Today’s post comes from reader Nachum, who contacted RSG to let us know his experience with Lyft’s insurance agent, Marsh Risk & Insurance Services. He also had rideshare insurance from Allstate. His story, outlined below, shows one of the best case scenarios you can have after an accident while on a rideshare app.

While Lyft and Uber do offer insurance coverage for drivers, in many cases it’s not sufficient during Period 1 (app on but no passenger in the car), which is why we recommend getting a rideshare endorsement to a regular auto insurance policy. It’s important to find an agent who understands rideshare drivers, which is why we’ve put together the Rideshare Insurance Marketplace.

Here you can find a list of insurance agents by state that are familiar with rideshare insurance and can help you find the best, most comprehensive auto insurance and rideshare coverage.

Click here to visit the Rideshare Insurance Marketplace.

A Recap of How Rideshare Insurance Works

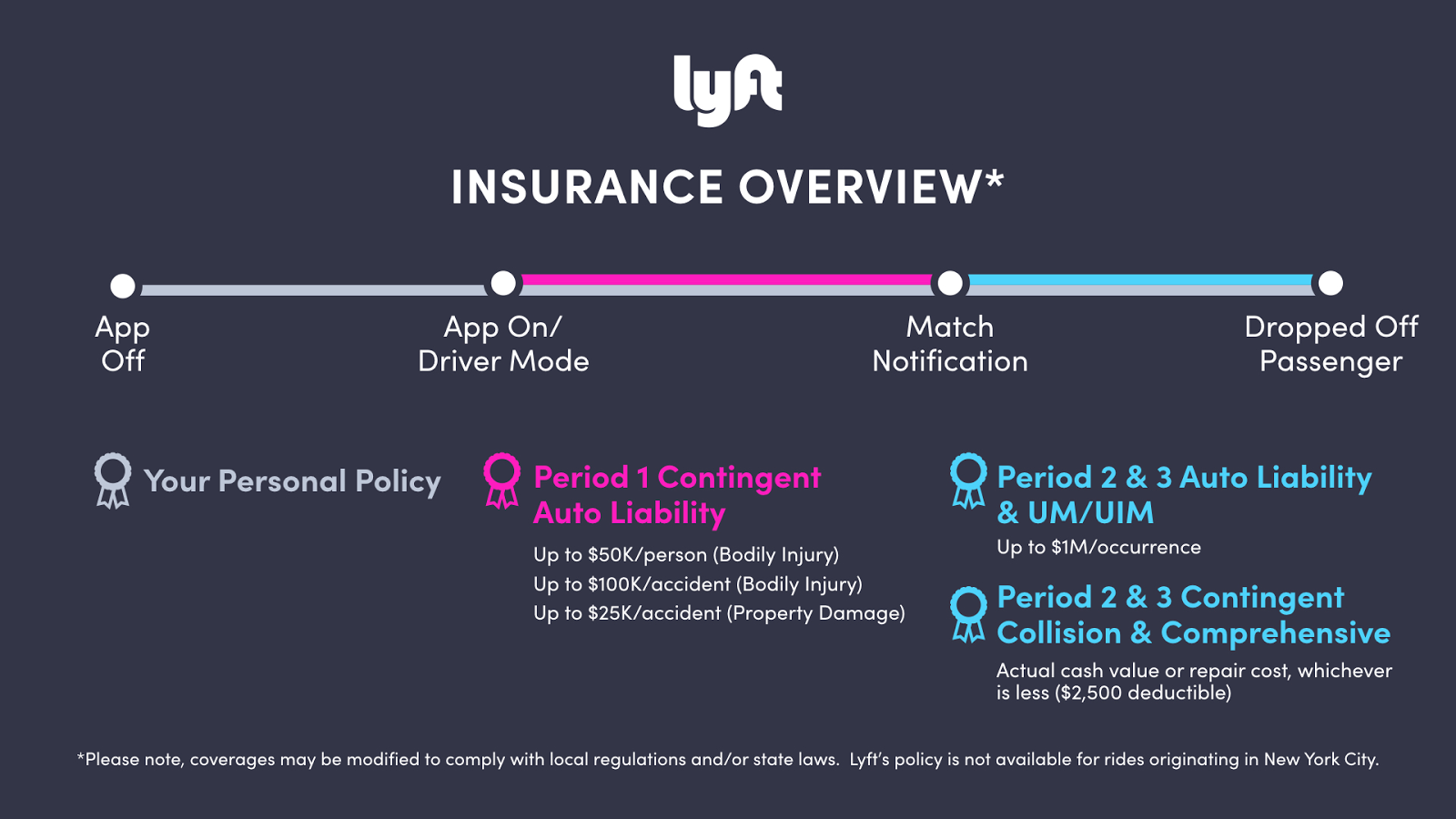

Uber and Lyft only cover rideshare drivers during Periods 2 and 3 (collision and liability). Period 2 starts once you accept a ride request and are en route to your passenger, and Period 3 starts once your passenger gets into your car. But when you’re online and waiting for a request during Period 1, you have no collision coverage from Uber or Lyft and much lower liability limits.

As a rideshare driver, you’re most at risk during Period 1, since you won’t get any collision coverage from rideshare companies and your personal insurer likely won’t cover you during this time either unless you have rideshare insurance.

But if you get into an accident with Lyft during periods 2 or 3, you’re covered – but you are subjected to Lyft’s $2,500 deductible. This means you have to pay $2,500 before Lyft insurance will kick in, depending on what type of additional auto insurance policy you have.

Many drives also don’t realize that, in addition to this deductible, Lyft (and Uber) contract out their insurance services. That means that while you may contact Lyft after you get into an accident, you’ll actually be served by another company, Marsh Risk & Insurance Services. They may also have their own insurance adjusters, in this case York Risk Services Group.

All this to say that insurance claims, regardless of who is at fault, may not be quickly solved. In addition, you likely won’t get much support from Lyft or Uber, since they contract out insurance services.

However, some of these issues can be mitigated if you have rideshare insurance. In some cases, your deductible may be taken care of by your auto insurance company, and/or you may be offered a car to use while yours is in the shop. It all depends on the auto insurance company. Below is Nachum’s story and the outcome after his accident.

Timeline of Nachum’s Accident and After-Accident Insurance Process

RSG reader Nachum recently wrapped up a total loss claim with Lyft, but his story is very different from that of previous RSG reader Tom’s, who had a difficult time going back and forth with Lyft’s insurance. Below is a timeline of what happened and how the incident was resolved.

- October 27: Reader Nachum runs up on a curb while on his way to a Lyft pick up. Hitting the stop sign, he triggers the airbag in his 2007 Corolla and police have the vehicle towed. Nachum first files a claim with Allstate, then uses the “call me” button in the app for Lyft’s Trust and Safety

- Later that day: Allstate confirms Nachum’s rideshare policy and says Lyft will have primary responsibility. Allstate kicks in the difference between Lyft’s $2,500 deductible and Nachum’s $600 deductible. Nachum calls the regular driver support line and explains the situation, is transferred immediately to T&S, which takes down claim details and asks Nachum to get photos of the car

- October 29: Shares photos with Lyft’s T&S team

- October 30: No response. Nachum emails or calls T&S to let them know there were no injuries or third parties involved.

- November 2: Nachum receives an email from Lyft saying the claim has been forwarded to the insurance company.

- November 3: Nachum calls York Risk Services Group (YRSG, one of Lyft’s insurance adjusters) and receives information about his claim number and adjuster. Later that day, the adjustor calls him back and indicates YRSG will pay for the car to be fixed. However, when Nachum tells the adjustor he has Allstate, the adjustor tries to say Lyft is “no longer responsible for the claim.” Nachum uses his rideshare endorsement policy to demonstrate what Allstate’s role is.

- November 6: Annoyed by the adjustor’s attitude, Nachum speaks with the supervisor – who is immediately much more helpful and works to get the claim wrapped up.

- November 8: YRSG declares the car a total loss, provides Nachum instructions on returning the title and other required documents for insurance, and Nachum provides all the documents quickly while keeping the supervisor informed.

- November 22: Once the YRSG supervisor verified the title was in the yard, Nachum received a check for Lyft’s portion via overnight mail.

While Nachum was waiting for Lyft, Allstate processed a debit card deposit for their portion of the claim, and Nachum used the money to put a down payment on a replacement vehicle.

Advice for Drivers in This Situation

Ultimately, it’s up to drivers to be proactive in this situation. Nachum’s advice to other drivers is to do some research on the adjustor in your state (it may be York Risk Services Group or another subsidiary), be persistent and be pleasant and professional.

It’s also worth pointing out the first person you speak with may not be the most helpful. While this won’t be true in all cases, in Nachum’s case, he needed to escalate the situation to a supervisor – who was more helpful than the line person Nachum spoke to. This doesn’t mean you need to immediately escalate your situation to a supervisor, but keep in mind that the first person you speak to likely has the least authority to help you.

Finally, by having rideshare coverage with his auto insurance policy through Allstate, Nachum was able to save money on the difference between his deductible ($600) and Lyft’s deductible ($2,500). That’s a substantial savings, and keep in mind that means Nachum only had to pay out of pocket $600 – the rest was handled by Allstate.

Also, while Nachum was waiting for Lyft, Allstate processed their portion of the claim, which meant Nachum could put a down payment on another car and be ready to drive again once approved by Lyft. This is one of the main issues drivers have while they’re waiting to hear back from Lyft or Uber’s insurance – since they’re not driving, they’re not making money, which means they can’t get another car to drive (or do delivery). By having rideshare insurance, Nachum was able to put a down payment on another car and get back to driving or doing delivery as soon as he wanted.

Overall, this is one of the fastest resolutions we’ve heard of at RSG, and it seems like it was resolved quickly because there were no other injuries and Nachum was persistent.

What Are Your Insurance Options?

In almost every case, having your own auto insurance with rideshare coverage is going to be better than going through Uber or Lyft’s insurance providers. You can check out a list of insurance agents familiar with rideshare insurance by state here, but there are two companies in particular that offer rideshare insurance plus other benefits.

Allstate Insurance

Allstate’s coverage works by adding what’s known as a “rideshare endorsement” to an otherwise standard Allstate auto policy. The endorsement prevents you from being dropped from your policy as a result of driving for Uber or Lyft – and it closes the all-important Period 1 coverage gap.

In addition to keeping you legal by allowing for ridesharing (and by closing the Period 1 coverage gap), Allstate’s rideshare endorsement also comes with a big perk: deductible gap coverage.

Deductible gap coverage through your Allstate rideshare policy will reimburse you for a portion of that deductible, so that it matches the deductible on your personal policy. You’ll still need to pay the full amount to the TNC first – but once you send the receipt to Allstate, they’ll pay you the difference between the TNC’s deductible and your personal one. If you’re on the hook for the full $2,500, but your personal deductible is only $500, Allstate will reimburse you $2,000.

We reached out to an Allstate agent, Doug Eisold (based in San Diego, CA) who told us,

“from walking and talking to drivers locations across Southern CA, we do notice that a large population of drivers do NOT know they have a $1,000.00 deductible with Uber and a $2500.00 deductible with Lyft in periods 2 and 3. Our agency offers help with these deductibles through our deductible GAP coverage that is part of our Rideshare plan. We want to help cover the car when we are your insurance company, AND help you keep money in your pocket when covered by Uber and Lyft, not something other companies offer.”

For more information on Allstate, check out our article ‘How Does Allstate Rideshare Insurance Work?’ In addition, here are a list of Allstate agents familiar with rideshare insurance by state:

Arizona

Donnie Plunkett – 480-595-7434

California

Doug Eisold – (858) 271-7900 – San Diego

Andrea Coulon – 949-951-9414 – Orange County

Illinois

Patrick McHugh – (847)-934-9480

Texas

Carl Hellwege – (817) 430-6331 – Dallas / Fort Worth

Washington

Colin Johnson – (425) 836-4595

Allstate is the auto insurance Nachum used.

Related: How Much Does Rideshare Insurance Cost?

Have you been in an accident with Uber and Lyft and, if so, what was your experience with insurance?

-Melissa @ RSG