Considering getting a new car? If so, you may be wondering if it’s better to lease vs buy a car. There are several key factors to consider in the lease vs buy debate, and RSG contributor Chonce Maddox-Rhea breaks it all down below.

Quick summary:

- Considering leasing a car? Keep in mind, many leases have mileage restrictions, which will limit how much driving you can do

- With a lease, you could potentially get a nicer car – at a cheaper monthly price

- Choosing lease vs buying a car depends on your lifestyle, too

Why Would You Lease a Car vs. Buy?

Should you buy or lease your next car? While a lease isn’t permanent, according to Consumer Reports, more people are choosing a lease over getting a car loan. The choice really comes down to a few key factors.

These factors include:

- How much you plan on using the car

- Long term cost

- Your lifestyle

You’ll want to determine how much you plan to use the car and what will be less expensive to you overall and provide the most value. There are pros and cons to buying and leasing. While some people swear by one over the other, it’s important to truly understand what it means to lease a vehicle and why this may or may not be the best decision for your current needs.

An Example of When Leasing is Better Than Buying

Leasing a car often allows you to drive a newer vehicle for a lower monthly payment. The average monthly payment on a 3-year lease for a 2017 Mazda SUV is $287.

If you want to drive a newer vehicle with more features and make a smaller down payment, leasing a car may save you some money upfront as opposed to paying tens of thousands of dollars over the life of the loan.

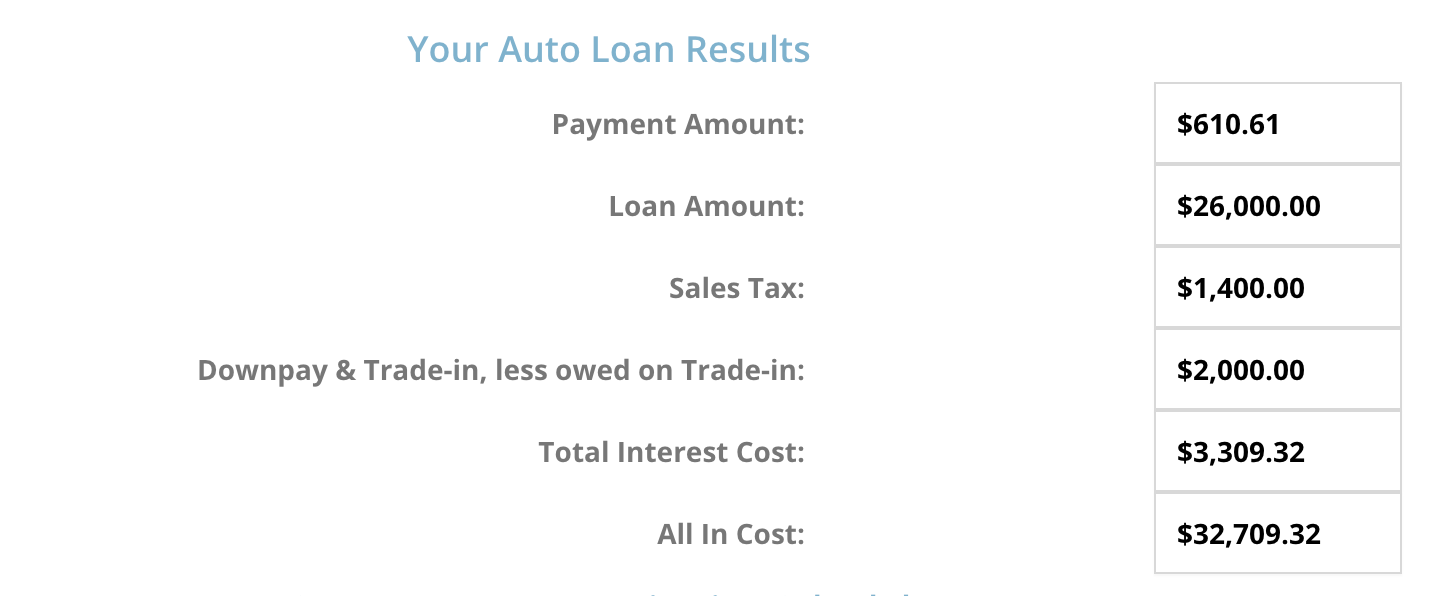

I went to CarPaymentCalculator.net and ran the numbers to see how much a 4-year car loan would cost for a $28,000 vehicle with $2,000 down.

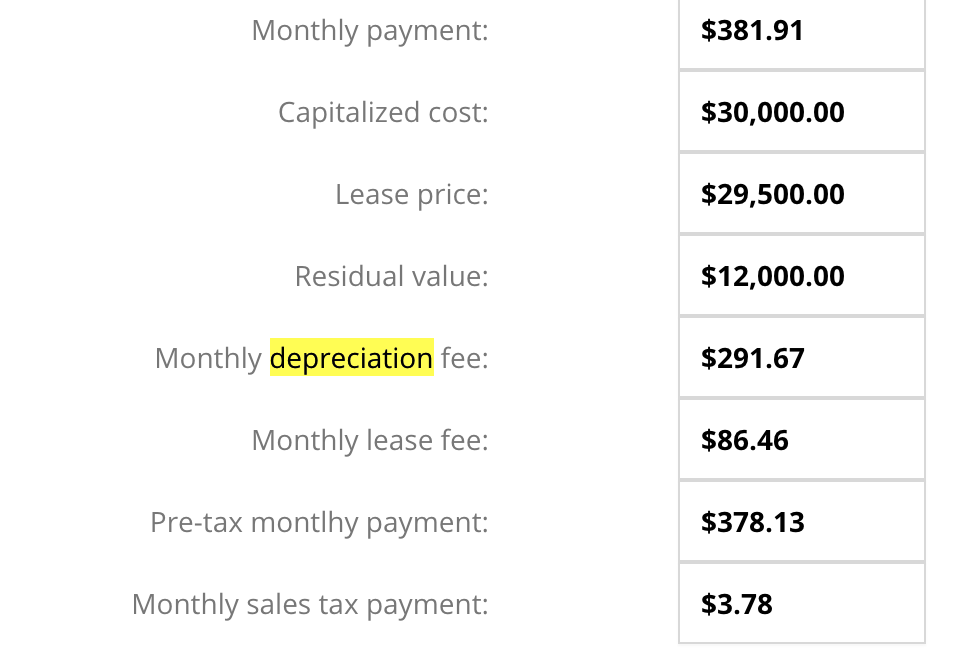

As you can see, the average person would pay around $610.61 per month and over $32,000 over the life of the loan. Let’s say you leased a $30,000 vehicle for 3 years and put $500 down.

You’d pay significantly less, depending on how quickly that vehicle depreciates.

If you’re going to lease a car, it’s best to choose a vehicle that has a slower depreciation rate. All cars will depreciate in value as soon as you drive them off the lot. However, the main factors that impact a monthly lease payment are taxes, interest, and depreciation.

Another reason why leasing may be better than getting a car loan is if you don’t want to deal with a lot of costly maintenance and repairs. Most things should be covered under the manufacturer’s warranty, and this isn’t always the case when you get a car loan. Also, when a lease is up, you get to give the car back and not worry about trading it in or having to resell it.

An Example of When Buying is Better Than Leasing

The key benefit of buying your car is that you’ll own it outright once you pay the loan off. Yes, the monthly payment may be a little higher, but if you have excellent credit, you’ll can score a low interest rate or even a 0% APR promotion. Right now, the average interest rate for an auto loan ranges from 3% to 10% depending on creditworthiness.

When you buy a car vs. leasing it, you’ll also face fewer limitations, especially when it comes to how many miles you can drive.

Most leased vehicles have mileage limits that you must stick to each year or risk paying a penalty fee. If you’re a rideshare driver, this probably won’t be feasible since you may not want to limit how many trips you can take and how far you can travel.

It’s not uncommon for leasing contracts to have annual mileage limits ranging between 10,000 to 15,000 miles. There are some high-mileage lease options out there, but you will pay a fee of $0.10 to $0.30 for each mile you go over. Who wants to pay for the miles they’re driving plus fuel?

Of course, you’ll be solely responsible for all maintenance and repair costs when you own your vehicle. However, you can often deduct some of these expenses on your taxes if you’re a rideshare or food delivery driver.

Buying your car may allow you to have better insurance options as well and be able to lower those premiums over time as your vehicle depreciates.

What’s the Difference Between a Car Loan and a Car Lease?

With a car loan, you’re borrowing money from a lender to obtain a vehicle with the goal of paying off the loan and owning the car outright.

With a lease, you’re basically renting out the vehicle for a set period of time with set monthly payments. At the end of your lease term, you can either buy out the lease by purchasing the vehicle or getting a car loan, or you can start a new lease with another car.

Car loan terms can stretch out much longer than lease terms, which are usually around 36 months. In a lot of ways, leasing or buying a car can be compared to renting or owning a home. With a lease, you’ll receive more assistance when it comes to covering maintenance and repairs, but you’ll have fewer freedoms in terms of how much you can drive and who your insurance is through.

Other Key Differences

- Buying a car can seem more expensive upfront because you’ll pay for the full cash price or make a downpayment while also paying taxes, registration, insurance premiums and other fees.

- With a lease, your payments are often lower since you’re mainly paying to cover depreciation of the vehicle over the life of your lease term. However, if you want to buy the car after your lease, you’ll face a sizeable buyout payment, which could lead to you financing the car anyway to eventually own it outright.

- The biggest drawback of leasing a vehicle is that you don’t have any equity in it. Cars are not the best assets, but when you own your vehicle after paying off the loan, you could sell it for its cash value. Leasing does not provide that benefit.

- Leasing a car could end up being more costly in the end if you exceed your mileage limit, or the car endures more wear and tear than the agreement allows

Should You Buy or Lease a New Car?

Determining whether to lease or buy depends ultimately on your end goal. Do you want to spend less money month-to-month and don’t mind changing your car every few years? Then a lease may be right for you – but you have to be okay with the limitations that come with leasing a car.

If you’re a rideshare driver looking to make the most bang for your buck, a lease probably wouldn’t be the best option since you don’t want to deal with mileage and insurance limitations.

If you take good care of your car and keep up with maintenance, you can likely spend less on repairs over time as your car gets older. Plus, you can deduct some of these expenses on your taxes so long as you keep driving for Uber, Lyft, or another app.

When it comes to financing a car, you want to get the best interest rate, but be careful with 0% APR offers. Often times, when you’re offered a 0% interest rate, you’re paying the full sticker price for the vehicle with no discounts or negotiations. Paying less interest may not be such a huge benefit if you have a much higher loan amount overall.

Take good care of your credit, but also save up a sizable down payment or trade-in your existing vehicle to reduce the overall loan amount. Make sure you can not only afford your monthly payment, but all your other regular vehicle expenses too.

Lease vs. Buy a Car: Pros and Cons

To decide whether leasing or buying is the better option for you, be sure to carefully weigh the pros and cons. This video does a good job of breaking down how much a car could cost you to buy vs. a lease, especially if you want to keep the car.

Leasing

Pros

- Cheaper monthly payments

- Maintenance warranty is often included

- Drive a newer model

- Could potentially qualify for higher tier Uber and Lyft rides

- Don’t have to deal with trading in the car or reselling it once the lease is up

Cons

- Mileage limitations

- You don’t own anything or have any equity in the vehicle once the lease is up

- Early exit fees – You can pay a car loan off early, but if you try to end your lease early, you’ll end up paying a penalty fee

- Some repairs may not be covered in the warranty (so you’ll basically be paying to repair a rental car)

- Can’t alter or make improvements to the vehicle

- Add-ons like insurance are chosen by the dealer and may not be the most affordable options

Buying

Pros

- You’ll own the car outright once the loan is paid off

- Pay off the car early or sell it whenever you want

- No mileage limitations

- More flexibility when it comes to choosing your auto insurance provider

Cons

- Payments can be higher than a lease

- Your vehicle’s value may depreciate faster

- Maintenance and repairs can get expensive if you don’t have a quality warranty

Buying a car will give you much more flexibility and freedom. Leasing is still an option so long as you know and welcome the risks and drawbacks that come with borrowing a vehicle for 2 to 3 years.

Readers, have you ever leased a vehicle and driven for rideshare? Have you ever leased a vehicle before? What was your experience like?

-Chonce @ RSG