This post is sponsored by Stride and as always, all opinions are our own. We’re proud to partner with Stride, because as rideshare drivers, we know it’s important to have reliable health insurance. We’ve found Stride to be affordable and reliable – two important keys to good health insurance!

If you are like many of us working as rideshare drivers in the big beautiful gig economy, you have struggled with getting health insurance. It is complicated and can be expensive! Unlike our corporate/government-working brothers and sisters who are given a health care plan as part of their benefits program, we are left to our own devices to research, choose and pay for a health plan.

Choosing the right insurance for you can be a daunting task since there are so many companies to choose from, each with a seemingly endless array of options. We see terms like: deductible, co-pay, primary physician, out of pocket, specialist, gold, silver, and bronze plans. It can be overwhelming.

What Is Open Enrollment?

In most states, open enrollment for this year ends on December 15, 2019.

Before jumping into my story with Stride Health, let’s go over the importance of this time of the year. Open enrollment is that time of year in which you can sign up for health insurance for 2020. If you don’t sign up for health insurance before the Dec. 15th Open Enrollment deadline, you won’t have health insurance for all of next year, and in California, you might even have to pay a fine.

If you are eligible and apply for health insurance during open enrollment, the health plan must insure you. The company is not allowed to use underwriting or require evidence of insurability, both of which could make it harder and more expensive for you to get health insurance. Therefore, it is important that you take action quickly in order to secure health insurance.

My Introduction To Stride Health

Stride Health is a company that helps us find health care plans and can also help us qualify for subsidies. Stride Health is available in all 50 states and represents over 230 different insurance companies including the five largest: UnitedHealth Group, Cigna, Anthem, Humana and Aetna. I would also add that Stride represents Kaiser, which is the plan I ultimately selected.

I discovered Stride Health two years ago while reading Christian’s post on how Stride helped him when he needed insurance. My previous health insurance plan was about to expire, and I wanted to see what was available in the marketplace, specifically for rideshare drivers. I wanted to see if I could get more and pay less. Stride certainly delivered for me.

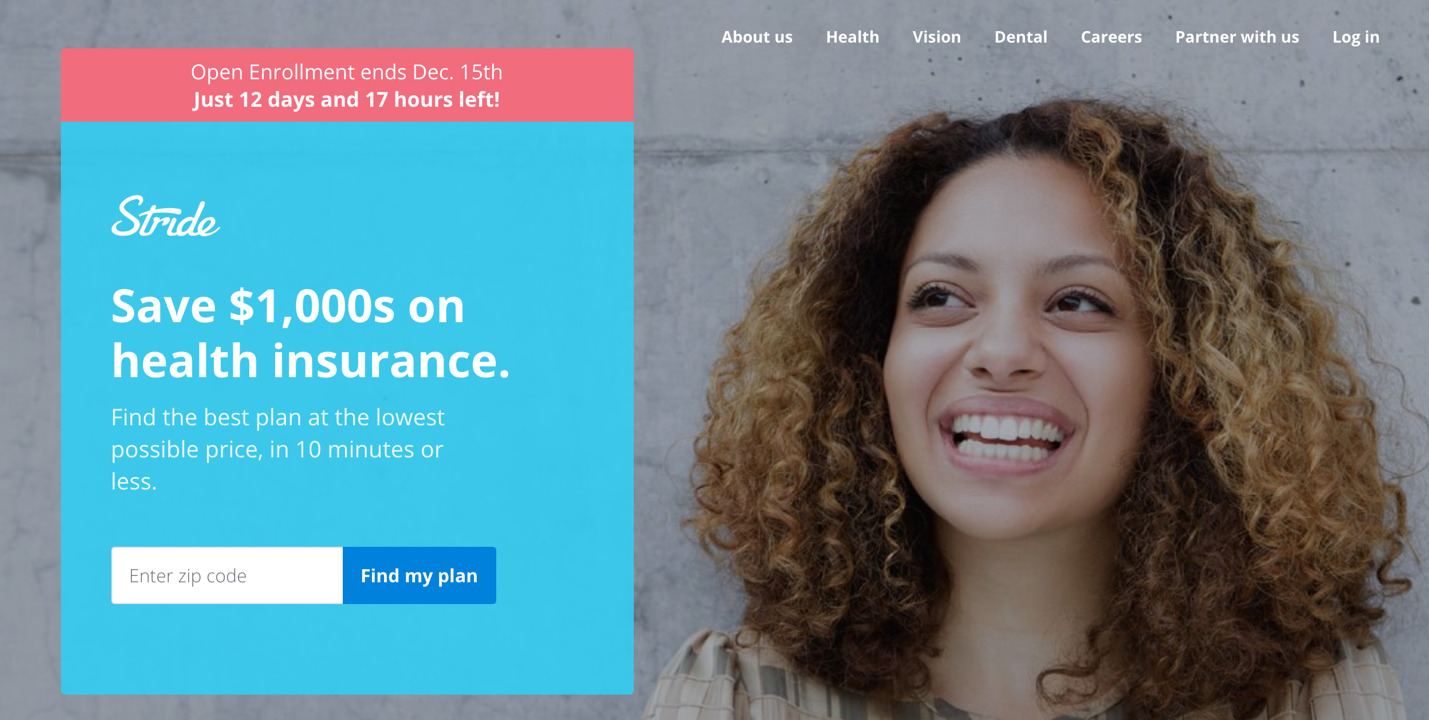

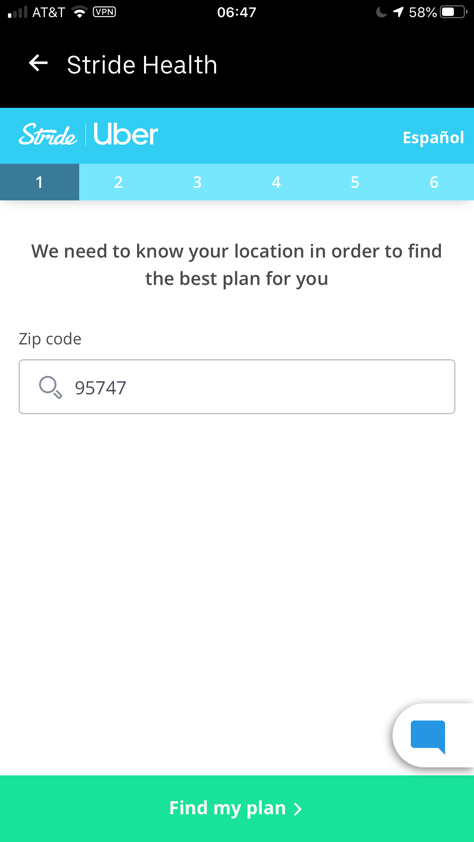

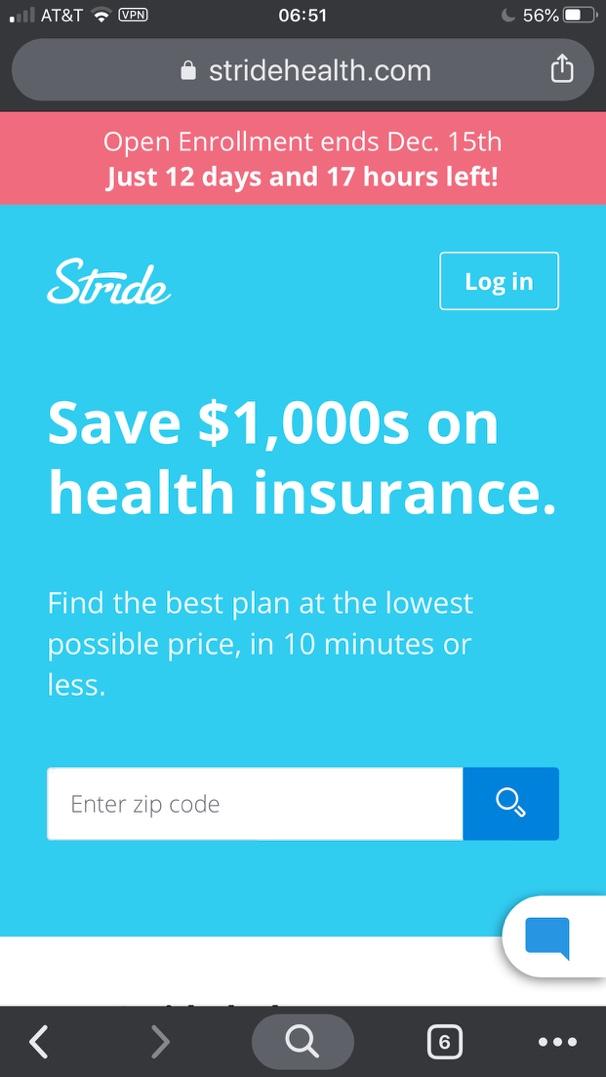

I went straight to Stride’s website. When I saw “Save $1,000s on health insurance,” I wanted to check it out. To get started with Stride, enter your zip code, which will help Stride pinpoint a plan that will work for you.

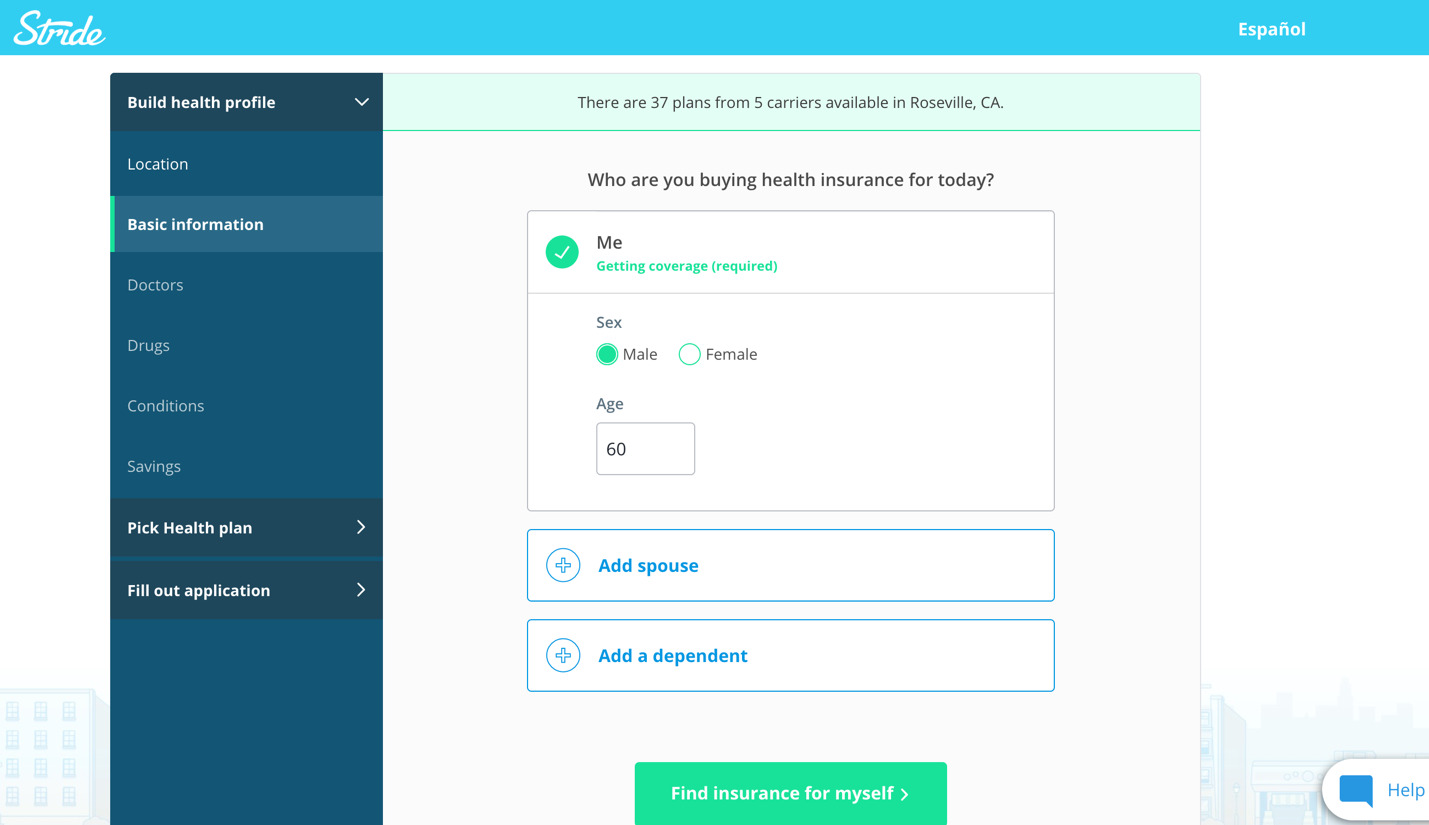

You will be asked to provide some very basic information about yourself, again to help Stride find the best plan for you.

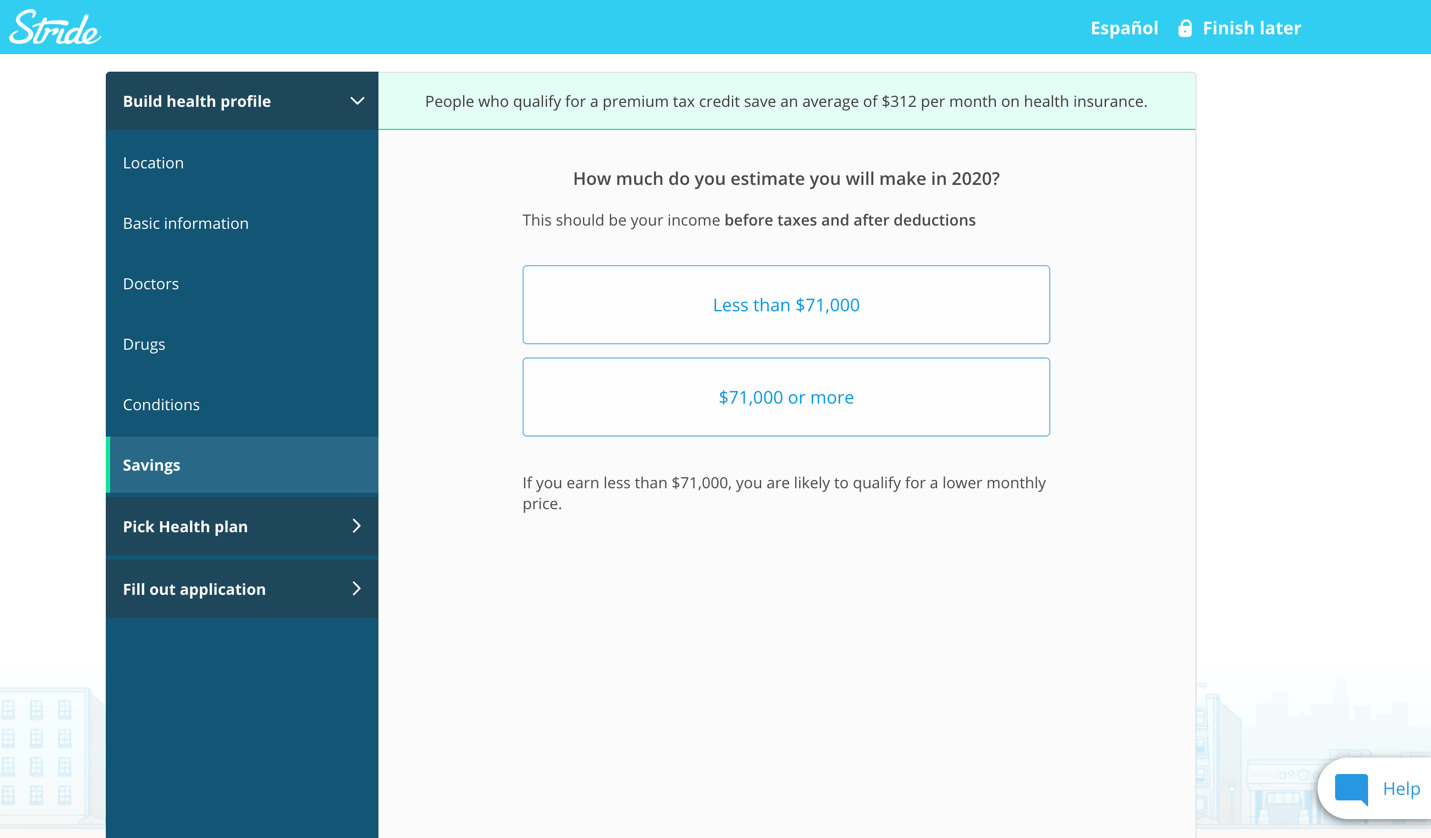

This is where it gets good for most rideshare drivers. If you are a rideshare driver with after deductions earnings over $71,000, you are not doing your taxes properly.

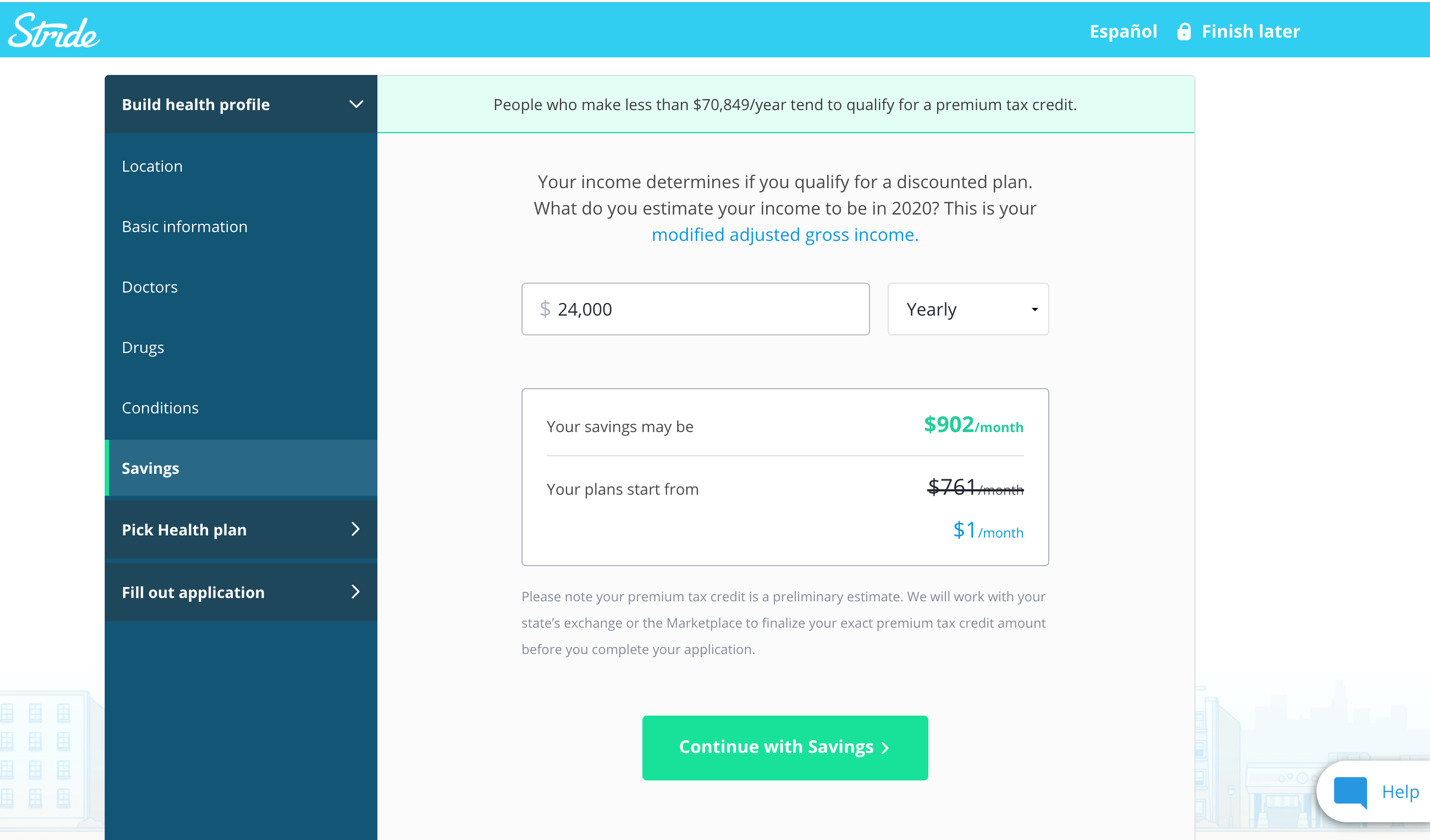

You will also notice in the screenshot that in the lower right corner, there is a help link. If you run into any challenges or have questions, there will be someone available to help you out.

This page is where Stride truly got my attention and my business. Since my after-deduction revenue is so low, I qualify for a massive deduction in premium. This screenshot says that at a $2,000 per month “after deductions” revenue stream, I can qualify for a $902 monthly savings. The CEO of Stride, Noah Lang explained why we, rideshare drivers, can get such remarkable savings:

“Thanks to the Affordable Care Act, which requires Americans to have health insurance or face penalties, many of those who enroll on Stride Health pocket insurance subsidies to lower their plan costs.”

Other Ways To Find Stride Health

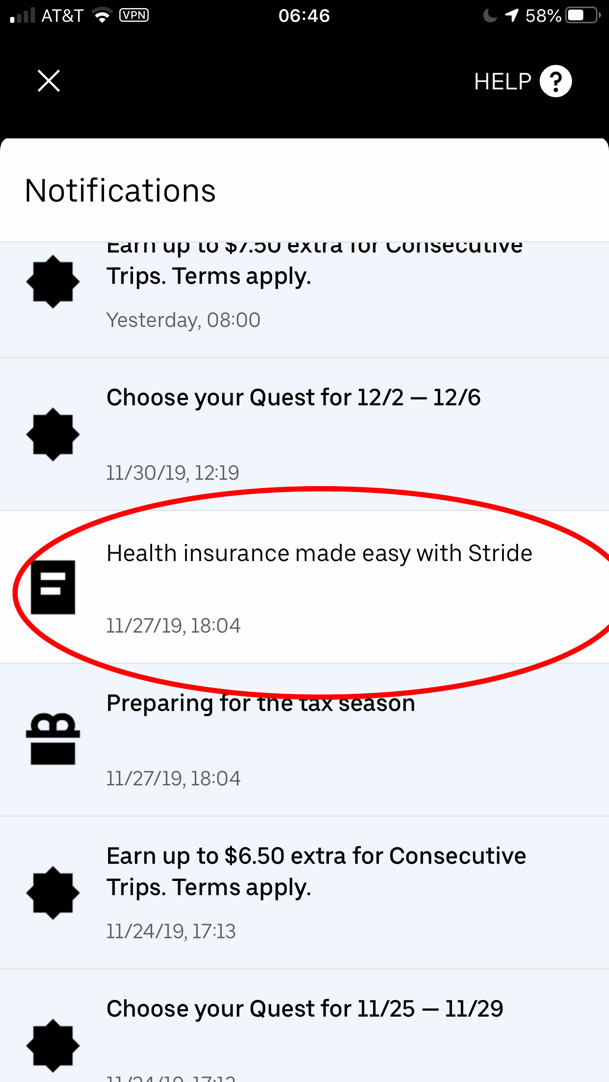

I used the Stride Health website, but if you prefer, you can also find Stride Health through the Uber app on the Notifications page.

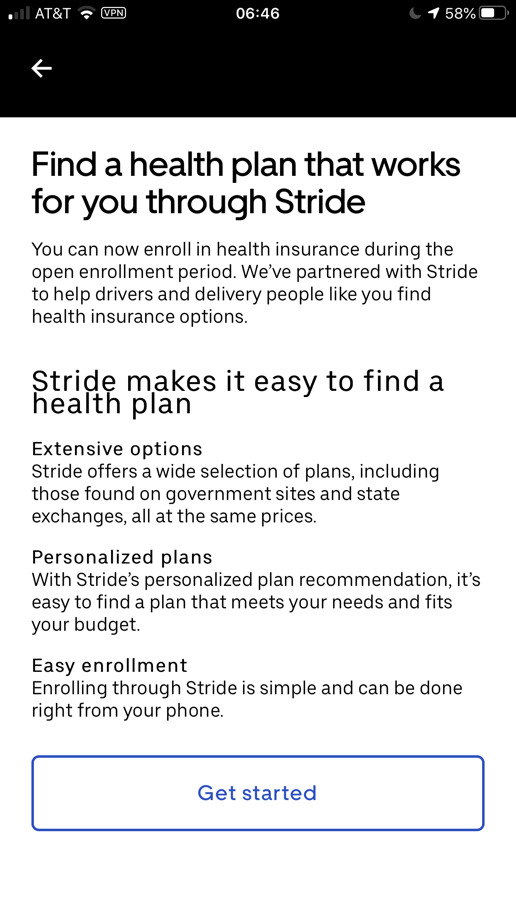

This will take you here:

And then to here:

You can also find the Stride Health Application process online through a browser like Chrome. As you can see, it is the same interface you can find online using your computer at home:

How I Saved $20,000 With Stride Health

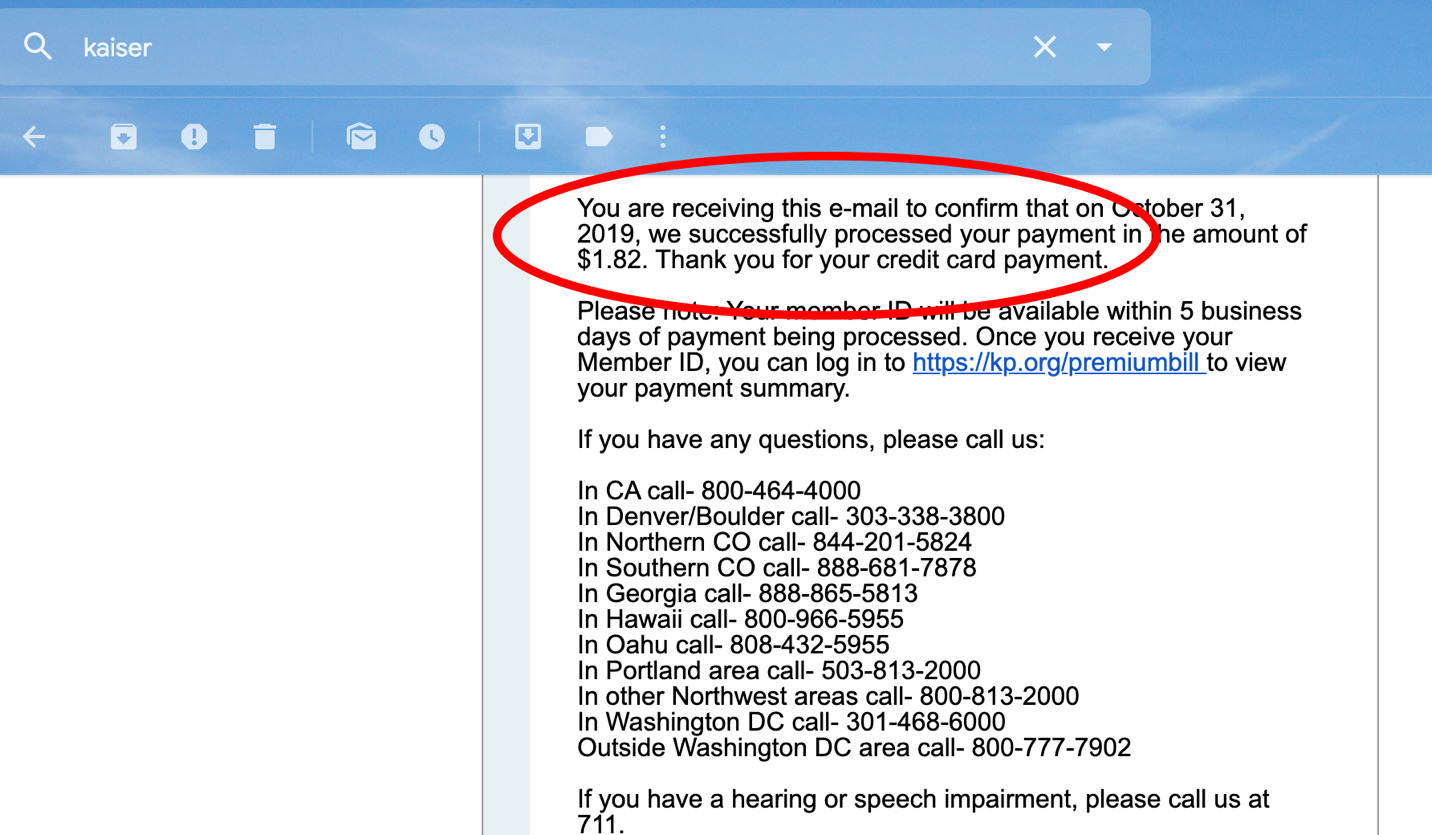

After looking at my options, I chose a Kaiser Bronze Plan. It gives me everything I need with very little out of pocket expenses. The cost of the plan is over $850 per month. However, due to the monthly subsidy that I receive, my actual payment is under $2 per month.

I am saving $850 per month, and I have been doing this for the past two years. In fact, I just re-qualified for a third year. $850 savings for 24 months is over $20,000 in savings. That is a remarkable benefit for rideshare drivers.

Why Should Rideshare Drivers Get Health Insurance?

I’ve lived some parts of my life without health insurance. I am healthy, and I have not been to a doctor in several years. But what about that accident that can cost me hundreds of thousands of dollars?

Financial ruin due to extreme medical expenses is one of the number one causes of bankruptcy. A study at Harvard suggests 62% of all bankruptcies occur as a result of medical expenses.

For me, I see health insurance as financial catastrophe insurance. I want to know that if the unthinkable happens, I won’t be financially decimated. Therefore, I have health insurance. Further, as I have shown here, you may be able to get this insurance for pennies on the dollar.

Key Takeaways for Drivers Considering Health Insurance

I know there are many drivers out there who do not have health insurance, or you have insurance and you are paying high monthly premiums. Rideshare drivers may think it is too expensive or not worth the hassle.

In many ways, this line of thinking is comparable to rideshare insurance for the car. Many drivers do not get rideshare insurance because they think it is too expensive. Yet earlier this year, I wrote an article about how I was actually able to save money by switching to a commercial policy from a personal policy. Here too, you may be able to get a very comprehensive health care plan for just a few dollars a month.

Whether you sign up for health insurance or not, at least check it out. It only takes a few minutes and it may deliver huge returns on your time investment. The peace of mind you will feel is priceless. Be safe out there.

Interested in checking out Stride’s health insurance plans in your state? Click here to visit Stride Health.

-Jay @ RSG