Recently, the news dropped that by the end of the year, the James River Group will no longer provide insurance for Uber. What does this mean for drivers? RSG contributor Paula Gibbins breaks down the latest below.

On Tuesday, the James River Group announced it was cutting ties with Uber. Is this a good thing or a bad thing for drivers? Are drivers still covered? Who will replace them? We’ll be answering all these questions as best we can and more! But first, a little background.

Background on James River Group No Longer Covering Uber

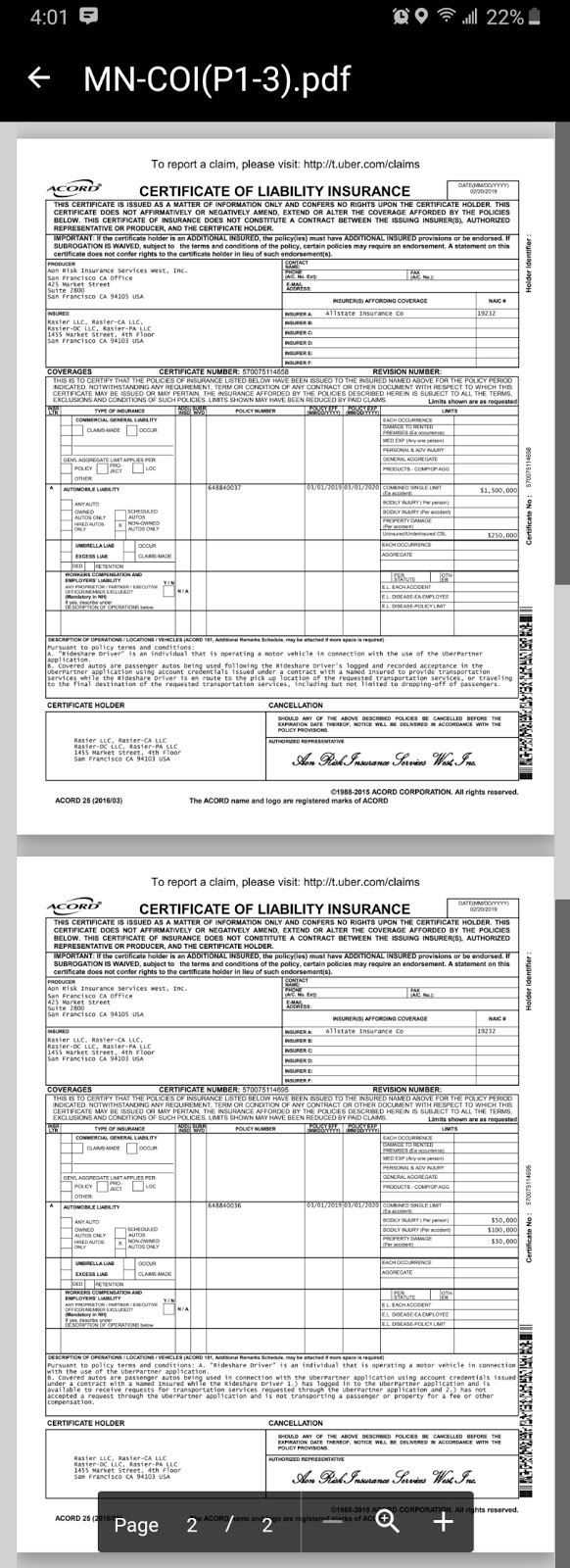

Uber only covers their drivers while passengers are in the vehicle or once you’ve accepted a trip and are en route to pick them up (And for the other times when Uber drivers are active on the app, it’s a good idea to have a rideshare endorsement through your insurance carrier.) This insurance coverage needs a company to be the underwriter. The underwriter chooses who and what the insurance company will insure based on risk assessment. In some states for Uber, the underwriter is Allstate, Farmers Insurance Group or Progressive Corp. For others, that underwriting company is James River Group.

James River Group has been providing commercial insurance coverage for Uber drivers in 20 states as well as Washington, D.C. and Puerto Rico through Uber’s subsidiary Raiser LLC. The policies affected are with Raiser, Uber’s commercial auto insurance business, and the changes will take place on December 31, 2019, which is earlier than the expiration date of many of the policies that were due to expire on February 29, 2020.

The announcement came through on Tuesday, October 8 after James River issued a notice of early cancellation. The reason for the seemingly sudden change is that it hasn’t been as profitable as James River Group had expected it to be.

J. Adam Abram, chairman and CEO of James River said in a statement, “This account has not met our expectations for profitability, and we think it best to terminate the underwriting relationship as of year-end.”

So, no surprise there. Uber isn’t making them enough money, so they are ending the contract early — at a cost — to make sure they are focusing on more profitable endeavors.

What Does This Mean for Drivers?

Here at the Rideshare Guy, we’ve heard of many (if not most) instances where drivers have been very unhappy with James River Group and the handling of their claims. For those drivers, this might be a change for the better. No one will know for certain until the change has been completed and we see where everything lands.

What this really means for us right now is that drivers will be covered until the end of the year by James River Group and then Uber will have to pair with another company in those 20 states, Washington D.C. and Puerto Rico by the end of the year. No one knows for certain which company that will be at this point, but since there are other states where Uber uses Allstate, Farmers Insurance and Progressive, those are some potentials.

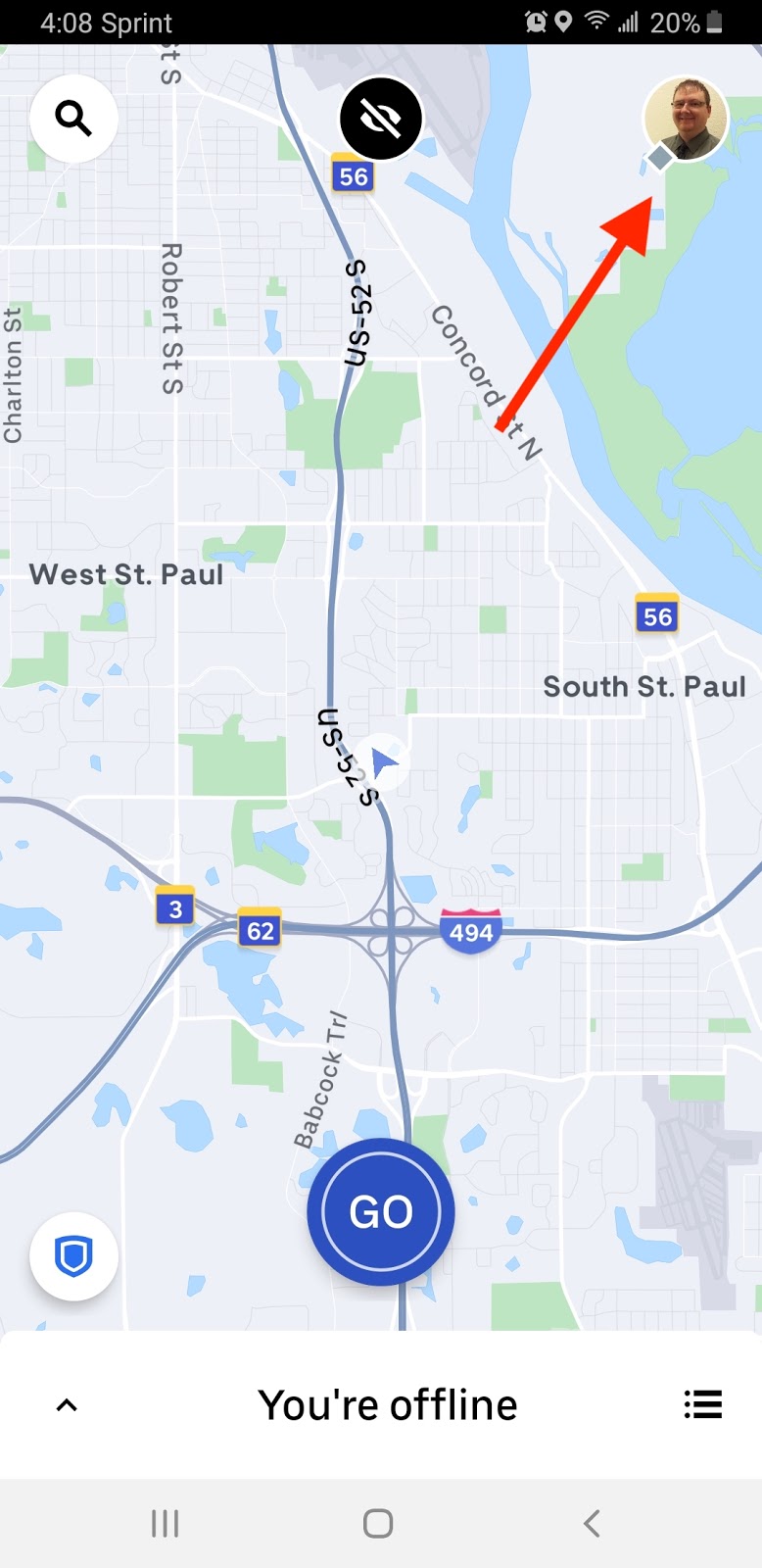

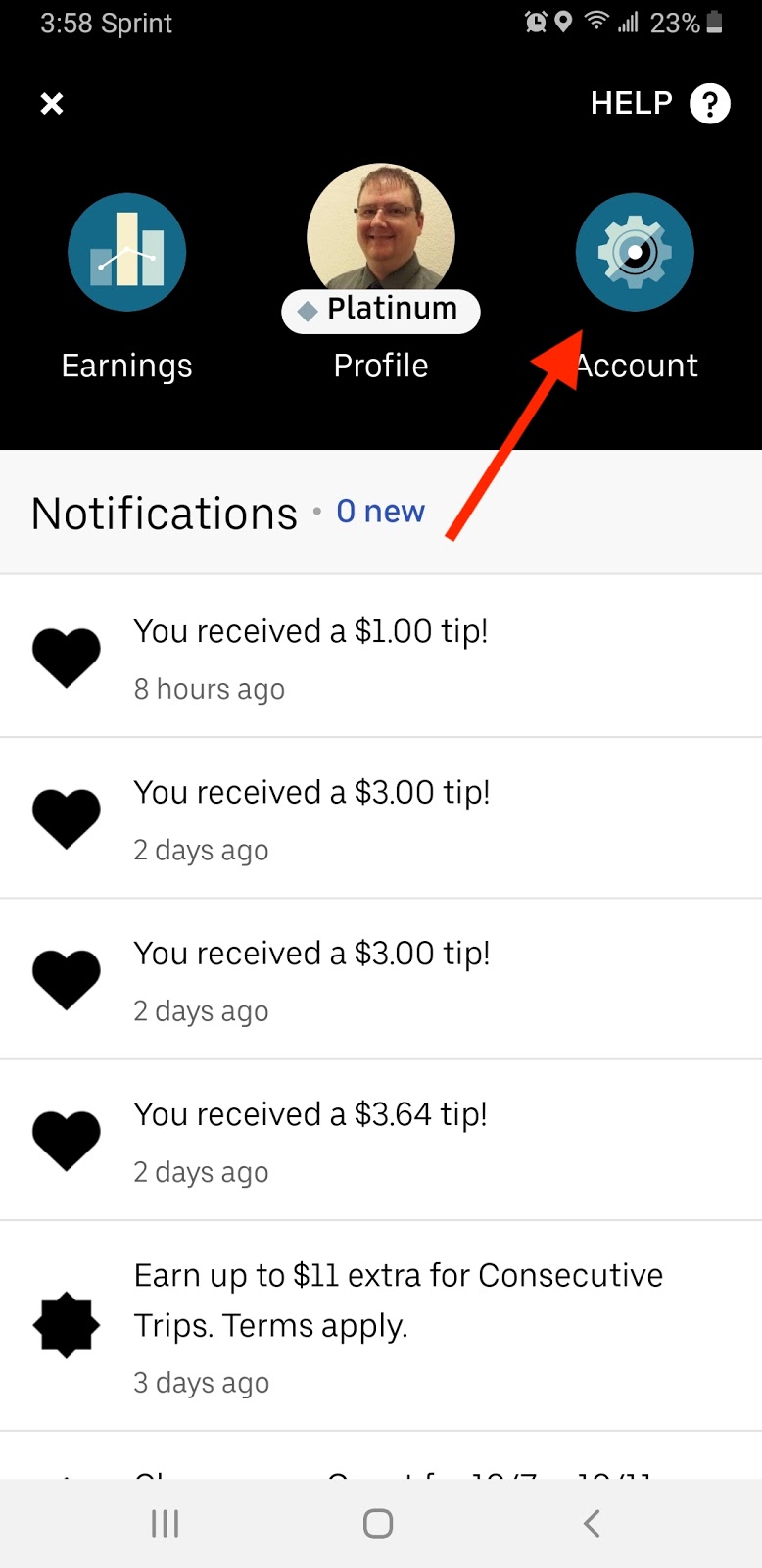

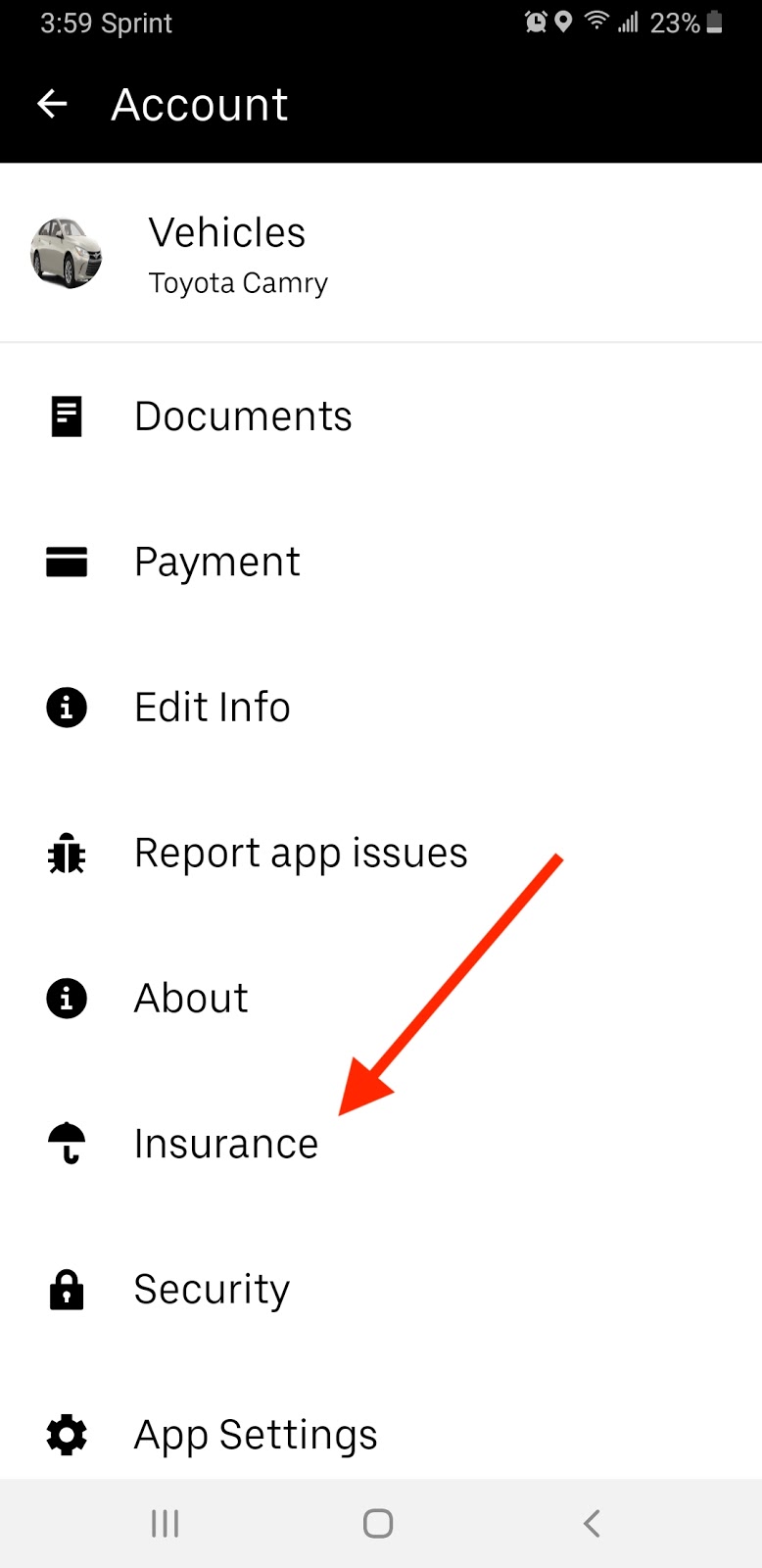

If you’re not certain if you’re covered by James River or another company currently, here’s the step-by-step process of how to find that in your Uber Driver app:

1. Click on your profile picture in the upper right-hand corner.

2. Click on “Account”

3. Then click “Insurance”

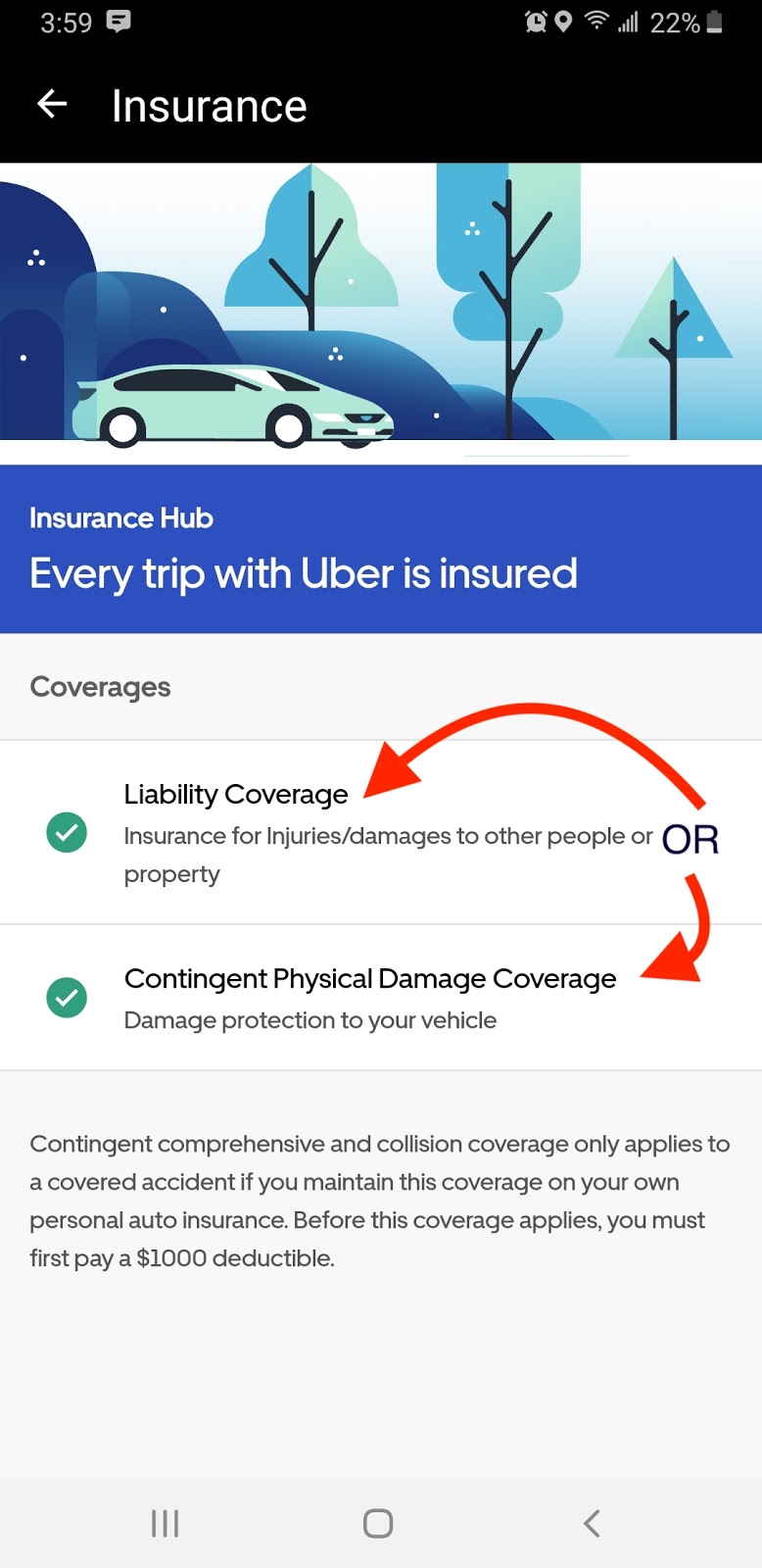

4. Choose either “Liability Coverage” or “Contingent Physical Damage Coverage”, depending on your needs.

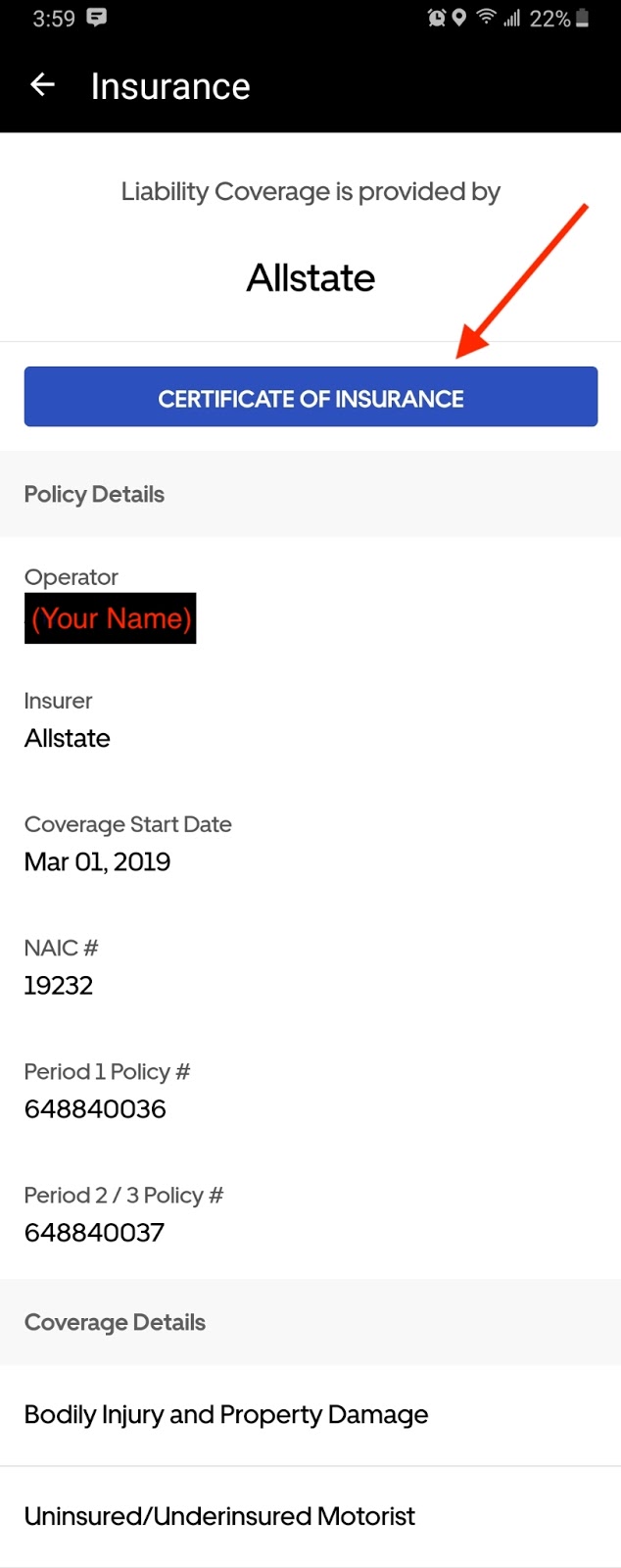

5. From there, the top will show you who your coverage is provided by. In my example, for us here in Minnesota, we’re covered by Allstate. If you want to view the certificate of insurance, click on that button to bring up the certificate.

Basically, as an average driver, you won’t really notice any real difference. The only ones who will really notice anything has changed are those who have gotten into an accident and had to deal with James River Group in the past, and if they get into an accident after a different company has taken over for those services.

Since Uber works with other companies in other states, there shouldn’t be any monetary difference to you as far as how much Uber takes out of driver’s pay in the form of Uber fees in part to cover this type of insurance coverage.

Ad: save money on evert gallon of gas you buy by using the GetUpside app

It will NOT affect your ability to drive for Uber. There is still currently coverage through James River as there has been since they were hired, and once the contract is up at the end of 2019, Uber will make sure you’re covered through another company.

All of this is a great reason to always have your own rideshare insurance – you can find more information about rideshare insurance here.

Have any other questions about this change? Let us know in the comments below!

-Paula @ RSG