I have been writing for RSG for over 5 years now and I have had my battles with the gig companies. Some battles were won and some were lost but nothing makes me more proud of this latest accomplishment.

Information and education is power and that is what we aim to do on the SMTMC (Show Me The Money Club) live stream/podcast.

I am thrilled that we could get roughly 1.4 million gig workers in CA tens of millions if not hundreds of millions of dollars of back pay. David beat Goliath on this occasion, stay tuned, there is so much more to come!

🙏 Special thanks to Pablo Gomez who brought this to my attention and my sincerest to Brian Merchant of the LA Times for amplifying this story and doing it justice. Without him believing in us and undertaking this task, we would not be able to spread the word!

Back Pay for Gig Workers: It Started With a Text Message

I am blessed to do what I do. Over the past year as the host of SMTMC, I have received hundreds of emails and screenshots a week.

Drivers all over the country have become my extra set of eyes and ears to keep these gig companies in check.

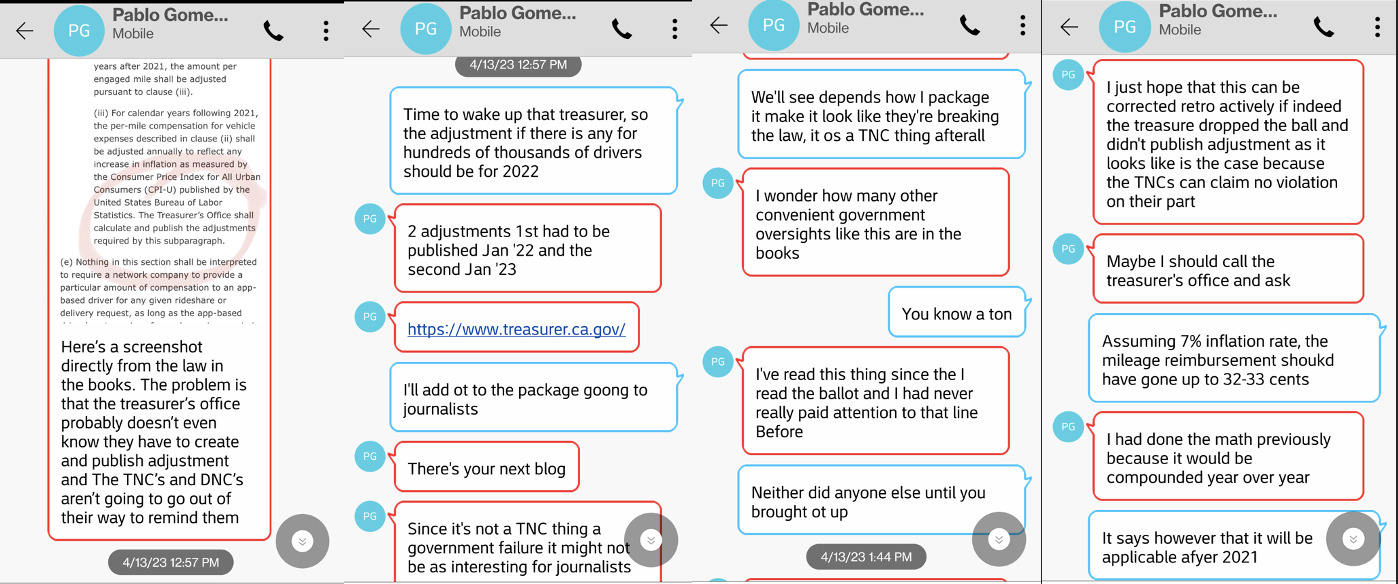

It was April 13, 2023, and I received this text message from Pablo. I am conditioned to read every email and text message I receive from drivers.

It looked like this, and a 15-minute conversation ensued, take a look at the screenshots below:

There are a lot more but you all get the gist of the conversation.

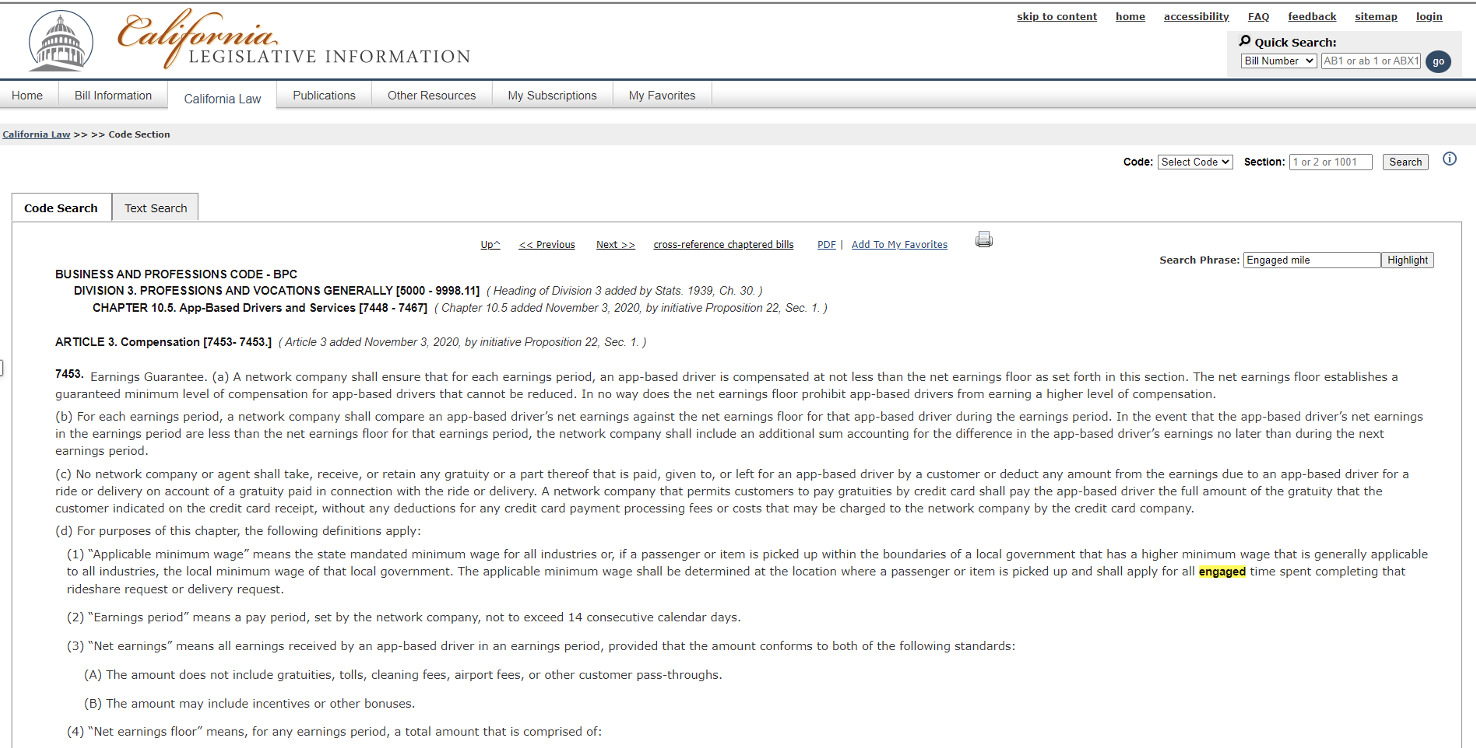

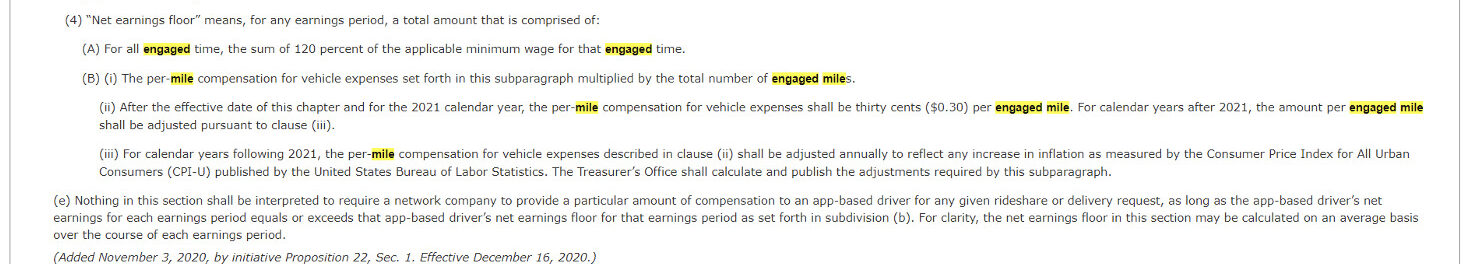

Now, I was more than curious, so I immediately started to dig. Sure enough, I found a ton of information on CA’s Prop 22, a law written and passed by gig companies during the 2020 national elections to nullify the effects of AB5 which codified all gig workers as Employees.

After reading the law, I fully agreed with Pablo’s assertion that the CPI-U inflation clause in B(iii) for driver mileage expenses was not adjusted for 2022 and 2023.

This law is written so vaguely but it does not surprise me about anything gig companies do as the word transparency is not in their dictionary.

The law left the proposed adjustment to be calculated and posted by the CA Treasurer.

Why not have gig companies:

…etc. do it themselves and pay the workers in a timely manner?

Unfortunately, the CA Treasurer Fiona Ma, who is running for Lieutenant Governor of the state missed publishing the adjustment in January 2022:

Back Pay for Gig Workers: The Research Intensifies

Now it was April 2023, fully 17 months after the date the first adjustment was supposed to be made and everyone was asleep at the wheel.

After speaking to Pablo, we decided that he should call the CA treasurer’s office and find out the reasons why she had not done so according to the law of the land.

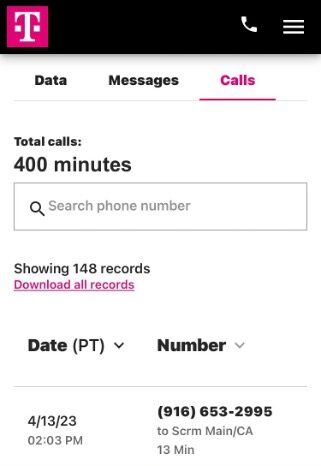

The screenshot below is the record of Pablo calling the CA Treasurer’s office. The conversation lasted 13 minutes as the person who answered his call did not even know what Pablo was talking about. Then he was told that the reason the Treasurer did not publish it was due to Prop 22 litigation.

We dug deeper, and after getting a legal opinion on the matter, our conclusion was that Prop 22 was not in litigation and it was just being appealed since a lower court judge considered Prop 22 as being unconstitutional in late 2021.

Armed with that information as well as all the evidence gathered, I decided that we had a big story at hand and pushed forward.

Back Pay for Gig Workers: Social Media To The Rescue

It had been almost three weeks since Pablo’s call to the treasurer’s office and there was no action taken by Fiona Ma. Subsequently, I followed up with another phone call to her office and was told the same thing as Pablo.

We then decided to take the cause to social media, here are the Twitter messages on May 4, 2023:

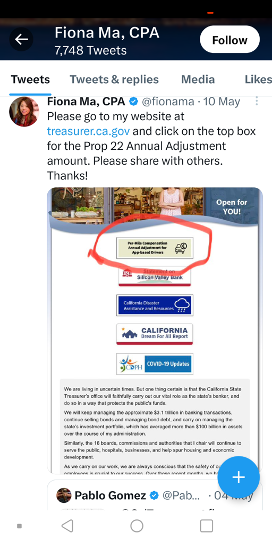

What ensued was shocking to both Pablo and me. Fiona Ma, the Treasurer of CA announced on May 10, 2023, that her office had finally published the adjustment, tagging Pablo directly on her Twitter feed:

There was no public announcement, in fact, her Tweet clearly indicated that we should spread the word on our own.

Is this how an elected official of the 4th largest economy of the world should act?

This is not a political issue, it is just looking out for gig workers’ rights. If we were not diligent enough to catch all this, how long would it take for gig companies or the CA Treasurer to finally publish the adjustment? God only knows!

Back Pay for Gig Workers: Victory 🏆

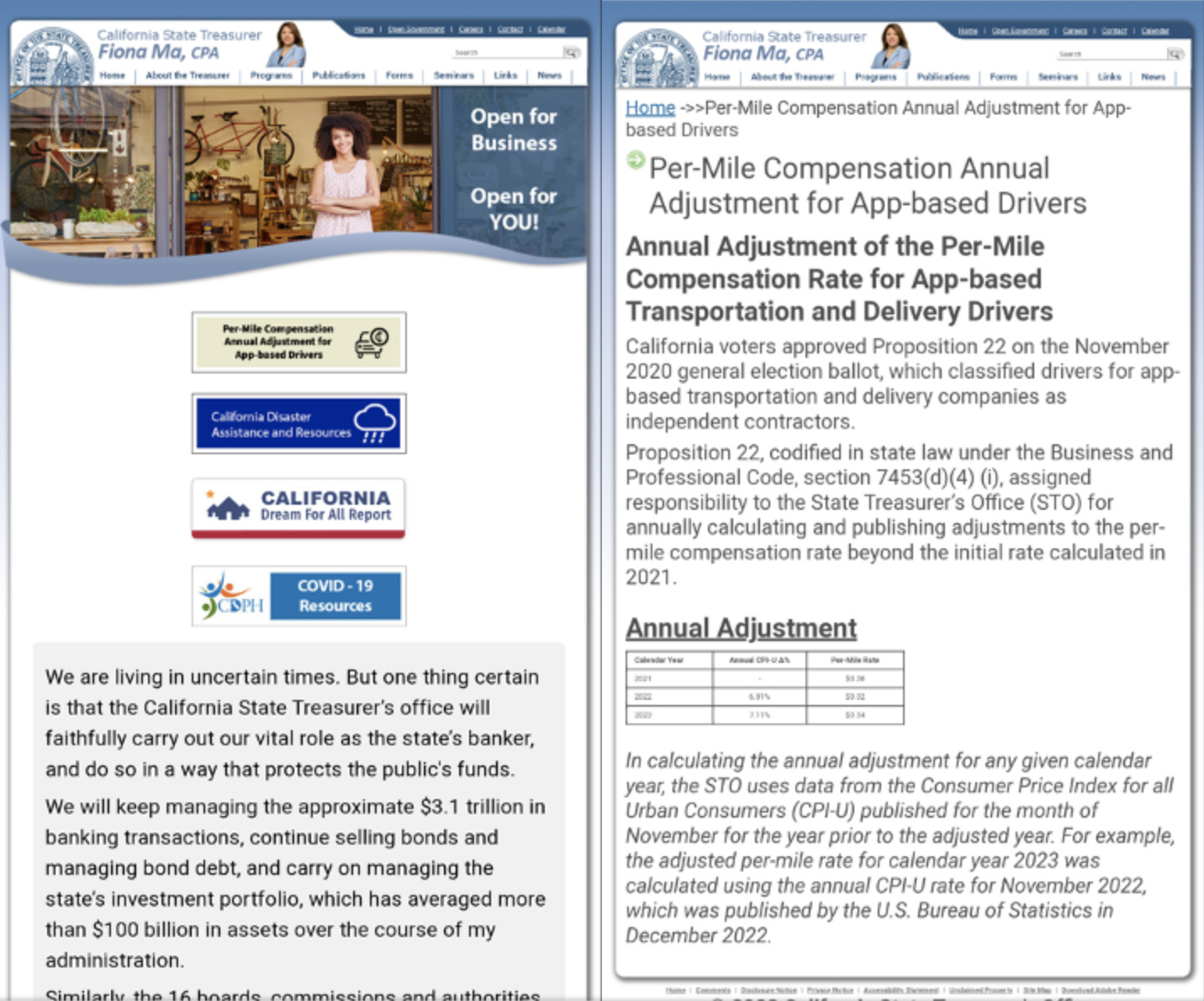

We immediately checked the CA Treasurer’s website and to our amazement, we saw she had published the inflation adjustment:

It was May 10, 2023, it was a day of elation, pride, and a great sense of accomplishment.

Although this was just a CA matter, I felt that this was a major story to be shared nationwide and that is when I got in touch with our good friend Brian Merchant of the LA Times.

Of course, he had to do his due diligence and after contacting all the parties he decided to write about it, and as they say, the rest is history.

DoorDash & Uber Respond about Back Pay for Gig Workers

Getting the inflation adjustment published was one thing, getting the gig companies to pay is a whole different matter.

To my surprise about a week after the CA Treasurer published the adjustment.

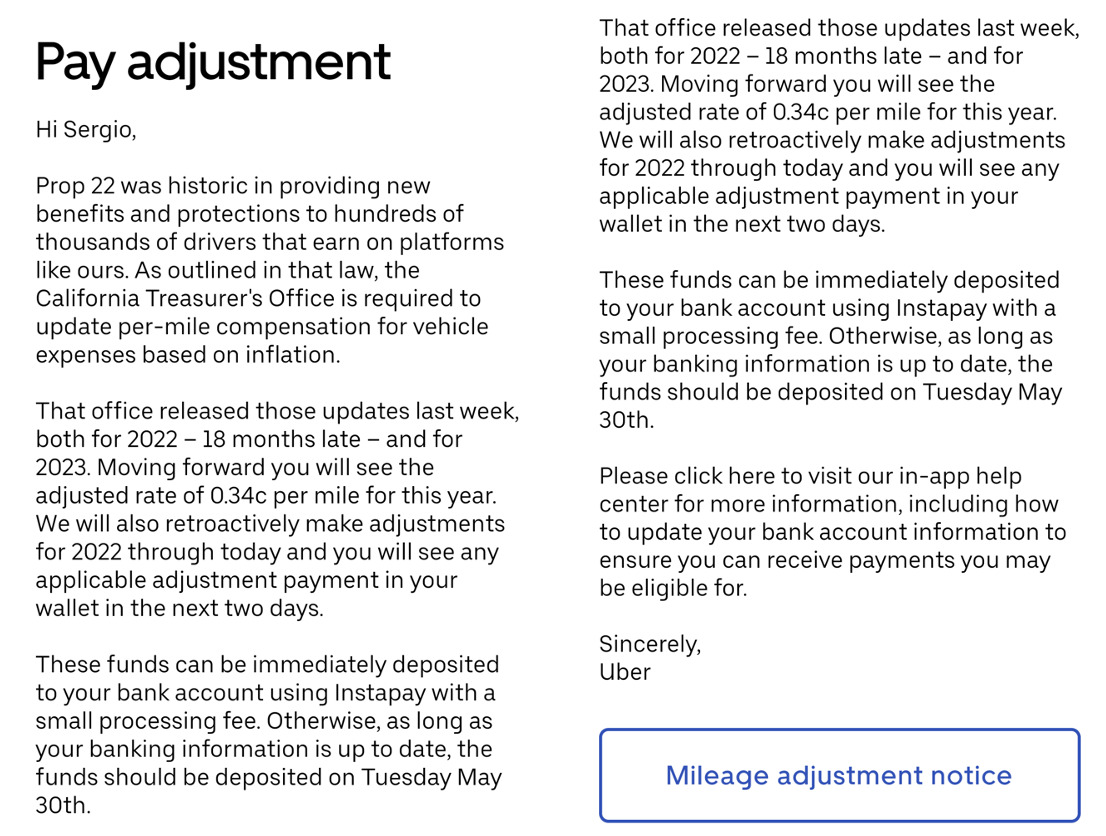

I received this E-mail from Uber:

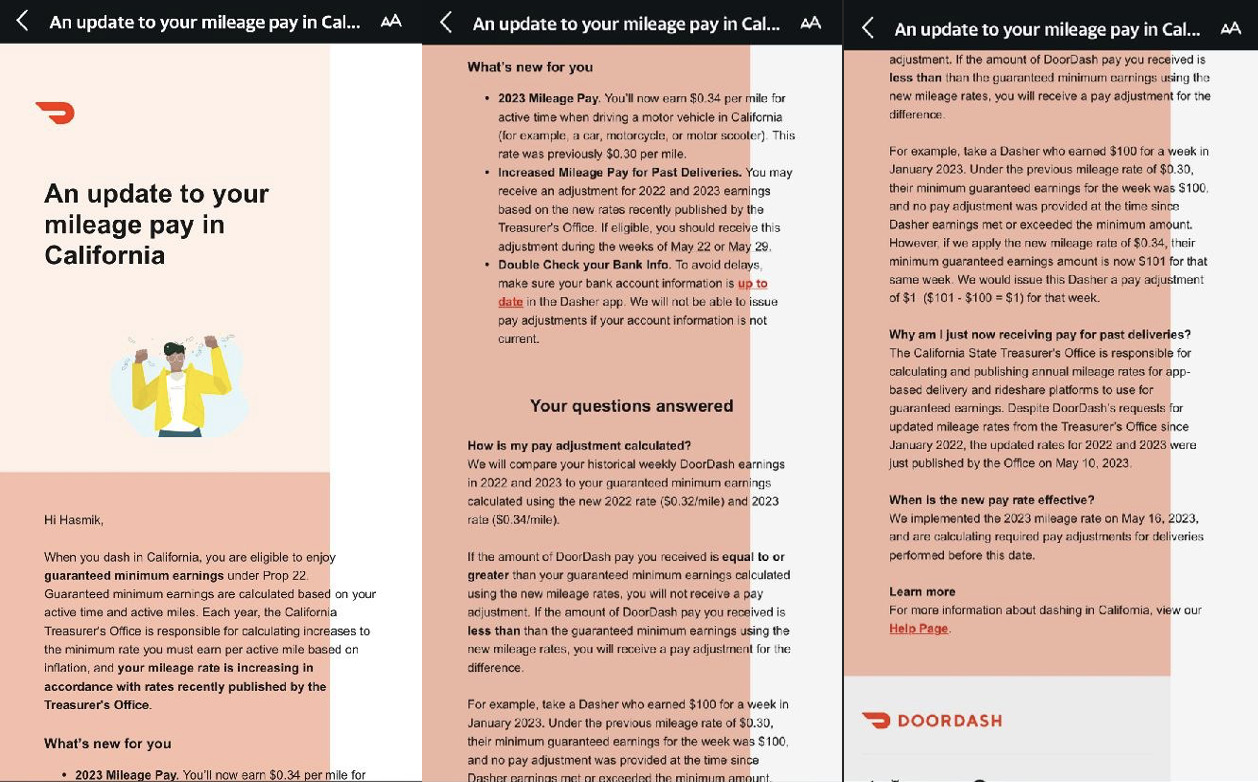

My Wife Does Doordash & Received this E-mail:

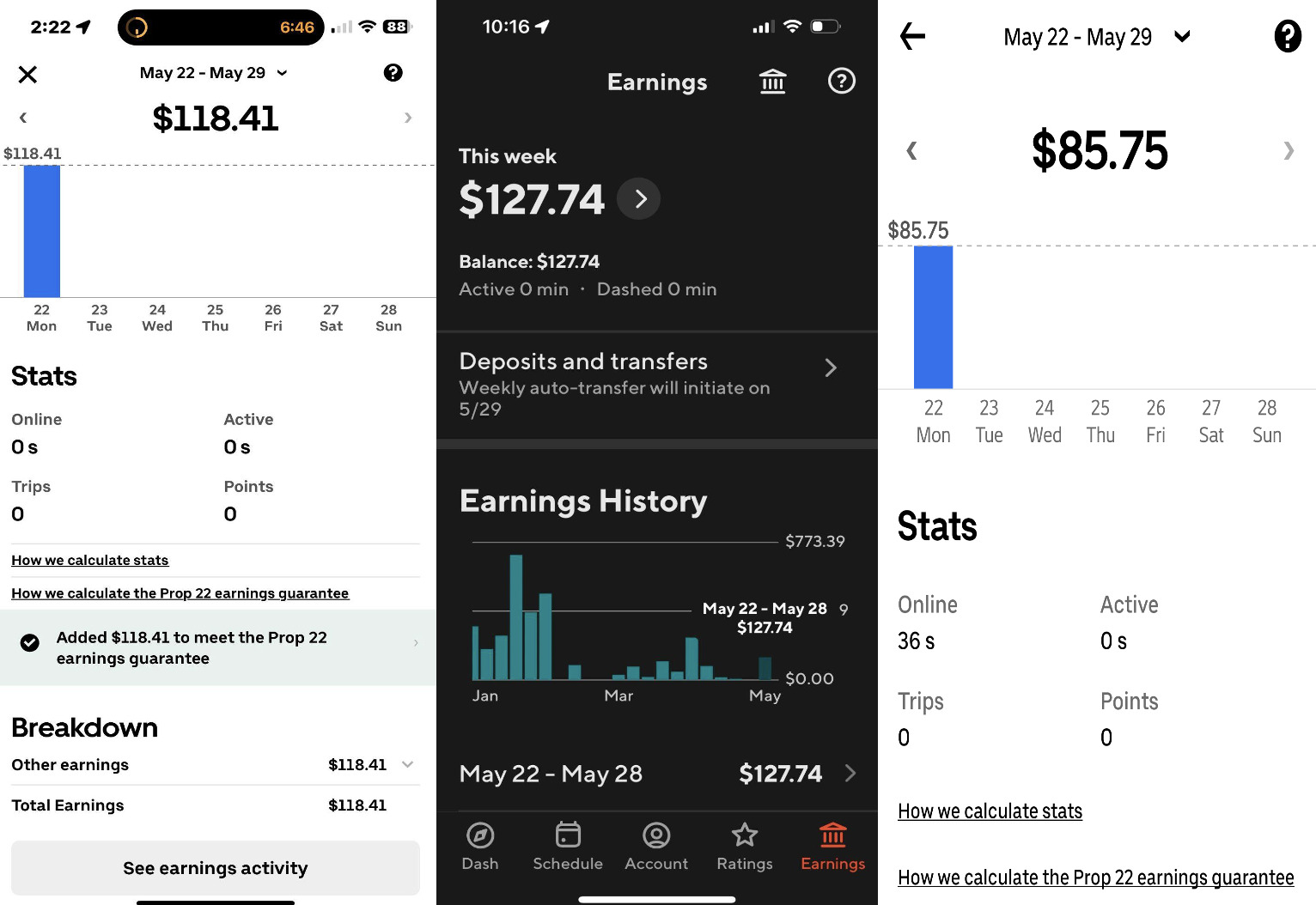

Both giants of the on-demand platforms basically announced that not only were they going to adjust the mileage component of Prop 22 going forward to 34 cents but were doing so retroactively, paying 32 cents a mile for 2022 and 34 cents a mile for 2023, hallelujah!

The Money Starts Rolling In

A lot of you may think what is the big deal with all this? How much difference can 2 or 4 cents make? Not so fast, here is the back-of-the-envelope calculation.

According to Pew Research, there are an estimated 1.4 million gig workers in CA. As per Uber and other gig companies, only 20-25% of drivers are on a full-time basis.

Considering that a full-time driver tacks on about 5,000 – 6,000 miles per month on their odometer, you can figure out the rest.

17 months at 5,000 miles a month equals 85,000 miles. On average of 3 cents a mile, a full-time rideshare/delivery driver may receive over $2,000!

Just in our family, between two very part-time cherry picker delivery drivers, my wife and I received over $300! Now multiply that by hundreds of thousands of rideshare/delivery drivers.

We will never know since none of the companies will announce the totals as well as present the drivers with a full breakdown of their active miles driven for 17 months, while they were basically enjoying an interest-free loan from the gig workers of CA.

My Take & Conclusion

As our friend Brian Merchant of the LA Times said it best in his article, who does not like a story of David beating Goliath?

I always give credit where credit is due, without Pablo Gomez nudging me, none of this would be possible. My deepest gratitude to both of them!

Friends who know me well call me a pitbull, once I latch on, it is a tough task to get rid of me. I feel like there is a lot of meat left on this bone.

With the help of journalist friends, we will expose a lot of the injustices of the gig economy as we did a month earlier in another great piece by Brian Merchant regarding Algorithmic Wage Discrimination.

Most importantly, the following is why I do what I do, I am a drivers’ advocate and so is everyone else at The Rideshare Guy. We are here to inform and educate and I think we are doing a great job of growing our community.

My inbox is full of testimonials from gig workers in CA, it is a great feeling! This may be our biggest accomplishment to date, stay tuned, more to come!

They caught up with us on that last week. I got $941 from Uber and $275 from Lyft. We need to get the insurance medical benefit that we deserve once we get the hours but we don’t qualify if we already have insurance through our family members or through another job or medical etc.

UBER sent me $1,100 and LYFT sent me $500, I drive in BAKERSFIELD CA, my mom lives in NEWHALL CA, next to Santa Clarita, SERGIO LIVES 7 MINUTES AWAY FROM MY MOMS, I'M GOING TO HAVE TO BUY DINNER TO SERGIO AND HIS WIFE, I WILL DO IT IF SERGIO MEETS ME at HIS FAVORITE RESTAURANT!

Hello Sergio, I was watching the live stream on the Delivery TV channel and I saw the subject of the payment of Proposition 22 in California. I received the amount of 535 dollars but after that payment, Doordash deactivated me.

Let us know in the comments below, if have you received your Prop 22 inflation adjustment yet.

If so, from what company and how much was it? What are you planning to do with the funds?