes to decisions involving money, it’s best to get references. Find people who use brokers and ask who they use. Do they have someone they’ve been using for 20 years?

The in-person option is best if you have a lot of cash and are unsure where you want to put it all. It gives you someone who will walk you through the process, and can help you decide if purchasing Uber stock is right for you.

Next, you have the online version. Whether you use a long-term broker like Charles Schwab, or a Robo Advisor, the process is pretty much the same.

You can use robo advisors like Robinhood, Webull or SoFi to get started.

You fill out your information, connect a bank account to the service, and then start purchasing stock.

Make sure you look at the fees with each of these services. For instance, do they charge you per trade? Or, do they charge a monthly or annual fee? Is there a minimum to invest before they even allow you to trade?

Uber Stock Prediction in 2021

Most years it’s almost impossible to predict what a stock will do. With the unknowns of the world we live in right now, it’s even more difficult.

As the world starts to open up, or close back up due to COVID-19, it makes it difficult to say what the price of Uber stock will be moving forward.

That being said, Uber is at the forefront of helping people continue to get food they love during the pandemic with Uber Eats. They are also still helping people get to and from work and to any social gatherings that are allowed with their regular rideshare services.

Plus, Uber has not stopped planning for the future by offering more delivery options like grocery, as well as continuing to develop autonomous cars.

I feel Uber stock will continue to stay steady for the next year as we see their sales continue to decrease in rideshare but increase in delivery and freight.

How to Buy Uber Stock

You can start investing with as little as $100. However, I strongly recommend never trading more money than you can comfortably stand to lose!

If you have some money to play with or want to take a long-term position, here are the best stock buying apps.

Among the stock buying apps, we’ve done a deep dive on the following:

Disclaimer: Futures, stocks and options trading involves substantial risk of loss and is not suitable for every investor. The RideShare Guy is in no way advocating for or against a particular stock. We are giving opinions and analysis. Make up your own mind. The valuation of futures, stocks and options may fluctuate, and, as a result, you may lose money. Trading strategies are used at your own risk.

What do you think about investing in Uber stock? Have you already or are you considering buying Uber stock?

-Tyler @ RSG