Wondering what’s going on with state unemployment assistance programs? Senior RSG contributor Jay Cradeur has an update on the status of his unemployment assistance in California, plus some important news for drivers who applied for the Paycheck Protection Program (PPP).

A most wonderful event occurred last Monday, May 11. In my neighborhood, the mail gets delivered around 2 PM. I thought my debit card for unemployment may arrive.

I had been told it was mailed out on May 1st and should arrive in 10 days, or on May 11th. That day was here.

I checked the mailbox at 1 PM. Then I went out at 1.30 PM. Then at 2 PM. “Where is the mail!”

I did a final run at 3 PM, went to the mailbox and discovered a white envelope from the Employment Development Department (EDD – California’s unemployment department). I did a quick feel of the envelope for something hard and debit card like. At first, it felt like just another correspondence and my heart sank.

Then I felt more deliberately and there in the corner was the feeling sensation I was looking for. It was hard and the size of a Bank of America debit card. This was the envelope. The eagle had landed.

Pro-tip: Sign up for free for Informed Delivery from USPS and you’ll get an e-mail every morning with a digital preview of your mail for the day!

Stay up to date on all the latest unemployment news:

- Follow RSG on YouTube for the latest

- Here’s what Uber and Lyft drivers are saying about the coronavirus

- Step-by-step process for applying for unemployment assistance

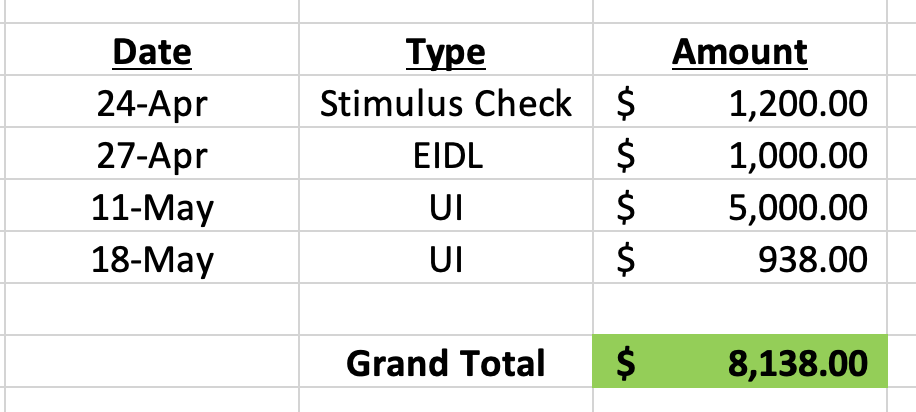

Like many drivers (58% of drivers according to our RSG survey), I stopped driving over three months ago. During that time, I have received a $1,200 stimulus check and a $1,000 Economic Injury Disaster Loan (EIDL) grant.

That is not much money over a three-month period of time. I applied for Unemployment Insurance (UI) way back in March. Like many of us, I was told I was entitled to zero benefits.

I appealed, then I was contacted by the EDD and asked 30 minutes worth of questions about my working relationship with Lyft to determine if I was an employee or an Independent Contractor.

Then the EDD announced that there would be a separate PUA application process on April 28th. I applied and certified. Money was added to my account.

But money in my account does not pay the bills. I needed a debit card.

It has been a long slog.

The Employment Development Department (EDD) Bank Of America Debit Card

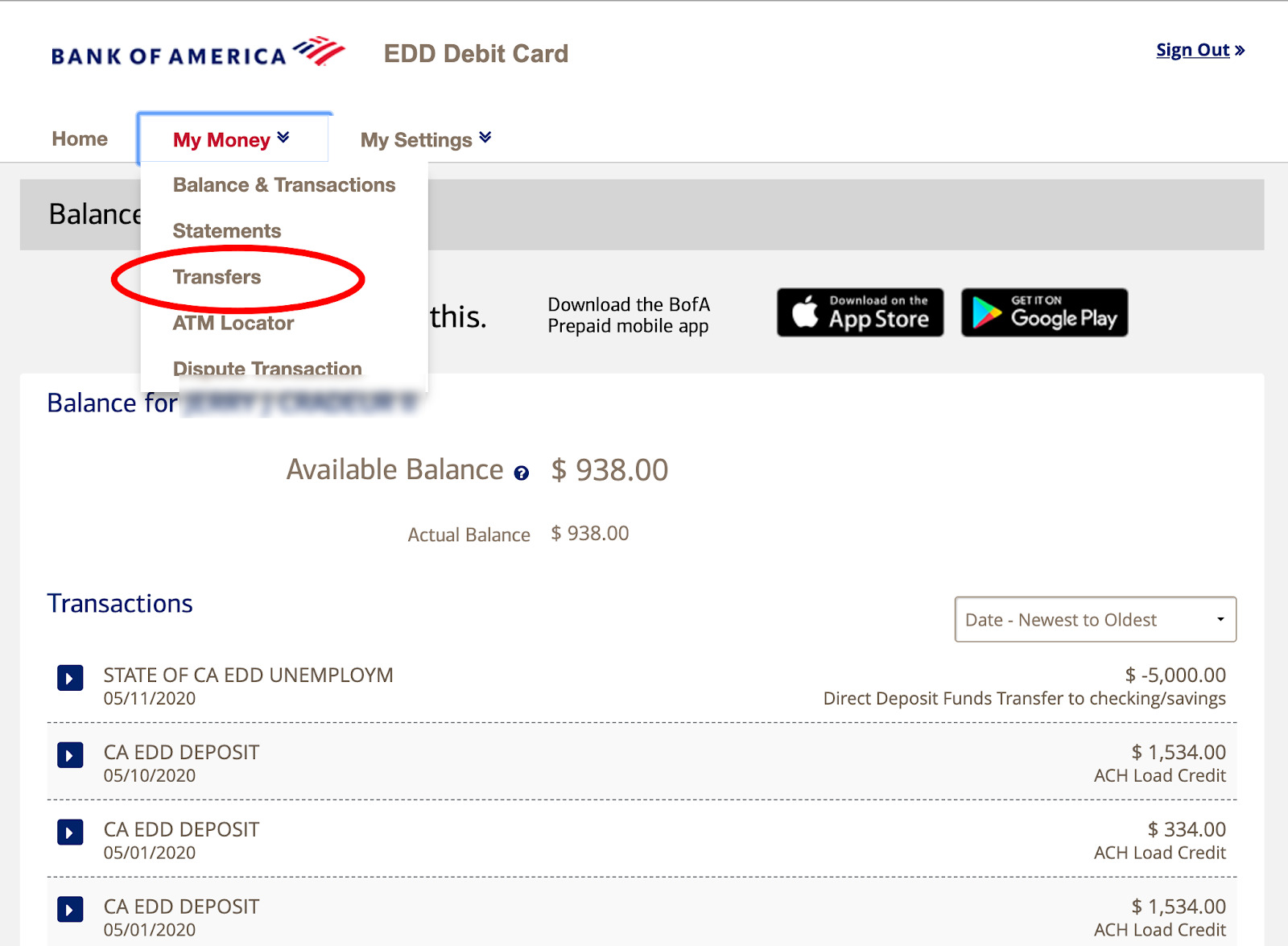

This part of the process was actually very simple. You will be instructed to go to the Bank of America website to activate the card.

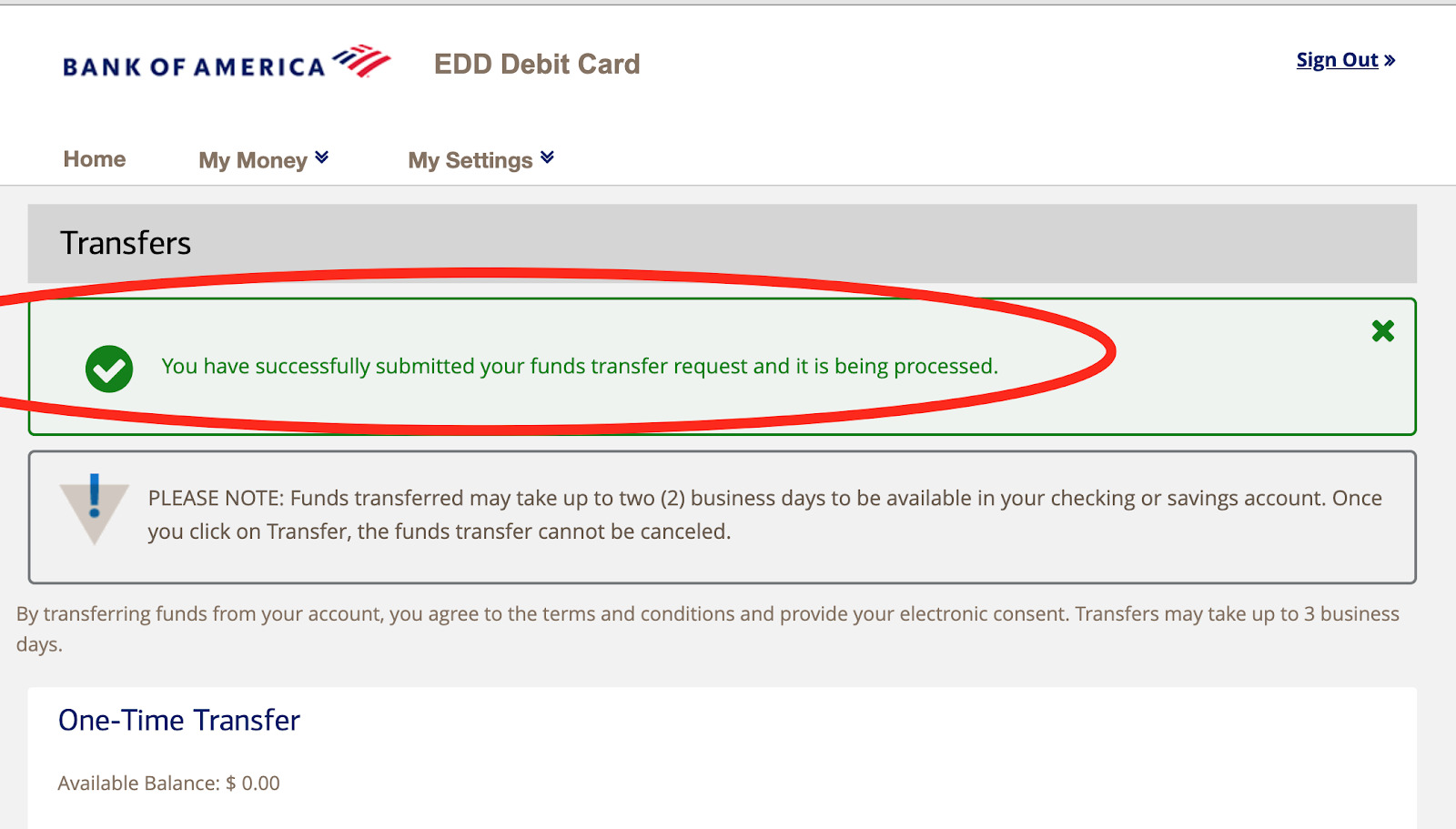

I then saw my balance which was $5,938. Next, I set up my bank account to do a transfer from Bank of America into my business bank account. There is a limit of $5,000 per week.

I transferred the $5K and now my account has the $938 remaining.

Since it has been a week, I am now able to transfer the balance.

Since it has been a week, I am now able to transfer the balance.

Last week, the funds landed in my business bank account the following day. Therefore, by tomorrow, my tally for the pandemic relief funds is as follows:

Last week, the funds landed in my business bank account the following day. Therefore, by tomorrow, my tally for the pandemic relief funds is as follows:

How To Get More Unemployment Insurance

How To Get More Unemployment Insurance

In most states, if you received any Pandemic Unemployment Assistance (PUA) funds, you were initially allocated the minimum amount.

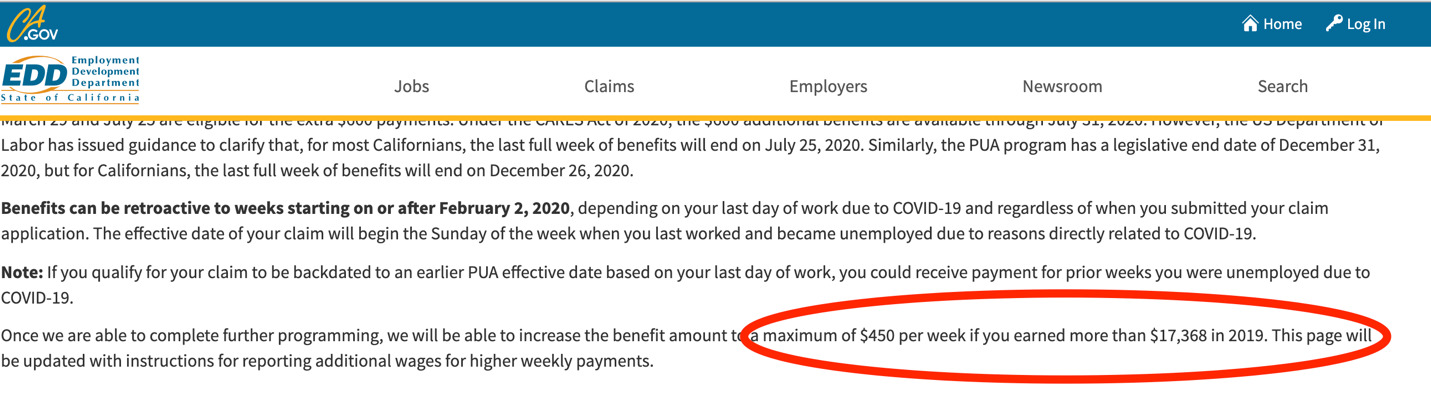

In the state of California, the weekly amount, less the $600 bonus, is $167. However, based on your 2019 income, you may be entitled to more per week. In California, the maximum amount is $450 per week.

You may think that is not that big of a difference. On a weekly basis, it is not. But when you look at it over time, it does add up.

Take a look at how much more I would be entitled to if I qualified for the maximum amount:

According to the EDD website, we will be able to certify for more funds at some point in the future:

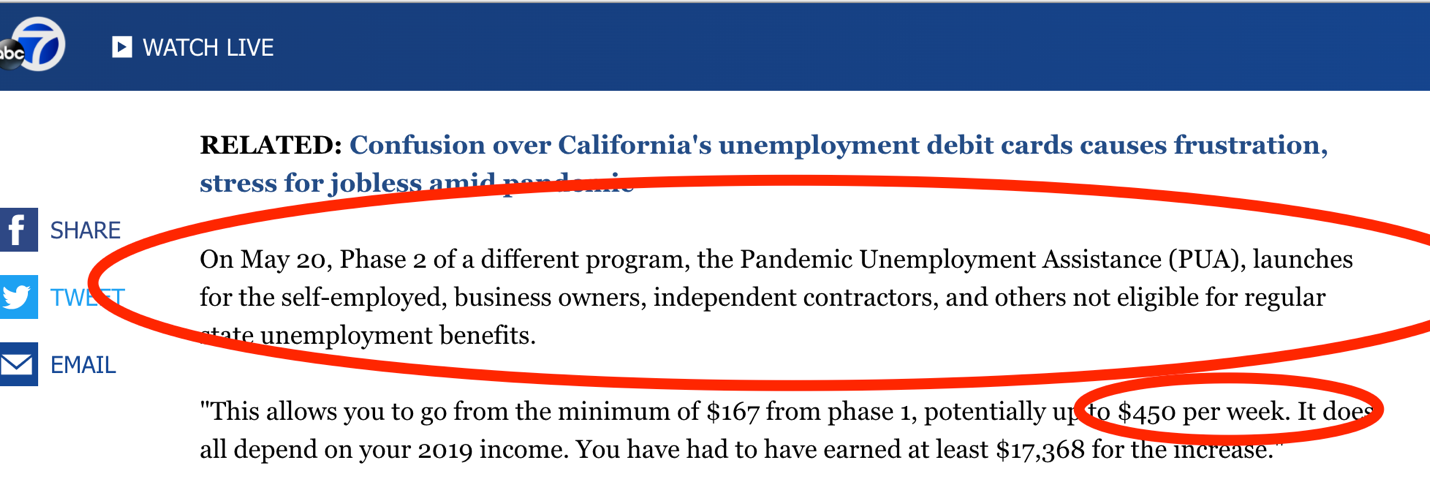

Local media is now reporting that we will be able to certify for higher benefits this week, on May 20th.

Local media is now reporting that we will be able to certify for higher benefits this week, on May 20th.

My recommendation, regardless of which state you reside, is to stay close to your unemployment website. Most states will allow you to get more benefits as long as you generated enough income in 2019.

My recommendation, regardless of which state you reside, is to stay close to your unemployment website. Most states will allow you to get more benefits as long as you generated enough income in 2019.

For California, the annual amount is $17,368. It is not clear if a 1099 will be sufficient, or if tax returns will be required.

From what I have read, it seems 1099s will work and that will be important for drivers since our net income is often quite low due to the massive mileage deductions we are able to claim.

We’ll keep you updated on the very latest on our YouTube channel – make sure to subscribe and go through our unemployment videos for how to apply, what to expect, and how my process is going.

Important Paycheck Protection Program (PPP) Update

I had applied for the PPP loan in the amount of $20,000. Last week, after doing some research, I spoke to my underwriter on the phone and withdrew my application. Why?

The rules have changed. When I first applied, a tax return was not required. I would have (when I first applied) been able to have the entire loan forgiven simply by paying myself the entire $20K.

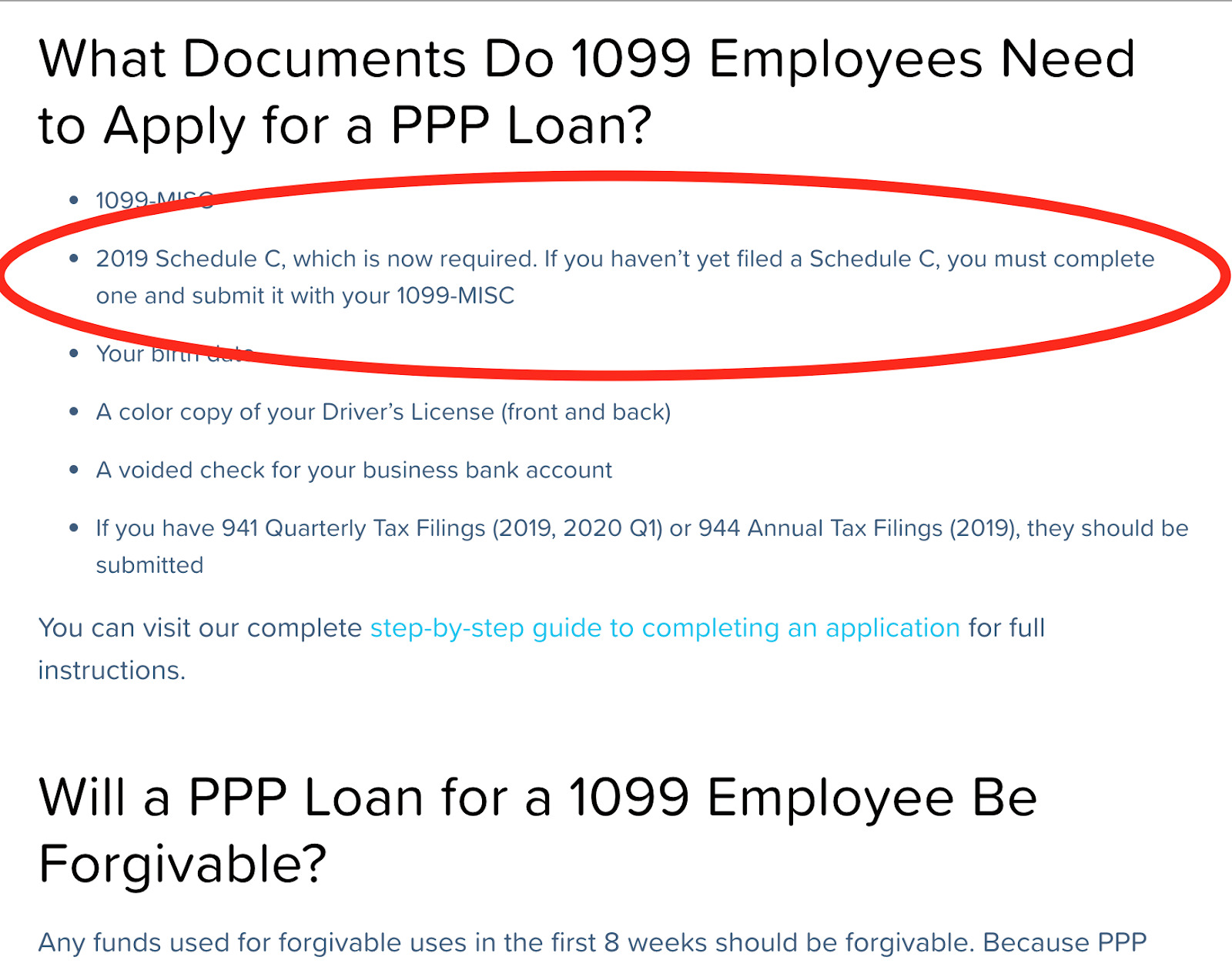

Now, when you look at the updated requirements for the loan on the Lendio website, you can see things have changed. A tax return is required.

Since a driver’s Schedule C shows the net income after all our driver deductions, the amount of the loan would be barely anything.

Worse still, had I received the $20K, the amount I could have forgiven would have to be based on Line 31 (net income) of my schedule C. As a result, the $20K would essentially be a loan that I would have to pay back in two years. No thank you!

Unfortunately, I am sure there are independent contractors and sole proprietors out there who got the loan based on 1099s and bank statements, and now that the rules have changed, will not be able to get all of the loan forgiven.

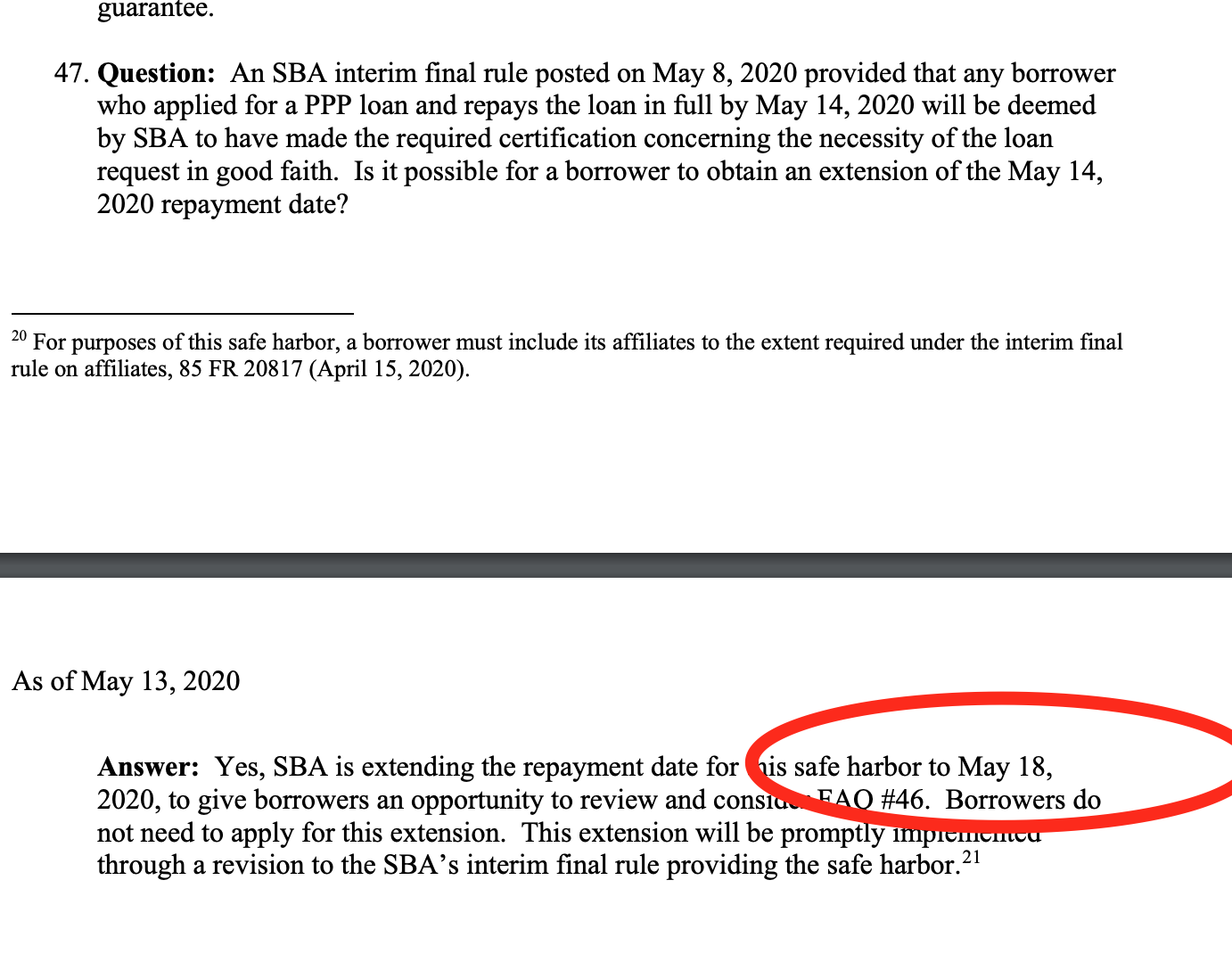

It is a difficult situation when the government keeps changing the rules. The government is allowing businesses to return the funds until today, May 18th.

This was the status as of May 13th according to the SBA’s own PPP FAQ document:

What To Do If You Receive PPP and Unemployment Insurance (UI) (or PUA)

What To Do If You Receive PPP and Unemployment Insurance (UI) (or PUA)

I asked my PPP underwriter this exact question. His response: “You can’t do both!”

His recommendation would be to immediately stop receiving unemployment benefits and continue on like that for 2.5 months, the term of the PPP loan.

Once that 2.5 month expires, and if you are still out of work, then you can resume the unemployment benefits.

That makes sense to me. You can double dip (accept both) but you run the risk of getting into trouble later on down the road. Fly straight and you won’t have to be looking over your shoulder.

Key Takeaways

I am not complaining. As it stands now, I have received just over $8K.

I will be receiving an additional $767 per week in unemployment and that amount may grow to $1,050 per week and that will continue through to the end of July.

The Democrats are proposing the unemployment benefits continue to the end of the year, but the Republicans don’t like the package. Clearly, some more money will be coming our way.

This pandemic is far more severe than anyone could have predicted. Over 20% of America is out of work. It will take years to get back to where we were.

The system may not be perfect, but I am very grateful for it. Stay strong. Be safe.

Readers, did you apply for unemployment assistance and have you received it yet? What is the wait time like in your state?

-Jay @ RSG

Stay up to date on all the latest unemployment news: