Last week, we explained what’s going on with AB5 and how it could turn us all into employees, but there’s a long way to go before that bill is finalized. In the meantime, we thought it would be interesting to take a look at what life could be like if we do all become employees. Today, RSG contributor Sergio Avedian walks us through what life could be like as an Uber/Lyft employee, plus examines other companies that have transitioned their workers from IC to employee.

Editor’s Note: We originally published this post last year but have updated it with current examples and information.

It’s Monday morning and I’m up early to drive. After brushing my teeth, I put my Uber collared shirt on and my Uber cap. I am ready to get on the road with cell phone in hand. As of today, I am an employee for Uber ready for my morning rush hour shift, I will be a Lyft employee for the evening rush hour shift. I have my Lyft t-shirt and hat in the trunk. The night before I picked my time slot and was warned to turn my app on exactly when I was told to do so. As a part time driver, morning rush hour fits my schedule.

Transition from an Independent Contractor to Employee

I’ve always been a surge only driver: I used to make close to $30-$50 per app an hour in Los Angeles back in April 2018 when surge was plentiful and power zones stretched across the core of the city. However, after a couple of vicious cuts over the past months, our rates in Los Angeles have been reduced to 60 cents a mile and 21 cents a minute.

I now consider myself lucky if I can crack the $25 per app on hour. Surge/PT (prime time was replaced by PPZ, Lyft personal power zones) has all but vanished due to an over saturated driver count, quests have been cut to 25-50 cents per ride from $2-3, power zones left Los Angeles a while ago and consecutive streak bonuses have all but disappeared. I never wanted to be an Uber employee, but thankfully the politicians stepped in and gave all drivers a lifeline by passing AB5.

Now, as an employee of Uber, I make $12 per hour which is minimum wage in California for 2019 while my driver app is on and I also get reimbursed for all the miles I drive. It’s a welcome change since we never got paid for dead miles and pickups in the past (for the most part – Lyft is trying out a new driver pay structure). I had to install a mileage tracking device to get reimbursed, a small price to pay. I won’t get healthcare since I’m a part time driver and I won’t get paid for overtime since Uber won’t allow a driver to go over 40 hours per week.

One of the nice things about AB5 passing was that it forced Uber and Lyft to divulge the destination of the passenger with the ride request. Unfortunately, I have to keep a 90% acceptance rate or I’ll be deactivated. My AR (acceptance rate) used to hover around 20% before as an IC, but as an employee of Uber, things have changed drastically. Now I must and am willing to accept every ping since I get reimbursed for all miles driven.

Uber and Lyft have turned me into a robot taxi. It’s still a flexible gig if I can keep 90% acceptance rate, do at least 250 rides in 30 days and hold at a 4.90 driver rating. If I don’t keep those numbers up, I’m not given priority and the chance to reserve my desired time slot.

It Was All a Dream… But What Happens if Uber Drivers Become Employees?

Ok, everything you read so far was just a dream. California bill AB5 is not the law of the land yet and and not yet throughout the country. However, if we assume for one second that AB5 passes in its current form and we all become employees, some drivers may quit immediately. More likely, most drivers would stick around though to see how things play out in (or not in) their favor.

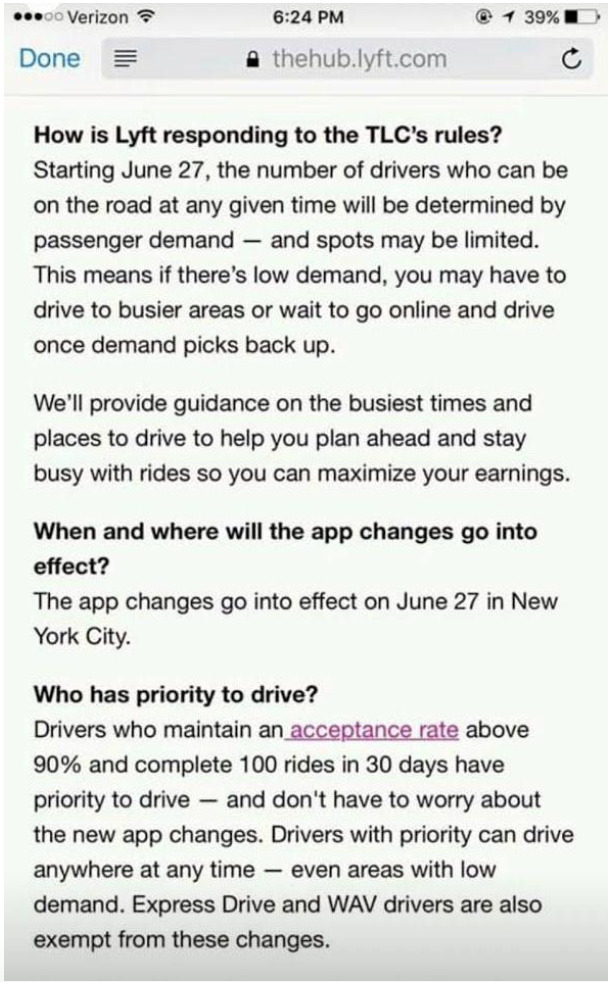

We already have a clue as to how one aspect of driver flexibility may change with the recent New York City legislation that set a “utilization rate”, increasing the amount rideshare companies have to pay drivers (at least $17.22 an hour after expenses) and froze the number of Uber/Lyft vehicles in NYC.

Fast forward a few months, and drivers are earning more per trip, but check out what Lyft is doing in retaliation:

This is happening in New York and while it may not seem fair to drivers, it also makes sense. Lyft or Uber don’t want to pay drivers to not do rides. They will need to have more control of when and where you drive if they’re required to pay you a minimum wage. Makes sense, right?

If AB5 passes in California in its current form, I expect the same to take place. Is it legal, yes, is it ethical? Definitely not, but I wouldn’t expect anything less from either Uber or Lyft. Isn’t it funny that Lyft flew under the radar for so long as a driver friendly company but now that the gloves are off, they’re showing their true colors?

And what’s ironic is that Lyft has actually banned driver-friendly apps like Mystro that could solve this very problem for them. If Lyft partnered with a company like Mystro, drivers could remain offline and get sent requests via Mystro once they’re ready for a trip.

Some Companies Have Already Made the Switch from Independent Contractor to Employee

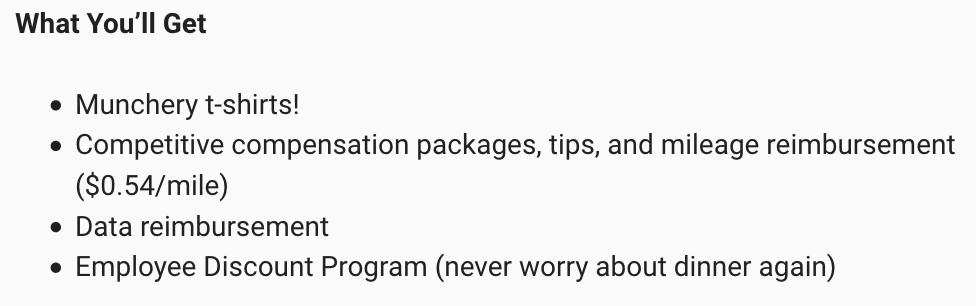

In 2014, a food preparation and delivery company called Munchery decided to switch from a workforce of independent contractors over to employees. They were the first company within the on-demand economy to do this but they later went out of business. Not sure how much the switch had to do with going under but it’s still an interesting case study.

According to this position for a delivery driver on their jobs page, those who deliver with Munchery would receive an hourly rate of $15, $0.54/mile (2014 IRS guidelines) reimbursement for the use of their car, some t-shirts, data reimbursement, and apparently free food:

Eaze Reclassified Drivers as Employees

Eaze is a marijuana delivery company in California that operates in a similar way to food delivery (except they actually deliver weed faster than food delivery delivers food). After recreational legalization, Eaze supported and advocated for the switch in classification from 1099 to W-2 for cannabis delivery drivers. This was part of an overall legislative effort to bring the adult recreational market into existence in 2018. The change affected all delivery drivers in the cannabis industry. Drivers are not employees of Eaze – they are employees of retailers.

What Happened With Eaze When They Switched From Contractors to Employees?

In the case of Eaze, they began contracting through a staffing agency to hire and manage their fleet of marijuana delivery drivers. So the drivers actually never became employees of Eaze so much as they became employees of a temporary employment company called Allied Staffing.

Flexibility also tightened from being able to login and work almost anytime (similar to Uber) to having to sign up for hourly blocks of shifts (more similar to Amazon Flex). When we sent Dash to sign up and deliver for Eaze, he said he missed the ability to turn on the app and do deliveries whenever he had free-time.

With Eaze, Dash estimated how much he could earn delivering with Eaze, and found it would likely be less than what he could do as an IC. Furthermore, almost all drivers are now limited to 40 hours a week to avoid paying time and a half. Part-time drivers have to work around 20 hours a week. You must signup for a shift, and if you miss it, you get in trouble. Just like a normal job.

How Did The Shift To Employment Status Affect Driver Pay?

Similar to Munchery, Eaze employee-drivers receive an hourly pay rate and a mileage reimbursement. Instead of getting paid per every job completed, the now employee-drivers of Eaze receive $15 per hour in addition to a $0.54/mile (2014 figures, $0.58 in 2019) mileage reimbursement. That’s ALL MILES driven. Not just on delivery runs!

The Mileage Reimbursement Alone Is Similar To Uber

To compare that to Uber Los Angeles driver pay (60 cents a mile and 21 cents a minute), Eaze’s mileage reimbursement alone is actually very similar to Uber non-surge base fares. For example, I currently earn $0.60/mile after Uber’s cut for an Uber X ride in Los Angeles, but only when I have a passenger in the car, and as we all know, we don’t get paid anything for the pickup.

An Eaze driver will earn $15/hour + $0.58 for EVERY business mile driven in their personal vehicle in the same market. That’s really good at today’s rates in most cities.

Flexibility and Scheduling

Several of the drivers at Eaze pointed out they didn’t like being an employee now because they were capped at 30 hours a week. This “30 Hour Ceiling” for part-timers has also been further observed by Alanna Samuels writing for The Atlantic, who interviewed a general manager of a dispensary named Sky Siegel on what happened to his drivers after reclassification: “Some left because Siegel can’t yet afford to offer them benefits, so he is limiting employees to 30 hours a week so as not to trigger IRS provisions that would categorize employees as full-time. “

Still though, some would argue that employees don’t necessarily need to be scheduled in order to work and that the idea of getting rid of flexibility is a bit of a farce. I think that’s true to an extent – and we still might still see a lot of flexibility in the rideshare world if other on-demand companies were forced to make the switch. However, so far companies forced to make the switch have been more in favor of scheduling.

Healthcare Benefits

Full time Eaze drivers presently receive healthcare benefits, vacation, sick days, etc. I have no word on whether they have a 401K though. I wasn’t able to get any details on what Munchery offers their drivers in the form of healthcare but hey, they offer free food, so that’s pretty good I guess.

Employee Protections and Rights

Being an employee means workers are entitled to a slew of laws and worker protections developed over the last 130 years. This includes things like workers compensation if injured on the job, paid breaks every 2 hours, paid lunch breaks, overtime pay past a certain point of working, the right to organize a union, as well as protections from discrimination in hiring and retaining workers. It is very expensive to hire and fire an employee in California.

Save on Self-Employment Taxes

There are several tax ramifications from going from contractor to employee. For example, you no longer have to pay an extra 7.65% in self-employment tax to cover your side of Medicare. It also means that your income taxes are deducted from your paycheck each paycheck.

Lose Standard Mileage Deduction (If Reimbursed)

Both Eaze and Munchery delivery drivers receive monetary compensation for the mileage they put on their personal vehicles. Under IRS rules, this means they would not be eligible to claim the standard mileage deduction (or any Schedule C deductions for that matter).

The standard mileage deduction makes a big difference for independent contractor-drivers because it’s often so massive that it reduces Adjusted Gross Income for a rideshare driver to near or below the poverty line (even though real earnings are actually much higher). As employees, this tax loophole wouldn’t be available anymore.

That being said, I’ll take a cash mileage reimbursement over a tax deduction any day of the week. Even if it means I have to pay a little more in taxes.

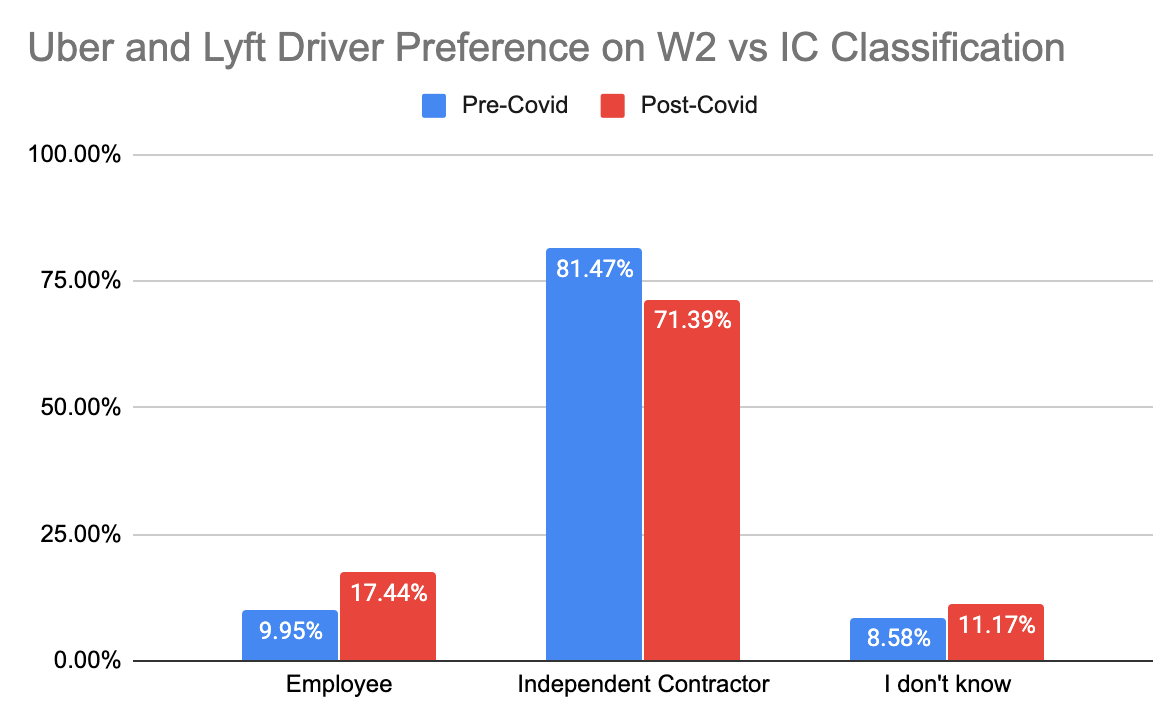

Do Uber drivers want to be employees?

In a recent survey we conducted, we found 71% of drivers surveyed still want to be independent contractors. Prior to COVID-19, 81% of drivers stated they wanted to remain independent contractors. So, no matter how you look at the info, most drivers would rather be independent contractors than employees.

In that vein, with the current state of the world in reference to the pandemic, drivers might be fearing what Uber and Lyft could do during times like these if they were employees instead of independent contractors. In recent news, Uber and Lyft have been laying off employees at alarming rates.

In that vein, with the current state of the world in reference to the pandemic, drivers might be fearing what Uber and Lyft could do during times like these if they were employees instead of independent contractors. In recent news, Uber and Lyft have been laying off employees at alarming rates.

Should Uber Drivers Be Employees?

I often hear arguments along the lines of “If we were employees, Uber would be completely ruined!” However, one of the few things that is clear when I look at Eaze and Munchery is that it is possible to still operate these companies when your workers are employees.

Another big mystery factor here is how Uber and Lyft would duck their obligations as an employer if AB5 passes and codified. Would they limit us to only 30 hours a week? Would they only hire experienced full-time drivers? Would any of us get healthcare? It’s difficult to know, and one can only guess. Regardless of how we would be treated as employees, we would finally have a federally recognized right to collectively bargain. Which could be…exciting. And loud!

Readers, what do you think the chances of AB5 passing are? Would you want to become an employee?

-Sergio @ RSG