This is the fourth article of our six part series on setting up your rideshare business. Last time, we explained why it’s important to set up a business credit card. Today, we’ll tell you all about the great free tools that exist to help rideshare drivers track their income and expenses.

If you liked this course, we’ve got another one over at MaximumRidesharingProfits.com. If you’ve found that your income has been decreasing lately with the influx of more and more drivers, we have released all of our top money making strategies in this course. We’ll help you work smarter AND earn more money!

Day 1 – Should You Form An LLC For Your New Rideshare Business?

Day 2 – Setting Up Your Rideshare Business Checking Account

Day 3 – Applying For Your First Rideshare Business Credit Card

Day 4 – What’s The Best Way To Track Your Income & Expenses?

Day 5 – What Are The Best Apps To Track Your Mileage?

Day 6 – Everything You Need To Know About Rideshare Taxes

I like to call the first month or two of a rideshare driver’s career “The Honeymoon Phase”. During this period, most drivers aren’t too concerned with how much money they’re making or what their costs look like. Instead, they’re just psyched to be getting paid to drive people around whenever and wherever they want.

It’s a cool feeling when you first get started as a rideshare driver and I still remember my first day on the job! I was nervous but I thoroughly enjoyed it. I don’t have quite the same enthusiasm as I did on that first day but I’m still pretty happy about being a rideshare driver.

Once the honeymoon phase starts to wear off though, most drivers start to really delve into how much money they’re making and what their expenses look like. Uber and Lyft don’t make it easy to calculate this number either since all of their income figures are before commission, gas, depreciation and maintenance.

As a business owner though, you need to plan for long term success and one of the best ways to do that is through income and expense tracking. Fortunately there are some great options out there that will help you do just that.

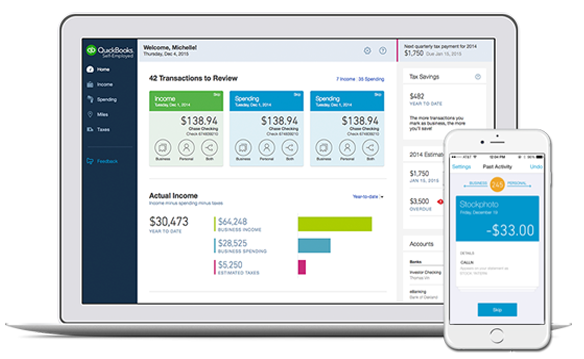

QuickBooks Self-Employed

I have been using QuickBooks Self-Employed to track my driving income and expenses for a while now. I used to stuff all those receipts in the glove compartment of my car, which got way outta control. Now, all my transactions come into my phone automatically and I’m able to get a real-time snapshot of how my rideshare business is doing.

One of the biggest problems drivers get into is guesstimating how much they’ll owe in taxes so what I really like about QBSE is how easy it’s made it to stay on top of my taxes. It ensures I’m deducting all those common driving expenses (like gas, mileage and maintenance) and integrates directly with TurboTax. Take a look and give it a test drive…we worked out a deal for a free trial and 50% discount for our readers!

We also have a couple great resources if you’d like to learn more about calculating your profitability as a driver:

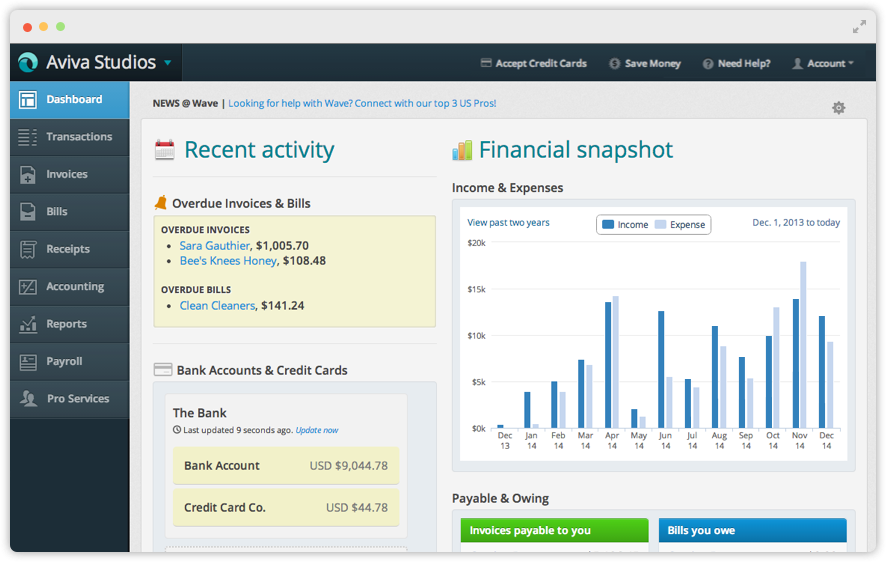

Wave

Wave is a free service that integrates with your business checking account and business credit card account. I use it to see how much money I’ve made during any given time period and to categorize my expenses. You can actually update each account with one click once you log on to Wave and from there, you just need to categorize transactions and verify them.

I usually log on once a week and manage my entire rideshare business in about 5 minutes. This product is designed for small business owners so there are some features like invoicing and payroll that rideshare drivers won’t need, but it is one of the best free options out there in my opinion.

Spreadsheet Method

If you’re old school, your other option is to just create a simple spreadsheet where you track income, expenses and mileage. This can be very simple and if you go this route all you need to do is enter a line item every time you receive a payment from a rideshare company and on another tab, enter a line item each time you have an expense.

Come tax time, it will help if you categorize all your expenses using the same categories that appear on your Schedule C:

- Advertising

- Car and truck expenses

- Commissions and fees

- Contract Labor

- Depreciation

- Insurance (other than health)

- Legal and Professional Services

- Office Expenses

- Rent or Lease

- Repairs and maintenance

- Supplies

- Taxes and Licenses

- Travel

- Meals and Entertainment

- Utilities

- Other Expenses

Now that you have a few different methods at your disposal for tracking income and expenses there are no excuses not to do it. Most accountants will charge you a lot more money at the end of the year if you hand them a shoebox full of receipts. But if you spend just a few minutes each and every week doing a little basic book-keeping, it’s going to save you a lot of money and your accountant a lot of hassle come tax time.

Did you like this article? If you’re ready to continue your education and want to start maximizing your profits today, join hundreds of other drivers who have signed up for our first of its kind video training series on Maximum Ridesharing Profits!

In the course, you’ll learn all about getting started with Uber and Lyft, how to maintain a 5 star rating and lots of strategies for finding more surge rides and maximizing your profits as a rideshare driver!

-Harry @ RSG

PS – Next time, we’ll go over all the different apps and methods available for tracking mileage. Mileage is one of, if not the biggest tax deductions for rideshare drivers so it’s important that you stay on top of it!

Read next: how to make more money as an Uber and Lyft driver

Save