Today’s post comes from reader Tom, who contacted RSG to let us know his experience with Lyft’s insurance agent, Marsh Risk & Insurance Services. His story, outlined below, shows what can happen when you make a claim with Lyft’s insurance agent after a Lyft accident.

While Lyft and Uber do offer insurance coverage for drivers, in many cases it’s not sufficient during Period 1 (app on but no passenger in the car), which is why we recommend getting a rideshare endorsement to a regular auto insurance policy. It’s important to find an agent who understands rideshare drivers, which is why we’ve put together the Rideshare Insurance Marketplace.

Here you can find a list of insurance agents by state that are familiar with rideshare insurance and can help you find the best, most comprehensive auto insurance and rideshare coverage.

Click here to visit the Rideshare Insurance Marketplace. Or click here to get Lyft life insurance.

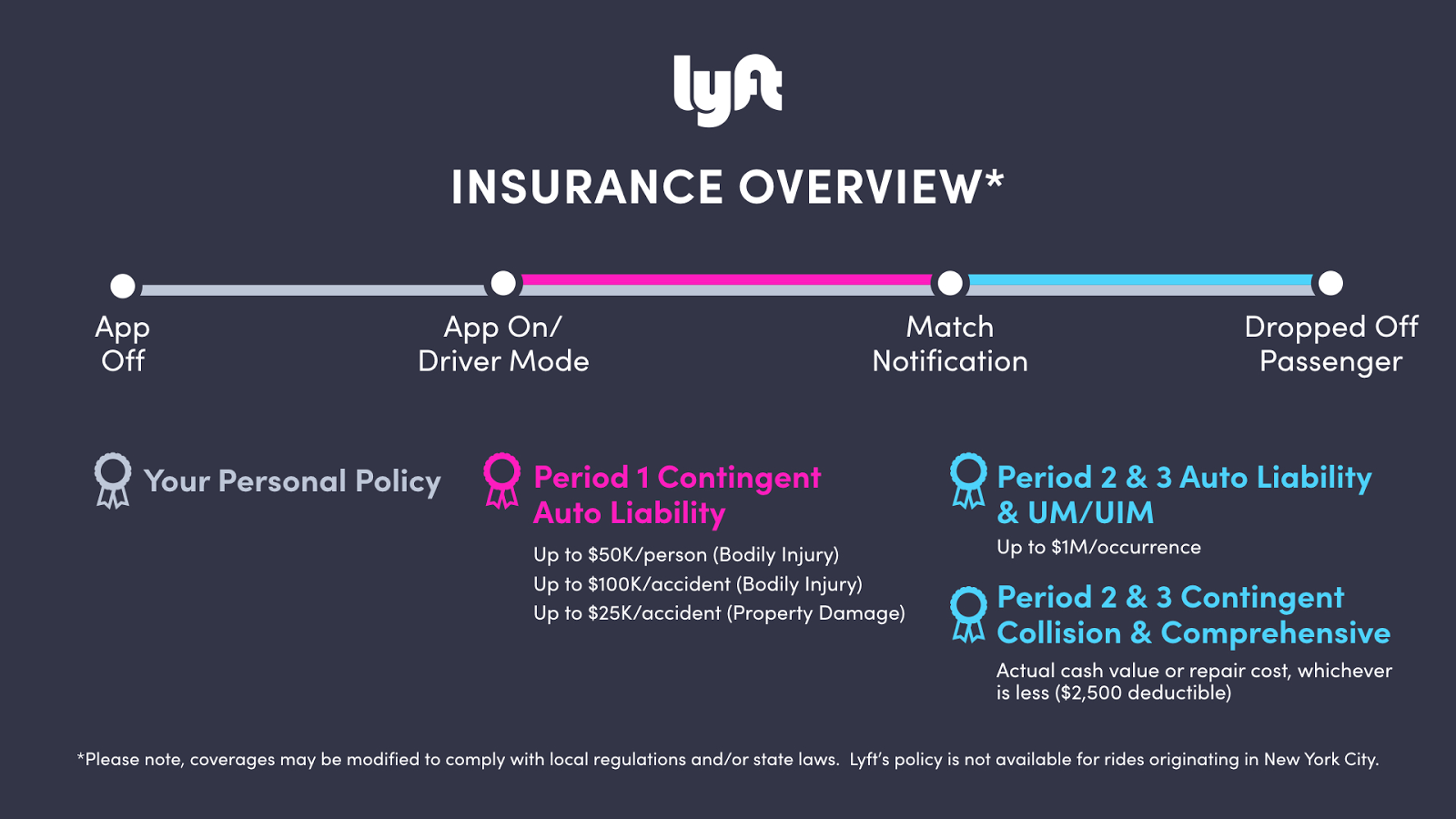

Lyft’s Insurance Policy Depends on When You’re Driving

Uber and Lyft only cover rideshare drivers during Periods 2 and 3 (collision and liability). Period 2 starts once you accept a ride request and are en route to your passenger, and Period 3 starts once your passenger gets into your car. But when you’re online and waiting for a request during Period 1, you have no collision coverage from Uber or Lyft and much lower liability limits.

As a rideshare driver, you’re most at risk during Period 1, since you won’t get any collision coverage from rideshare companies and your personal insurer likely won’t cover you during this time either.

But if you get into an accident with Lyft during periods 2 or 3, you’re covered – but you are subjected to Lyft’s $2,500 deductible. This means you have to pay $2,500 before Lyft insurance will kick in, depending on what type of additional auto insurance policy you have.

Many drives also don’t realize that, in addition to this deductible, Lyft (and Uber) contract out their insurance services. That means that while you may contact Lyft after you get into an accident, you’ll actually be served by another company, Marsh Risk & Insurance Services. They may also have their own insurance adjusters, in this case York Risk Services Group.

All this to say that insurance claims, regardless of who is at fault, may not be quickly solved. In addition, you likely won’t get much support from Lyft or Uber, since they contract out insurance services. But let’s explore a few key items:

- How long does it take to process a claim?

- How you can avoid the $2,500 deductible

If you get into an accident while rideshare driving, you may be eligible for lost wages, medical bills and more! We recommend speaking with Bryant Greening, an attorney at LegalRideshare – (312) 767-2222. And you can also head over to our new Uber Accident Lawyer page to learn more.

Timeline of Tom’s Experience with Lyft’s Insurance Company

RSG reader Tom recently reached out to us to share his experience with Lyft’s insurance contractor. Below is a timeline of what happened, what Tom did to make the process move faster, and how long it has taken to hear back from the insurance company.

- July 12: Reader Tom drives for Lyft and rear-ends another vehicle. Tom immediately contacted Lyft about insurance coverage.

- August 22: York Risk Services Group (YRSG), an insurance company Lyft contracts with, offers Tom an initial settlement. Tom responds asking for a higher amount of compensation based on his research. No response from YRSG.

- August 29: Tom sends a second request to YRSG, no response.

- September 4: Tom contacts YRSG again. No response.

- September 14: YRSG responds “no” to Tom’s request for higher compensation. Tom responds asking for an update on the process and the settlement check. No response.

On July 12, Tom was driving for Lyft when he rear-ended another vehicle. His passenger was fine, and Tom contacted Lyft about insurance coverage. Lyft contracts insurance services through Marsh Risk & Insurances Service, Steadfast Insurance Company and York Risk Services Group.

York Risk Services Group (YRSG) is the claims adjuster and, after five weeks, they deemed Tom’s car to be a total loss. During this time, Tom compiled fully and quickly with all requests from Lyft support and YRSG.

York Risk Services Group did not offer Tom an initial settlement until August 22 – over a month after Tom’s accident. If you’ve ever worked with insurance companies before, you know that sometimes what they offer you for your car repair or replacement is less than what you expected. Tom knew this and had done his research on car replacement pricing, so he responded quickly to YRSG and asked if they would be willing to increase their offer based on his research. He did not receive a response.

One week later, Tom emailed a second request asking for a response to his inquiry. He did not receive a response. On September 4, Tom contacted them again for a response, but didn’t hear back.

Finally, on September 14, Tom received a reply from the insurance adjuster at York Risk Services Group. Note this response came 17 days after Tom responded to YRSG, asking them to raise their settlement offer based on Tom’s research. YRSG’s reply? “No” to increasing the offered amount.

Tom responded to YRSG, asking them to update him on the steps in the process and mailing him a check based on the amount of their settlement offer. Tom has not yet heard back since reaching out on September 14.

Related: Life insurance for Lyft drivers

Lyft’s Response During This Time

While Lyft is not an insurance agency and does not provide insurance services, Lyft is invested in getting drivers on the road. As such, you may expect Lyft to do more for drivers to help them get back on the ride sooner. However, Lyft’s Driver Support response to Tom has been to refer him to “the adjuster”, in this case, York Risk Services Group.

While Tom expected the settlement process to take a while, he never expected it to take this long, given his prompt responses and well-researched documentation on a replacement vehicle. However, it is not that surprising that Lyft isn’t getting involved in this situation, as they contract out insurance services and aren’t involved in that process.

What Can Drivers Do in This Situation?

In Tom’s case, he’s made formal complaints to the State of Texas’ Department of Insurance, and Tom is providing social media updates to a local rideshare drivers’ group on Facebook. Overall, it’s important to keep a few things in mind if you get into an accident and have to deal with Lyft or Uber’s insurance companies:

- Be patient – in most cases, it will take a while for your claims to be processed.

- Keep multiple copies of everything – police reports, witness statements, the other person’s insurance information (if your accident involved another person), communication with the insurance company (if you do it by email, but also make notes of when you call the insurance company, with whom you spoke and what they told you). You may likely need to send the same information to the insurance company multiple times.

- Be persistent – Tom advises staying on top of your claim by following up, reaching out, and just generally being persistent with the insurance company. They want you to give up and accept the first low offer, or go away entirely, so it’s in your best interest to be persistent but polite

- Share your story – if you’ve successfully come to a resolution with Uber or Lyft’s insurance companies, share how and what you did! If your claim is still under review, share your story online or in driver forums so others are aware of the process. Much like being persistent, being vocal can work in your favor or, at the very least, make other drivers aware of the insurance process.

Are you an Indiana or Illinois driver? Check out InsuredASAP for affordable car insurance for residents of Illinois and Indiana. InsuredASAP offers coverage from Progressive, Met Auto-Home, Founders (a Utica Company), United Equitable Insurance Company and more.

Are There Better Insurance Options?

In almost every case, having your own auto insurance with rideshare coverage is going to be better than going through Uber or Lyft’s insurance providers. You can check out a list of insurance agents familiar with rideshare insurance by state here, but there are two companies in particular that offer rideshare insurance plus other benefits.

Allstate Insurance

Allstate’s coverage works by adding what’s known as a “rideshare endorsement” to an otherwise standard Allstate auto policy. The endorsement prevents you from being dropped from your policy as a result of driving for Uber or Lyft – and it closes the all-important Period 1 coverage gap.

In addition to keeping you legal by allowing for ridesharing (and by closing the Period 1 coverage gap), Allstate’s rideshare endorsement also comes with a big perk: deductible gap coverage.

Deductible gap coverage through your Allstate rideshare policy will reimburse you for a portion of that deductible, so that it matches the deductible on your personal policy. You’ll still need to pay the full amount to the TNC first – but once you send the receipt to Allstate, they’ll pay you the difference between the TNC’s deductible and your personal one. If you’re on the hook for the full $2,500, but your personal deductible is only $500, Allstate will reimburse you $2,000.

For more information on Allstate, check out our article ‘How Does Allstate Rideshare Insurance Work?’

State Farm

State Farm is one of the only companies that offers coverage across the board in all three periods, so you’ll never have to worry about going through a TNC to process your claim – and they’ll work to refund your deductible when you’re not at fault.

Some rideshare insurers offer “gap coverage,” which extends your personal policy to include period one, but stops short of providing coverage during all three periods. In this scenario, you’ll be at the mercy of Uber and Lyft’s insurance providers if you’re in an accident during periods two or three. Except for liability coverage, which shifts to the TNC, your State Farm’s car policy coverages (such as rental, medical payments for you or comprehensive) actually extend through all three periods. So if you have an accident at any point, you can go through State Farm.

With State Farm, you can avoid all that hassle and just call State Farm’s claim department, regardless of which period the accident happened in. You’ll still receive all of your usual personal policy’s features. They’ll work to refund your deductible if you weren’t at fault – and if you opt for coverage that includes a rental in the event of an accident, you may even be able to keep working while your car is in the shop.

For more information on State Farm, visit our article ‘How does State Farm Rideshare Insurance Work?’

Related: How Much Does Rideshare Insurance Cost?

Tom’s claim is not yet resolved, but we will stay in touch with Tom and let RSG readers know once there is a resolution.

Have you been in an accident with Uber or Lyft and what was your experience handling Uber or Lyft’s insurance?

-Melissa @ RSG