Harry here. Today, RSG contributor Christian Perea takes a look at an interesting trend we’ve been noticing over the past year. Maybe you’ve noticed it too so feel free to chime in in the comments section below.

It’s no surprise that Lyft changes a lot. But in the last year and a half, it seems like a lot of those changes have brought them closer in line with Uber. Why is that?

Well, for one thing, Uber is winning. Hard. They dominate market share and have compiled a war-chest of cash to fight anyone or anything they perceive as a threat.

Say what you want about Uber, but they are aggressive, efficient, and effective. Lyft realizes that it needs to emulate a lot of this or risk dying off. Lucky for them, they can benefit by learning from some of Uber’s mistakes too.

Some of the recent Lyft changes (to be more like Uber) have been unpopular, like raising driver commissions and lowering prices, but not all of them are necessarily bad.

Here are the 7 changes Lyft made to make them more like Uber:

1) Increased New Driver Commissions to 25% Instead of 20%

Source: Lyft Commission Structure

A lot of drivers were not really upset about this because well…it didn’t affect drivers already on the road. In fact, some openly welcomed it as they figured it would prevent new drivers from saturating the Lyft platform.

A lot of drivers figured it would just translate to 5% commissions if they got the Power Driver Bonus. Hopefully in the future they don’t try to weasel their way into pushing the 25% onto existing drivers. This sentiment was similar when Uber switched their fee from 20% to 25% until they started finding ways to push the higher fee onto existing drivers (i.e. if they go inactive for a period of time).

2) Price Cuts: Tit-for-Tat Against UberX

Lyft followed Uber quickly in the latest round of price-cuts and matched Uber’s new prices almost cent-for-cent (but not in Detroit).

Uber has led the price-wars over the past several years, and Lyft claims that this has forced their hand in matching prices. I know a lot of drivers try to present an argument that “Lyft could be a higher quality, slightly more expensive service” but unfortunately most passengers don’t care about glowstaches nearly as much as they care about saving sixty cents on their ride.

Lyft has tried to soften the blow in the past with no commission promotions (which actually ended up turning into the PDB) and providing 50% off fares in certain markets, but these promotions were only temporary.

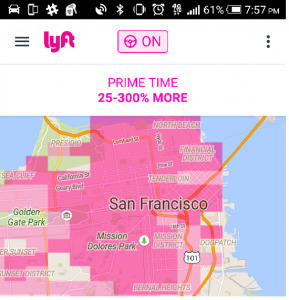

3) Quietly Uncapped Prime Time to Be More Like Surge Pricing

This is an obvious win for drivers. In the past, many drivers would log off of Lyft as soon as surge got higher than 3.0X (200% PT was the old cap and it equaled 3.0X on Uber). To put it bluntly, Lyft’s dynamic pricing structure has long been terrible compared to Uber surge in so many ways (like not being able to see if a ride is on PT – you still can’t do this on Lyft actually).

But even with PT problems, the uncapping of PT could provide a much needed boost to drivers during big-events and holidays. It will also ensure that drivers are available during these major rushes.

We may even get to see more headlines of people taking expensive Lyfts on New Years Eve, because the news can’t seem to get over that story after running it 4 years in a row.

4) Power Driver Bonus: 2011 Vehicle or Newer

A lot of the Lyft loyalists have had a lingering anxiety about the Power Driver Bonus disappearing since it first came into play about a year and half ago. Sometime in December, Lyft announced a restructuring of the PDB, which most drivers were okay with…. except that only those with 2011 or newer cars would qualify – which seemed to go against what many perceived as the ethos of the company.

This is becoming more like Uber because it reinforces a sort of Uber image of providing a “baller on a budget” product versus “your friend with a car”. It also ignores a lot of drivers who have worked very hard by spending close to 50 hours a week in their less-than-new cars. Personally, I think anybody who can sit in a car for that long deserves a Power Driver Bonus. Especially since they are likely to know the road, the laws, and how to do their job more efficiently.

In a strange twist, Uber is now testing a Power Driver Rewards program in San Francisco. So, sometimes Uber copies Lyft as well.

5) Announced Autonomous Vehicles As Part of Their Future

With General Motors’ recent $500 million investment in Lyft, a vision appeared of combining Lyft’s software/brand with GM’s R&D on autonomous vehicles to compete with the likes of Uber, Google, and Tesla. Within a week of the investment, John Zimmer was on Re/Code talking about self-driving cars that offered an “experience”.

This doesn’t come as a surprise to me, but some people (and Pando) interpreted it as Lyft adopting the same stance as Travis Kalanick’s infamous “other dude in the car” statement.

I figured Lyft would eventually have to take a stance on autonomous vehicles to remain relevant and not sound disillusioned to reality. I still don’t think we will see autonomous vehicles for at least 5-10 years, so my take is that a lot of this was playing up the GM/Lyft partnership in the press.

6) Positive Lyft Changes: They Ditched the Giant ‘Stache and Fist-Bumps

This happened a while ago, but I think it was actually a really good move on Lyft’s part.

Why? Because America adopted rideshare with the following conversation:

“Let’s call a Lyft!“

“Wait… Aren’t they they the weird ones with the pink mustache on the car? Don’t they make you fist-bump the driver?“

“Yeah, Lyft is kind of weird. OK lets call an Uber. Uber is like Lyft without the weird stuff.“

“Okay cool, I don’t wanna be seen in a car with a pink mustache.“

After Glowstache (and Jesse McMillan)

“That’s pretty cool! I love the glowing lips! Way cooler than Uber and that dumb mustache!!”

7) Local Offices/Local Teams

One of the reasons that Uber grew too tremendously to overshadow Lyft in market share is because Uber deployed a large network of “Uber DMV’s” in addition to local marketing and management teams. They basically launched a bunch of turn-key mini-startups staffed by hungry and competent individuals, and gave them the power to execute. These teams rapidly recruited drivers, recruited passengers, sponsored local events, and basically beat the ever-living-hell out of Lyft’s ‘market everything from SF’ model.

About a year ago, Lyft (finally) realized that they couldn’t competitively manage everything from San Francisco and ponied up the money to launch localized teams in all of their major markets. These teams are specifically tasked with managing the profit & loss, supply, and passenger activations in each market. For the SF local market team, this has involved an aggressive ambassador program that has leveraged the driver base and offered opportunities beyond rideshare driving. Ideally, other markets will emulate this success.

Lyft’s team in LA was able to expand their coverage zone when drivers alerted them to a large event that had been taking place only a few miles from its border. Uber had been able to capitalize on this two years in a row. The GM got it fixed and expanded the service area before the show and even made some arrangements with the event.

Lyft is Still Different From Uber

UberPool vs. Lyft Line Rates

Uber has started decoupling driver pay for UberPool and paying drivers less than they earn on UberX (here’s an example). These rates have separate rate cards which drivers must agree to within the Uber App before logging in. This means that UberPool now pays less per mile than UberX and Lyft-Line.

Update 5/5/16: Lyft has completely transitioned to Uber Pools model of paying their drivers less per mile and per minute for Lyft Line.

I am adamantly against this because we already do more work for UberPool and Lyft Line while assuming much more risk. Paying less for more work seems like a laughable slap in the face towards worker/drivers. It also opens up an entirely new front in the price-wars where drivers are inevitable casualties.

As this barrier has now been completely crossed by both companies, you can expect the gap to remain narrow at first and I can almost guarantee you it will widen in the next round of price-cuts.

Tipping

“There will never be tipping in the Uber app. It is not going to happen.” – Travis Kalanick

Critical Response Line

When Should You Call It? Read More

Lyft has a Critical Response Line (855-865-9553) that you can call if you get in an accident or if something is going terribly wrong. Uber does not. In fact, Lyft has invested a lot of money in having this line and call center when they could have followed Uber’s lead and continued to stay with email only responses.

Mentor Program

Regarding mentoring, we all know its nowhere near perfect. There are fewer mentors in most markets now with Mentor 2.0 (or whatever iteration they are on). This offered a layer of training and identity verification, and I think it can help weed out some of the crazies.

Gathering Driver Feedback

After prices were slashed in January, Lyft flew in a group of drivers from different markets throughout the US (I was also there) to talk about price-cuts and to see what they could do to make things slightly better for drivers.

This involved several hours of us all sitting around with John Zimmer (President/Co-founder) and Woody Hartman (VP of Operations) bouncing ideas about lessening the blow for drivers after price-cuts. Someone suggested getting rid of the Prime Time cap, and that’s where that came from.

John Zimmer also sent out a letter a few weeks later announcing some of the ideas, and acknowledging that it would be unpopular with drivers. This is much different than the classic “you’ll earn more with lowered prices and more rides!” slogan. Can you imagine Travis doing that?

It was definitely cool of Lyft to not only solicit feedback from drivers but also act on it.

My Take

On a macro level, these Lyft changes seem to be addressing the harsh realities of the industry and acknowledging that Uber controls the industry through its massive market share. Many Lyft changes are because they have to do certain things, like matching Uber prices, or raising commissions to capture a higher percentage of revenue reflect the competitive nature of the market. Otherwise, they risk the ire of investors, thus driving them into the arms of their biggest rival. So in this light, it’s a more pragmatic and mature company.

But The Mustache Company also risks remaining in a permanent second place to Uber if it follows too closely. If they are too much like Uber, they may lose any distinction they have from them as a service. If everything is the same, why would anyone waste their time with second place?

Drivers, what do you think about Lyft and their assimilation with Uber? Have you noticed that Lyft is becoming more like Uber, and what do you think they can/should do to distinguish themselves?

-Christian @ RSG