As part of the Proposition 22 passing in California, it was promised that drivers would receive a health care stipend each quarter if they had eligible coverage and drove the required number of hours. Despite the promises and some information directly from the companies, it’s still confusing many drivers on how to get the stipend and who qualifies. We did some digging and research to try to help answer these questions and more.

How to Qualify for the Prop 22 Health Care Stipend

The first step, of course, is knowing how to qualify.

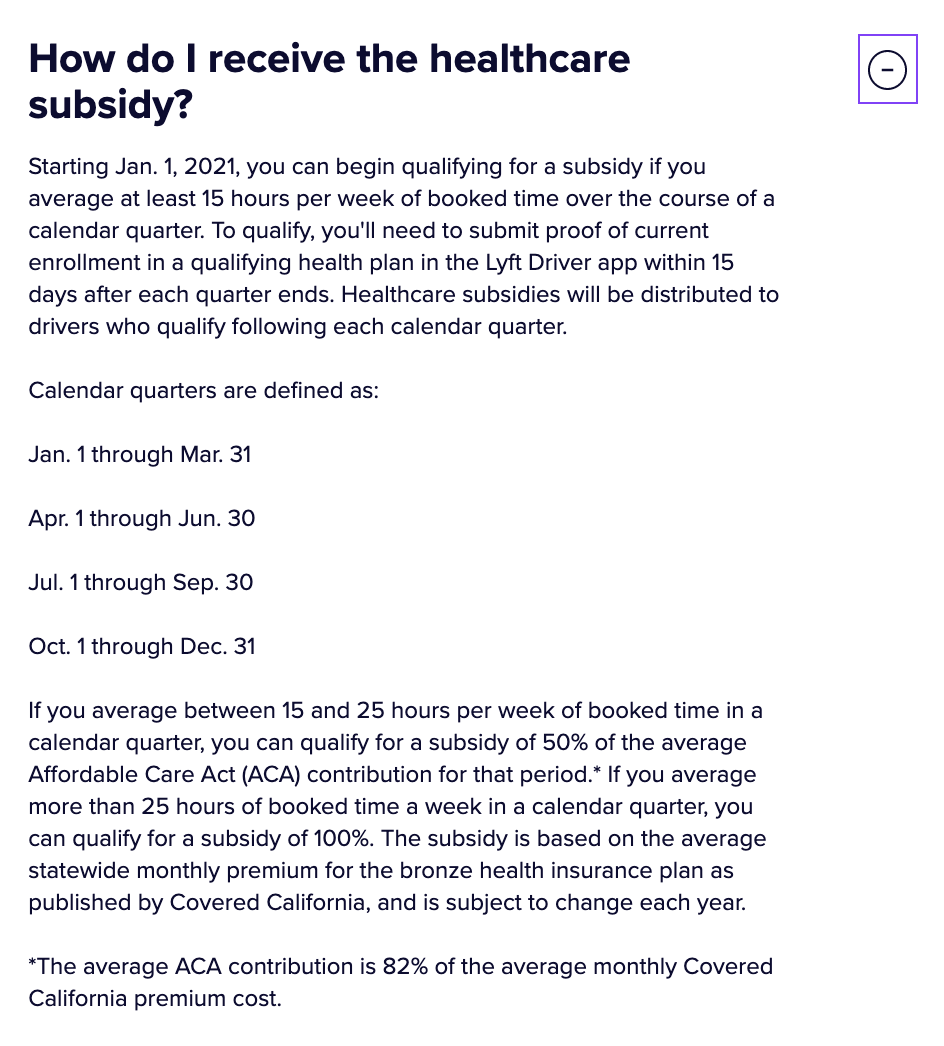

This is taken from Lyft’s website, but all of the California rideshare apps have similar wording and the same requirements.

You need to average at least 15 engaged hours a week—meaning a passenger is actively in your car on a trip—over the course of a calendar quarter to qualify for the lowest tier of distribution (50% of the average employer contribution under the Affordable Care Act).

If you average at least 25 engaged hours per week for the quarter, you’ll qualify for the highest tier of distribution (100% of the average employer contribution or equal to 82% of average premium costs, according to an Uber spokesperson.)

You also have to submit proof of your current enrollment in a qualifying health plan within 15 days of the end of each quarter.

It is not possible to combine engaged time across platforms. However, on Uber and Uber Eats, drivers and couriers can combine their work on the Uber platform itself and accrue engaged time beginning the moment a driver accepts a trip or delivery request.

The subsidy amount itself is determined by the average statewide monthly premium for the bronze level health insurance plan published by Covered California. It is subject to change each year.

For 2021, the average statewide monthly premium for the bronze level health insurance plan published by Covered California is $499.

Which Health Plans Qualify?

This is something that’s been hazy. If you’re on Medicare, you do not qualify.

However, I spoke with a driver, Stan, who is on Medicare who did qualify because he has add-on benefits that he does have to pay for out of pocket. Because of this expense, as opposed to getting free health care, Stan qualifies for the stipend and did receive it after the first quarter in 2021.

Otherwise, if you are on a state subsidized health plan such as Medi-Cal, you will not qualify for the Prop 22 health care subsidy. You will also not qualify if your insurance is employer provided. So, if you have a W-2 job where they offer health insurance (whether you pay premiums or not), you will not qualify.

Keep in mind, if you are enrolled in a qualified health insurance plan, you’re not necessarily going to receive money back to cover the full cost of your premiums. It is based on the average statewide monthly premium for the bronze level health insurance plan published by Covered California ($499 in 2021.)

So, if you have a higher level of coverage, you will likely only see a portion of this money back if you meet the qualifications.

Glitches in Tracked Hours

One problem that several drivers have had is that Uber seems to have troubles with properly tracking the engaged hours. This has been an ongoing problem that the company is aware of. One driver I spoke with thinks it may have gotten ironed out sometime in May 2021, but he’s not 100% certain of it.

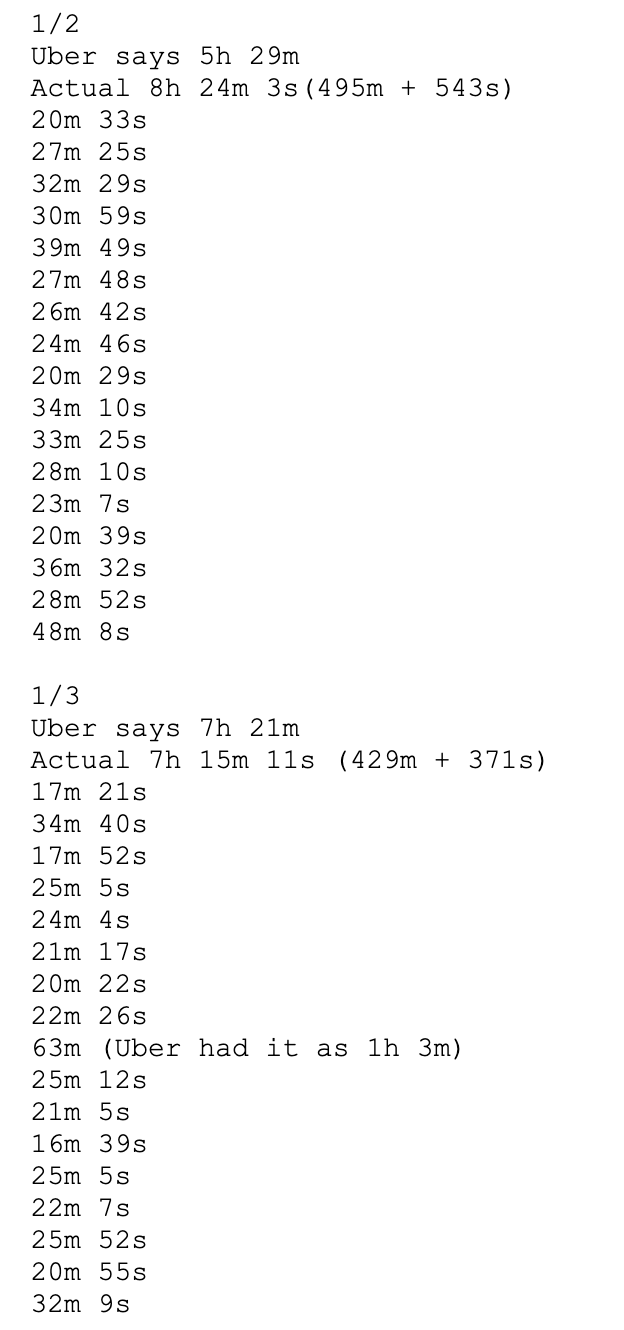

We had a few drivers reach out to RSG to share their numbers. One was tracking all of his active hours in a document and comparing to what Uber showed his hours to be, which were always off. Mostly lower, but sometimes even higher than his daily totals were showing.

Here’s a screenshot of two of his days of driving. He breaks it down by trip, showing the actual hours he was in engaged hours on the Uber app. He also shows what Uber says are the engaged hours for the day. The second is close, but clearly neither of them are adding up properly.

Others reported similar issues. One driver said he’d been in contact with Uber and they did say this was a known issue that was being worked on, but he never received communication about a fix.

We reached out to Uber about this glitch, and a spokesperson said: “A temporary error did occur, which impacted a small number of drivers. This glitch was resolved and all the impacted drivers were paid in full for their time.”

Proposition 22 FAQ

Below are a few other questions that have come up with regards to Proposition 22.

How does the health stipend pay out?

It will come as a separate deposit into your connected account for your weekly direct deposits.

Can you get the stipend from more than one gig app?

If this is possible, no one is sharing it on the internet that I can find.

Can you combine your engaged hours between platforms to reach the minimums?

No, you cannot combine engaged hours across platforms. However, if you drive with Uber and Uber Eats, you can combine hours because it is in one platform (Uber’s platform), for example.

How does the minimum earnings guarantee work?

For every 14-day guaranteed earnings period, you’ll earn at least 120% of the minimum wage for booked time, plus 30¢ per booked mile — from the moment you accept a ride request until the time you drop off your passenger.

Note: You are not paid for your “pickup” time up front in the app, but it is part of the calculation to determine your guaranteed earnings.

As it states on Uber’s blog, “The guarantee applies to active time, which starts when you accept a trip and ends when you complete it, for both rides and deliveries.”

Guaranteed earnings are a bit tricky and hard to understand. Their blog further states:

“When calculating your earnings guarantee, we calculate 120 percent of the pick up city’s minimum wage for your active time plus the number of miles you drove during that active time, multiplied by $.30. If you earn less than this guaranteed amount through your trip fares and applicable promotions, we’ll pay you the difference. Tips, refunds for tolls and cleaning fees, cancellation fees, and referral payments are on top of your earnings guarantee.”

This person on UberPeople explained the calculations very well (note: the numbers are from 2017, so you may need to make adjustments on calculations depending on where in California you drive). They said:

The earnings guarantee does not replace current rates per mile or rates per minute. What it does is guarantee that drivers will earn 1.2 times the minimum wage plus 30 cents per mile but only from ping acceptance until pax drop off.

So, using SF rates, let’s say that you get a ping that is one mile away and the trip length is 5 miles; total distance driven is 6 miles. It takes you 4 minutes to drive to the pax, 3 minutes for the pax to get to the car and 15 minutes to drive the pax to their destination; total time = 22 minutes. Uber would guarantee that the driver would make on this trip:

Mileage: 6 x $0.30 = $1.80

Minimum wage x 1.2 for those 22 minutes: $15 x 1.2 x (22/60) = $6.60

Total guaranteed earnings: $8.40

Now let’s see what the trip earnings would be for this trip:

Base fare : $1.60

Miles: 5 x $0.72 (the app only calculates miles with pax on board) = $3.60

Time: 1 minute wait time + 15 minutes’ drive = 16 minutes. 16 x $0.31 = $4.96

Total: $1.60 + $3.60 + $4.96 = $10.16

Because $10.16 actual earnings is $1.76 above the $8.40 guarantee, no guarantee payment would be made.

California drivers, what has your experience with Prop 22 been like? Have you received the health care stipend?

-Paula @ RSG