Today, I wanted to share a post with you that was submitted by Carlypso, a company that’s aiming to make the process of buying and selling used cars easier.

I really liked this article because it’s an idea I’ve been toying around with myself after hearing how successful it has been with people buying homes to rent out on AirBnB. This post should get the ball rolling if any of you are interested or have thought about doing something similar.

The key assumptions here are the price at which you can get a car and the amount you can fetch from renting it out on a site like Flight Car and/or Relay Rides. There’s obviously some risk and it definitely isn’t a get rich quick scheme but if you are willing to put in the time and effort to price these out and figure out the system before other people, I think there is definitely some potential.

It all started when we noticed a trend of customers without special requests for used cars. Our pricing engine treats vehicles like commodities, but it’s not often that you find groups of car buyers who don’t care about paint color or interior, or even a few dings and dents. The only request was to make sure that the price was competitive.

Through these conversations, we discovered that these buyers were not looking for a vehicle for themselves, but rather one to be loaned out to Flightcar, or dedicated as an Uber or Lyft car. Seemingly absurd at first… so our data team at Carlypso.com dug a bit deeper.

“It’s a trend we’re seeing too,” says Ryder Pearce, co-founder of SherpaShare. “We’ve talked to several rideshare drivers who are starting to build their own fleet of cars to rent out to people. They realize this is one way they can scale their micro-entrepreneur efforts.” Furthermore, they also noted this wasn’t just a ‘second car,’ but rather a fourth or even fifth vehicle for some. “When you’re juggling 3-4 apps at the same time, while you’re being more efficient as a driver, you’re still only using your available time. Adding cars and building a small fleet can be attractive for some.”

So how does this work?

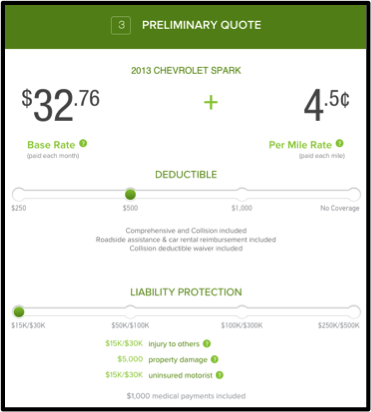

Flightcar.com is a cross of car-sharing and long-term parking; it’s also a way for your car to work for you rather than sitting collecting parking tickets. Depending on the make and model, Flightcar can pay you up to $500 monthly for the use of your vehicle. These companies, for a host of legal, operational, and other reasons, don’t want to actually own the vehicles themselves. (Otherwise, we would be scraping the internet for cars all day for them, and they would be the next Hertz).

(Ed: I’ve also looked into this with RelayRides – another service that allows you to rent out your personal vehicle)

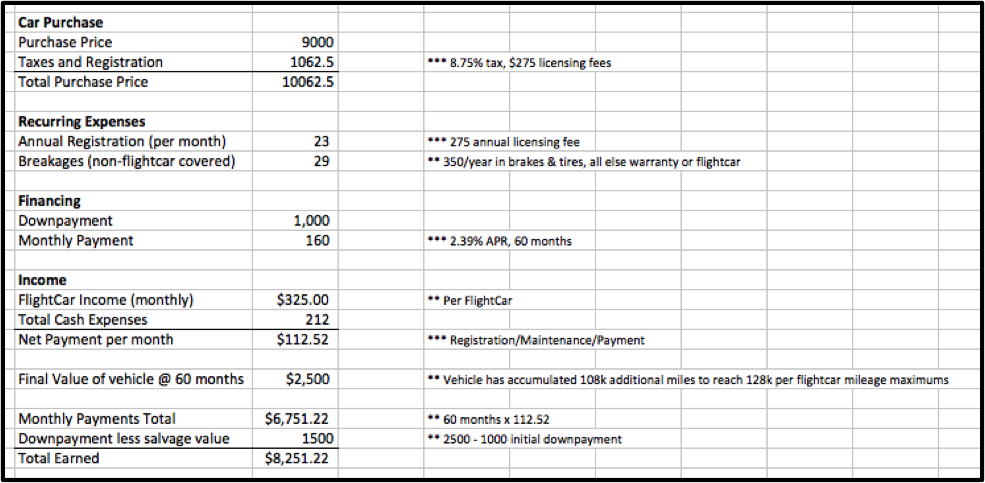

The example below is for a 2013 Chevrolet Spark with about 20k miles:

Bear in mind that this assumes a few things:

- Obviously, the cash flows are not discounted over time.

- The rates remain the same over time (e.g. Flightcar won’t begin paying lower values in 2016).

- That you don’t hold minimum liability insurance on the vehicle, and rely purely on Flightcar… But this not a big number if you make use of a pay-as-you-go type of car insurance.

Even given that the residual value of the vehicle will likely stay ahead of the financing paydown, the car will still generate income. You need to think about your a car like a commodity: find a car with lowest payments, with the best return.

If you need help, or have questions, we can also work with you to make the equation straightforward and transparent. Our tip for “income cars” is to 1) find the models with the best return on investment. 2) control for quality by getting a car via auction, which will ensure that a third party has looked at it and applied a rating to the quality, so that you can have confidence in buying an asset sight unseen.

A few years ago it was not uncommon to hear about a wealthy friend purchasing an apartment with the sole intent of renting it out on Airbnb. At first, people thought this was crazy; however, as the service has grown more popular, you are seeing more people trusting the ‘share economy’ with their assets. Now with vehicles as income generators, there is a less capital intensive avenue.

Chris Coleman and Nicholas Hinrichsen are two Stanford MBAs who co-founded Carlypso.com, a website devoted to the sale of used cars. The team is made of gear heads and data nerds from MIT and Stanford, all obsessed with cars.