July 2021 Update: At this time, we do not recommend Womply to our readers. We have heard numerous complaints about Womply from our audience and we have had a bad experience with Womply ourselves.

Many of our readers have complained about not being able to get a hold of Womply when they have questions or issues. People have even reported being approved for loans and then not receiving funds.

Here are just a few examples of people having issues with Womply: Example 1 | Example 2 | Example 3

Womply’s support has been so bad that many users are going to social media to vent their frustrations and they are now being targeted by scammers. If you get contacted by someone on social media claiming to work with Womply, it is probably a scam.

At this time we do not recommend signing up for Womply, and we recommend researching alternatives instead.

You can read our initial review of Womply below, before the complaints started coming in.

Original Womply Review

Think you don’t qualify for the Paycheck Protection Program (PPP)? Think again! RSG contributor-at-large Jay Cradeur qualified for over $25,000, and plenty of other drivers have reached out to us saying they qualified for thousands as well. But how do you apply and what is the process like? In this Womply review, RSG contributor Chonce Maddox-Rhea shares more about Womply, the PPP application process and answers your questions below.

There are so many companies and tools out there that are aimed at helping small business owners and contractors run operations more efficiently. Womply is one of those companies.

Womply is a local commerce platform that is doing a great job at helping drivers and couriers apply for the Paycheck Protection Program.

With round two of PPP loan applications in full swing, it’s good to hear that most drivers now qualify since your loan offer can now be based on total revenue for the year and not just your net income. Womply has helped simplify and streamline the process so that applying for your PPP loan takes very little time now.

What is Womply and What Do They Do?

Womply is geared toward helping small businesses thrive in a digital world. The company was founded in 2011 and now serves over 500,000 small businesses. Womply provides customers with everything from reputation management, CRM, marketing automation, financial tools, and more.

Millions of small business owners have also applied for the forgivable loan through the Paycheck Protection Program (PPP) and Womply has been there to help get these loan applications ready for processing.

Womply and the PPP Process

Covid-19 has challenged millions of small business owners and independent contractors, affecting their income and livelihoods. Luckily, the Paycheck Protection Program (PPP) was designed to help those business owners and independent contractors get back on their feet with funding to make up the gap in earnings, due to COVID.

Womply put together an entire guide to help walk Uber, Lyft, DoorDash and other drivers through the process of determining eligibility and applying for a PPP loan.

The deadline to complete an application and be eligible to accept funds has been extended to May 31st, 2021. With that date in mind lenders would have until June 30 to process those applications

If you were part of the first group of people who received financial help, you can also be eligible to be a part of this second draw PPP loans. Rideshare drivers are among one of the many different careers that have the opportunity to access these loans. As long as the loan is used as directed, you can be granted full forgiveness so it’s very much like receiving free money.

Learn how applying for the PPP through Womply works in this video: PPP Loan Application: How Lyft & Uber Drivers Can Apply (Step By Step)

At least 60% of the loan must be spent on payroll costs for the loan to be forgiven. In addition to payroll, there are a few other expenses that can be used with the money from the PPP loan including:

- Operating costs

- Property damage (looting damage not covered by insurance)

- Worker protection

- Supplier costs

This round of loans does have a “covered period” that can be extended between 8-24 weeks.

If you do have to pay back the loan, payments are deferred for 10 months after your covered period. Borrowers won’t be eligible for forgiveness after their loan matures.

Step 1: Make Sure Your Qualify

Given the new set of PPP rules, you will likely qualify so long as you’re someone who has 1099 income. This means sole proprietors, gig workers, and self-employed individuals are all welcome.

The only condition is that brand new rideshare and delivery drivers may not qualify. If you started working after February 15, 2020, you may not make the cut since you won’t have taxes yet to verify your income.

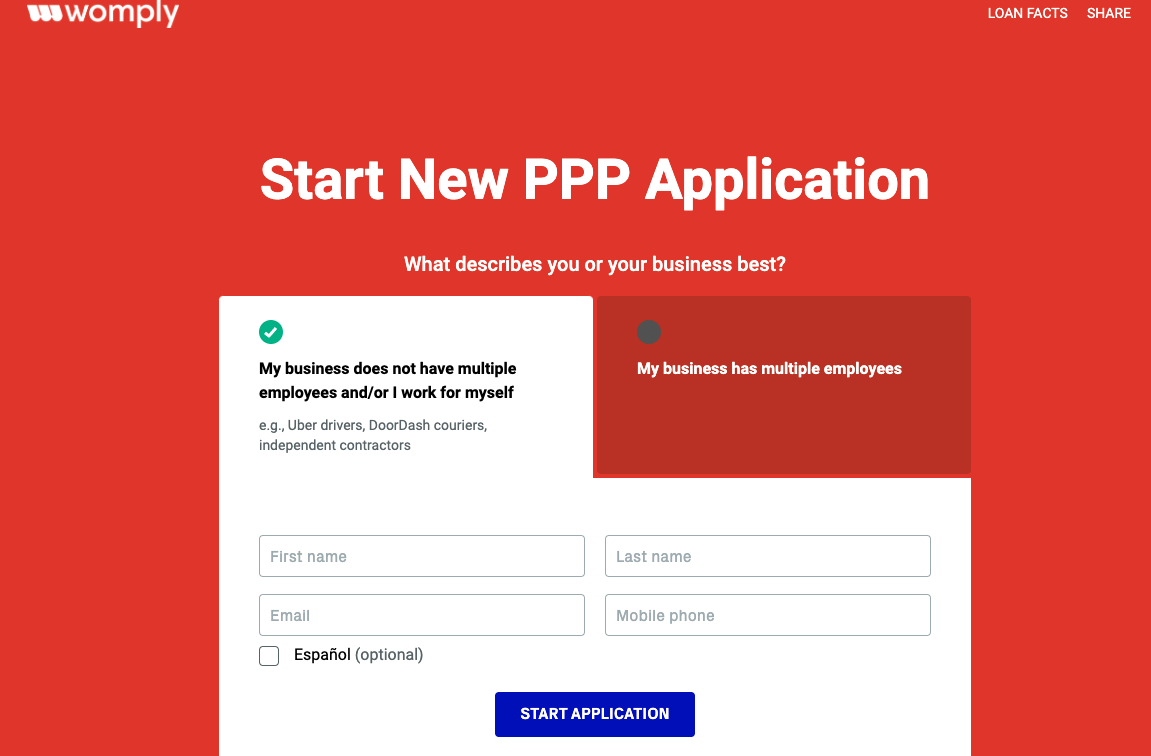

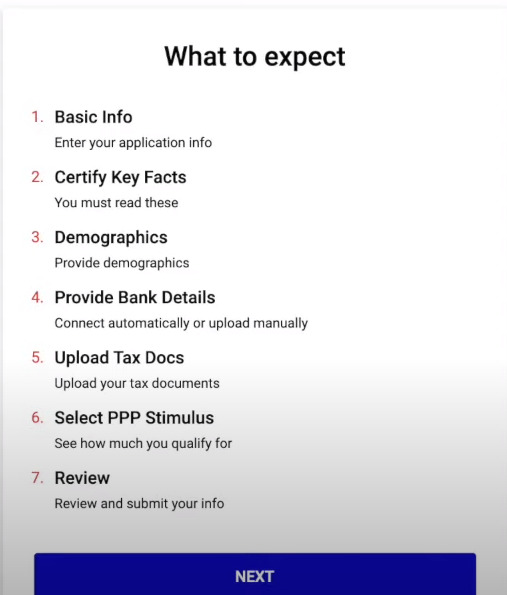

Step 2: Fill Out Basic Information Online Through Womply’s App

Next, you’ll need to go to Womply’s site and click the button or page that opens the online application for your PPP loan. Be sure to select the option that says ‘My business does not have multiple employees and/or I work for myself’ if you’re a driver.

You’ll need to include information like your address, annual income, and bank details.

You’ll also need a US mobile phone number, social security number or ITIN.

Step 3: Upload Tax Forms

A 1040 tax form with a schedule C along with either your 2019 or 2020 fax fillings is required to complete the loan application.

Toward the end of this step, you’ll also find out how much you qualify for based on your monthly payroll or monthly gross income.

Womply PPP Loan Next Steps

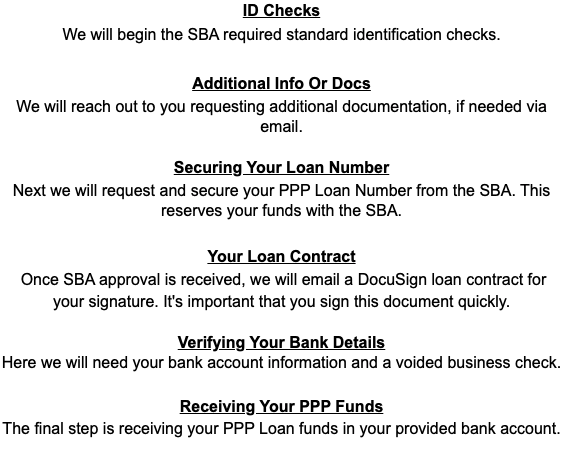

Once your application is submitted, Womply will partner with a lender to review your documents and process your loan. Loans can come back funded and ready to go sometimes within 14 days. It can be even sooner if applicants are able to turn in all the paperwork on time and correctly. There is no fee to do a “fast lane or non-fast lane” application through Womply. Womply makes their money through their lender partners.

In fact, shortly after sending in his PPP application through Womply, our very own Jay Cradeur was funded! Watch his video here: PPP Loan Application: I Got $27,264 As A Lyft & Uber Driver!

Where is Womply Based?

Womply only has one physical location in Lehi, Utah and they are headquartered in San Francisco California.

Womply Competitors

Womply vs Kabbage

Kabbage is also located here in the United States. They are based out of Atlanta, Georgia. One of their big focuses is opening checking accounts for their customers, and they also service loans. Kabbage offers a quick and secure online application process and partners with K Servicing to accept PPP loan applications.

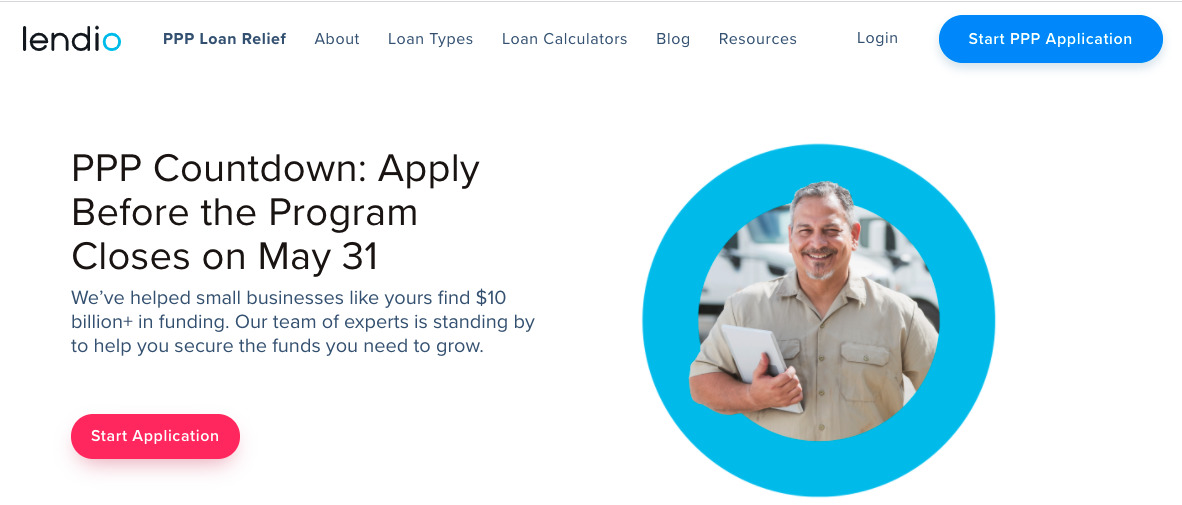

Womply vs Lendio

Lendio is another small business loan marketplace. Business owners can use Lendio online services to search for loan products from a network of lenders. Applications can be completed in as little as 15 minutes. Some applicants through the platform can have access to their loan capital in just 24 hours after applying.

Lendio can help process PPP loan applications. They also point out some important requirements that all applicants have to follow. In order to be considered your business has to have been in operation as of February 15, 2020. In addition business owners have to have 500 or fewer employees.

I actually applied for my PPP loan through Lendio and it was a very easy process. Lendio did a good job at simplifying the application and helping me understand what I needed to do on my end. I made a mistake on my form and received an email and phone call from an account manager at Lendio. Getting the opportunity to talk to someone on the phone and email questions was very helpful and made the experience more personable.

Once my application and documents were received by Lendio, I received an email from the partner lender outlining the next steps.

It looks like it should be smooth sailing for this moving forward.

Womply vs BlueVine

In 2020, BlueVine helped over 150,000 small businesses apply for PPP funds. It looks like they are well on their way to help thousands more in 2021. BlueVine also puts an emphasis on helping small business owners get a checking account established. PPP Funds are limited so be sure to apply prior to the May 2021 deadline.

Womply vs BlueAcorn

BlueAcorn focuses on independent contractors like rideshare and delivery drivers.

Drivers can receive 2.5 months of earnings forgiven from the SBA if they are approved for the loan. Not sure if you will qualify? BlueAcorn allows anyone who visits their site to take a 60-second quiz to not only tell them if they qualify but also gives an estimate on how much they can receive.

Womply Reviews: What are Womply Users Saying?

So far, I’ve only seen positive customer reviews about Womply including the PPP loan application experience with this company.

The RSG’s very own Jay Crader used Womply to apply for his PPP loan and shared some interesting insights in his video.

Womply does offer a ton of other services, but in the case of their PPP loan application, it would be very difficult to mess up your application or have a bad experience since everything is laid out and easy to understand. Below are a few additional customer reviews via Womply’s site:

“You were so helpful and calming to me when I was in tears. Thanks to all of you at Womply for your dedication, calmness, and help during this PPP loan application process.”

Julie M.

Edina, Minnesota

(Womply Site)

“Thanks for your help with the PPP funds application. It was unclear to say the least before your emails and webinar. My bank decided not to participate so I was in the dark as to how to find an SBA lender. Thanks again for this important help to small businesses!”

Nancy C.

Carrollton, Texas

(Womply Site)

Summary

You worked hard all last year despite living through a pandemic so if you qualify, you should definitely consider using Womply for your PPP loan application. If you’re a local business, Womply also offers some pretty helpful services that could help you sustain and grow your operations as well.

Many industries were affected this past year and Womply is doing its part to bring some normalcy back to small businesses across the nation. The application process is virtually painless and easy to understand. You’ll move through the online form in just minutes. That way, you can get closer to receiving your PPP money before the deadline and using it to sustain your livelihood.

Readers, have you applied for the PPP loan, either through Womply or another lender? What was your process like?

-Chonce @ RSG