Mobilitas is an all-in-one insurance company that covers you whether you’re a rideshare driver or just need vehicle insurance for personal use. It even covers delivery driver insurance to ensure you’re covered no matter what.

Mobilitas just launched on Tuesday, October 13, 2020 and has already been selected by Lyft to provide rideshare commercial insurance coverage in 11 states. Lyft drivers in the states below can get a quote in their Lyft driver app.

- Colorado

- Idaho

- Minnesota

- Montana

- Nebraska

- North Dakota

- Oregon

- South Dakota

- Washington

- Wisconsin

- Wyoming

Is Mobilitas not offered in your state? You still have options! Take a look at our Rideshare Insurance Marketplace.

What Type of Coverage Can Rideshare Drivers Expect?

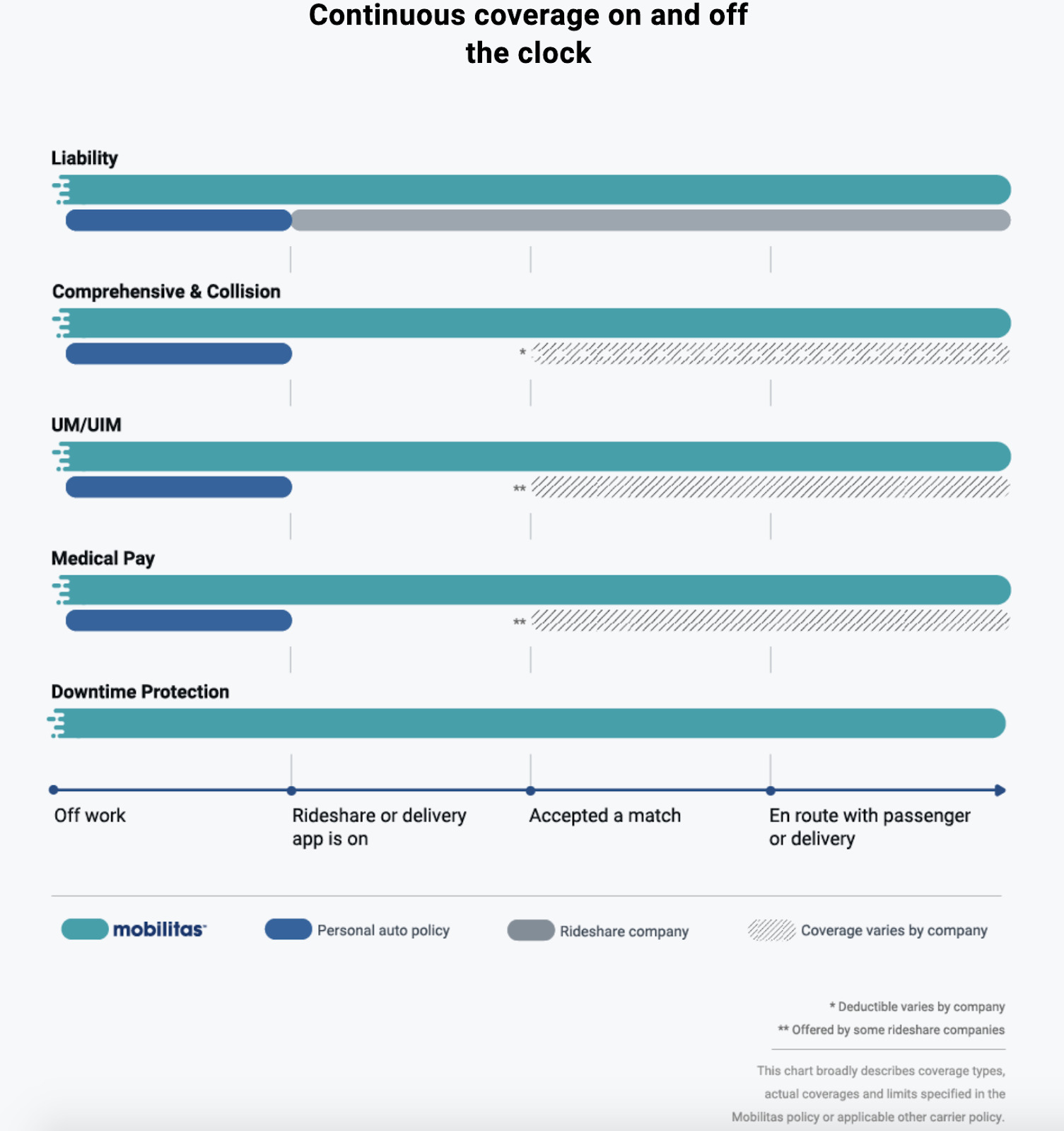

Unlike some rideshare insurance coverage, the policy with Mobilitas will take care of you no matter where you’re at in your day. If you’re on the app, have a passenger or are on your way to a passenger, you’ll be completely covered.

Features

Mobilitas boasts flexible payment options, allowing you to pay every two weeks, monthly or in full up front.

You can also manage your policy straight from the mobile app without having to call in to make a change. However, if you need extra help or help with anything for that matter, you can call for live help.

An added benefit that rideshare drivers might enjoy is that you can get up to $100 per day for 14 days if you can’t work because your car was damaged in an accident.

If you already have a Lyft account, you can get a quote and purchase a policy with Mobilitas from the Lyft driver app.

What Are People Saying About Mobilitas Coverage

According to Ed Walker, Micromobility and Shared Economy Practice Leader at USI Insurance Services, who specializes in the mobility and insurance industries:

Mobilitas is a welcome addition to the growing body of insuretech focused insurance providers within the shared economy and on-demand service space… Mobilitas aims to attack this commonly underappreciated aspect of insurance by providing a full optional suite of gig economy specific claims resources, risk management tools, and top to bottom technology/telematic mobile app integration to help ensure ridesharing operators and drivers have the insurance they need and the tools to manage it.

If Mobilitas is not yet offered in your state, take a look at all of your rideshare insurance options here.

Why Do I Need Rideshare Insurance?

Uber and Lyft only cover rideshare drivers during Periods 2 and 3. Period 2 starts once you accept a ride request and are en route to your passenger, and Period 3 starts once your passenger gets into your car.

However, when you’re online and waiting for a request during Period 1, you have no collision coverage from Uber or Lyft and much lower liability limits.

This means as a rideshare driver, you’re most at risk during Period 1 since you won’t get any collision coverage from rideshare companies and your personal insurer likely won’t cover you during this time either.

Mobilitas covers drivers through all periods of driving for Lyft – periods 1, 2 and 3. This gives drivers peace of mind and makes sure they’re protected in case anything goes wrong.

Mobilitas not offered in your state? Find your state’s rideshare insurance options here.

FAQs

Where is Mobilitas insurance available?

Mobilitas originally launched in Colorado, but now Lyft drivers in the states below can get access to coverage with Mobilitas through their Lyft driver app:

- Colorado

- Idaho

- Minnesota

- Montana

- Nebraska

- North Dakota

- Oregon

- South Dakota

- Washington

- Wisconsin

- Wyoming

Can I bundle other types of insurance with my Mobilitas policy?

No. “Since Mobilitas exclusively offers commercial vehicle insurance, it cannot be bundled with other types of insurance.”

Which rideshare delivery apps are covered?

“Mobilitas Insurance provides complete coverage for all rideshare and delivery apps. Whatever company you drive for, you’re covered.”

This means you’re covered for some of our favorites, including DoorDash, Postmates, and Instacart.

What are the coverage limits?

“Mobilitas offers policies that exceed Colorado’s minimum insurance requirements for vehicle owners. The state of Colorado requires automobile owners to carry liability insurance to cover injury to another person or property damage to another’s vehicle or property when the insured is at fault for an accident. The following coverages are offered by Mobilitas:

-

$50,000 for bodily injury or death to any one person in an accident

-

$100,000 for bodily injury or death to all persons in any one accident

-

$50,000 for property damage in any one accident”

How do I contact Mobilitas?

You can call Mobilitas at 877-268-1408

Mobilitas isn’t offered in my state – now what?

Luckily, the majority of states now offer specific rideshare coverage. Find and compare rideshare insurance options in your state here.

Readers, does this sound like insurance coverage you’d be interested in? Why or why not?

-Paula @ RSG