Bottom line: if you’re a new investor or want to get started with cryptocurrency, Robinhood is an excellent, free service. While there are limitations, Robinhood is good for beginners plus offers new account-holders one free stock with no deposit required.

If you’re looking to get into day trading without investing a ton of money upfront, Robinhood may be the app for you. Robinhood cuts your trading fees and makes it easy to start investing in stocks with as little as $1.

In this Robinhood review, I’ll explain how the app works, any fees you should look out for, and how to determine if it’s a good fit for your investing needs.

Quick links:

- Get started with Robinhood here and get one free stock

- Alternatives to Robinhood? Our Webull review

- Robinhood is best for beginner traders and those who want to get started with cryptocurrency

What is Robinhood? Robinhood Review

Robinhood was the first platform to allow commission-free stocks, ETF, and options trading. Other platforms have since followed the same path, so Robinhood has pioneered the idea of also having free cryptocurrency trading as well.

The account minimum is $0 for Robinhood, and only taxable investment accounts are available on the platform. Robinhood offers mobile and web trading. Because of the $0 account minimum, no money is needed to create your account.

Once you are interested in investing then you will need to start contributing money. The signup process is quick and easy, and new customer accounts can be approved immediately.

Robinhood Functionality and Usability

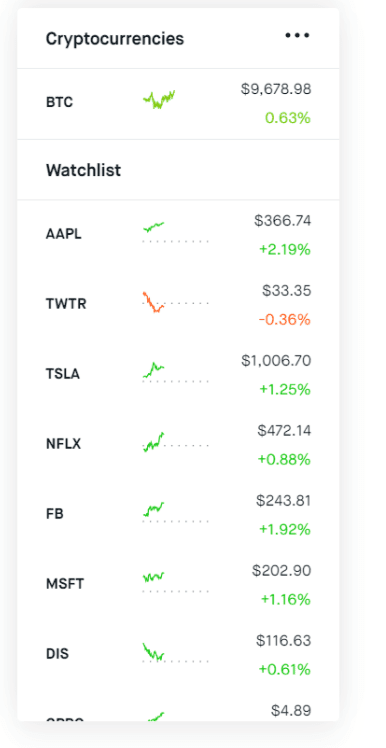

Robinhood is one of the most user-friendly investing apps for beginners out there today. If you want to research a certain stock, the app makes it easy to do that. The app will show the charting from the last day, month, or back one year. Investors get to choose between a line or a candlestick chart.

You’ll also get easy access to stats like market cap, P/E ratio, and the 52 weeks high or low.

Check out this beginner tutorial on how to use Robinhood below:

What Does Robinhood Offer?

Cryptocurrency Trading

The thing that makes Robinhood stand out from other platforms is options and cryptocurrency trading. Cryptocurrency trading is available, but only in select states. Cryptocurrency can only be used on Robinhood though, and the cryptocurrency like bitcoin can’t be transferred out.

So you don’t have the option to store it in a hardware wallet or to send it to someone. The only option would be to cash out of the cryptocurrency that you own to get it out of Robinhood.

Fractional Shares

Robinhood has announced that, coming soon, investors will be able to buy fractional shares with Robinhood.

A fractional share is a small portion of a share of a company or ETF. For example, if you want to buy a share of Google but a single share costs $1,362 and you don’t have that amount, you can pay a small amount to buy a fraction of a share of Google.

Because of this option, you are allowed to trade stocks and ETF’s in pieces of shares. Fractional shares through Robinhood can be as small as 1/100,000 of share.

Stocks worth over $1.00 per share with a market capitalization of $25,000,000 qualify for fractional share orders.

Cash Management Account

The cash management feature is also in the works with Robinhood. This will be a high yield savings account that offers you a place for your money that’s not invested in stocks.

Account-holders will earn 0.30% APR on their cash. Interest is paid monthly on the uninvested cash.

Free Stock

Robinhood users receive a free stock when they open an account. A surprise stock appears in your account. All you will have to do is claim it.

You won’t need to deposit any money into an account to get the free stock.

The stock could be worth up to $202.94. Investors have a 1 in 150 to get a Microsoft ($202.94), Johnson & Johnson ($143.92), or Visa stock ($198.72).

There is a 1 in 50 chance that the stock could be HP Enterprise, GE, or Keybank. The value of a share is between $2.50-$200 but does fluctuate depending on movements in the market.

What Does Robinhood Not Offer?

Dividend reinvesting is not an option on Robinhood. There are also no retirement accounts currently on the platform.

Something else that would be great for new investors that is not offered on Robinhood is a trading simulator to practice investing without using real cash. Robinhood does not have mutual funds or bonds.

Robinhood Amenities

Referral Bonus

Robinhood amenities include not only getting a free stock for opening a Robinhood account but also referring others to open one as well. For each person you refer, you and your referral both get a stock. Members are eligible for up to $500 in reward stocks each year.

Robinhood can’t provide any updates on referral accounts or applications, so you’ll have to follow up directly with the referral. Free stocks need to be claimed within 60 days.

Research Offerings

Robinhood has gotten better over the years with its research offerings. Robinhood allows users to customize news about their assets so they can stay informed on what’s happening right in the app.

Not only do they have analysts rankings for each company, but they also feature top movers, links to earnings calls, and also provide earnings calenders.

Investors also have the option to view the current popular stocks on the market and a section featuring stocks that ‘People also bought’.

News and Analysis

You also have access to news articles to help you stay informed on the latest news on companies.

Want to know what the analysts are advising investors to do? The platform has a section for that as well.

Don’t know if you should buy, sell, or hold a stock? This is the place to look for advice.

Robinhood Gold

Robinhood Gold is the optional paid monthly subscription option to consider. Paying the $5 monthly will grant access to $1,000 of margin which could then be used to purchase stocks with borrowed money.

Another great feature of Robinhood Gold is larger instant deposits.Instant deposit is the money added to Robinhood with a plan to invest it.

Gold members will be able to use the money right away instead of having to up to 5 business days like some accounts have to.

If you don’t have Robinhood Gold, you get up to $1,000 in instant deposits regardless of the value of your account. Robinhood Gold is different.

- $50k instant deposit limit if your portfolio value is over $50k

- $25k if your portfolio value is over $25k

- $10k if your portfolio value is over $10k

- $5k for every other Gold user

Customer Service

Robinhood has a Help Center where investors can go for many of their questions.

Unfortunately, Robinhood does not have a number for customers to call to talk to a live person. The ‘contact us’ section is a way for users to send Robinhood a question over email.

They also offer limited help on their Twitter account @AskRobinhood.

Is Robinhood Safe?

Robinhood makes it clear to users that their money is safe with them. A CNBC article states that Robinhood cash management accounts “sweep” money from a brokerage account to many of the various FDIC-Insured bank partners. Because of this Robinhood uninvested cash is insured up to $1.25 million.

Robinhood bank partners include Citibank, Goldman Sachs, Bank of Baroda, Wells Fargo Bank, HSBC Bank, and U.S. Bank. Robinhood is a member of Securities Investor Protection Corporation (SIPC) and securities are protected up to $500,00, including $250,000 cash.

Your private information, like your Society Security Number (SSN), is encrypted even before it is stored. Robinhood also says they do not store your online banking information. It’s just used once when creating an account to verify the account belongs to you.

The video below breaks down how Robinhood secures its users’ data:

Robinhood has measures in place to help keep accounts safe. Some of those include adding layers of verification to sign in. Some of those verifications include Face ID, Touch ID, two-factor authentication, or custom pin.

Robinhood has had its fair share of outages, including three earlier this year. With the Covid-19 outbreak, this year has been filled with uncertainty. On March 2, there was a daylong outage on the platform for the 10 million Robinhood users.

This was a bad day to have an outage because the Dow increased nearly 1,300 points, the S&P 500 jumped 136 points and the Nasdaq rose 384 points. This was followed by two days of glitches on the app, help center, and website. A class-action lawsuit was filed in Florida seeking unspecified damages.

Robinhood Pricing: Robinhood Fees

There is no fee to set up, maintain or transfer funds from a Robinhood account. Users aren’t charged to execute trades. The Robinhood Gold account costs $5 a month.

Robinhood Hidden Fees

The regulatory transaction fee is used to cover for supervising and regulating securities markets and securities professionals. This Robinhood fee is $22.10 per $1,000,000 of principal (sells only), the amount is rounded up to the nearest penny.

The trading activity fee is used by the Financial Industry Regulatory Authority (FINRA) to recover the costs of regulating and supervising brokerage firms. Robinhood then charges its customers.

The fee is $0.000119 per share (equity sells) and $0.002 per share (options sells). The fee is rounded up to the nearest penny and never greater than $5.95.

Robinhood Review: Pros and Cons

Pros

- Free Trading

- No minimum deposit required

- Offers cryptocurrency trading

- Robinhood Gold features

- Easy to use mobile app

Cons

- 2020 app crashes

- No retirement accounts

- No bonds or mutual funds

- Majority of customer support is done through email

Robinhood Review FAQs

Who is Robinhood Best For?

Robinhood welcomes investors of any background. The fact that it’s easy to start and navigate and no commission on trades makes it a great choice for beginner traders.

How Does Robinhood Make Money?

Interest on uninvested cash, lending stocks purchased on margin instead of cash, fees from the companies credit card, order flow payments, Robinhood Gold monthly fees.

Is Robinhood Legit?

Absolutely, over 10 million users trust Robinhood with their investments.

Is Robinhood a Good Way to Invest?

It’s a legit way for beginner, intermediate, and expert traders to invest right from their phones.

How Do I Get My Money Out of Robinhood?

If you wanted to transfer money from Robinhood you can do that by selecting the person icon on the bottom right of the app. Then select transfer to your bank, Robinhood will then initiate the transfer to the bank account you have on file.

Is Robinhood Worth Using?

Yes! Fee-free stock trading and a cash management account are some of the many reasons Robinhood is well worth checking out.

Get started with Robinhood here and get one free stock today!

Readers, have you used Robinhood or would you use Robinhood?

-Chonce @ RSG