Join us for our October YouTube live on Tuesday October 9 at 5pm PT! You can subscribe to our Youtube channel here and be sure to turn on notifications (instructions here) so you know when we go live.

Today we have a sponsored post from optOn, a new type of rideshare insurance that you only pay for when you’re using it. Currently, optOn is only available to drivers in Illinois, but keep an eye out as it rolls out nationwide. If optOn isn’t currently in your state, you can still find rideshare insurance options in your state. As always, opinions are our own and reviews are done based on our experience as rideshare drivers.

OptOn is a new type of rideshare insurance that you only pay for when you are actually using it. It’s probably one of the most flexible rideshare insurance policies and it only requires a minimum of four hours of commitment. What’s not to love?

First, How Does Rideshare Insurance Work?

Right now, most rideshare companies offer a limited amount of insurance when you are using your vehicle for commercial purposes. The biggest gap for this comes during the time that you are logged into the app and driving around waiting for rides without a passenger (known as Period 1 in insurance speak).

You can get a rideshare endorsement on an auto policy with certain companies, however it’s still relatively limited and often requires a brand new policy or switching to a new company (and losing your current rates). That means getting a new (and probably higher) quote for the premium, and that makes the switching costs high for someone who just wants to dip their toes into the on demand economy or just drive toward short term goals.

How optOn Works

OptOn offers what is called a micro policy via their optOn app. If you consider that most insurance policies are purchased in terms of years or months, a policy that lasts only 4 hours (or less if you choose to end early!) sounds a lot more like the type of insurance I would buy if I needed to drive to fund a vacation or buy a Viking sword.

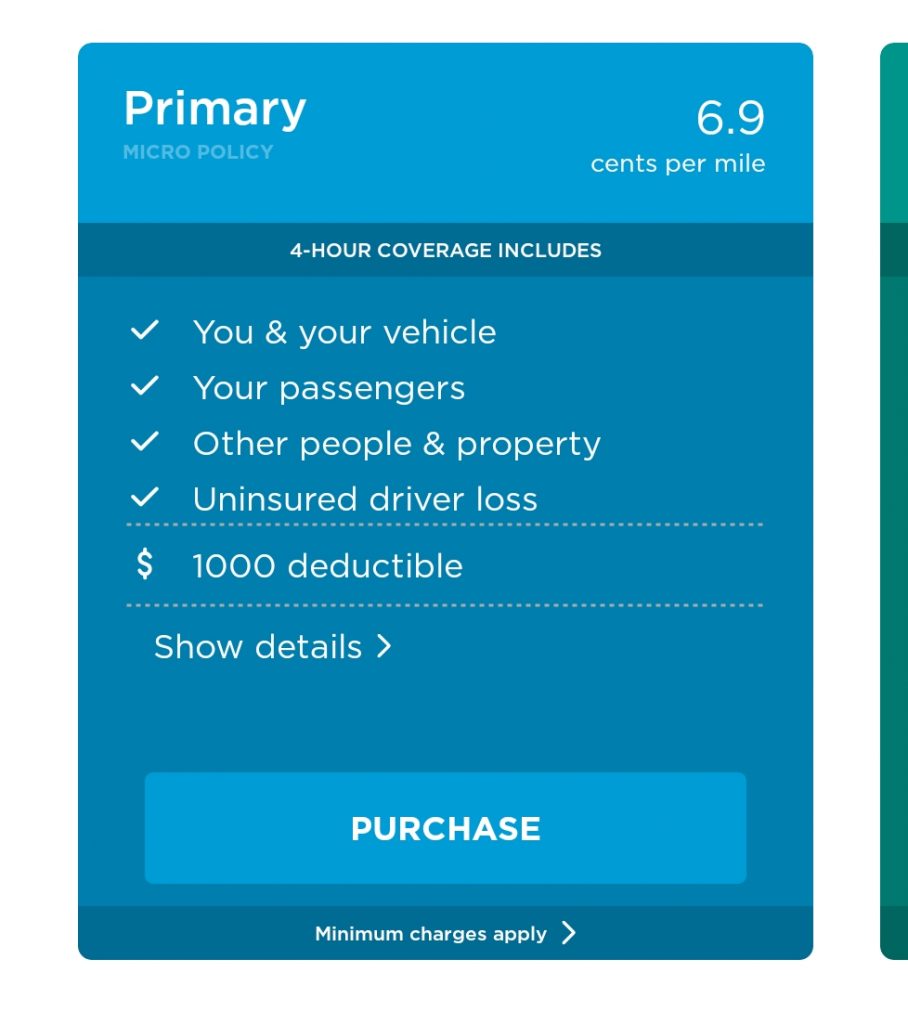

OptOn sells their policies in increments of 4 hours, and they charge you for the distance you travel as tracked via the optOn App. They offer different policies at different costs and coverage levels ranging from Primary to Premier.

When Does optOn’s Policy Actually Kick In?

It begins as soon as you tap “Purchase” on the policy card you select. If you only drive for 2 hours, you can end the coverage by ending the policy within the app. You’re only charged when you have an active optOn policy running. And it’s important to note, you’re not really charged for the policy, but for the miles you drive while the policy is active.

Legally, optOn cannot set the policy to auto-renew, but you can renew within 15 minutes of your original policy expiring. This will initiate another 4-hour micro policy, which will start as soon as your original policy ends. To prevent any accidental lapse in coverage, optOn will notify you in the app to renew:

What Exactly Does optOn’s Micro Policy Cover?

OptOn acts as your primary insurance during periods 1, 2, and 3 while rideshare driving. However, this policy is not a full auto policy, so you will need your standard minimum liability insurance policy for your car when you drive it without optOn for personal purposes.

OptOn covers any rideshare, delivery, or on-demand job, so it works for those who switch between Uber, Lyft or delivery companies. You can select from three tiers of coverage ranging from Primary to Preferred to Premier. Cost of coverage increases based on the tier you want.

OptOn will not run a lengthy background or driver history check on you, but they will check to make sure your vehicle is 15 years old or newer, you have a valid driver’s license and credit card. That’s it.

How Much Does optOn Cost?

Each micro policy is priced a little bit differently based on factors like where you drive, your age, the time of day, or even weather conditions. Costs vary from as low as $0.07 per mile for a Primary policy in a small town to as high as $0.30 per mile for a Premier policy in Chicago during peak conditions. It really depends on all the variables, and you have to download the app and get a personalized quote to see what your rates are.

For example, a teacher who is considering rideshare driving as a means to earn extra income might not want to commit to an entirely new insurance policy yet. If they needed to drive around 2,000 miles (2-4 weeks of part-time driving) to make that decision, they would spend around $200 (2,000 miles * $0.10/mile) during that month to be covered for rideshare driving.

If that same teacher already has a great rate for their personal auto insurance policy that doesn’t offer rideshare insurance (or charges a lot more for it) then it makes sense to use optOn. The same can be said for someone who only drivers on the weekends, or for someone who drives only a few months a year.

However, a full time driver in Chicago puts anywhere between 40,000 and 80,000 miles a year on their car. If that is you, it would almost certainly be cheaper to get a more long-term solution since optOn charges by distance travelled.

Lower Deductible

Lyft has a collision deductible of $2,500 while Uber has a deductible of $1,000. One benefit of optOn is that their deductibles start at $1,000 and go as low as $500 on their Premier policy. If you’re new to rideshare, it’s definitely worth considering this, especially if you drive with Lyft since their deductible is so high!

A part-time driver might also be interested in using optOn if they drive less than 500 miles a month for rideshare and don’t want to increase the cost of their vehicle insurance by an extra $100 each month. Especially if they only intend to drive for Uber or Lyft part time.

Who Is optOn Best For?

OptOn is clearly best suited for those who do rideshare part-time or on a contingent basis. A full-time driver putting 1,000 miles a week on their car can certainly find a better financial deal, although they may not find the same level of coverage, service, or level of deductible.

That being said, a part-time driver who doesn’t want to commit to the extra cost of a full-on rideshare insurance endorsement before even giving their first ride will really find optOn convenient because instead of voluntarily paying an extra $80 to $400 for a six month policy, they’ll pay between 8 and 30 cents a mile for their first few hours on the road. If I were giving my first ride in Chicago today, I would definitely use them to avoid Lyft’s $2,500 deductible.

Readers, what do you think of the options offered by optOn?

-Christian @ RSG