E-scooters seemed to pop up out of nowhere and have been spreading around the world like wildfire – but what does it take to build a scooter company? Today we have a guest post from Asher Meyers on what it takes to start an electric scooter rental business that’s profitable and successful!

How to Start an Electric Scooter Rental Business in 3 Easy Steps

- Determine what vehicle hardware & fleet software you’re going to use

- Choose what third party operations you’ll use for rebalancing, recharging, repairs

- Identify your edge, your unique proposition

Article sponsors:

Joyride, a company that helps you launch your scooter or bikeshare. Learn more about Joyride here, and make sure to contact Harry Campbell if you’re interested in an introduction.

& Ed Walker, insurance expert. If you need insurance for your scooter startup, contact Harry Campbell. Harry will introduce you to Ed, who helps startup transportation and micromobility companies create custom insurance policies.

How to Start an Electric Scooter Rental Business

The scooter startups Lime and Bird have sunk hundreds of millions on building and deploying scooter fleets all over the world. Uber, Lyft, Skip and Spin have joined their ranks. How could the average Joe possibly run with the bulls, without tens of millions in funding?

These firms, particularly Bird and Lime, have had to spend on big fixed, upfront costs — things like:

- Vehicle hardware design

- Logistics software, to coordinate charging, deployment, repairs and legal compliance for scooters

- The app, which people use to unlock the scooters

- Lobbying local and state governments

All of these have classic ‘economies of scale’ — build it for one scooter or 10,000, and it costs a lot either way. They’re barriers to entry — hurdles that make it hard for new firms to form and compete.

Tooling up a new car factory, for instance, costs billions of dollars. Unsurprisingly, there have been very few new car companies for decades. Bullish investors like to cite these barriers as reason for why their companies will make money in the future.

With all these obstacles, how can any whippersnapper scooter fleet even begin to compete to start an electric scooter business?

The good news: increasingly, smaller operators can overcome these barriers, either by partnering with a company like Joyride, or by outsourcing these roles to independent companies, in return for a modest unit cost instead of big upfront fixed costs.

Since none of these suppliers have a monopoly, and since operators can always do the work in-house or with a contractor later, competition should keep the cost of outsourcing reasonable.

As for government lobbying, well… you can let the big boys be the trailblazers there 🔥💵🔥. As Silicon Valley villain/wunderkind Peter Thiel might put it, the “Last Mover Advantage” is within reach.

Vehicle Hardware & Fleet Software for an Electric Scooter Company

There’s a truism in business – ‘don’t mine gold when you can sell the pickaxes’ – because there’s less competition and more assurance of getting paid, when you’re the supplier, not the miner.

In the scooter world, Ninebot (aka Segway) is the pickaxe peddler par excellence. “Almost Every Electric Scooter in the World Comes From This Chinese Company” a recent Bloomberg headline reads. Ninebot has been developing scooters the longest, and remains committed to being neutral and selling scooters to all comers, more or less. Important for people thinking of starting an electric scooter rental business.

Ninebot has also (finally) announced a more ruggedized model designed for sharing, that will first be fielded with Lyft. Typically, manufacturers will offer temporary exclusivity in return for a higher price or a high volume order, and I imagine that’s the deal Lyft secured.

Other manufacturers are stepping up — including Electisan, Onan and Minimotors, to name a few. Electisan makes theBird Zero scooter, according toThe Rideshare Guy, and Minimotors has provided vehicles for Skip.

Another promising provider is Superpedestrian, whose upcoming scooter has bigger wheels, longer range (so less charging), and more ruggedized construction. The manufacturing cost isreportedly $500. Inboard also promises a fleet-ready scooter, featuring a swappable battery bigger wheels and a wider deck, sold at retail for $1,299 and to fleets, but only has a 12 mile range according to Verge.

Boosted Boards recently received $60m tobring light electric vehicles to market, and presumably, that will include shared scooters. As someone who’sseen andspoken with with their current CEO Jeff Russakow and former CEO Sanjay Dastoor, respectively, it’s apparent that Boosted puts a high priority on quality, safe vehicles.

Either way, the options for high quality, commercial grade fleet scooters are set to multiply.

Instead of retrofitting scooters fresh off a cargo ship from China, the firmware and communications hardware for shared scooters can be installed more efficiently at the point of manufacture.

Moreover, bothNinebot and Superpedestrian will offer fleet logistics software with their scooter hardware. In addition to vehicle makers, there are firms that specialize in fleet management, such asJoyride,Vulog andWunder Mobility, for as little as $5 a month per vehicle, or less.

As cities increasinglycall for operators to disclose historical and real time data on rides, fleet software providers can make compliance easier, and provide general advice on setting up your scooter fleet.

The App for an Electric Scooter Rental Company

To date, all of the scooter fleets have had their own app. On first glance, an app seems inseparable from running a scooter rental business.

But this is starting to change. You can book JUMP and soon Lime rides through the Uber app — though admittedly, Uber owns JUMP, and also has a $335m investment stake in Lime.

Access through truly independent apps already exists, just not for scooters (yet).

The Whim app, live in Helsinki, Antwerp and Birmingham, UK, lets users buy access to cabs, carshares, public transit and bikeshare, without requiring other apps. Moovel offers similar functionality in the German cities Stuttgart and Hamburg, among others.

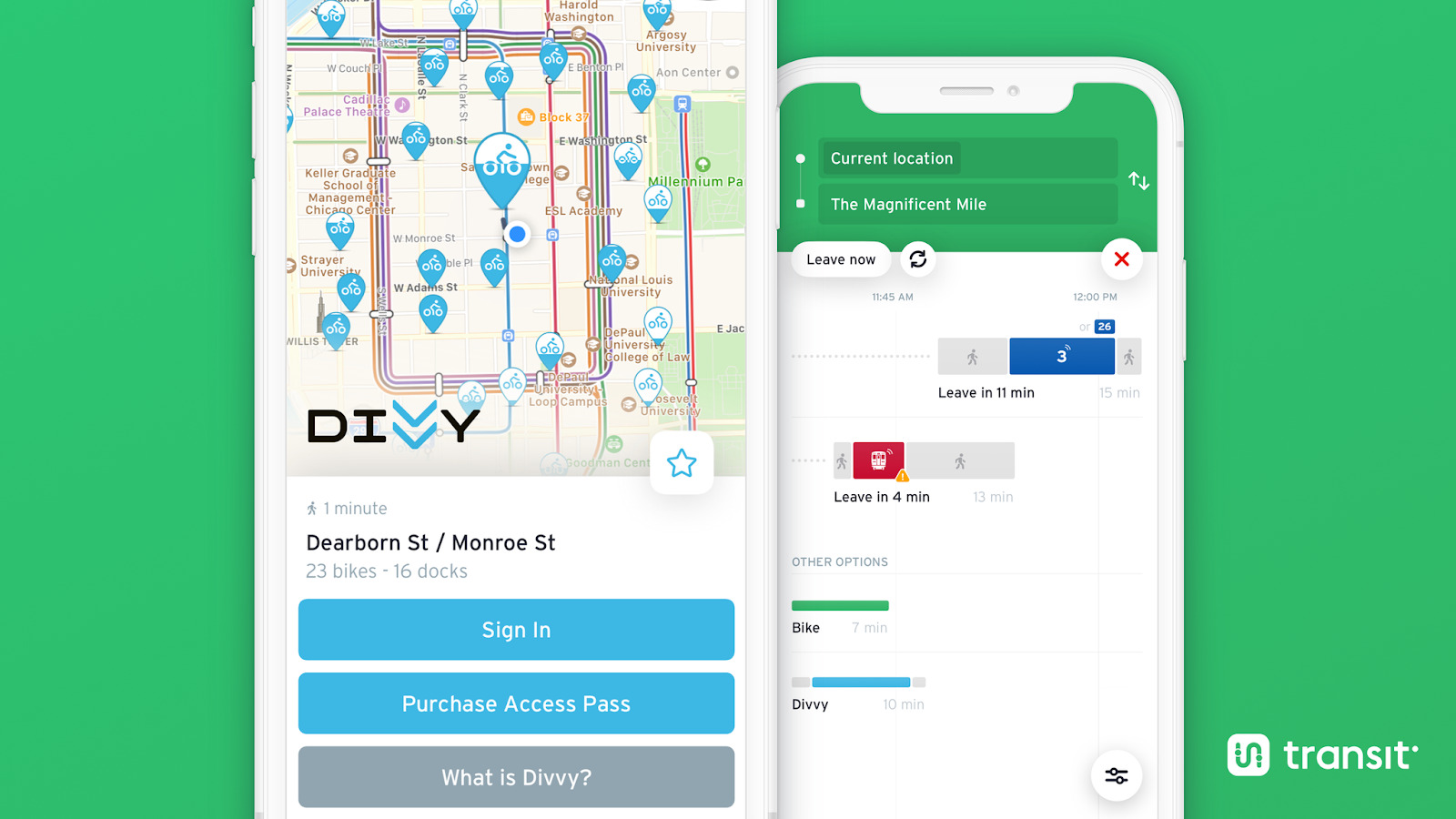

Transit is an app that lets users buy access to a similar suite of services in cities across North America, right as you’re planning your trip — plus you can compare your preferred mode with other options. (I work for Transit Inc., the app’s maker.)

In some cases, like Toronto’s bikeshare, the fleet operator has no app of their own, and relies on outside apps (Transit and Cyclefinder) for letting customers buy ride passes through an app. In-person kiosks are also available next to designated bike parking areas.

Cities like Washington, DC increasingly require operators to publish vehicle locations in real-time to make it easier for users to find the closest scooter. Third party apps like Transit use that data to show their users nearby scooters; to unlock the scooter, the user is prompted to download the relevant app, where the ride can be started.

With the integration of your fleet in an app like Whim or Transit, users can seamlessly book your scooters, with one app instead of several.

Third party integrations offer a few benefits:

- Instant exposure to the user base of the third party app

- Streamlined account creation, due to name and payment data already being stored

- It eliminates the need for a user to have an app for each service — in DC alone, there are 6 operators, each with their own app

- The operator no longer needs to maintain their own customer-facing app; public transit agencies and some bikeshares have already learned this lesson, and rely on the likes of Citymapper, Google Maps, Moovit and Transit

- Users can compare between travel modes more easily, especially with Transit’s trip planning and public transit integration

- Payment processing is handled by a third party, so you don’t need to go through hoops to get and secure payment data yourself

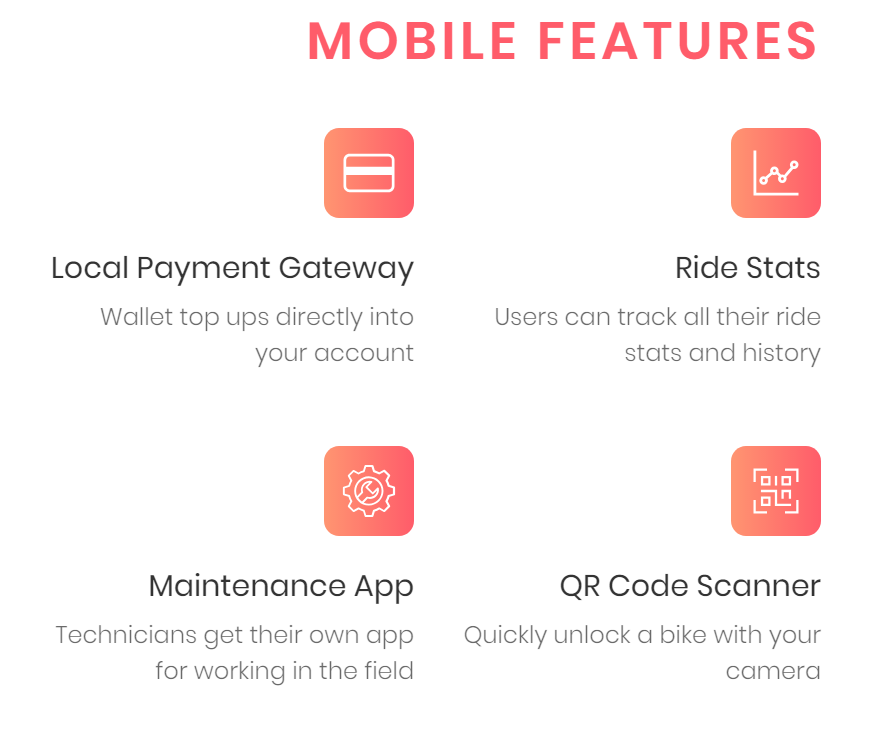

Alternatively, Joyride offers a white labeled app and payment processing as part of its product. Joyride aims to offer all the app features you’d find among say, Lime or Bird, from rider statistics and QR code unlocking to vehicle tracking and and support alerts, for $5 or less, per month per vehicle.

Invers offers a similar software suite, complete with an operator dashboard and a white-labeled app for riders. Its service is used by dozens of firms, including the “moped” sharing service Emmy with over 1,000 vehicles across Berlin, Hamburg, Dusseldorf and Stuttgart.

While Joyride, and Invers are new to kick scooter sharing, the software essentials of operating a dockless car, bike, moped or scooter share are much the same; the scooter sharing operator, however, will have to pay closer attention to maintaining vehicles left out on the road, compared to the operators of cars and mopeds.

Operations: Rebalancing, Recharging, Repairs

Unlike writing software, your day to day fleet operations don’t have the same high upfront costs, and they increase as you get more scooters. Outsourcing your operations won’t have the same pressing advantage.

Even so, a third party ops crew may have an efficiency that single small firms don’t. Consider garbage collection — the trash company with the lowest cost to service you will be the one that already serves your next door neighbor.

In the future, third party logistics could manage more scooters in a given area than any single operator. That means less time traveling between scooters, and consolidating recharging and repair facilities under one roof. They may also have warehouse space available on short notice, making it easier to enter new markets on a trial or seasonal basis.Third party logistics (3PL) are already widely used in the business world at large.Sweep Crew is one such player focusing on end to end logistics solutions, and currently works with scooter share Spin among others.

New York’s bikeshare Citi Bike has pioneered ride credits and prizes for users who rebalance bikes; we may see similar rider incentives from operators, offering free rides in return for say, fixing someone else’s bad parking job. Conversely, Bird famously offers ‘bounties’ for gathering and recharging scooters.

Between third party logistics, rider incentives, and ‘gig workers’, operators have a number of options besides hiring their own staff, and each option must be weighed if you’re thinking of starting an electric scooter rental business.

The Correction is Coming

There is no billion dollar opportunity for newcomers to the electric scooter rental company industry. Recent press reports suggest Lime’s and Bird’s valuations are flat since last year, despite their massive growth in ride volume. Many suspect that operators are having trouble making money on a per ride basis, let alone with the cost of overhead. Average rides per user has been under 2 per month (see Christchurch, Charlotte and Waterloo, Ontario, for example). Lime recently reported 34 million rides among 10 million users – a lifetime average of 3.4 rides per user after less than a year or so of offering scooters.

Meanwhile, Uber and Lyft have lost billions year after year in ridesharing, and there’s little evidence yet that their large existing user base will advantage them in the scooter saga. In places like Los Angeles and San Diego, Lyft and Uber haveundercut existing players on price in a bid for relevance.

Here’s a paragraph by Yves Smith worth considering:

“Uber also has much higher overhead costs: vastly better-paid employees, in prime office space, engaged in activities that a local cab company either rarely or never has to handle, like driver recruitment (Uber has recruitment centers), public relations and advertising, litigation, airfare, and other costs of running a global operation.”

That’s true of Bird, Lime, and Lyft as well, who are based in those frugal bastions Venice Beach and San Francisco. They have a headcount far beyond what you’d need for the nuts and bolts of a scooter fleet.

These companies have spent money not only on infrastructure like their app, but also appear to have subsidized the rides themselves, the thing meant to turn a profit. The current scooters lack durability, as well as protection from vandalism and the elements. In a bid for financial viability, the operator Skip has raised per minute prices 67%, from $0.15 a minute to $0.25.

Bird and Lime in particular have deployed in dozens of cities without apparent profits per ride, while Lyft and Uber scooters are in fewer than 15 cities. Whether they are being more judicious about deployments, or simply lack the supply to keep up with Bird and Lime, is unclear.

Why would Bird and Lime burn money on subsidizing rides, instead of say, biding their time to design more rugged, cost-effective vehicles? It’s the venture capital (VC) pitch — that once someone downloads your app, signs up, and takes their first ride, they’re yours!

But there’s little evidence this is actually true — that customers will be loyal enough to pay more, to cover your initial ride subsidies. Especially once seamless integrations proliferate, as we saw with Whim, Moovel and Transit, and with the third-party ecosystems generally. In ridehailing, the share of users routinely riding with both Lyft and Uber is steadily increasing.

I may not be the only skeptic — investor enthusiasm in scooters is abating, and Bird’s valuation did not increase markedly in funding rounds 6+ months apart. As the VC cash river dries up, operators will have to charge more to stay afloat, wring out equipment failures, and/or lay off staff. Admittedly, this correction has been building for the better part of a decade, beginning with Uber and Lyft.

Uber’s presence can seem omnipresent, ubiquitous… inevitable. In reality, Uber has retreated in the face of local competition in markets around the world, from Russia to China to Southeast Asia. Size and spread is no guarantee of survival.

What’s Your Edge?

If everything can be outsourced, what’s left?

A new electric rental scooter company can avoid the bloodletting by deliberately remaining a bare-bones operation, and outsourcing when it makes sense. Let the bigger players blaze a trail, while you avoid their costly mistakes. Or be a vulture, and acquire rights to the software of a failed operator; getting to market first means solving lots of costly problems yourself — like vandalism, legal penalties, and vehicle design failures. Bigger operators may not even want to go after cities that don’t warrant 500+ scooters.

As a smaller operator, you may need a niche that gives you space to turn a modest profit. Maybe you use the scooters as bait for an even bigger product, much like trains were used to increase the value of land nearby. (Notably, Lime has received investment from real estate groups.)

Here are some possible niches for a smaller player:

- Corporate fleets, university campuses, stores, resorts & hotels, retirement villages, property managers.These partners may not need to turn a profit, and just want the scooters as an amenity to market their main product. They may even offer discounted or complementary vehicle servicing, like charging the scooters

- Tourist attractions, like beachside rentals

- Smaller cities that offer exclusivity in return for lower pricing or special branding / customization

Here’s what you won’t be doing, if you want to stay solvent:

- Deploying without city permits: the city will punish you, and you can’t afford to lose scooters and pay fines

- Using untested, non-durable hardware: existing scooters last a month or two, if they aren’t vandalized first; your scooters will likely have to last ~6-9 months to break even on ride revenue (based on Louisville, KY and Austin, TX data)

- Opening in every city that will have you, where you have little insight

- Putting out vehicles in conditions they weren’t designed to tolerate, and which expose riders to dangerous circumstances

Bird evidently has already caught on to the appeal of an easy-bake electric scooter rental business — itsplatform will provide the hardware and software, in return for 20% of ride revenue; you cover the scooter hardware and city permit costs, and you get to brand the scooters as you like. This squeezes the competition with more rival scooters, without all the capital and compliance costs for each whip. A one-stop shop solution like Bird’s could be a good match for people who just want to provide a service or advertise their brand, rather than make money off of it directly.

In early 2019, the third-party ecosystem will still be a patchy affair; the big players will still be content with operating losses — Uber has committed tospending $1b in 2019 on ebikes and scooters in 2019. As the ecosystem matures and the Lyft/Uber IPOs occur, 2020 and onwards is where things get interesting (and maybe even viable)…

Asher Meyers is an admirer of car-free cities and efficient transport, and currently works as an analyst at Transit in Montréal; he formerly lived in Los Angeles as a cost analyst in the aerospace industry. He can be found onTwitter andMedium.

Article sponsors:

Joyride, a company that helps you launch your scooter or bikeshare. Learn more about Joyride here, and make sure to contact Harry Campbell if you’re interested in an introduction.

& Ed Walker, insurance expert. If you need insurance for your scooter startup, contact Harry Campbell. Harry will introduce you to Ed, who helps startup transportation and micromobility companies create custom insurance policies.