Uber recently announced its second quarter results, and they were mostly as anticipated. Investors expected demand for rideshare to decline due to COVID-19, which is what the earnings statement announced. However, Uber did surpass expectations in some areas. Senior RSG contributor Paula Gibbins breaks down Uber’s Q2 earnings results below.

With the coronavirus still affecting many cities throughout the U.S., it’s not difficult to believe that companies like Uber and Lyft, whose main focus at least used to be rideshare, are reporting overall losses for their latest quarter.

Uber’s Q2 Earnings

Uber beat top-line estimates, but did fall short on earnings and gross bookings. After reporting this, Uber’s shares fell 2.8%. Gross bookings totaled $10.2B, but that is down 35% year over year. Mobility bookings were down 75% while delivery bookings grew to be $6.96B.

This was the first time that Uber’s revenue was generated more from delivering food than from transporting people. It just wasn’t quite enough to offset the decline in rides.

It shows us that there are still not as many people requesting rides due to shelter-in-place restrictions and other policies to try to prevent people from traveling when it’s not deemed necessary.

There’s also been a decline in the number of drivers on the road, in part because of the Pandemic Unemployment Assistance being offered to drivers who saw a decline in earnings directly related to the pandemic, which we saw an end to at the end of July.

Some drivers who have felt unsafe driving passengers have switched over to UberEats to deliver food, so this helped bolster the earnings in that sector.

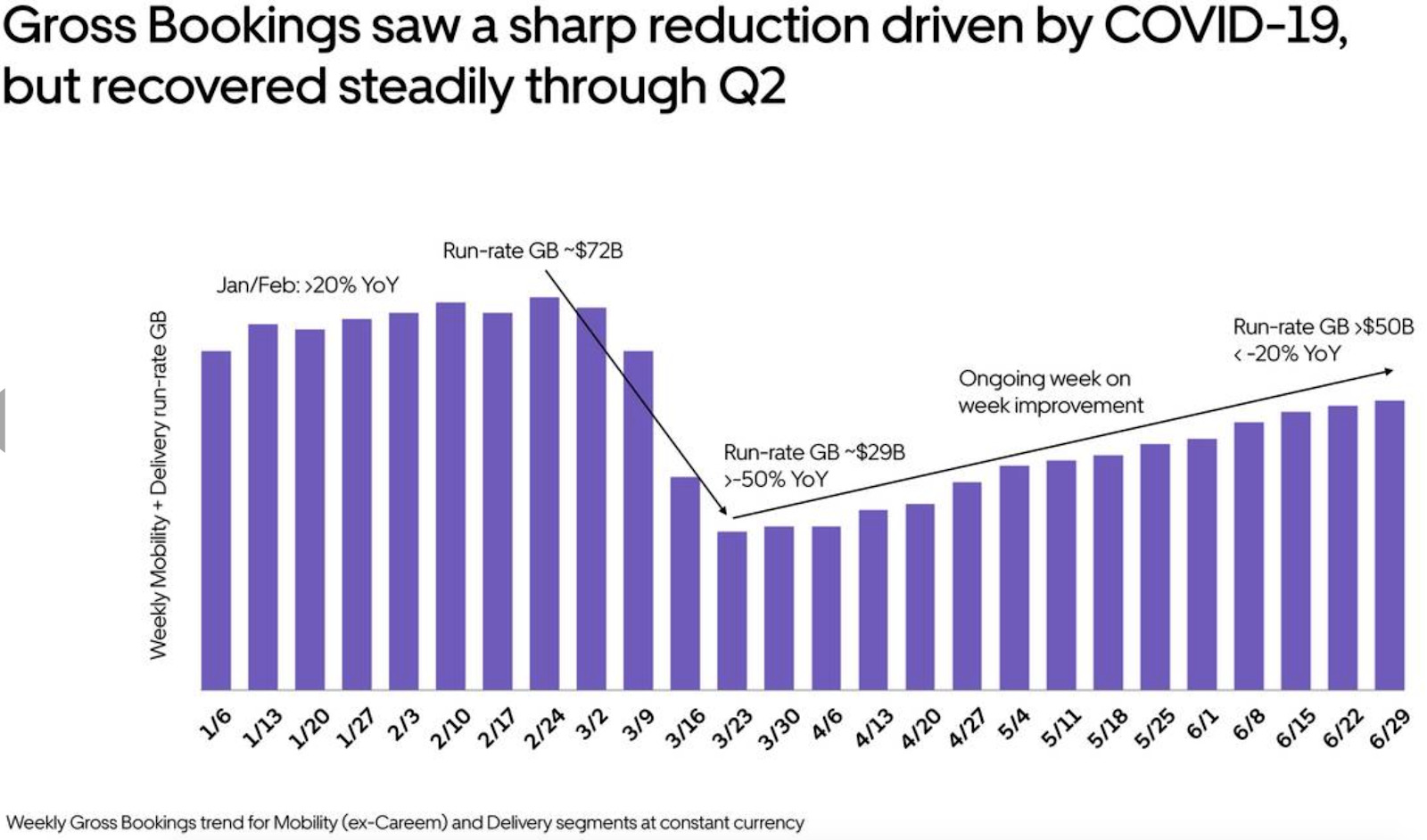

Snapshots taken from Uber’s Q2 announcement shows that they are on the upswing from the worst of the worst during COVID-19.

“Gross bookings saw a sharp reduction driven by COVID-19, but recovered steadily through Q2.”

The chart shows a sharp decline from around February 24 through to the lowest on March 23. It’s been on a steady incline through the remainder of Q2.

Our Analysis

Uber wants investors to realize that they are not putting all of their eggs in one basket. Uber is continually looking at ways to expand their business, including investing more in freight and autonomous vehicles.

This image taken from their Q2 report states: “Investing in a massive market opportunity to build the most reliable logistics on-demand network. Leveraging Uber’s brand, tech and product infrastructure, and global footprint to launch and scale.”

It sounds like Uber is looking to leverage their partnership with Toyota more in the future with the focus being on autonomous vehicles.

On CNBC TV, their analysts could not come to a consensus. Some said people should hold off on buying Uber stock for at least a year, whereas others said buy now for a big rebound later on. Still others saw upticks in the used car marker as an indication that rideshare demand will be down.

As airport rides, nightlife, etc. are key components of rideshare demand, it’s no wonder that demand for rideshare is down. There’s no need for people to get to concerts, sporting events, movies, etc. because none of those activities are happening right now (for the most part).

It’s our opinion that demand for rideshare will continue to be depressed until those activities return. Frankly, who knows when that will be? We can’t predict which areas of the United States will rebound faster than others – as soon as you think one area is ‘safe’, coronavirus seems to come back!

Unfortunately, that uncertainty obviously puts a damper on demand for rideshare drivers – and Uber’s earnings. However, Uber is an aggressive company, so these numbers may force them to innovate or double down on one of their other bets (as mentioned above).

If you do believe Uber is headed for a major bounce back, consider investing in Uber using WeBull or Robinhood’s investing apps. You can read our WeBull review and our Robinhood review to learn more about each company.

Overall, Uber’s food delivery business did help to staunch rideshare losses, but not completely. It’s clear that Uber is betting on other aspects (and areas of the world) to make up for what’s happening in the US. According to TechCrunch, Uber CEO Dara Khosrowshahi said during the Q2 earnings call:

“Our mobility recovery is clearly dependent on the public health situation in any given area. Asia and India are in the recovery. We’ve seen gross bookings in Hong Kong and New Zealand at times exceed pre-COVID highs and European trends have also been encouraging.”

Khosrowshahi also noted that once US cities do reopen, trips bounce back sharply. It looks like until their is a significant, sustained recovery from COVID in the US (either due to appropriate mask usage and social distancing or a widely accepted vaccine), Uber’s future earnings call may be similarly disappointing.

Readers, what do you think of Uber’s Q2 earnings news?

-Paula @ RSG