As rideshare drivers, car insurance is something we need more than the average Joe. We also love saving money wherever we can. In this article, RSG Contributor Chonce Maddox-Rhea reviews Gabi, an insurance comparison marketplace geared toward finding you the best rates in your area.

Gabi Insurance

Personally, I’ve been super impressed at how the auto insurance industry is changing and progressing. I remember when getting insurance was a pain because it involved getting tons of quotes and making several phone calls.

Thankfully, sites like Gabi exist to help you compare quotes and gather all the best insurance options in one place. No phone calls needed.

If you’ve never heard of Gabi before, I’m sure you’ll start hearing more and more about this online insurance broker outside of this post. Gabi has been on a mission to share its services, and it’s likely you’ll see ads for Gabi on TV soon if you haven’t already!

So, What is Gabi?

Simply put, Gabi is an insurance comparison marketplace that is geared toward helping you save on your home and auto insurance. Within just a few moments, Gabi can give you a list of insurance quotes from multiple companies so you can choose the best fit for you and your family.

The average person should shop around for the best insurance rates every one to two years. But are you doing this consistently? If you’re not, odds are you could be overpaying for insurance.

I understand. There’s just so much to do in a given day or week that shopping around for insurance is probably not high on your list right now. So, let Gabi take care of the research for you for free and save you some money by finding the best insurance rates around.

According to a Money Talks News article by Chris Kissell, car insurance rates are set to rise again this year. Money Talks News founder, Stacy Johnson, used Gabi personally and found big savings:

“I’m currently insuring two cars with USAA at a combined cost of about $2,400. Gabi said Progressive could give me the same coverage for 22% less, saving me $546. All I had to do is give Gabi the go-ahead and my driver’s license number. Then, Gabi would confirm the rate and even do the switching for me.”

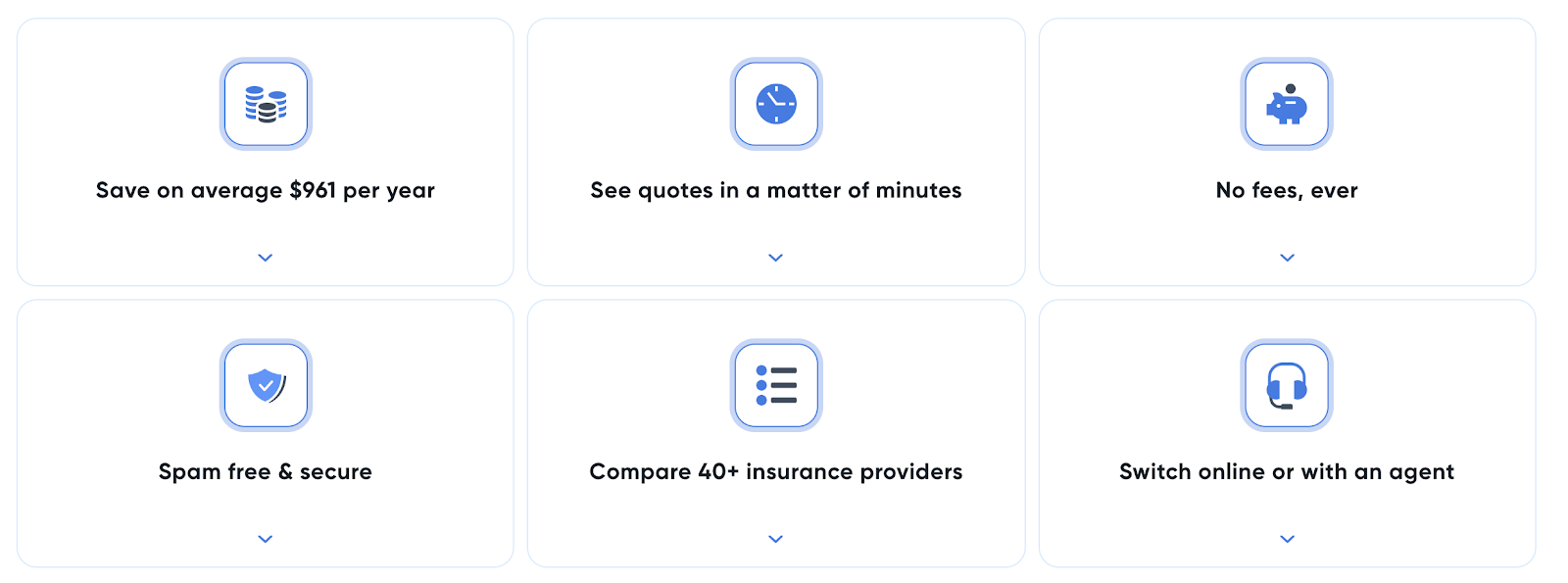

You no longer have to visit insurance companies in person or call each one to get a quote. Gabi is a licensed broker in all 50 states and Washington, D.C. The insurance broker site has helped many people find savings averaging $961 per person each year.

Gabi Features

Gabi works with over 40 insurance companies to help find you the best insurance rate. They can focus on finding savings for home, landlord, umbrella, car, motorcycle, RV, condo, and auto insurance. They find you the cheapest rates possible for your exact coverage.

Gabi saves you time. Their technology quickly pulls up new quotes for you to match your current coverage. No more visiting multiple websites or making endless phone calls to shop for cheaper coverage.

They can help you find coverage for many different types of insurance. The more policies you let them know you have, the more potential savings you can have by bundling them together.

How to Sign Up for Gabi

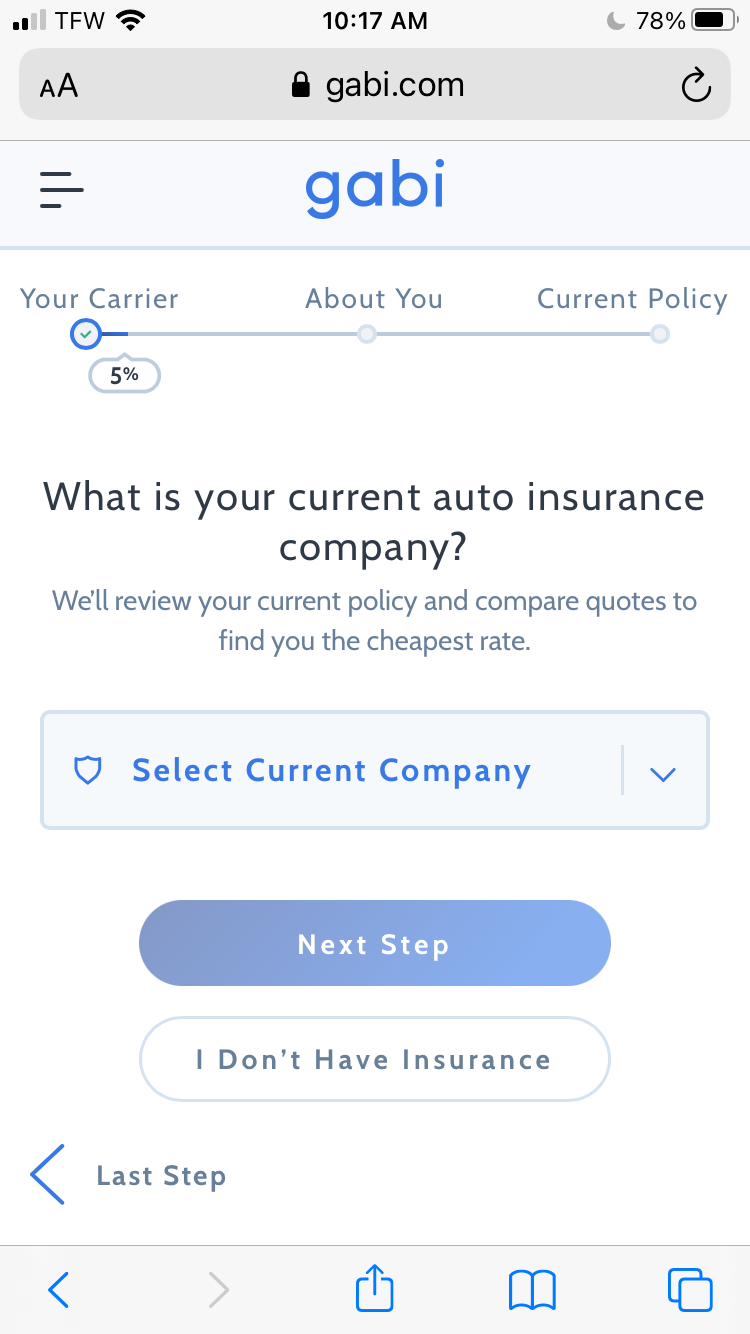

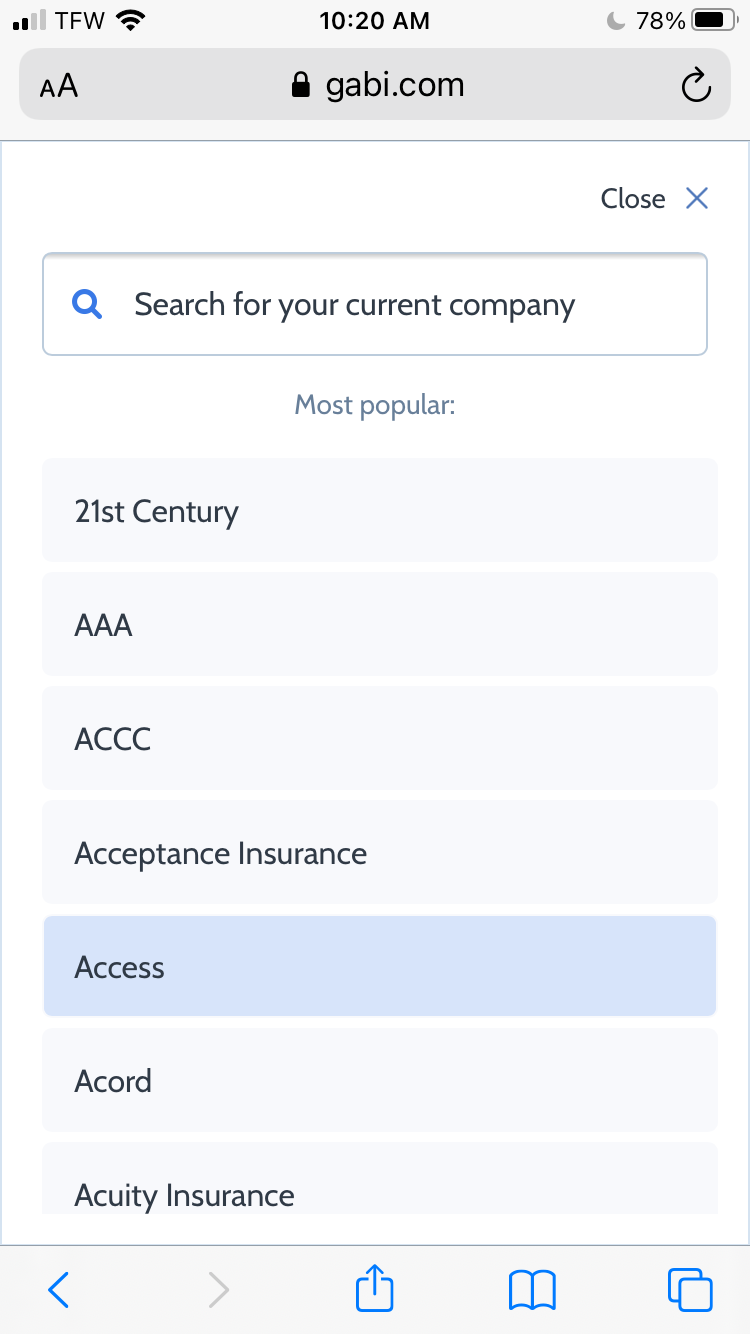

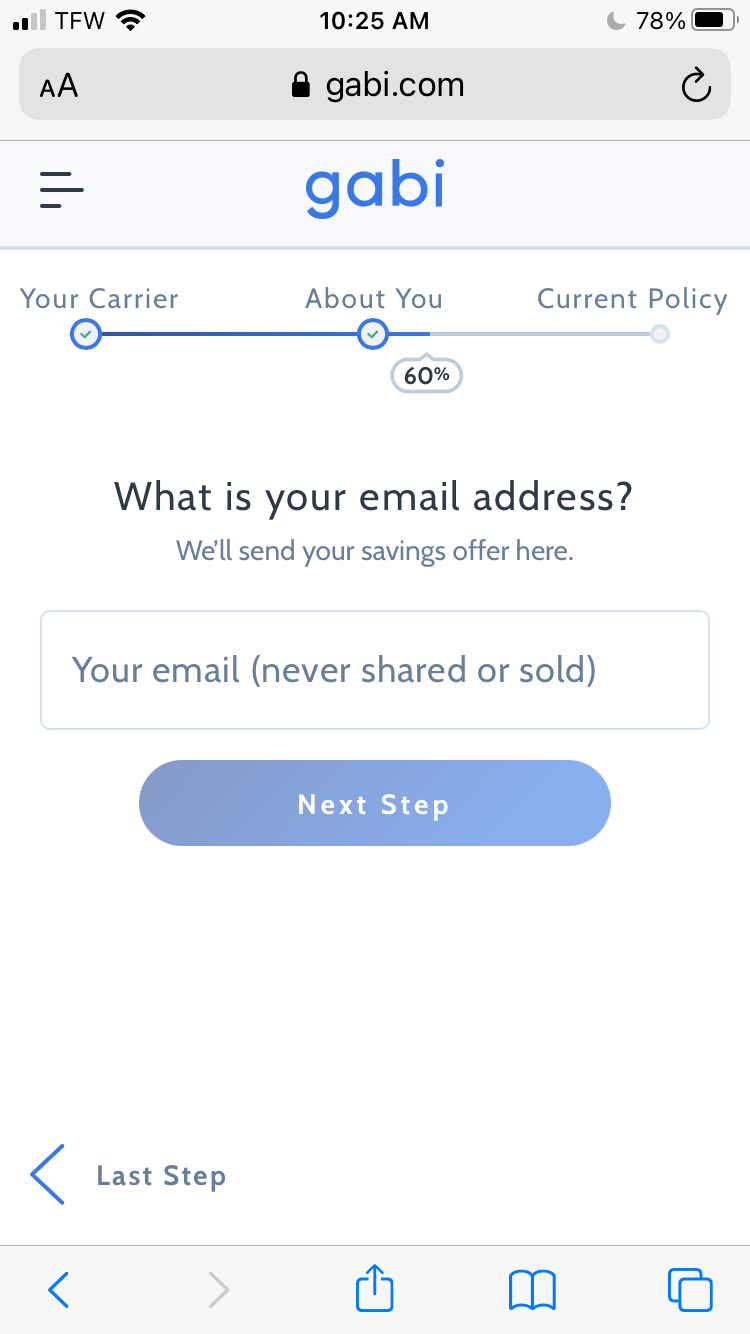

One of the first questions you’ll have to answer when signing up for Gabi is what is your current insurance company? They work with the most popular companies and give you access to several lesser-known insurers, as well. They even have an avenue for people who don’t have insurance to get insured.

Gabi will need a few pieces of information to get started:

- Name

- Date of birth

- Home address

- If you’re a homeowner

- How you heard about them

- Email address

- Phone number

If you’re switching insurance companies, you can always connect your existing insurance account so Gabi can pull the details they’ll need instead of you having to enter them manually.

How to Use Gabi

How to Use Gabi

The main way you’ll use Gabi is to obtain a free insurance quote and compare it to what you’re already paying.

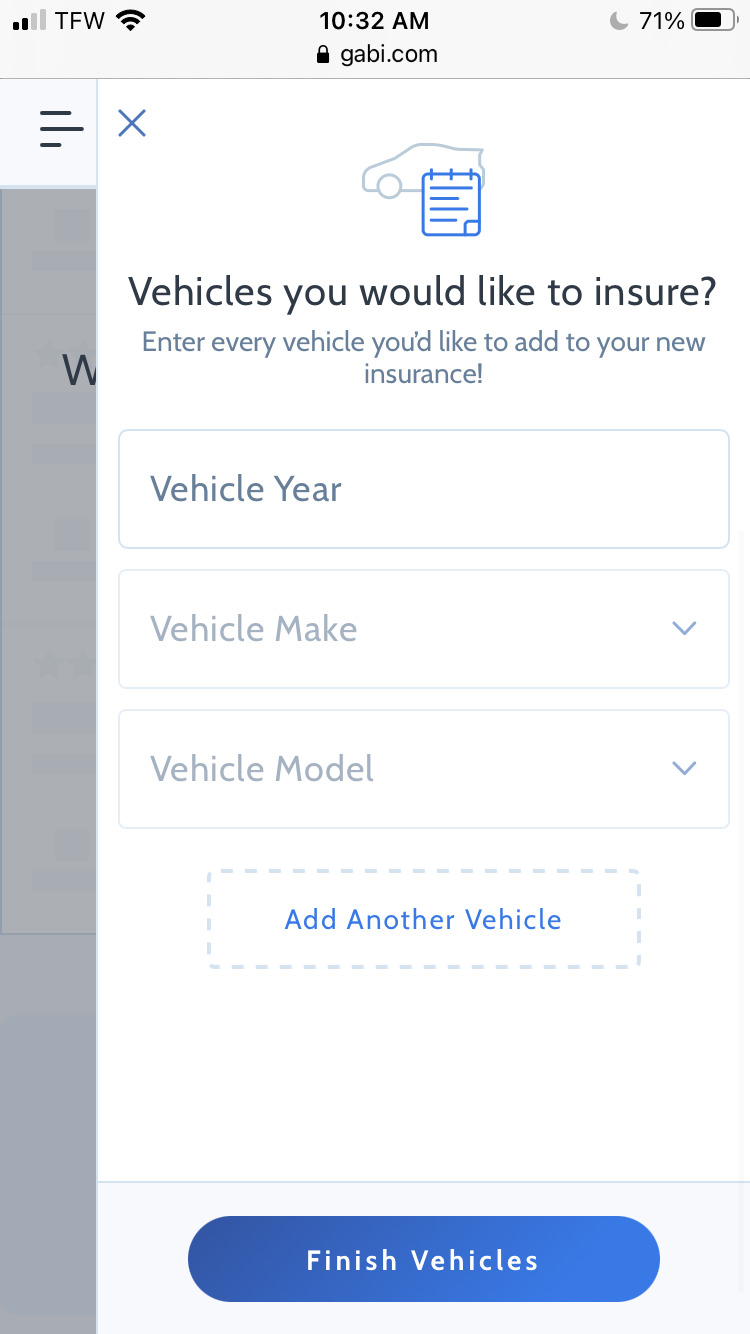

Logging into your current insurance provider’s account will allow Gabi’s system to do most of the leg work for you. If you’re looking for new car insurance, you will also have to list how you use the vehicle, plus Gabi will ask if the vehicle is leased, owned, or financed.

When getting a quote for homeowners insurance, the system auto-fills the address you entered when signing up with Gabi. With that, Gabi will be able to know the year the house was built, the square footage, and the year the roof was most recently upgraded. These are all important pieces of information needed to get the most accurate homeowners insurance quote.

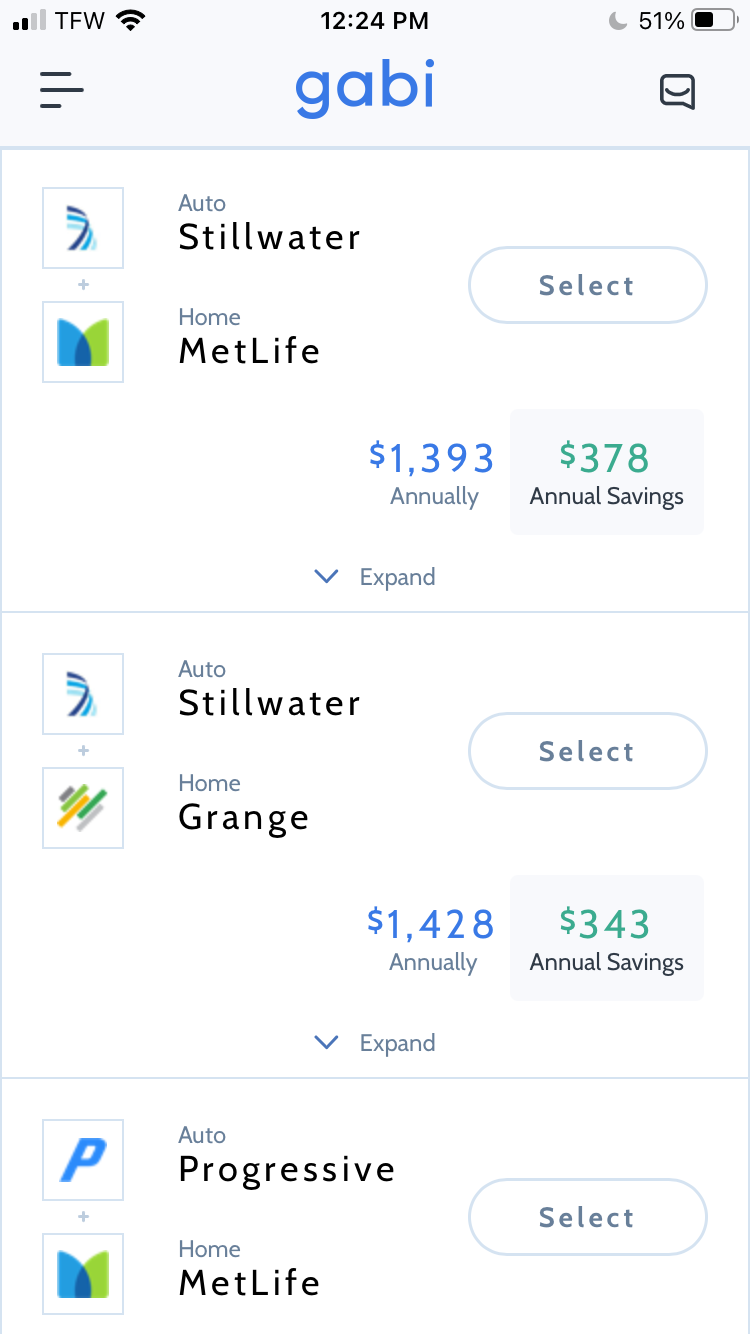

In some cases, Gabi recommends two different insurance companies for the best savings. One that I saw was $378 in annual savings for switching to Stillwater Auto Insurance and MetLife homeowners insurance.

In some cases, the same insurance company can be used to receive the best savings. The platform will list the option with the most savings at the top and even gives you a rundown of how switching to a few companies can make your rate head in the wrong direction and increase.

How Much Does Gabi Cost?

It’s free to use Gabi to browse potential savings on insurance policies. Gabi makes their money from the insurance companies they work for. They earn by referring customers to the insurance companies they partner with, so customers like you don’t have to worry about paying anything to use Gabi’s services.

Is Gabi Insurance Mobile-Friendly?

Yup! We had a great experience using the mobile app. We ran into no problems or bad experiences using the mobile version of Gabi. It is available for iOS devices.

Gabi Insurance Customer Support

If you have any questions along the way, just shoot Gabi an email: advisors@gabi.com. They also have a chat feature option while logged into your Gabi account so you can get answers faster.

There have been plenty of people who had a good experience with Gabi and their customer support, including Lyndsey Guerrero who left this Gabi review on Facebook:

“I saved a decent amount of money with GABI. I was unsure of why to expect, but once I made the jump it was the best decision I made. The person that reached out to assist me throughout the process of transferring from my old insurance to my new insurance I found through GABI was EXTREMELY helpful! They were with me every step of the way. Text and email they answered all my questions and concerns. I was busy with work and the holidays. Then trying to rush to switch my auto insurance in the middle of everything. I was expecting it to be a nightmare. However, they made the process as easy as possible. It was seamless! I saved so much money AND without a headache or extra stress. I love GABI!”

Pros and Cons of Using Gabi

Pros

- Opportunity to lower your car insurance rates (and homeowners insurance) with little to no effort on your part

- It’s free! Gabi does not charge you a fee to shop around for insurance quotes

- Licensed in Washington, D.C., and all 50 states

- Quick and accurate quotes

- They don’t sell your personal information

Cons

- Gabi does not work with all insurance companies

- Gabi doesn’t always gather all the information insurers need, so the quote isn’t always the most accurate – you may need to add some details in yourself

- Recommendations of lesser-known policies might not always be the best choice

Alternatives to Gabi

PolicyGenius

PolicyGenius is a similar platform to Gabi but does have some differences. PolicyGenius focuses more on life insurance but does have options for auto and homeowners insurance, as well. They too are an insurance broker but primarily help people get term and whole life insurance.

If you don’t have the time to look for life insurance yourself, PolicyGenius is an alternative option for you. PolicyGenius has helped over 30 million people save over $1,100 per year.

Who is Gabi Best For?

Gabi is good for anyone looking to change auto or homeowners insurance without having to put a lot of extra effort into it. If you want cheaper rates, check out the options Gabi compiles for you. Best yet, they do it all for free.

Summary

The Gabi insurance broker site can save people nearly $900 per year. That money you were using on higher home and car insurance rates can now be put towards something else in your budget, or simply saved for emergencies, go toward a vacation, or used for something fun.

Calling multiple insurance offices to get a quote can be annoying and tedious. Gabi makes that a thing of the past. Save time and money with Gabi.

Readers, when was the last time you check to make sure you had the lowest insurance rate available? Give Gabi a try today!

Chonce @ RSG