As rideshare drivers, it’s really important to have insurance – both auto and health. With all the driving we do, even if we drive part-time, statistically we’re more likely than average drivers to be involved in an accident. Luckily, there are affordable options out there for drivers. Today, senior RSG contributor Christian Perea shares his experience getting health insurance using Stride Health

Stride Drive is one of our affiliate partners but they didn’t pay us for any of this. This is a testimony from my direct personal experience because they did such an excellent job at simplifying open enrollment for me last year and probably helped save my life. (Christian’s life. Not Harry’s. Harry is fine.)

It’s open enrollment season again. That wonderful time of the year where I have to figure out how to see a doctor without also having to sell a kidney (or by holding a real doctor hostage in my Uber until they write me a prescription). Fortunately though, this is the first year since I became an independent contractor that I’m not stressing out thanks to Stride Health.

If you are new to driving full-time and don’t have another means to health insurance, you need to know now that you are legally an independent contractor, and you must buy YOUR OWN insurance. Assuming you don’t qualify for Medicare or something else, legally you have to buy insurance or pay a penalty at tax time.

Want to see what health insurance options are available in your state? Click here to check out Stride Health.

Healthcare is Complicated, Frustrating, and Personal

Truth is, when I switched from a W-2 job and began driving in the gig-economy full-time, I had a lot of trouble figuring out how all of this worked. I knew I had to take care of this on my own, but I was busy trying to drive and pay my bills, and I let things slip. So like every good 20-something, I simply pretended I didn’t need healthcare and that I could live forever by using a proprietary mixture of caffeine, pushups, and whiskey.

That turned out to be a very big mistake though.

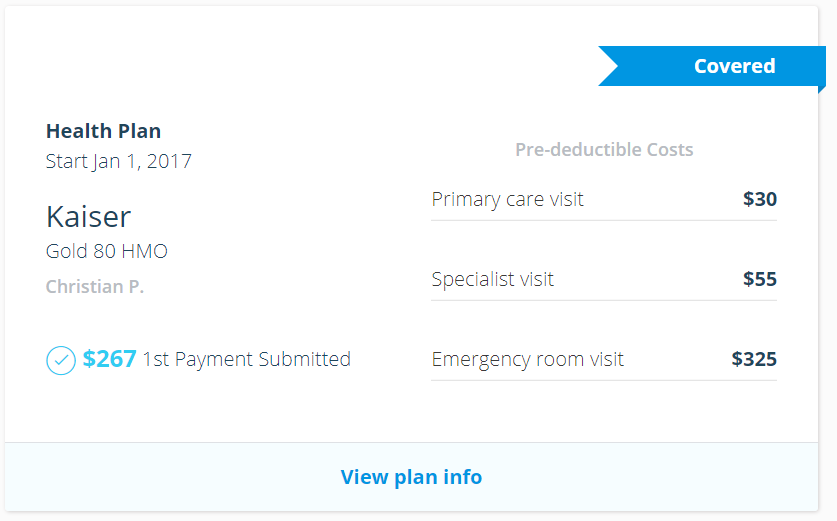

Two years ago, I decided to finally get my act together and went over to Stride Health’s site to sign up for a Kaiser Gold HMO plan for around $267/month after ACA subsidies. I knew at the time I was Type II diabetic and probably would spend a lot of money, so I sprung for the fancy gold plan.

I also figured that if Stride Health screwed anything up I could come back to the blog here and let you all know about it 😉

I cannot stress enough how easy Stride Health made it for me to get setup. I spent about 15 minutes setting up an account. After about an hour or so of researching which plan I wanted, it then took about 10 minutes to sign up. A few months later I spent another ten minutes uploading my income verification (you can even use a weekly summary from Lyft). In comparison to using CoveredCA, it was almost ridiculously easy.

Tangent: This is a really good example of how private companies can

Most importantly though, I ended up going to the doctor for the first time in a while. After a month of tests, and then some more tests, it turns out I actually wasn’t a Type II diabetic, but rather a Type I diabetic. It was an important thing to learn about my health.

It was important for a lot of reasons, as I had been running around with blood sugars in the 300 and 400 mg/dl range. My feet and legs hurt all the time. My cognitive function was greatly reduced and I was consistently grumpy (Harry can confirm). I knew something was up but I just blamed it on myself and resolved to manage my diet better. Truth is, there was nothing I could biologically do to make things better without insulin.

Related: What Can Drivers Do While Waiting for a Ride?

Now that I had healthcare, I was able to get the help and medication I needed without going bankrupt. My sugars are much better now, and I feel pretty close to normal again. I feel in control.

Without health insurance, I probably wouldn’t have found out until I had a bad (and expensive) incident. I would have remained ignorant to the reality of my situation until reality intruded.

Take Open Enrollment Seriously

I know my experience is unique, but the one thing I learned from this is that health is unpredictable. I don’t want to scare you into thinking you will find something like this out when you sign up for healthcare and finally see a doctor – my situation is probably uncommon.

However, open enrollment and getting insured should be taken very seriously. There is no control over the fate of genetics or happenstance. All you can do is make sure that when it happens, you are prepared the best you can be.

I’m not even saying everyone should use Stride Health. I’m saying it’s important to make sure to have your health care situation sorted out by the time open enrollment ends.

Editor’s note: Enrollment for health insurance is now open from November 1. Open enrollment ends December 15. You can sign up through Stride Health here.

We Have Dangerous Gigs/Jobs

We also have very little protection in case we get hurt…

The longer you’re in a car, the more likely it is that you will be in an accident. I’ve been in 3 accidents since I started driving, and all of them involved people running into my car while I was parked in a parking lot. One of them was a Luxor cab who backed into me and sped off, running several red lights.

Related: Don’t have rideshare insurance yet? You need it – and you have more options than you think.

My point is, it doesn’t matter how good of a driver you are. The other people on the road REALLY suck at driving. Even if you are perfect (and I guarantee you are not) someone is going to eventually run into you as they are tapping on their phone screens behind the wheel.

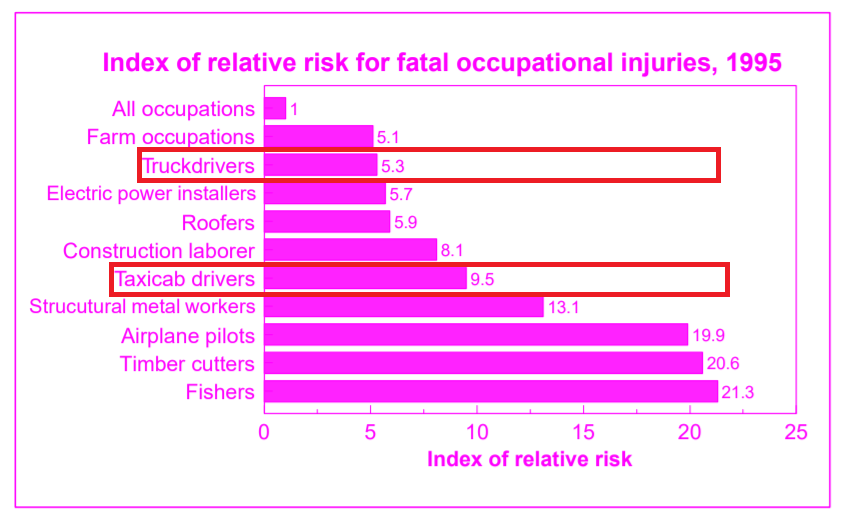

This is why transportation jobs are consistently ranked among the most dangerous jobs in America.

Uber and Lyft know this, and they have taken steps like partnering with Stride Health so we can sort it out. Uber has even gone one step further than Lyft by pioneering Driver Injury Protection Insurance. They even raised the rates of pay to cover the cost for drivers!

How Stride Makes Its Money

There is a big network of head-hunting referral fees for anyone who refers someone to a health insurance plan. Think of it as a driver referral. They make money off of health care referrals. The insurance companies have been paying these out since the beginning of time, so it’s nothing new.

The prices you pay for a Stride Health plan aren’t affected by this.

I Ask You One Thing

Everyone’s situation is very different, but if there is anything I would ask you, it is to please, PLEASE get some sort of healthcare before open enrollment ends on December 15.

I wrote this post for Stride as a sort of thank you for helping me figure it out for myself last year. Getting health care led to a major change for the better in my life. I wouldn’t let them pay me for this review if they offered to.

You can visit Stride Health and get setup yourself. If you have more questions or want a personal touch, Stride Health is also partnering with some Uber Greenlight Hubs to help drivers sort things out. You can check the driver app to see if Stride Health will be at your local Greenlight Hub.

Feel free to let me know how confusing healthcare is (or if you got it all figured out) in the comments section.

-Christian @ RSG