Getting a home loan approval can be a long and arduous task, even if you have a good-paying W-2 job and great credit. But what about rideshare drivers and other gig workers who don’t have the W-2 jobs to prove their income? It may take longer and be a bit more difficult to get through, but it is possible.

I recently bought a house. I have both a W-2 job and freelance work. It took a bit of explaining to my loan officer what exactly I did, how much I earn on average each month and that it is steady income that I am expecting to stick around for a while. They had their own requirements I had to follow, as well.

I’m going to breakdown the process I had to go through as well as steps an independent contractor will have to take in order to prove income for getting approved for a home loan.

Quick summary:

- While it is a lot more difficult for independent contractors (including full-time rideshare and delivery drivers) to qualify for a loan, it’s not impossible

- You will need a lot of proof that your income is steady, if not increasing. Having copies of several years of your tax returns can help

- Getting pre-approved, having a large down payment, or having a spouse with a W-2 job can all help too

Why is it so Hard for Independent Contractors to Qualify for a Mortgage?

This one is an easy answer, but it sucks for us. Because we are independent contractors, that income can disappear without any kind of notice (in theory). That instability makes loan companies nervous.

When you get a home loan, the company is essentially investing in you. They choose people who have proven they can pay back loans (credit reports will show them this) and people who have what they consider reliable income. Banks want to make sure you will pay them back, and they won’t be “stuck” with a house (car, etc.) if you can’t pay.

Since our income as delivery drivers, rideshare drivers, and even freelance writers (me) fluctuates from month to month, it’s often viewed as “unreliable income.”

However, there are steps you can take to help prove you’re not as much of a risk as they think you are. You will need a few things, though, including:

- At least two years of tax returns

- Proof of regular, steady income (a year or more, and many banks require two years!)

- Profit and loss statements for your business

- Bank statements

One thing I had to prove was that my freelance income was holding steady, or better yet, increasing year over year. I was able to prove this with my taxes.

Overall, this should be a straightforward task, but my luck being what it is, it got more complicated. See, my husband and I have an LLC and all of my freelancing and all of his driving are lumped under the business name.

With the pandemic, he put a pause on driving for Uber and Lyft, while my freelance work kicked up a notch. It was pretty difficult to explain that my income is increasing when the business income technically went down because of the lack of driving.

Eventually, they understood what we were trying to say and we were allowed to count my freelancing income separate from the LLC and from my husband’s driving.

Challenges ICs Face When Applying for a Mortgage

Not only is it difficult to prove you have steady income, some loan companies do not take independent contractors seriously. It’s not often viewed as a legitimate source of income that can be used to support such a sizable loan.

To top it off, independent contractors, like rideshare drivers and delivery couriers, take deductions on their taxes, which makes it look like they earn a lot less overall. True, you’re paying less in taxes, but in order to do that, you’re showing decreased income, which is not in your favor when it comes to getting a home loan.

Don’t even think about unemployment income, as some drivers and couriers earned during the pandemic. That is considered temporary and not really considered income. It’s often seasonal or just available for a set number of weeks.

Even though during the pandemic gig workers have been able to collect unemployment, and for longer than the standard 13 weeks, loan providers do not consider it income that can be counted toward a loan approval.

How to Improve Your Credit “Worthiness”

I know a lot of what was said makes it sound nearly impossible to get a mortgage, but there are things you can do to help yourself look more appealing to mortgage companies and less risky.

Some of this may not be what you want to hear, but it definitely helps in the long run. If you’re buying a house on your own, it would help to have a full time, W-2 job that is not part of the gig economy. I don’t make enough money freelancing to buy a house, so it definitely came in handy that I have a full-time job elsewhere.

In the same vein, it would be helpful if you’re doing a joint loan if your spouse has a full-time job that’s not gig work. As long as one of you has the “steady income” they are looking for, it makes the process a lot smoother. They will still count your income toward the loan approval, but having another person with a W-2 job will make your case that much stronger.

If you have savings built up, this can also be helpful. Mortgage companies look pretty closely at your bank accounts, and if you show you’ve got significant savings over a long period of time, this would likely make you a more appealing option than someone with just a couple hundred dollars squirrelled away. Similarly, having a large down payment can help as well.

Finally, it can also be helpful if you have worked with the lender before. If you have a history with the loan company, it will reflect well on you if you’re known for submitting on time payments. Companies also value loyalty, so they’d be more likely to keep you around as opposed to pushing you toward a competitor for a loan.

Tips for Freelancers and Gig Workers Trying to Get a Mortgage

The number one thing I can say is you need patience. Even without the added hassle of being an independent contractor, applying for and getting approved for a home loan is one of the most annoying and difficult processes I’ve ever gone through.

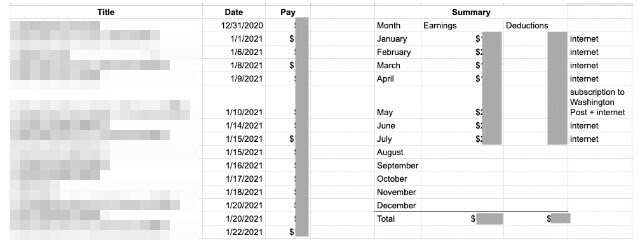

Aside from patience, it’s also good to have a Profit and Loss statement ongoing for the current year. The lenders will look at your taxes for past income, but you need to be able to verify that you’re continuing to make that much on a regular basis, or better yet, increasing your earnings.

It doesn’t have to be anything elaborate. For me, I write the date, the general theme of the work I’m doing (topic of an article I’m writing, if I’m doing research, etc.) and the amount I am getting paid or have been paid for that work.

In another portion of the sheet, I then have a running total for how much I’ve earned and how much I’ll be deducting based on expenses for the month. Luckily, as a freelance writer, my deductions typically just boil down to the cost of internet usage each month.

As a rideshare or delivery driver, you’d include the cost of gas, maintenance, etc. if you’re planning on taking the itemized deduction, or it would be the standard mileage rate as an alternative. Just do your best to track your earnings and deductions as clearly as possible so your lender can understand what you’re making and plan on deducting at tax time.

Another piece of advice I have is to keep your deposits into your account reasonable. If you have a $4,000 deposit out of the blue, you will need to track for your lender where that money came from and why you’re getting it.

I don’t mean to say that you have to cash out your earnings every day, but if you’re earning a significant amount every week, be ready to show how you earned that money to prove you actually made it and it truly belongs to you.

And finally, keep your expectations realistic. If you only make $45,000 a year doing rideshare and nothing else, you’re not going to qualify for a $500,000 home loan.

Summary: Qualifying for a Home Mortgage as a Rideshare or Delivery Driver

It can be difficult, but not impossible, to qualify for a mortgage as a Lyft, DoorDash, Instacart, or Uber driver (or any kind of gig worker!) There are several things to keep in mind as you go through this process:

- Gather all of your documents ahead of time – tax returns, profit/loss statements, proof of down payment, bank statements, etc.

- Be prepared to get denied by several lenders before finding one that will work with you

- Understand this process may take much longer than friends or family members’ processes (if they had W-2 jobs and weren’t also independent contractors)

- Be patient and be realistic

Have you tried to qualify for a mortgage or car loan as an independent contractor? What was your experience like?

-Paula @ RSG