In his previous article, deliverer extraordinaire Dash Bridges detailed his first shift working for Eaze. In the latest post on Eaze, Dash breaks down what you really want to know: how much did he make?! Keep reading below – the answer may surprise you.

In my previous two articles, I described the state of cannabis delivery in certain states (where legal) and the sign up process with Eaze. I also covered the hiring/onboarding process and my first day on the job. Now, let’s get right into what most of you want to know. The stats and the money!

Comparing Shifts with Eaze and DoorDash

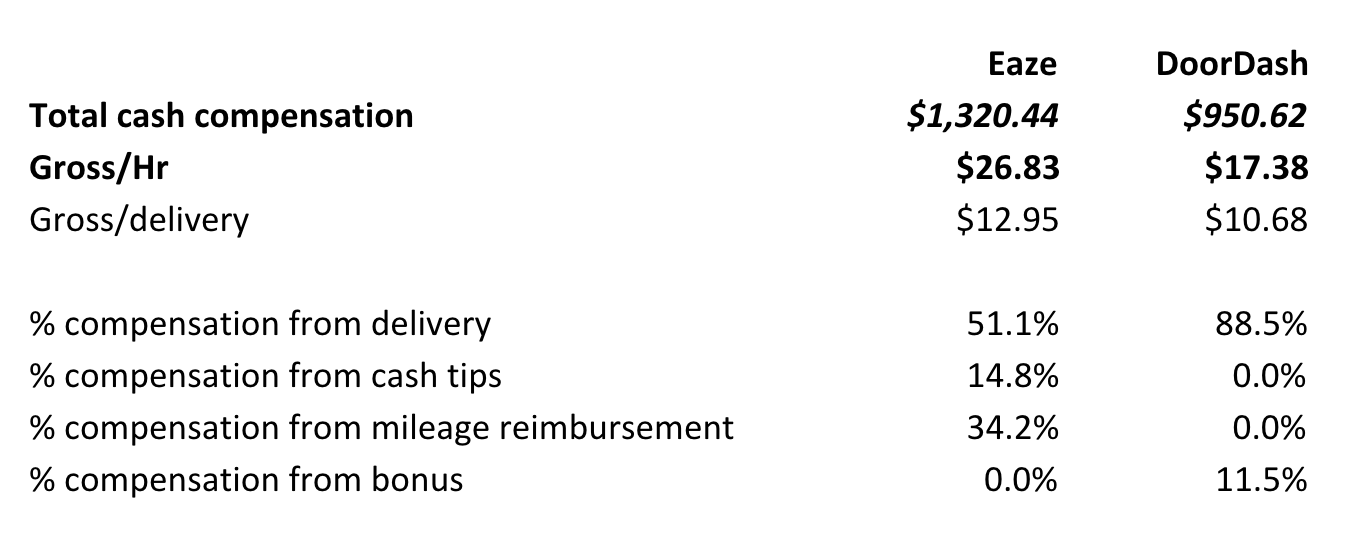

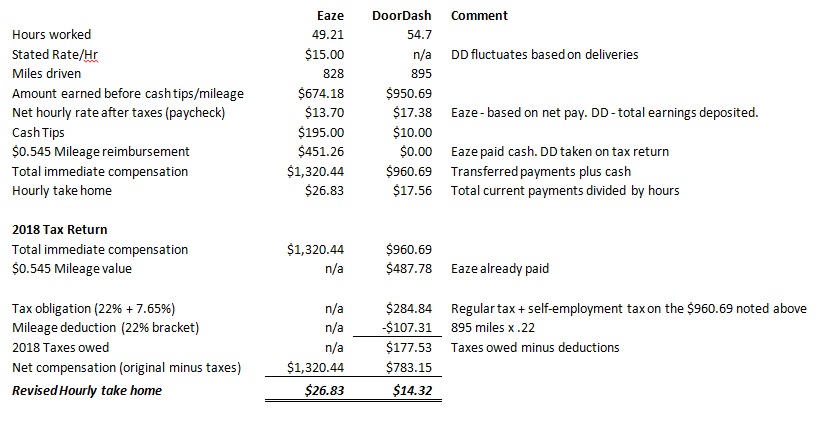

First, we have a by-the-numbers comparison between Eaze and DoorDash. My Eaze numbers were taken from my first 10 shifts, occurring in August. My DoorDash numbers are based on a three-week run in July. Here’s how they look:

Pretty similar. DoorDash’s numbers reveal a bit of summer slowdown, but otherwise it’s close to the norm.

At this point, I expect to open my window and hear the faint yell, “BORING! NOT WORTH THE CLICK, DASH!” But, it gets interesting. Read on…

Why Eaze is Better than DoorDash (Hint: Taxes)

As you may recall, Eaze (technically, Allied Staffing) hired me as a W-2 employee, which is unique among the app-based delivery companies. The practice is likely required per government regulation on marijuana delivery, but regardless, all drivers are W-2.

The difference between W-2 and Independent Contractors involves huge tax implications. It’s also too simplistic to compare total hourly compensation without considering federal taxes. At Eaze (Allied Staffing), my pay rate is a flat $15.00/hour, counted from the shift start time to final signout following my equipment return. If Eaze is $15.00/hour and I’ve been touting DoorDash’s traditional $19-$20/hour, DoorDash is better, right?

WRONG!

Let me reveal more of that chart.

“$26.83 an hour? ARE YOU KIDDING ME?”

It’s true! Mileage reimbursement is a huge factor. The difference is due to your status as a W-2 employee vs. an independent contractor. As a W-2, Eaze is obligated to compensate me $0.545/mile for all driving done on the job (remember the GPS device I install before every shift?).

Unless you’re driving a Ford F3500, the $0.545/mile payout is a generous allowance. If I drive 1,000 miles for Eaze, they are required to pay me an extra $545.00 (1000 x $0.545). They pay it every two-week pay period.

As an independent contractor, I’ll deduct $545.00 from the taxable income on my 2018 federal 1099 form. That’s different than a straight reimbursement. Fast forward through the accounting, and I’m only reimbursed a total of $162.00. That’s a staggering difference! Plus, that reimbursement occurs many months from now when I receive next year’s tax return.

Simply put, mileage reimbursement for W2 employees is paid in full, quickly, and outside of tax considerations. With Eaze, I drove an average of 16.8 miles each hour. 16.8 miles x $0.545/mile = $9.16 UNTAXED per hour. Additionally, Eaze’s common (and untraceable) cash tips averaged $3.96/hr. Combine those two and we’ve got ourselves a bonanza!

The Full Breakdown of Pay

With Eaze, once I receive my paycheck (taxes withheld) and receive my mileage reimbursement, my tax obligation is more or less complete. However, my Independent contractor work has tax implications when I fill out my 2018 return. I went through the expected tax calculations for the same work period:

As I was saying, all of the Eaze tax considerations are complete. Looking ahead to Spring 2019, the revised income remains $26.83/hr. For DoorDash, I need to calculate the taxes on the earnings and subtract the mileage deductions. When all is said and done, the taxes were higher than the deductions, further decreasing the net DoorDash hourly pay to $14.32/hr. Crazy, right?

As soon as I started, it was clear that my income was much better than my $15.00/hr suggested. After a couple of shifts, I’d need to hit an ATM to deposit all the cash collecting in my wallet. And that’s before I’d receive my mileage reimbursement. Again, all untaxed.

Getting Cashed Out by Eaze – Literally

Funny story about the mileage reimbursement… Eaze doesn’t reimburse mileage through normal payroll. It’s done by giving an envelope full of cash every two weeks. One day before a shift, a supervisor handed me an envelope with a label that said “Dash Bridges, $X dollars, X date – Y date”, and it had a huge wad of cash inside!

No printout. No calculations. Just a ton of cash. I had my own calculations for my mileage for that period, and the payment was off by a noticeable amount in my favor. It was one of the craziest employment experiences I’ve ever had! A real, legit company just handing me an envelope full of cash without any sort of corroborating documentation. I was totally flabbergasted.

Is it Worth it to Drive for Eaze?

So, to wrap up my Eaze experience, I tried it because I wanted more delivery responsibility and subsequently earn more money. And that’s exactly what happened, even if it was an unintended consequence of regulations forcing marijuana delivery drivers to be employees instead of contractors.

That’s my biggest takeaway from this experience. If you want to work in the mobile-app delivery space, or elsewhere in the gig economy, find someone who will put you on a W-2. There’s greater commitment, for sure. But if you’re the slightest bit professional, you’ll be fine. Maximize your earnings on your time. Isn’t that why we’re here?

Drive safely, everyone!

P.S. My status as the last person in America to have neither a tattoo nor a Twitter account has come to an end. See my delivery observations at @DashBridges.

Would you drive for Eaze if it came to your city? What other questions do you have for Dash?

-Dash @ RSG