One of the most frequently asked questions we receive at The Rideshare Guy is along the lines of “how much car can I afford“. So today we’ll answer that question: how much should you spend on a car? That answer varies depending on your needs, your family – even where you live! If you’re wondering how much you should spend on a car, senior RSG contributor Chonce Maddox-Rhea has created a handy guide to help you figure it out below.

How much car can I afford?

Looking to buy a new car? One of your first concerns is probably your budget. Everyone wants to get as much car for their money as they can!

According to Edmunds, the average used car is $15,000 to $18,000 while the average new car is $27,000+. People tend to put anywhere from $2,000 to $3,500 down when financing a vehicle.

Before you determine whether you can or can’t afford a new car right now, it’s important to consider all the factors that apply so you can make an educated decision. Here are a few things you need to consider when determining how much to spend on a car.

Start With Your Budget

Start With Your Budget

How much do you think you can afford to spend on a car? If you’re going to finance or lease, you may want to break things down on a monthly basis.

A popular rule of thumb is to spend no more than 15% of your take-home pay on monthly vehicle expenses.

This means, if you earn $3,500 per month after taxes, your monthly car expenses shouldn’t exceed $525. That includes the monthly car payment, repairs, maintenance, and other costs.

Consider your other expenses and whether you can currently afford to spend that much on a car each month. Can you cut or reduce any expenses or change things around in your budget to make it work?

Review Loan Terms

Nearly 44% of Americans rely on a car loan to finance their vehicle. Let’s face it, many of us probably don’t have $20,000 to $40,000 laying around. If you’re going to finance a car, understanding how auto loans work is key.

Most lenders will want you to make a down payment. This can be as low as $500 or $1,000, or it can be $3,000 or higher. Your down payment will reduce the amount of money you borrow and could even help you secure a shorter term.

Today, auto loans can be stretched out as far as 84 months, which is 7 years. It’s important to watch out for longer loan terms because cars are depreciating assets.

Your car will be worth much less in 7 years that it is today. Plus, you’d be paying interest on that loan for all that time. Putting more money into an item that is losing value is costly.

Most auto loans are fixed-rate loans and your interest depends on your credit score. You may be able to calculate your payment beforehand either on a dealership’s website or with a finance manager, depending on where you decide to buy your car.

Pay close attention to the loan terms and not just the monthly payment. See how much it will cost you over time to have the car loan and how much money will go toward interest each month. Make sure you’re okay with all the terms because the vehicle will be used as collateral. If you can’t pay the loan, your car will likely get repossessed and it can also hurt your credit.

Fuel and Insurance Costs

In addition to a monthly car payment, you’ll also have to consider costs for fuel and insurance. Fuel costs will vary depending on rates in your state. However, if you’re a rideshare or food delivery driver, you can expect to spend much more than the average person to keep your car moving.

Looking to save money on gas? Check out our article on the best ways to save money on gas.

The average auto insurance premium ranges from $1,200 to $1,800 per year for full coverage. You could pay more or less depending on the type of coverage you have. If you’re driving a lot, you may want to consider including roadside assistance and there’s also rideshare insurance to help protect rideshare drivers.

Check out our Rideshare Insurance Marketplace for the best vehicle insurance options for drivers.

Actively compare quotes before you settle on an insurance plan and see if you can bundle your auto insurance with another type of insurance (like homeowner’s or renter’s insurance) to save money.

Already have an insurance plan but not sure if you can find a cheaper plan? Check out our Savvy review, which helps you compare quotes to save money on insurance.

Registration

When you buy a new car, you’ll incur a lot of fees, like your registration fee. This is also something that will come up most years so be sure to budget for it. Some states charge a flat rate, while others charge variable fees based on the weight, age, or value of the vehicle.

Registration costs can even increase as well. In my state, our vehicle registration fees increased from $100 to $150 this year so we’re paying $300 per year for two cars. In order to renew your registration in some states, you will have to take an emissions test that must be passed (more likely with an older car).

If your vehicle doesn’t pass, you’ll need to pay for the repairs a mechanic can make to get it up to standard.

Sales Tax

Sales tax is one of the most underestimated costs when buying a new car. Some lucky states like Oregon don’t have a sales tax. In California, the sales tax is 7.25%.

Be sure to look up your state’s sales tax rate so you can factor this in when buying a new vehicle.

Type of Car

The price of a car heavily depends on the make and model. For example, a RAM truck may cost more than a Honda Accord. Review different car makes and models that you’re interested in and compare pricing. Narrow down which features you’re interested and what will fit into your budget.

New or Used?

This is another key factor for the ‘how much car can I afford’ question that often determines how much you’ll pay. Personally, I’ve always been a fan of used cars, but I also want something that’s safe and reliable. Luckily, even if a car is 10 years old at this point, it’s likely been manufactured well and has modern safety elements.

How Can I Reduce How Much I’ll Spend on a Car?

How Can I Reduce How Much I’ll Spend on a Car?

Once you know your budget for a new (or new to you) car, it’s a matter of making it work. This may likely involve finding ways to reduce your out-of-pocket costs.

You can start by doing simple things like making a larger down payment. If you receive a tax refund or any other bonuses, consider putting that toward a vehicle down payment. That way, you’ll have a smaller loan amount.

Some car lots will even offer you a down payment credit if you trade in your existing vehicle. Even if you don’t think it’s worth much, you may be able to get $1,000 to $2,000 to put toward a new car when you trade your existing one in.

Another option is to buy a car from a private owner. Private-owned vehicles are usually priced lower than cars at a dealership.

You may also be able to negotiate better with a private owner especially if they are looking to sell the car quickly. If you need a loan, apply for a personal loan from your bank or credit union. The interest may even be much lower than what dealership financing would offer.

Just be sure to being a mechanic with you to check out the car beforehand and give it a thorough test drive.

Of course, you always challenge yourself to pay for a car in cash. You’ll need to be disciplined and stick to your budget. However, it’s not impossible especially if you’re buying a used car.

If your budget for a used car is $12,000, this may look like setting aside $1,000 per month for 12 months. You may want to look into getting a side hustle to help boost your savings. Also, don’t forget to save a little extra for taxes and registration fees.

Looking for a few ways to make $1,000? Here’s how to make $1,000 fast!

How to Calculate How Much You Should Spend On a Car Based On Salary

If you’re using the 15% rule I mentioned above, calculating how much you should spend on a car should be pretty easy.

If you earn $60,000 per year, that’s around $5,000 per month. However, you want to look at your take home pay. Say you’re bringing home $4,000 per month after taxes and retirement contributions.

4,000 x 0.15 = 600

This means, you may want to spend no more than $600 on monthly car expenses. If you don’t feel comfortable spending this much, reduce it to just 10% of your income.

When I bought my last car, I had to finance it but wanted to keep the amount low. My car note was $233 for a 60-month term. I could have afforded to pay more or buy a more expensive car, but I didn’t want to.

At the end of the day, it all comes down to your preferences and financial goals.

What to Know About Car Financing

When considering financing a car, be sure to check your credit first. Your credit score is one of the most important factors that will determine your interest rate. If you use a site like Credit Karma or Credit Sesame to check your credit, realize that lenders may see a lower score so be sure to factor that in.

Sites like Personal Capital can help you manage your finances and save for the future. Check out our Personal Capital review to learn more.

There are so many different score scoring models and tools that only lenders have access to so your credit score may vary, but it’s important to get a good idea of where you stand in general.

Also, have an idea of how much you can put down and how much you’ll need to borrow. For example, if your budget is a $18,000 car and you can put $3,000 down, that means you’ll be left with a $15,000 loan.

To pay that off in 5 years would mean paying $3,000 toward the principal plus any interest or other fees.

Know that if you go to a dealership, you will likely be pressured to buy a newer car or apply for their special financing deals. This is why it’s important to do your research and have a firm plan before you start car shopping. If you don’t want to buy a 2020 (or 2021) vehicle with $0 down, don’t be afraid to say so and stick with your original plan.

What About Leasing?

What About Leasing?

Leasing is another financing option where you’ll basically borrow the car for a fixed amount of time and make monthly payments. Think of it as renting a car.

Your payments won’t go toward a loan or paying the amount down. When your lease is up, you can either buy out the lease and keep the car, or you can return it and start another lease.

My biggest problem with leases is that they often limit how many miles you can drive during the lease period. This isn’t helpful to someone who drives a lot or has a long daily commute. Also, the fact that you have to return the car eventually would make me feel like the car really wasn’t my own.

While leases may provide you with a lower interest rate and less or even no money down, it’s probably not the best option for full-time drivers due to the added limitations.

How Much Should I Spend on a Car: Car Calculator Options

Be sure to map out how much you want to spend on a car beforehand to get a realistic picture of your options. There are a lot of affordability calculators online to help you generate some estimates.

If you’re interested in figuring out ‘how much car can I afford’, it helps to use a car affordability calculator.

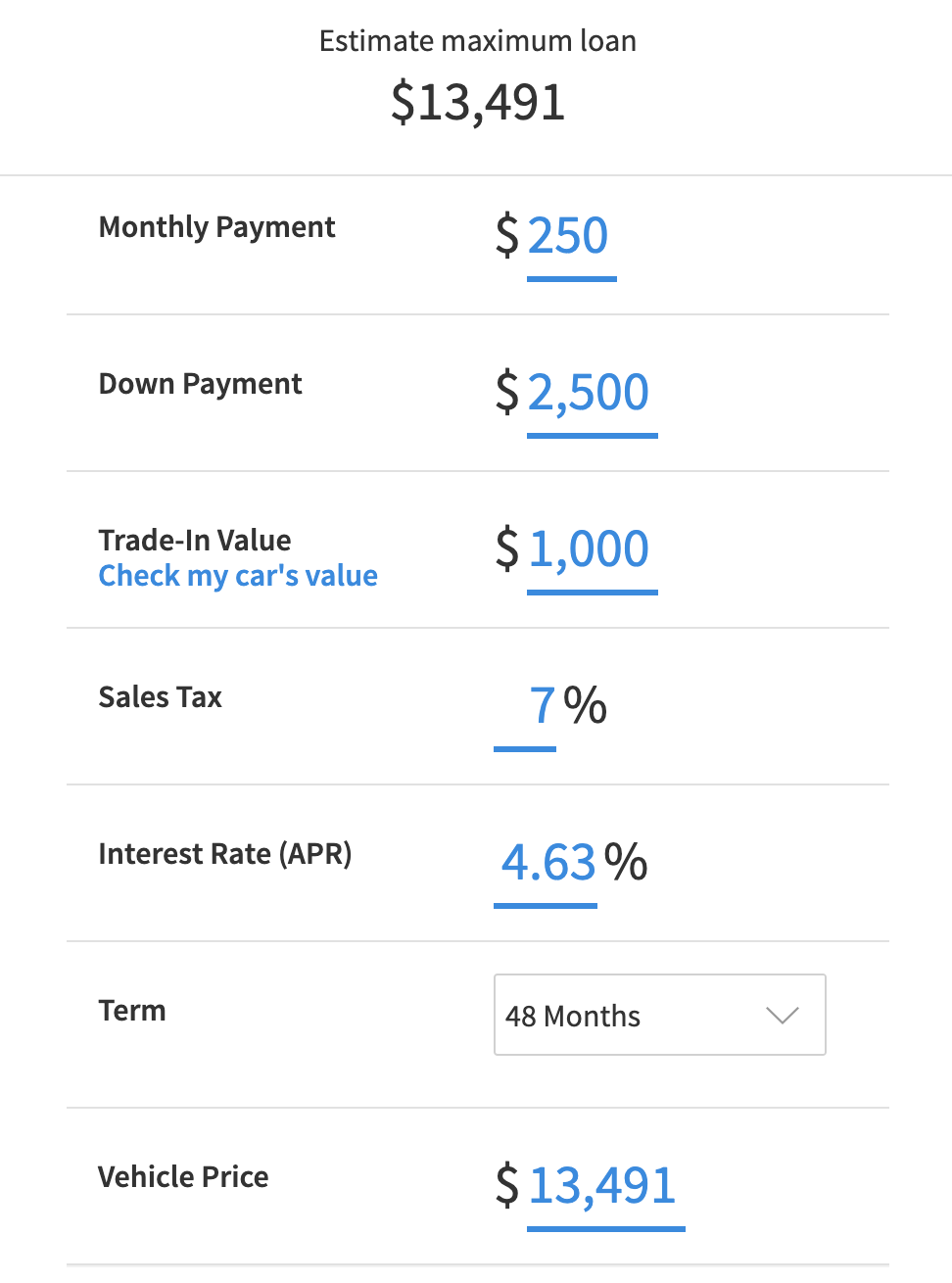

Some of the most popular ones can be found on Cars.com and Edmunds. These calculators allow you to determine how much car you can afford based on your down payment amount, desired term and monthly payment.

As you can see with this calculator, if I want to only pay $250 per month with a 48-month term, I can afford a vehicle around $13,000. This also factors in a $2,500 down payment and a $1,000 vehicle trade-in.

How Much Car Can I Afford? It Depends on Several Factors

In the end, how much car you can afford depends on how much you have to put down, how many months you want to pay for your vehicle, your state’s sales tax rate and the interest rate you get for your loan.

Also, it depends on what you want to do with your car! If you just need to get from A to B, make a few food deliveries here and there, and don’t care what your car looks like, a $5,000 car could be very reasonable.

But if you want a four-door vehicle, maybe something to drive Uber and Lyft passengers around in, and something more comfortable and safer for you, chances are your costs are going to go way up.

If you’re not sure what kind of car you want or if you want to drive rideshare vs. delivery, take a look at car rental options here. You can rent a car and drive in it for a few days to see if you it – and some car rental options will let you drive for delivery and/or rideshare, too!

How did you choose the car you currently drive? Did you buy it or lease it? Let us know what you drive in the comments below.

-Chonce @ RSG