No one wants to be involved in an accident while rideshare driving, but what happens if you’re involved a relatively minor accident (like hitting a curb) and need insurance coverage? We sent RSG contributor Chonce Maddox Rhea to investigate this tricky question, and what she found may surprise you if you don’t have rideshare insurance coverage.

Being involved in a major collision is the last thing any driver wants to experience. For rideshare drivers, having an accident can be an even bigger risk, especially if you have a passenger in the car or are on route to pick someone up.

Even with an independent contractor status, you are still working for a rideshare company and representing them. Getting into an accident can put you and other passengers at risk to injuries and other issues. Not to mention, taking damage to your car may mean you’d have to take a break from driving – and halt that source of income – until you get your car fixed.

But sometimes things happen – you aren’t paying attention and you bump into someone, you hit a parked car, etc. How should drivers handle these minor accidents?

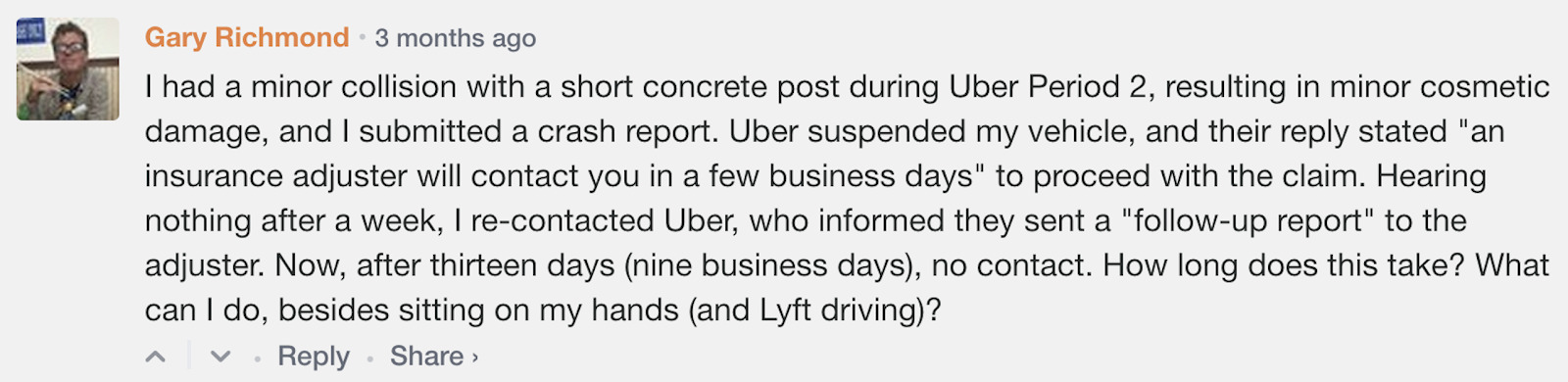

We recently had a few rideshare drivers reach out and share their minor collision experiences and ask about their options for filing an insurance claim. One had a collision with a short concrete post during Uber Period 2 which resulted in minor cosmetic damage to their vehicle.

Another driver accidentally hit a curb when en route to pick up a passenger. The impact, unfortunately, destroyed her front tire and deployed her airbag. In situations like this, having rideshare insurance can provide a lot of relief.

We hope you never get involved in a collision while actively rideshare driving (or at any time for that matter). However, if you ever do hit something like a curb while driving, it’s important to be prepared and carefully weigh your options.

Let’s start by examining what type of insurance your rideshare company offers.

Looking for rideshare insurance? Check out our rideshare insurance marketplace here.

Understanding Insurance Provided By Rideshare Companies

Uber

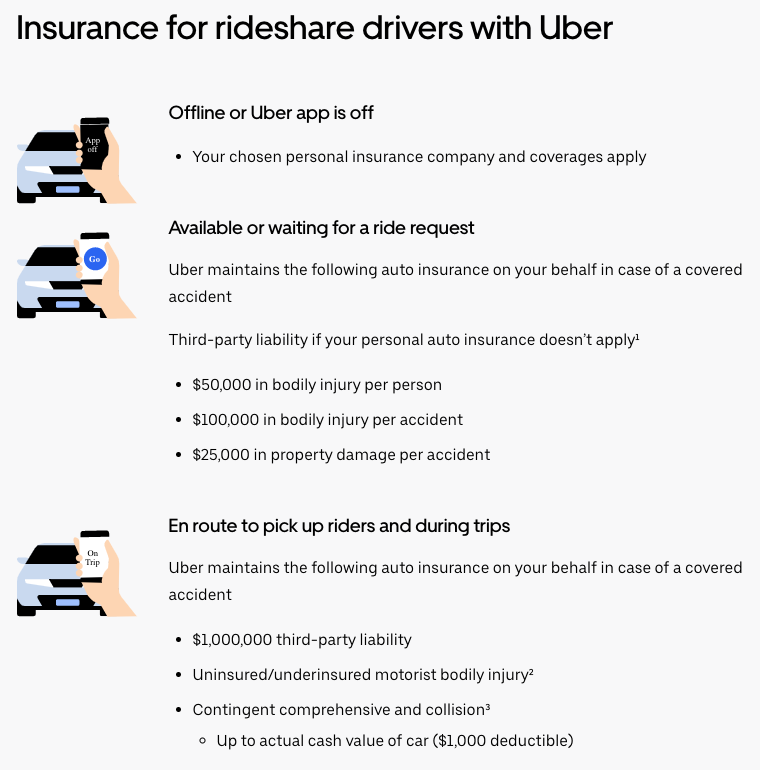

When you drive for Uber, they maintain commercial insurance on your behalf. Uber partners with leading national auto insurance companies to provide coverage during the different stages of your route.

Of course, Uber does not provide insurance coverage when you are offline or the app is off. When you go online and start driving, insurance coverage will be broken up by what they refer to as ‘periods’.

Period 1

This is when you are waiting around to be matched with a rider who requests a pick up. During this period, Uber provides the following insurance coverage in the event of an accident and if your third-party liability insurance doesn’t apply:

- $50,000 in bodily injury per person

- $100,000 in bodily injury per accident

- $25,000 in property damage per accident

Note: There is no collision coverage during Period 1 which is why rideshare insurance is so important.

Period 2

This occurs once you’ve been matched with a rider and are en route to pick them up. The driver who hit a curb when en route to pick up a passenger was most definitely in Period 2 at the time.

Uber provides the following insurance coverage for this period:

- $1,000,000 third-party liability

- Uninsured/underinsured motorist bodily injury

- Contingent comprehensive and collision (up to actual cash value of the car)

If you file a claim for a collision during this period, you will have a $1,000 deductible.

Struggling with high deductibles? Here’s how to avoid high rideshare insurance deductibles.

Period 3

Period 3 starts when your passenger gets in the car and it ends when they exit the car. Uber maintains the same level of insurance as in Period 2.

If you were to hit a curb, or anything for that matter, while driving for Uber during Period 2 or 3, their 3rd party liability coverage would likely kick in. This insurance covers bodily injury and property damage to a 3rd party (something or someone other than you or your car) due to an accident. You’d also get collision coverage but you’d be responsible for the deductible.

Illinois drivers – try OptOn for insurance! OptOn is a rideshare driver insurance app that you only pay for when you are actually using it. It’s easily one of the most flexible rideshare insurance policies that requires only four hours of commitment and charges cents per mile with three policy types (Primary, Preferred, and Premier).

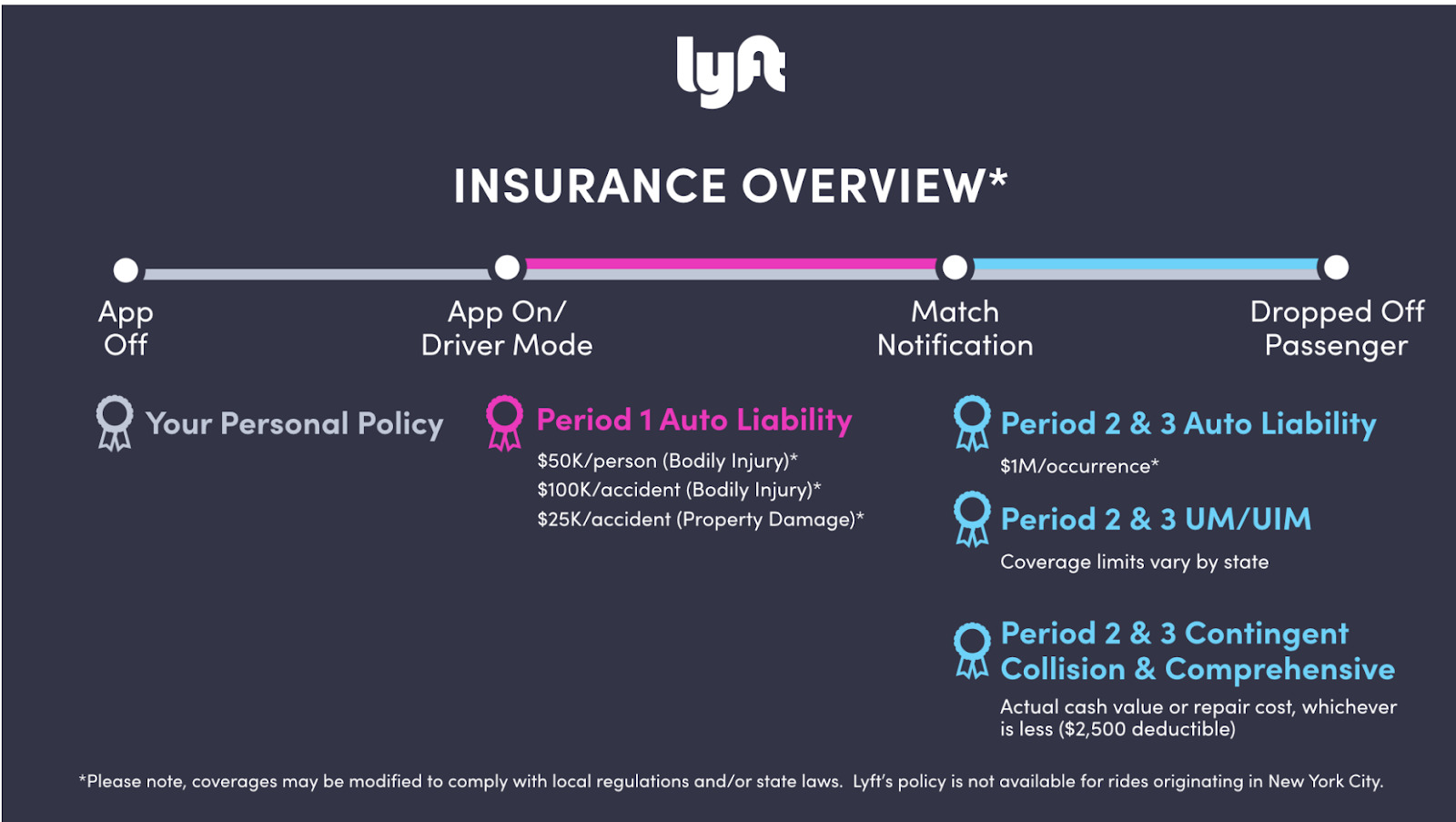

Lyft

Lyft provides drivers with the same coverage amounts as Uber for Period 1 and Period 2. They also offer primary auto liability for up to $1,000,000 (just like Uber) from the time you accept a ride request until the ride has ended in the app.

Lyft’s insurance deductible is $2,500 so it’s a little higher than Uber’s $1,000 deductible.

Contingent Collision and Contingent Comprehensive

Lyft’s contingent collision coverage is designed to cover physical damage to your vehicle from an accident so long as you have collision coverage on your personal auto insurance policy. Contingent comprehensive coverage will cover physical damage to your vehicle that results from a non-collision event like a natural disaster for example.

***Lyft’s driver insurance policy is available in all U.S. states except for rides originating in New York City with a Taxi and Limousine Commission driver.

Obtaining Rideshare Insurance

So as you can see, you get some coverage from Uber and Lyft but there are high collision deductibles in periods 2 and 3 and there is no collision coverage in period 1.

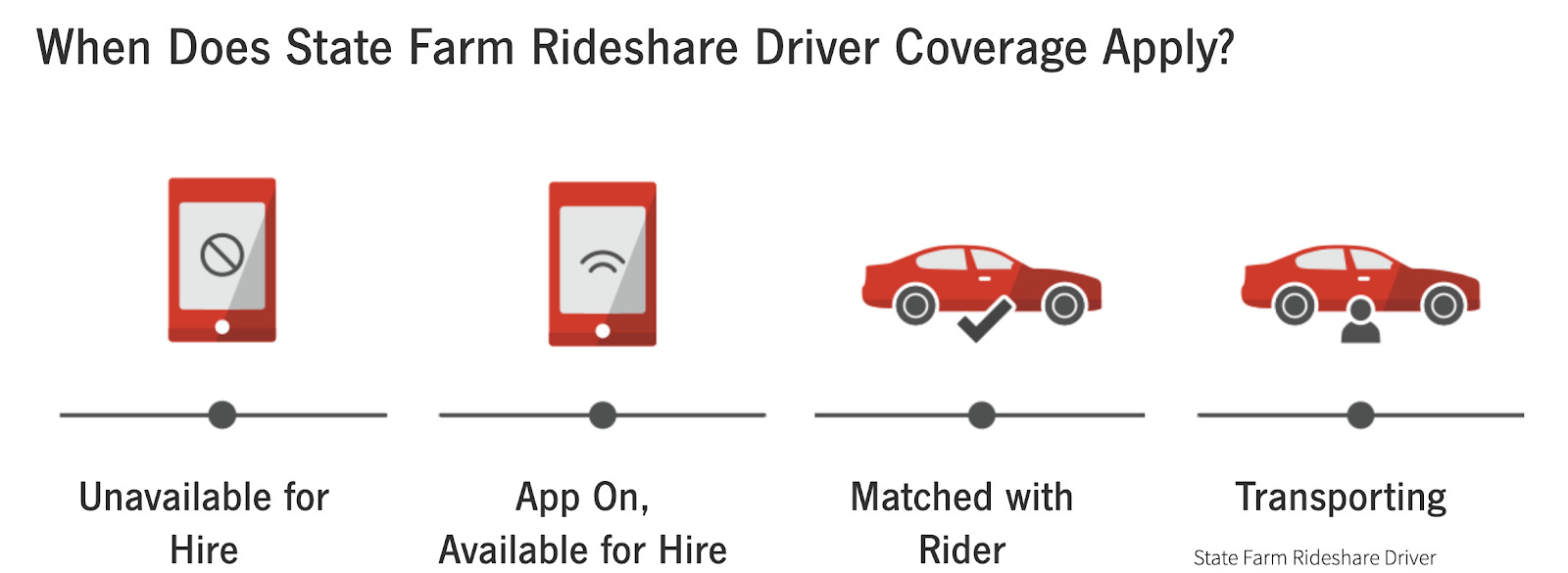

Rideshare insurance is a no brainer, in my opinion, to make sure you’re covered and there are some companies like State Farm that will actually cover you for Periods 1-3. So not only do you get the gap coverage during Period 1 but you’ll also get their coverage during 2 and 3 which means a lower deductible (potentially, if your deductible is lower than $1k or $2.5k) and you won’t have to deal with Uber and Lyft’s insurer (James Rivers) which is notoriously difficult.

To see which rideshare insurance options are available in your state, visit our rideshare insurance marketplace.

When Should You File a Claim?

Let’s say you hit a curb while rideshare driving and need to file a claim. If this happens, you’re obviously at fault but if the damage is less than $1,000, you might as well go get a quote from the local body shop to repair your car.

Since you have a $1,000 deductible with Uber’s insurance coverage, it doesn’t make much sense to file a claim.

However, say your damage is estimated to be above $1,000. At this point, you can definitely file a claim with Uber, but realize that they will immediately deactivate you and it takes between 1 to 4 weeks to get everything resolved and return to active status.

Driving for both Uber and Lyft can come in handy. While Lyft has a $2,500 deductible, if you file a claim with Uber and they deactivate your account, at least you can still drive with Lyft for the time being if the cosmetic damage on your car is safe and minor.

Insurance is there for a reason and it can be super helpful, but you want to carefully assess your situation when involved in a small collision to see if you should make a claim or get your car fixed on your own if the damages will end up costing less than the deductible.

Reporting a Collision and Sending An Insurance Claim

The first thing you’ll need to do is contact your insurance company along with your rideshare company and tell them you need to fill out a claim form. They will instruct you on the best way to submit a claim.

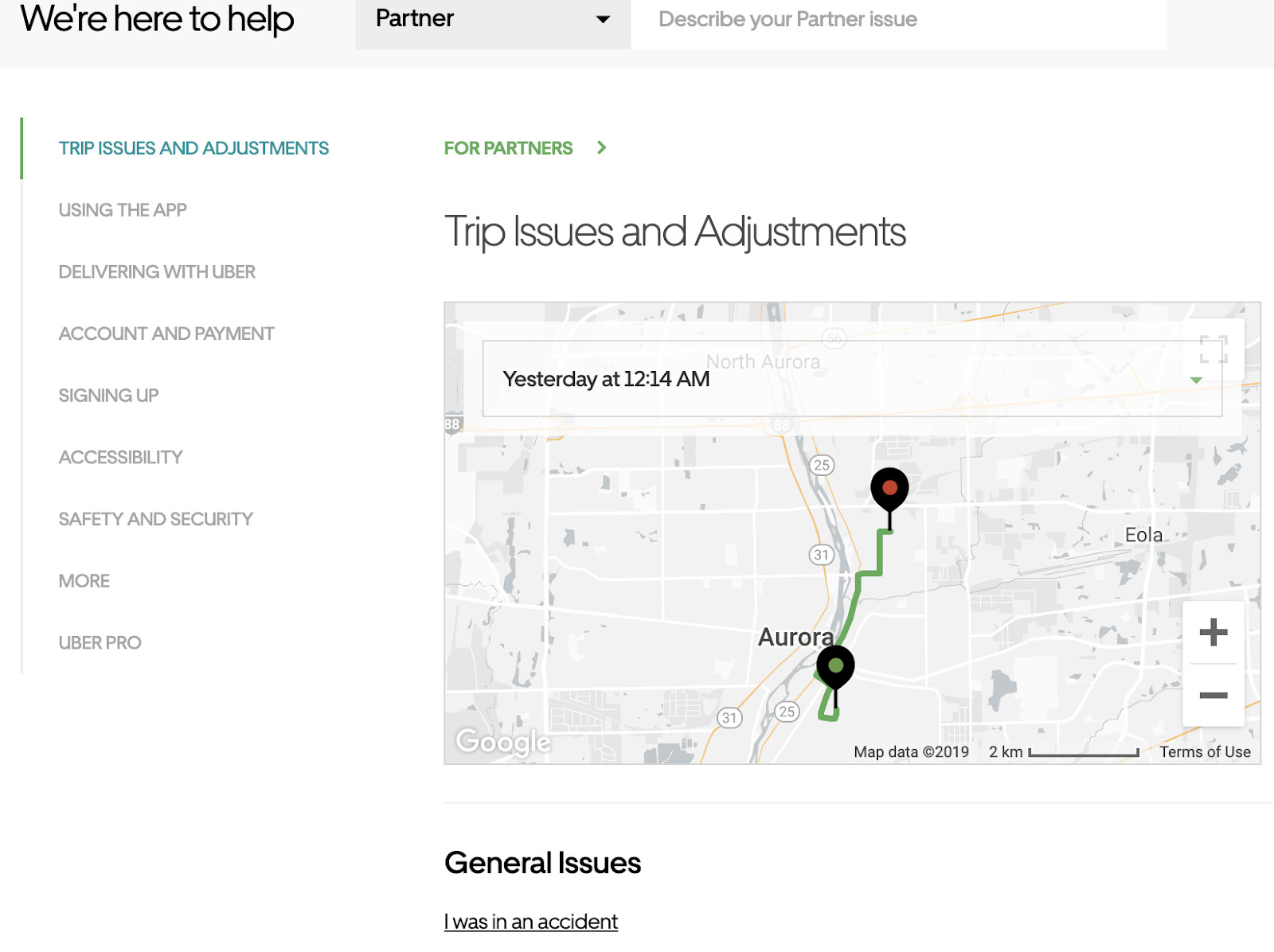

For example, you may want to call your personal insurance company or fill out their online form to file a claim. If you’re an Uber driver looking to report a collision, you can do so via the app by going to Help > Trip Issues and Adjustments > I got into an accident.

Or, you can submit a crash report through Uber’s website.

If you’re a Lyft driver, you can contact their Claims Customer Care team through the app or on the website. You can also call their emergency hotline number at (855) 865-9553.

Carefully assess the damage, take pictures, and keep track of any estimates or damage reports if you do get your vehicle looked at.

Keep in mind that companies like Uber could take a while to respond during the claims process and your non-rideshare insurance may simply refuse to cover the incident.

A few months ago one of our readers shared how he’d been waiting over a week to hear back from Uber after filing and claim and getting his vehicle suspended on the app.

Even a few days can seem like a long time if you’re suspended due to an accident and depend on your rideshare income.

If you don’t hear back after filing a claim, be sure to follow up within a few days and consistently if you have to. Don’t just stop there either.

You can also take more aggressive measures and stop by your local Uber office to see if you can speak to someone in person about the issue. Stop by greenlight centers in your area for the best results.

You can find the closest one near you by doing a Google search for ‘[your city] Uber Greenlight Hub’. Also, consider calling Uber’s phone support from within the help menu of the driver app or take a shot at reaching out to them on social media.

Delayed response times from your rideshare company when filing an insurance claim another reason why it’s so important to have a separate rideshare insurance policy to protect you no matter what.

Still, if your collision happens during Period 2 or 3 your personal insurance policy may not cover it unless you have a rideshare insurance policy.

Keep following up with your rideshare company and maintain all your receipts and documents.

If you need an Uber Accident Attorney, read our Uber Accident Lawyer page to learn more about how to handle rideshare insurance after an accident.

Readers, do you have rideshare insurance? If so, which companies do you recommend?

-Chonce @ RSG