A lot has happened since Uber and Lyft were founded, but one thing that has remained constant: the economy has been doing well during most of their growth phase. Every traditional metric – GDP, stock market and unemployment rates – has shifted healthily since both companies launched their ridesharing services in 2013 and 2014.

Cue March 2020: With Uber and Lyft badly hurt by state and city quarantines due to the coronavirus, what does the future hold for Uber, Lyft and rideshare in general? Will the gig economy survive an economic downturn?

It’s hard to say how bad this economic downturn could be for the gig economy without knowing how long quarantines will last. If restaurants, bars, events, and travel is shut down for a month, it would be bad – but not as bad as all of that being shut down until the fall.

While I’ll refer primarily to Uber from here on out (since they’re the top dog in the rideshare world) a lot of the same dynamics should also apply to Lyft. They tend to follow in Uber’s footsteps anyways.

Important note! If you’re looking for work but can’t drive for Uber/Lyft due to reduced demand, now is the time to sign up for the best food delivery job companies like Instacart! Instacart is ramping up hiring of drivers and is even removing issues like low-ratings for drivers. Sign up for Instacart here and, while you’re at it, sign up for Amazon Flex too!

How does Uber affect the economy? It depends on what you’re looking at.

Both Uber’s riders and drivers would be affected in different ways and at different times in a financial recession and I’ve broken it down into a few phases below:

Phase I – Early Warning Signs

In a financial downturn, capital markets are affected before labor pools (labor/employment is a lagging economic indicator). In other words, companies don’t start firing employees en masse at the first sign of economic instability. They’ll wait a few quarters and see how things shake out but in the meantime, it may be harder to raise more debt, yields on junk bonds will go up, etc.

Riders won’t be directly affected by much of this, but any changes to their discretionary income will cause them to make some small cuts on non-essential trips. As drivers, we know that most Uber and Lyft rides are for pleasure (or really just revolve around drinking), or out of convenience (i.e. Uber in the rain instead of walking) and when money is tight for riders, these expenditures would be the first to go.

Right now, because of the pandemic, the economics of driving for Uber aren’t looking good. Because of quarantines and restrictions on travel and gatherings, many riders are avoiding going out at all – and that includes taking rideshare rides.

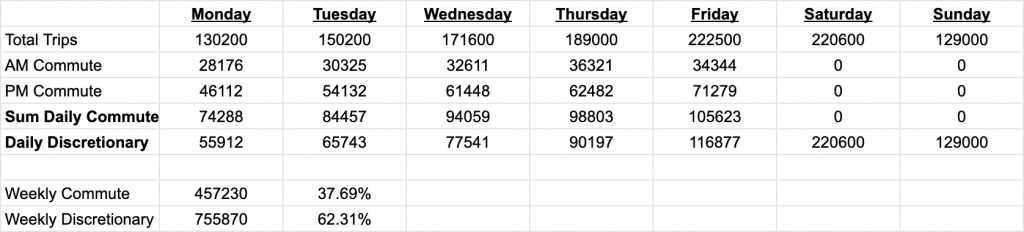

There isn’t a ton of data out there to confirm the percentage of commuting rides vs. discretionary rides but I did stumble upon an interesting data set from the SFCTA that included all the Uber and Lyft trips in San Francisco during a short period in 2016. You can review my assumptions and math here but here’s what I found:

Less discretionary spending means fewer rides to the bars/restaurants/etc., and riders will opt for cheaper modes of transport or just stay home completely. This will cut into a majority of Uber’s trips and accordingly, drivers will see fewer trips.

Uber could easily adjust their marketplace for the lower demand though by lowering weekly driver incentive bonuses. That would lead some drivers to cut back on hours or quit and then the marketplace is back in balance.

This phase of a financial recession could actually improve Uber’s unit economics since they’d be able to pay drivers less (lower bonuses) without taking a huge hit to their demand.

Unfortunately, while the above is true during a simple recession, what is happening right now does not look like a regular recession. People are being forced to cut back on discretionary trips – which looks now to be triggering a regular recession of job loss, loss of discretionary income – and fewer trips. The difference to the gig economy this time around is that drivers are also being forced off platforms – they’re not leaving because of cuts to pay.

Phase II – Lots of New Drivers Pile On the Platform

If the market crashes, people will start to lose their jobs and for many, discretionary spending will drop to zero. So on the rider’s side of the Uber platform, we’ll see:

- Fewer discretionary trips.

- Uber will start to lose some of its weekly commuting trips due to a combination of people losing their jobs and other workers tightening their belts.

- Uber would also lose a portion of their business travel as companies cut back on discretionary expense accounts and other perks, a not insignificant part of Uber’s revenues.

For all those recently laid off employees, driving for Uber will now be the perfect temporary gig or stopgap. In the midst of a downturn, Uber will have a glut of drivers to choose from and a huge oversupply. This will allow Uber to lower driver rates even further in order to stimulate more rider demand or take a bigger spread on fares.

Phase II is good for new drivers in that they’ll have a job, but bad for existing drivers since they’ll obviously be making less money and face more competition. In a good economy, about 2/3 of all drivers quit after just 6 months, but that’s because they have better options or don’t need the money. In a bad economy, churn will decrease for Uber since a lot of those drivers won’t have better options.

In this phase, we can really see Uber’s impact on the economy. Once things get back to normal and people are allowed to gather, go to restaurants, etc. expect to see a glut of drivers on the road. These will be the former restaurant and hospitality workers who lost their jobs when businesses closed because they couldn’t stay open with no demand.

Those drivers who stay on the platform will also see reduced demand because of the reasons outlined above.

Related: 7 Reasons Why Uber and Lyft Drivers Are Quitting Rideshare!

Phase III – Prices Spiral Downwards – Will This Be an Uber Recession?

As things get worse in the economy, it will get easier for Uber to recruit drivers and theoretically, they could continue to lower prices if there are enough drivers willing to work for less and less. As long, of course, as the quarantine is lifted and people are allowed to gather.

But there has to be a price floor since part of a driver’s pay goes to maintaining their vehicle right? Not necessarily.

One phenomenon we’ve already seen is that many drivers today have no idea how to calculate the cost of running their vehicle. So they’re effectively trading depreciation on their vehicle for cash today. And to be fair, it’s a tough problem to figure out – even Uber messed this one up with their failed attempt at Xchange Leasing.

Since personal vehicle ownership in the US is high, during a recession, you’ll have a bunch of recently laid off workers with cars but no job. And since all you need is a pulse to drive for Uber, they’ll have an easy way to make quick cash. So with a huge supply of drivers, Uber will now be able to continue to lower rates to spur more demand.

And when Uber lowers rates, drivers actually shoulder a majority of the cost since Uber takes a fixed fee from every ride and then lets the driver keep 75% of the remaining amount. So on a $10 ride in Los Angeles for example, Uber takes a $2.30 service fee right off the top and then pays the driver 75% of the remaining $7.70. So Uber gets to keep $2.30 + $1.93 = $4.23 while the driver only gets $5.77 on a $10 ride.

If Uber were to cut rates by 10%, then that same $10 ride would now be $9.23($10- $7.70*10%) because the service fee would still be $2.30. With a rate cut of 10%, Uber would now make $4.03 ($2.30+$1.73) or 5% less on every ride. But the driver would make 10% less = $5.20. Effectively, any rate cut is felt twice as hard by drivers. And if a 10% rate cut generates 5% more in demand, Uber would break even but drivers would get screwed. Not to mention the fact that drivers are working harder and putting more miles on their cars, even if their utilization goes up.

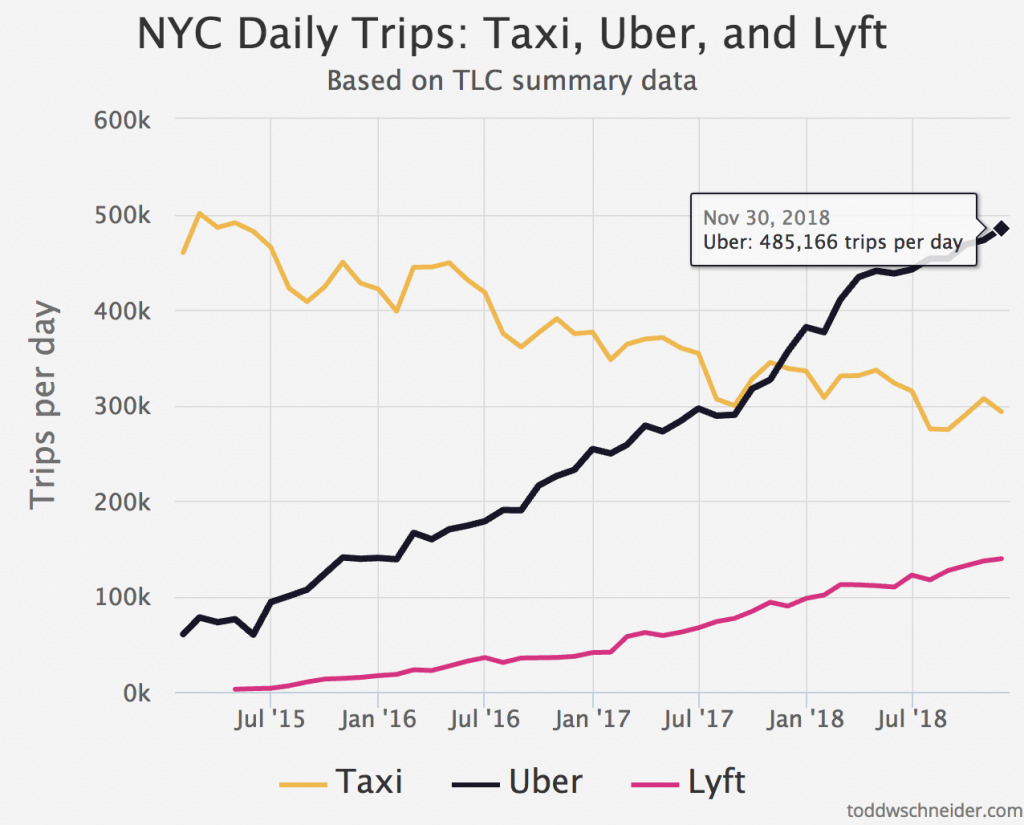

I’ve seen some people (at Uber) say that Uber is recession-proof but I don’t think that’s the case since Uber is really a luxury service and luxury services get cut in a recession. If you think back to the days before Uber, it was more of a hassle to get around but people got by just fine. The data in places like New York shows that Uber has eaten into some taxi trips but a majority of their rides did not exist just a few years ago.

In Jan. 2015, taxis were doing nearly 500,000 rides a day but today, taxi rides have dropped to 300,000 per day, yet Uber is doing 500,000 per day. So where did the extra 300,000 trips come from?

In a recession, I don’t think Uber/Lyft passengers will go back to taking taxis since there’s no financial benefit to do so, but I do think people will go back to cheaper modes of transport like public transportation, walking or even calling a friend for a ride from the airport instead of taking an Uber.

Would A Financial Recession Make Uber Profitable?

It seems clear to me that drivers will get squeezed in a financial downturn but remember, Uber is a company that is ten years in and they still lost $1.1 billion in Q4 of 2019. They’re investing a ton of money in micro-mobility and self-driving cars, and I still don’t believe their core rideshare business is profitable due to all the weekly incentive bonuses for drivers and the offers they continually send to passengers.

A downturn will allow Uber to squeeze drivers some more but it won’t do much to improve their shaky P&L. There are limits to the discounts Uber can offer to offset shrinking consumer demand and there will still be competitors like Lyft to deal with.

In early 2020, Uber initially said it would expect to be profitable in 2020 (while expecting a full year loss). Now, it looks like that profitability promise is nothing but a pipe dream, no matter how long this recession lasts.

I like the way Columbia professor Len Sherman summed it up: “the predicted recession in our future is likely to cause a lot of shared pain, and for Uber, who hasn’t been able to make money in the best of times, a recession will likely prove very damaging.”

Readers, what do you think will happen to Uber if the economy goes downhill?

-Harry @ RSG