In the majority of cases, you aren’t going to get rich driving for Uber. However, there are ways to plan for your financial future so that you’re not dependent on Uber when you’re 65. Senior RSG contributor Christian Perea covers what younger rideshare drivers can do right now to prepare themselves financially – and all it starts with is $20 a week.

I recently took a ride as a passenger with a driver who was 75 years old. He told me he’d had several heart attacks and back surgeries and was living off a combination of his Social Security and Uber income. Without a steady Uber income, this man wouldn’t be able to pay for his daily expenses, putting him in a tough position.

Unfortunately, he’s not the only one I’ve met with this type of story; there are a lot of 65+ year old drivers supplementing their retirement income with rideshare earnings. And according to our 2018 Rideshare Survey, nearly 35% of drivers are over the age of 61.

But I’m not writing this article for them. I’m writing it for the younger drivers who haven’t gotten around to thinking about savings and retirement. After all, this isn’t the type of job you want to have to do when you’re older, it’s a job you’ll want to want to do when you’re older.

Traditional jobs often have retirement plans like a 401K or pension that make it easy for anybody to setup a retirement plan regardless of their investing savvy. I started putting money into my 401k when I was 18 because the Human Resources (HR) lady at work dropped off a pamphlet in my cubicle and by “carefully reading it” I could take a break from my actual job for a few minutes. I was 18 and probably thought Warren Buffett was the singer of “Margaritaville”.

The thing is, driving for Uber or working in any other part of the gig economy means we have to handle all this stuff ourselves now. And while I’m not writing this to be your personal finance pro or to tell you how to invest, I’m just trying to make it clear that you have to do something even if you’re 25.

After all, you don’t want your last moments on Earth to be behind the wheel of an Uber while a teenager plays whatever song teenagers listen to in the year 2060 (hint: you’re gonna hate it).

What Would Happen If You Only Saved $20 A Week?

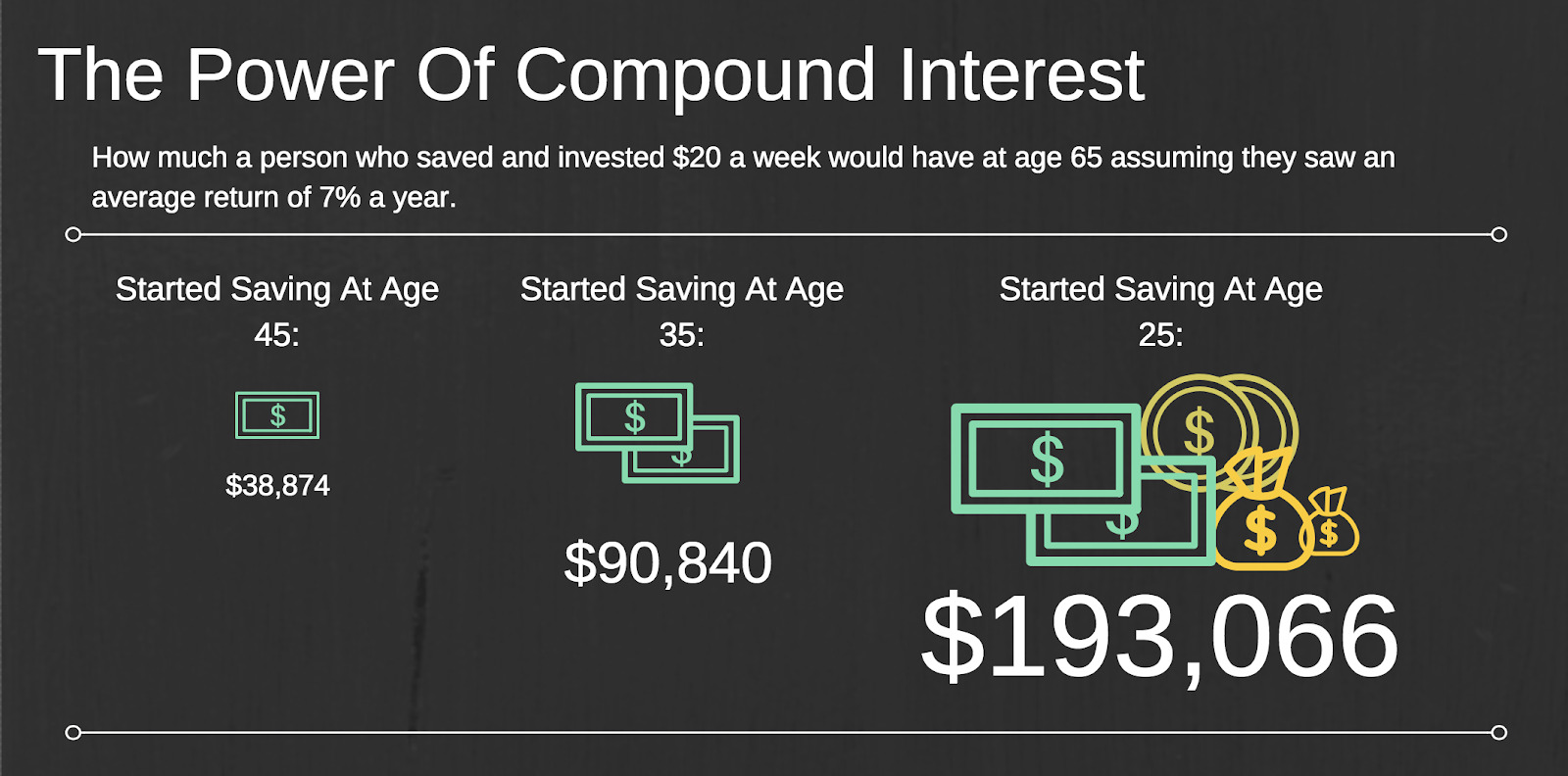

We all know what $20 looks and feels like, so I’m going to use it as an example of how powerful savings and compound interest is. That $20 a week comes out to about $80 a month, or $1,040 a year (before it earns interest or a return).

$20 a week is a doable amount but if you can save more (and you truly should), then all of this becomes far more powerful.

Notice that the person who starts saving at 25 ends up having a much larger portfolio in retirement. The 25 year old ends up with more than twice as much ($193,066) as the person who starts saving at 35 (only $90,840).

Further, we see that waiting until the last minute (when you’re 45) to begin saving results in savings of only $38,874 by 65.

Now, let’s take a quick look at what your numbers would look like if you managed to squirrel away an average of $20 a day into your retirement fund ($140 a week).

Source: Bankrate.com Retirement Calculator

This is more how I like it: The 25 year old would have around $1.7 million and the 35 year old would have around $637k. That’s certainly a lot more to work with in the later years of your life!

Retirement Plans for the Self-Employed Uber Driver

There are a lot of plans when it comes to retirement-land. I’ve listed three examples of plans that are geared towards self-employed individuals, but this is by no means an exhaustive comparison or review of them:

SEP IRA: According to Kali Roberge, financial writer and blogger at GoingBeyondWealth.com, you can contribute to a SEP (which stands for Simplified Employee Pension) “if your employer offers it, or if you make any amount of 1099 income.” Your contribution limit is determined by how much money you earn. Your contributions to a SEP IRA cannot exceed the lesser of:

- 25% of compensation, or

- $55,000 for 2018 (subject to cost-of-living adjustments)

You can calculate how much your contribution might be here. The money you contribute to this account (up to the limits) are tax deductible. The money goes in at a higher untaxed value and hopefully performs well over time. You then pay regular income tax on that money when you withdraw it.

Roberge adds, “if you can contribute to a SEP, do so (because contribution limits are much higher than traditionals), then open [and] fund a Roth as well to balance your tax advantages.”

Solo 401K: Also tax deductible, except you can contribute up to $18,500 annually with a $6,000 catch-up for those who are 50 or older at any point during the year. You can also usually borrow from the value of your solo 401(k) if you end up in a pinch (although you should really try to avoid this).

Roth IRA: This account is a little different than the others. You put “after-tax” money into this bad boy and whatever you get from it becomes tax-free (assuming you follow the rules) at retirement. If you win big in the stock market, you want it to be with your Roth IRA!

You can contribute up to $5,000 a year in 2018, unless you make more than $133k per year, in which case you no longer are eligible to contribute to a Roth IRA.

But you can still technically do a Roth IRA through the backdoor regardless of income.

“But…What If I Don’t Live to Be 65?”

Well…what if you live to be 95? Huh?

Chances are (81%) if you’re born today, you will live to be at least 65. Taking the TIME’s life expectancy calculator, the average 25 year old male has a 75% chance of living until 85 (your results may vary based on gender, ethnicity, health habits, etc., but still – your chances of living a long time are good!)

Also, if you DO croak before then, if you save now, you will leave your kids and spouse something to survive on when you’re gone. The least you can do is pay for your funeral (that’s right! You gotta PAY to die!).

I also hear a lot of people say “When I’m old, I’ll just tell my kids to give me the pillow treatment” and it won’t be a problem. But they won’t. They’ll probably be burdened with your failure to plan ahead.

Uber and Lyft’s Present Partnerships

Uber and Lyft have set up partnerships with investing firms to help you save for retirement as a driver that allow you to funnel your rideshare earnings into a plan with more ease. However, I wouldn’t be surprised if Uber and Lyft eventually phased these programs out, as there doesn’t seem to be as much demand among drivers for them.

Uber + Betterment: You can set up an account and auto draft with them through the Uber Driver app. As an Uber driver, you won’t pay any management fees for the first year of opening a Betterment account.

Lyft + Honest Dollar: As part of their partnership, all Accelerate drivers (Silver, Gold, and Platinum) don’t pay an advisory / account fee for 3 years from the time they first fund the account (for accounts with a balance under $5,000 – it’s the standard 0.25% for balances over $5,000).

To be frank, these programs aren’t too popular with drivers, so I highly suggest that you do your research on both firms and their fee structures before opening an account with them.

Save Today To Get Rich Slowly

It doesn’t take much, but maybe you’ll get addicted to saving. It’s really where you build true, long-term wealth, especially if you find yourself living more or less paycheck to paycheck. The biggest takeaway from this though is that you really gain a lot of power to prosper if you start early. A difference of 10 years can be the difference between being a millionaire and $637 thousand-aire!

Readers, how are you saving for the future? Have you heard of or tried Uber + Betterment or Lyft + Honest Dollar?

-Christian @ RSG