There’s a new type of insurance policy coming out for drivers in Georgia. Buckle aims to save you money and provide you comprehensive auto insurance coverage, all at affordable rates. Senior RSG contributor Paula Gibbins outlines what drivers can expect with insurance from Buckle.

Buckle is now available in Georgia, Illinois, Tennesee, Texas and New Jersey! Not in your area yet? Check out more rideshare insurance options here: Rideshare Insurance Marketplace

What is Buckle?

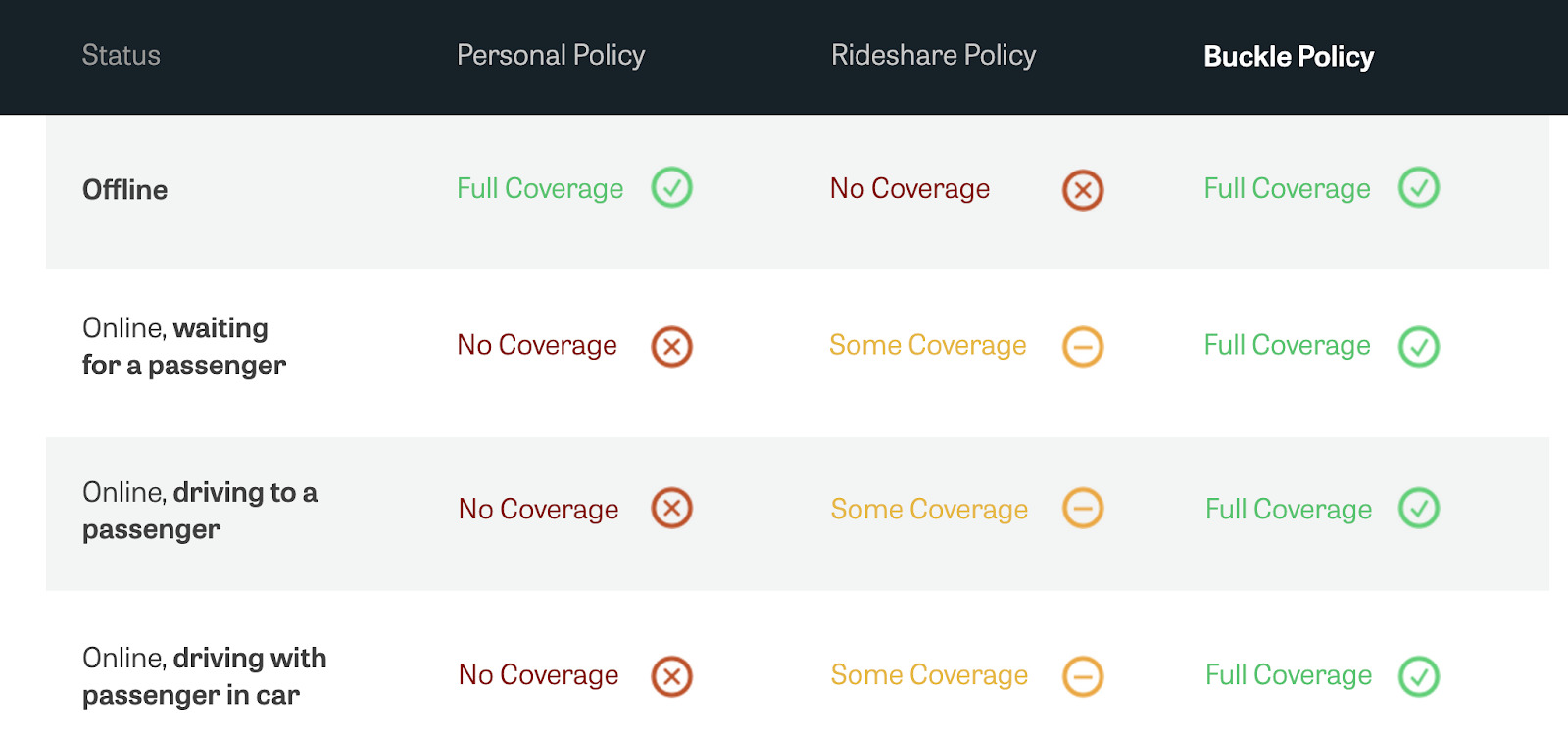

Buckle is a company that has partnered with Lyft and created a policy specifically built with rideshare drivers in mind. It’s one policy that covers you instead of having two separate policies. Their website boasts that you get round-the-clock coverage no matter who is in your car, whether you’re ridesharing at the moment or not.

Buckle also states you’ll get a lower price than you’re paying now with total coverage. So, how does it work? According to their FAQs, “We use your rideshare information, such as your star rating, to determine how much we can save you. In general, rideshare drivers have proven to be better, safer drivers. We put our trust in our drivers and strive to get them the lowest rates possible. No credit checks, no bias, just teamwork.”

So, how much you can save depends on your driving habits. Are you a safe driver with a high star rating on Lyft? Then you’ll probably save more!

What Does Buckle Offer Drivers?

Buckle offers personal and commercial coverage with one policy. It only insures rideshare drivers and they do this without running a credit check. They only care about your driving, not your credit history.

Unlike most policies, they offer you full coverage all the time. As shown in the image above, Buckle covers you when you’re Offline, Online and waiting for a passenger, online and driving toward a passenger and while you’re online with a passenger in your car.

There are no gaps in coverage when you use Buckle.

Where is Buckle Available?

Buckle is available in Georgia, Illinois, Tennesee, Texas, and New Jersey. Buckle has plans to expand into more states, too, so keep your eyes out for it!

Not in one of those states or want to compare Buckle to other insurance options? Visit our Rideshare Insurance Marketplace.

What Makes Buckle Unique from Other Insurance Options

Since Buckle only works with rideshare drivers, it’s probably safe to assume they know what they are doing in any rideshare related situation that comes up. If you have an issue, you should be able to contact Buckle and they will take care of you.

Buckle also seems to know what rideshare drivers need in coverage, offering it in one policy instead of having to add rideshare coverage. With Buckle, you’re just automatically covered for all situations.

You do have to have a Lyft account in order to get a quote and/or sign up for Buckle insurance.

How Much is Typical Buckle Insurance?

Their website states that you can get Buckle car insurance rates in Georgia starting at $55/month, but they don’t state what that covers exactly. We were unable to determine what the starting amount of $55/mo provided, but will update if we receive more information.

Buckle also states you can save anywhere from $50-200 a month by switching to Buckle from your current policy. To get a quote, you have to connect your Lyft account. So, I wasn’t able to get a quote since my Lyft shows me working in Minnesota.

Buckle News

According to an article on Crunchbase, Buckle has secured $31 million in a Series A round, led by HSCM Bermuda and Eos Venture Partners. It’s also backed by Munich Re and Clear Blue Insurance.

With the help of this seed money, Buckle hopes to expand its coverage nationwide as opposed to only covering Georgia.

Georgia drivers, have you ever heard of Buckle before? What insurance company are you currently using for rideshare insurance?

-Paula @ RSG