If you have solid credit, need to refinance or borrow a lot of money, and are looking for a well-known company offering low rates, no fees and flexible payments, SoFi is a great option.

SoFi is an American finance company that is known for their loan refinancing solutions. In 2019, SoFi launched their investment product, SoFi Invest. It’s a free retirement savings and stock investing platform that has really taken off among some of their other features.

Today, SoFi seems to be a one-stop-shop for your financial needs whether it’s a money management tool, a personal loan, student loan refinancing, mortgages, or investing.

In this SoFi review, I’ll explain how some of their key features work and why you may want to consider becoming a SoFi member.

Quick links:

- Get started with SoFi using our referral link here

- SoFi offers investing options, refinancing, loans and more

- SoFi does have stricter eligibility rules, and is best known for their student loan refinancing options

SoFi Pros and Cons: Quick SoFi Review

Pros:

- Low APRs (SoFi Loans and Refinancing)

- Flexible repayment terms (SoFi Loans and Refinancing)

- No fees (SoFi Money + SoFi Invest)

- No minimum balances (SoFi Money + SoFi Invest)

- Commission-free stock trading and ETF trading (SoFi Invest)

- Access to fractional share investing (SoFi Invest)

- Unemployment protection options

Cons:

- Higher credit score requirement to qualify for loans

- Stricter eligibility rules – 680 credit score and at least $45,000 annual income

How to Sign Up With SoFi

It only takes a few minutes to sign up for SoFi. Just head to their website and click the button that says ‘Find My Rate’ or click on the product you’d like to sign up for.

Here’s a summary of the products that SoFi offers.

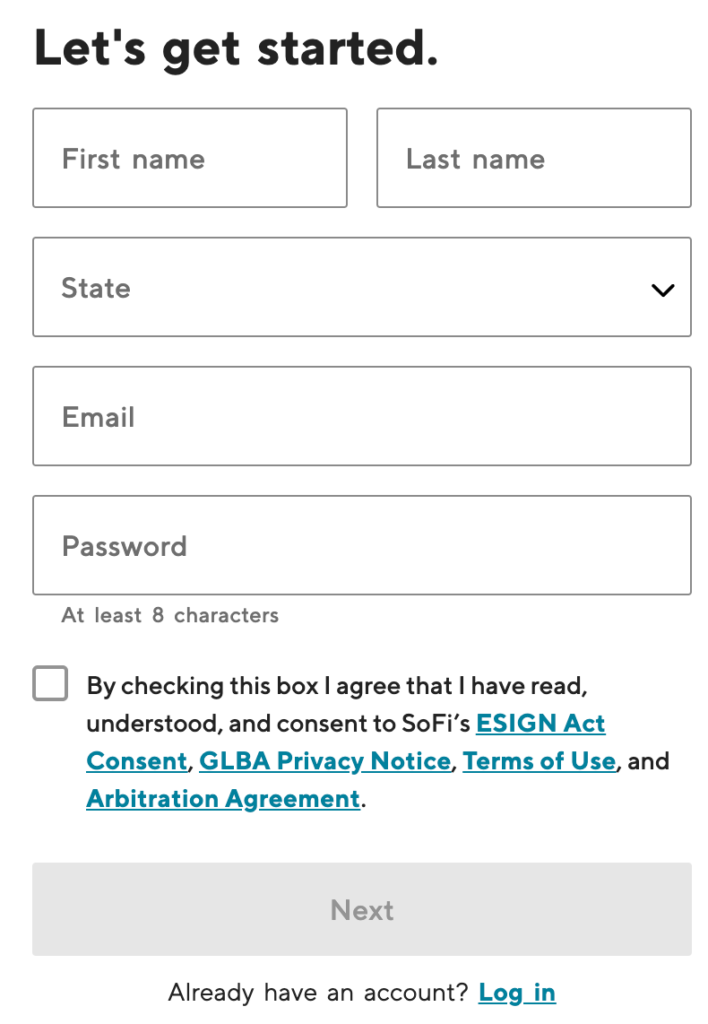

To start the process, enter your name, state and password followed by your address

To start the process, enter your name, state and password followed by your address

SoFi will also ask for your phone number, employment status, possibly your Social Security Number (depending on the product you’re interested in) and a few other personal details. They use 256-bit SSL encryption to transmit all data safely.

SoFi Personal Loan Terms and Requirements

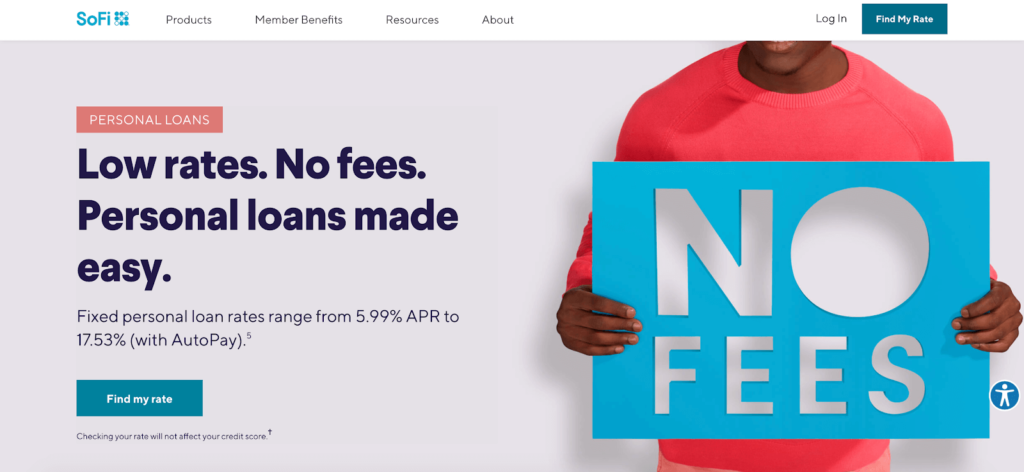

SoFi offers low-rate personal loans to help you with home improvement projects or to consolidate credit card debt. If you’re paying more than 20% APR on your credit cards, SoFi can possibly help you save thousands by helping you score a lower interest rate.

Their personal loans range from 5.99% to 17.53% depending on your credit. Loan repayment terms are between 2 – 7 years and you can borrow anywhere from $5,000 – $100,000.

When considering a loan, it’s important to pay attention to your out-of-pocket costs in addition to the interest. Some loans charge a fee just for applying or getting set up, and there are also plenty of hidden fees to watch out for.

The great thing about SoFi’s personal loans is that they don’t have any origination, prepayment, or late fees. This means you won’t get charged extra if you pay your loan off early.

Another benefit of their personal loan product is the Unemployment Protection. If your loan is in good standing and you lose your job (at no fault of your own), you can apply for their Unemployment Protection program. You’ll get job placement assistance and can easily suspend your monthly SoFi payment in the meantime. Benefits are offered in 3-month increments and capped at 12 months.

SoFi for Student Loans

SoFi is well known for their student loan refinancing services. They offer a fast and easy application process online along with the opportunity for you to compare rates.

SoFi is well known for their student loan refinancing services. They offer a fast and easy application process online along with the opportunity for you to compare rates.

How it works is first you’ll get prequalified online. Then you can shop around for your new term and rate.

SoFi likes to base your new loan on a goal, whether it’s to save money on interest or lower your monthly payment. Then, you’ll upload screenshots of your information and sign the paperwork automatically.

Once all your loan documents go through, SoFi sends the payment to your student loan servicer, then you will start paying SoFi on the new loan. While refinancing your student loans with SoFi can save you thousands of dollars, it’s also a big decision that you should carefully consider.

If you have federal student loans, you may not want to refinance with SoFi since your rate may already be low, and you’d also lose federal loan relief options like deferment or forbearance. Read about more federal student loan benefits here.

SoFi is a better option for your private student loans.

Get started with SoFi using our referral link here.

SoFi Mortgages

SoFi can also issue your mortgage as well as mortgage refinance, cash-out refinance, and home equity loan. If you’re already a SoFi member, you’ll get to save $500 on mortgage processing fees. They offer 10-, 15-, 20-, and 30-year mortgage terms and borrowers must put at least 10% down.

To get started, you’ll just click the ‘find my rate’ button on SoFi’s mortgages page. It takes 2 minutes to get a mortgage rate estimate and your credit won’t be impacted during that initial process.

SoFi Variable and Fixed-Rate Options

It’s important to realize that SoFi offers both variable and fixed-rate loans. A fixed-rate loan is a when your interest rate stays the same throughout your repayment term. With a variable rate loan, your interest can go up and down depending on the market.

Variable rate loans do often have a cap on how much interest you can be charged, regardless of market changes. While there is no right or wrong option, I personally like fixed-rate loans because they are predictable. If you apply with SoFi when rates are pretty low, you can lock in a good rate and have consistent payments throughout your term.

However, if rates are higher and expected to drop soon or you have a little wiggle room in your budget, you may be okay with getting a variable rate loan. Just know that your payment could be subjected to change due to the interest fluctuation even if it starts off pretty low.

SoFi Payment Options

By now you may be wondering how SoFi’s payment process works. SoFi has an app that allows you to check your balances and manage your payments easily. The first payment for a fixed-rate loan will be exactly 30 days after your disbursement date. However, this date falls between the 26th or the 4th, your due date will be the 5th of the following month.

Payments for a variable rate loan are always on the 10th of each month. If you are in good standing with your loan, you can change your monthly payment date to any date from the 1st or 25th of the month. Keep in mind you can only change your payment date once per year. As of April 18, 2018 they stopped charging late fees on personal loans.

Make your payments each month through the app or you can set up automatic payments from your bank. If you set up automatic payment withdrawals, you’ll get a 0.25% discount on your rate. Other payment options include setting up online bill pay to SoFi or sending in a check.

Right now, SoFi doesn’t accept payments via credit card. If you suddenly become unemployed, you may be able to apply for Unemployment Protection.

SoFi Reviews

There are a lot of SoFi reviews out there, but I wanted to narrow down some authentic reviews from people who have actually used a SoFi product before. Learning from someone else’s experience can be so helpful.

One Reddit user refinanced their student loans with SoFi about a year ago. This person refinanced about $85,000 of private student loans ranging from 10% – 13% interest rates.

The reviewer did say SoFi prefers borrowers have a higher credit score (at least 680). so their loan and refinancing products probably wouldn’t be best for someone with a lower credit score.

They also mentioned how they liked SoFi’s pre-approval feature and that the actual loan funding and disbursement process can actually take a few weeks. Read more about their experience here.

One other Reddit user received an offer from SoFi that would cut their monthly student loan payment in half. Initially, they were paying $1,200 per month on their loans with a 9% interest rate. SoFi would offer a minimum monthly payment of $650 with an interest rate of 2.8% – 3.5% through their student loan debt consolidation service.

Finally, a Reddit user who utilizes SoFi’s money management and investing features has a complaint about their customer service overall:

Overall, the application, approval, disbursement and payment part of SoFi seem to work well but, as we see from many companies, their overall customer service can be lacking. Make sure to read through any agreements made with SoFi carefully and ask plenty of questions at the beginning.

Who is SoFi Best For?: Summary SoFi Review

SoFi offers a lot of financial solutions all in one place. If you’re looking to just deal with one company to handle some of the needs outlined in this review, you should definitely consider using SoFi.

This would also be a good company to consider if you can meet the credit and income requirements. Their low interest rates are competitive, but if you don’t have a good credit score, you may not qualify.

Get started with SoFi using our referral link here.

Readers, would you or have you tried out SoFi?

-Chonce @ RSG