Harry here (sorry we had some trouble with our e-mail service today, so we’ll send the round-up tomorrow and here’s yesterday’s post). There’s been a slew of instant pay options released lately and today, RSG contributor Jonathan Knope compares the top options from Uber and Lyft and walks you through the process for ActiveHours and DailyPay if you’re looking for a great third party option.

We’ve all been there: Your car needs a new part, or you get an unexpected bill in the mail, or you’re short on rent. What do you do? You could throw the charges onto a credit card – but that’s a dangerous game, and almost always ends up costing you more money in the long run. You could grab a payday loan – but that’s even worse than credit cards.

Fortunately, for those who are rideshare drivers, there are some pretty unique options that have launched over the past few months. Today, we’re going to look at some of the top options for Uber and Lyft drivers for getting paid instantly and see how they stack up.

Lyft’s Express Pay

Lyft’s Express Pay feature now allows you to cash out your current earnings at any time (between $50 and $5,000) for 50 cents per transaction. You need to have earned at least $50 and your Lyft account must of course be active. You also won’t receive any bonuses, like the power driver bonus, early – instead, those will show up at the end of the week.

This option works with most banks and once you link your debit card, the money really does appear almost instantly (20-40 minutes for most). Harry himself has used it several times and the service worked flawlessly.

Uber Instant Pay

Uber, on the other hand, is still beta-testing this idea – and it’s unclear when and how the feature will make its way into the standard partner app. In order to get set up though, you’ll need to apply for a new debit card which will take 7-10 days. Uber will then deposit your earnings onto this debit card. Unfortunately, it does carry some ATM fees if you use an out of network ATM, and for many drivers, having a separate bank account for their Uber earnings is kind of a hassle – so this program may not be ideal for every driver.

We’ve gotten mixed reviews from RSG readers who have tested this feature but I will say that most of the complaints have been on the GoBank customer service side of things. A few drivers have reported major problems getting in touch with GoBank if they needed to switch back or cancel their accounts. This is a pilot though, so growing pains are expected. I’d keep an eye on this program as it likely will improve once they iron out the kinks.

However, for the enterprising driver, there’s actually a couple new options that drivers have been flocking to lately.

ActiveHours

ActiveHours works by plugging into your bank account and analyzing your direct deposit history. After they’ve verified your income, you’ll be able to cash out up to $100 per day, or up to $450 per week. Once your regular paycheck arrives in your bank account, ActiveHours will automatically pay themselves back for the money they advanced you.

The best thing about ActiveHours is that you can pay what you want. Each time you make a withdrawal, you’ll have the option to pay for the service on a “name your price” basis. This allows you to stay in control of your spending. Plus, you can even make withdrawals through the ActiveHours app, so you can cash out on the go, too.

The other benefit to the ActiveHours model is that you don’t need to redirect your income to them in order to sign up; your paycheck will still be deposited in your bank account as usual. This is ideal for drivers who only need to use the service occasionally.

ActiveHours works with other employers, too, not just Uber. However, they currently only support one employer per account – and the $100/day, $450/week limits apply regardless of how much money you’re earning. These withdrawal limits are the main drawback with this service.

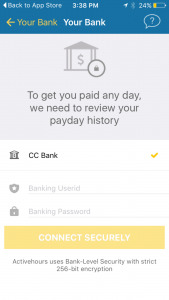

How To Sign Up For ActiveHours

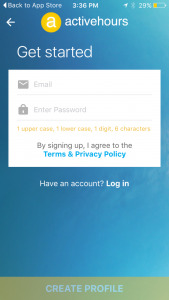

First, you’ll need to go ahead and download the app (affiliate link). Once it’s installed, you can begin the sign-up process.

First, you’ll need to create an account with your email address and a password.

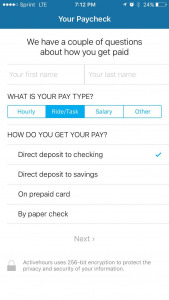

Then you’ll select “Ride/Task” and “Direct deposit” for your pay type.

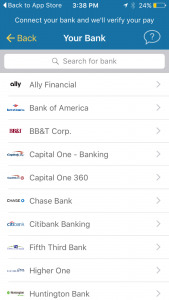

Select your bank from the list (ActiveHours works with almost any bank)

And enter your bank login details. (Don’t worry, the app uses industry-standard encryption to keep your info safe!)

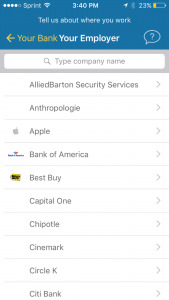

Select “Uber” as your employer.

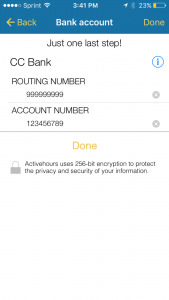

Enter the routing and account number for your checking account. This can be found on one of your checks.

Once you’re signed up with the service, ActiveHours will make two small deposits in your account. To verify that it’s yours, you’ll need to log in to the app and enter the dollar amount of those two deposits. For me, the test deposits showed up the next day, although it may take up to two days for the verification process to complete.

Once you’ve verified your account, you’re ready to cash out. To do this, you’ll need to submit a screenshot of your earnings that displays both your name and the days you worked. Here’s one of mine:

It’s actually a bit tricky to get this screenshot right, because ActiveHours requires that it displays both your name and the days worked. That means that capturing the “Earnings” screen in your Uber app won’t count, as it doesn’t display your name – you have to log into your partner account on the Uber website and capture your current payment statement for ActiveHours to accept it. As you can tell, the required info barely fits on my phone screen – and I have a rather large phone! You may need to take this screenshot on a computer, send it to yourself, and upload it through the app – which can be a bit of a hassle. Once you have that image, though, the process is super easy – simply select “Upload Timesheet” in the app, locate the file on your phone, and ActiveHours will verify it instantly. Then, you can cash out whatever amount is on your pay statement – up to $100 – straight to your bank account.

DailyPay

Update: DailyPay is no longer accepting payments for Uber drivers but you can still use them for DoorDash, GrubHub Delivery, Instacart & Fasten. Also, DailyPay now offers a manual payments option, which is great for people who don’t want to receive their money every day but want to receive money only when they need it.

DailyPay offers a similar service, but with a very different setup. With DailyPay, you’ll need to modify your DoorDash (or other) account so that your direct deposit goes straight to DailyPay. Then, DailyPay will do just that – pay you per day – by tracking how much you’ve earned through your DoorDash account. When you use DailyPay, they will cash you out for your entire daily earnings.

Unlike ActiveHours, DailyPay has a fixed fee structure. If you take a day off, you won’t be charged (nor will you receive a deposit). If you earn less than $150, Daily Pay charges a 99 cent transaction fee. And if your daily earnings are above $150, the fee goes up to $1.49.

DailyPay works withSeamless and GrubHub restaurants, but not Eat24. Plus, transaction fees are waived for the first two weeks after you sign up with our link. Also worth noting – DailyPay offers a referral program which earns you $20 for referring a driver OR $100 for referring a restaurant that you can get to signup for their service. That’s a pretty sweet deal!

How To Sign Up For DailyPay

First, create an account with DailyPay with your name, email address, and a password.

Then, give DailyPay the login details for your Uber Partner account. They’ll use this to monitor your earnings each day and figure out how much money to send you.

Enter your bank account number and routing number where you would like the deposits to appear. DailyPay only deposits money – they don’t take any money out.

Finally, you’ll need to go into your Uber account and change where Uber sends your direct deposits. You’ll enter the account info provided by DailyPay here, as they will be accepting your direct deposits for you from now on.

That’s it! Once you’re signed up, daily deposits will begin automatically, and you’ll be able to view all your payment statements. In the statement shown here, the transaction fees are $0.00 – just like yours will be for the first two weeks when you sign up with our link. DailyPay’s cutoff is 5:30 PM local time, so 100% of any money earned before 5:30 will appear in your bank account at the end of the day.

You can also set up a minimum cash-out amount between $5 and $25. That way you won’t be paying those transaction fees just for tiny deposits – instead, the money will roll over into the following day’s earnings.

Which Is Better?

If you only need advances occasionally, I’d recommend ActiveHours. Their pay-what-you-want model is tough to beat, and you can get paid normally (and not spend any extra money) when you don’t need cash right away. However, taking screenshots of your name, hours worked, and earnings in a single file can be tough to do from your phone – and sending a file from your PC to your phone can be a bit of a hassle. Once you master the process though, it’s pretty straightforward.

If you’re making a lot of money and want to get paid daily on an ongoing basis, DailyPay is the superior choice. It’s also extremely low-maintenance once you’ve finished signing up for the service and verifying all your accounts. A word to the wise, however: Although their $0.99 and $1.49 transaction fee tiers seem nominal at first, remember that they will collect these every day you work. Over time, that begins to add up – if you work 5 days a week, you’ll end up spending about $22/month for the service. Nonetheless, for some drivers, the convenience of having cash on hand automatically at the end of each workday is definitely worth it – and if you’re able to refer one person a month, that $20 payout will go a long way towards covering the fees.

Also worth noting: if you use a fuel card through Uber or an Uber Xchange loan, DailyPay’s service gets a bit more complicated. Since Uber will already be docking your pay for your loan and/or fuel payments, DailyPay has special terms that kick in to make sure they’re not advancing you too much money. In particular, drivers with loans will receive only 25% of their daily earnings in advance; and if DailyPay does end up advancing you too much money, they will determine a customized plan for you to pay that money back. They determine the terms on a case-by-base basis, so I would be very wary of this situation – and probably wouldn’t use DailyPay if I had an Uber Xchange loan.

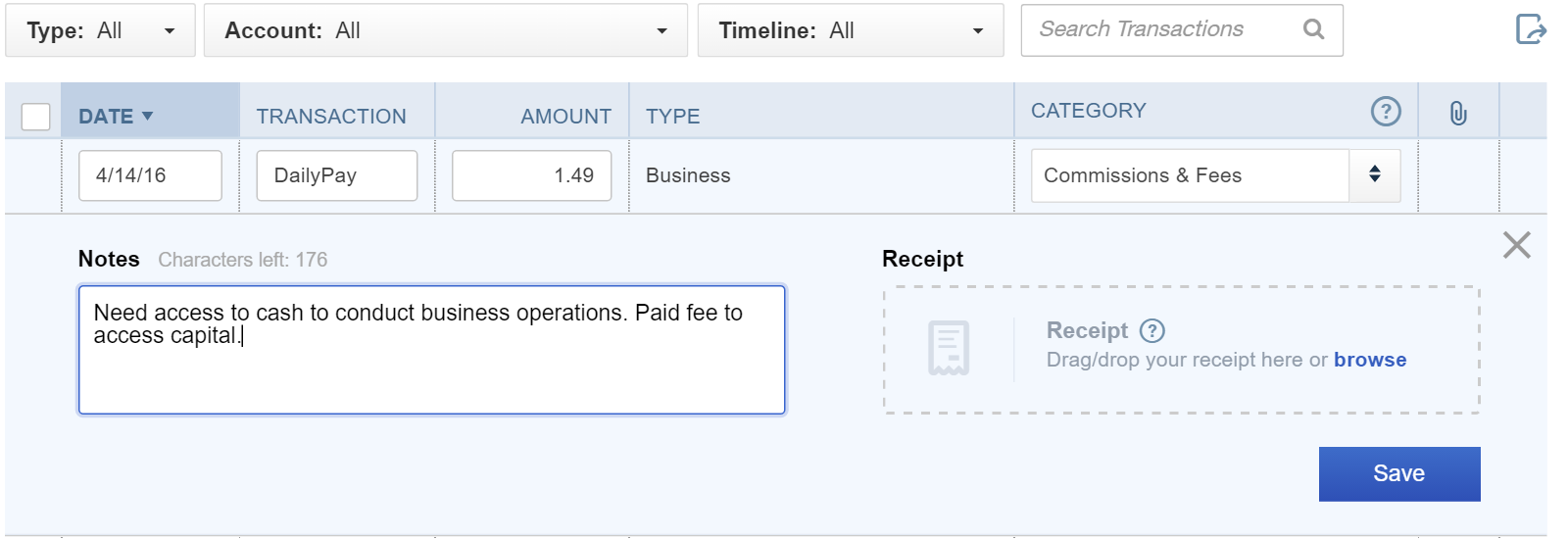

Keep Track of Your Fees Because They’re Deductible!

If you use any of these services, it’s important to keep track of your fees so you can deduct them on your Schedule C. You can record the transactions under “Commissions and Fees” within QuickBooks Self-Employed and they will take care of the rest for you. It also enables you to see how much you are spending over a year to have these services.

A Cautionary Note

If possible, I would recommend not becoming too reliant on these services. It’s never good to “live on the edge” for an extended period if you don’t have to. Plus, the terms and fee structures for both these services could change at some point – and you don’t want to be left in the lurch. In particular, I suspect ActiveHours may wind up implementing minimum fees for withdrawals once they gain enough users – but perhaps I’m just a pessimist. We shall see! For now, however, these two companies seem to be playing fair – and each can be a real lifesaver if you’re encountering unexpected expenses.

Readers: How do you get paid instantly? Is it working for you? Let us know in the comments!

-Jon @ RSG