Have you heard of the DasherDirect card from DoorDash? If you’re looking to get paid the same day you dash, reduce your spending on gas, and more, the DasherDirect card could be an excellent option for you. Senior RSG contributor Dash Bridges shares what the DasherDirect card is, what Dashers are saying about it, and who it’s good for below.

As you may know, Dashers have options to either receive payment for the previous week’s (Mon-Sun) earnings the following Tuesday, or pay $1.99 per deposit, once daily, to have their current earnings sent to their bank account immediately. DoorDash recently introduced a solution to eliminate these fees.

In late 2020, DoorDash and Visa introduced DasherDirect, a prepaid debit card with no earnings cash out fees. By early 2021, the offer expanded nationwide.

What is DasherDirect?

Per its own blog entry, DoorDash explained, “We’ve done surveys and conducted interviews with Dashers…what we heard loud and clear was this: Dashers want faster and more flexible access to their earnings, and they want cash back on key business expenses, especially on gas.”

DasherDirect allows Dashers to do several things.

Automatically deposit daily earnings without charging for FastPay

Are you a Dasher who cashes out your earnings at the end of most shifts? At $1.99 per Fast Pay transfer, if you do that three times a week, that’s around $25/month in avoidable expenses. This card allows daily earnings to go directly to the DasherDirect card. No fee.

2. Use the money as a prepaid debit account

It’s a Visa debit card provided through Stride Bank, so you can perform any traditional debit card purchases and access no-fee ATMs within the AllPoint network. There are also other ATMs you can use to access your Dasher funds for a small fee of $2.50 if you ever needed to. ATM machines can typically be found in stores such as Costco, CVS, Walgreens, and gas stations. You can manage these functions through the DasherDirect app, available through the Apple Store or Google Play.

3. Earn 2% cash back on gas station purchases

A natural accompaniment to dashing, you can earn money back using this card for gas purchases. Technically, this benefit applies to most gas station purchases.

In the midst of the skyrocketing gas prices this year, I was taking advantage of this perk because DasherDirect was offering a boosted 10% cash back for gas purchases to mitigate the skyrocketing gas prices. For a solid 4 months or so, you could get 10% cashback by using your DasherDirect card, and it was offered around June – September of 2022. It was a huge help because I was able to rake in about $500 from cashback alone within that timeframe. That was roughly around 8 – 9 full tanks of gas for the average sedan! So that is one thing to keep in mind is that they might offer awesome incentives like this from time to time which is yet another reason to get the DasherDirect prepaid debit card.

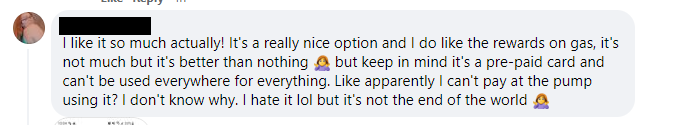

Remember, the DasherDirect product is a prepaid debit card. Unlike a credit card, where you can spend to a credit limit and pay later, you must (obviously) add money to your prepaid debit card before making expenditures. This is an important aspect to note about the DasherDirect card because I charged it for a gas purchase when I didn’t have enough money on it and was declined. Normally, if you tried that with a credit card the transaction would still go through despite not having enough credit limit.

As one driver we spoke to about the DasherDirect card noted:

“I started relying on the DasherDirect as my fleet gas card, and the 2% cash back is free money for more gas. I discovered you need to keep a minimum of $75 balance in order to perform a full tank fill at the pump. [Editor’s note: this is true of all debit cards] Otherwise, you have to go to the clerk to specify an amount needed.”

Just keep in mind this is a prepaid card, not a credit card. You will need cash on this card in order to use it. Nearly everyone who applies for this card should qualify.

Plus, the benefits of a network of free ATM withdrawals and 2% cashback on gas station purchases compare favorably to other prepaid debit cards. Compared to other gig-related debit cards, DoorDash is offering the most gas cashback compared to other platforms. If your circumstances include a decent credit score, you can apply for a variety of credit cards offering benefits on gas station purchases and more.

Pro-tip from reader Danielle: “As a user of the DasherDirect card, I just wanted to pass along a pro-tip. I signed up for GetUpside using the DoorDash promo code to get bigger savings, and then I connected my DasherDirect card to GetUpside. Using both together, I get more cash back when I put gas. Just wanted to share!”

What Dashers are Saying About DasherDirect: Benefits of DasherDirect

Depending on how you manage your earnings, you can benefit in a couple of ways.

#1. If you spend $1.99 to cash out after multiple shifts each week, you can now transfer this money without paying the fee.

If you like to isolate your Dasher earnings from other income, it’s a convenient way to keep those earnings separate from other money. Furthermore, you’ll save 2% on fuel by using the card.

Via Twitter, DasherDirect user @radconradcom says the cashback program, “says to allow 2-3 days (to accumulate awards) but I typically see it in my rewards balance later (in the) same day.”

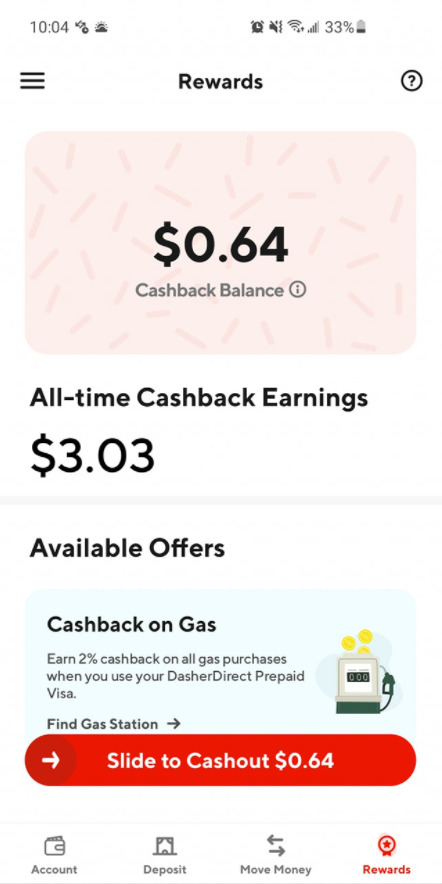

An example of your cashback status will look like this:

Another reason why I love DasherDirect is because of how simple it is to transfer the cash back funds to your account. As you can see in the screenshot above, all you have to do is slide the red bar to the right, and the cash is instantly transferred to your account. I have other credit cards from other financial institutions, such as Chase and Bank of America, and the cashback usually takes 3 – 5 business days to transfer to your account. DasherDirect is by far the fastest way to use cashback that you have accumulated over time.

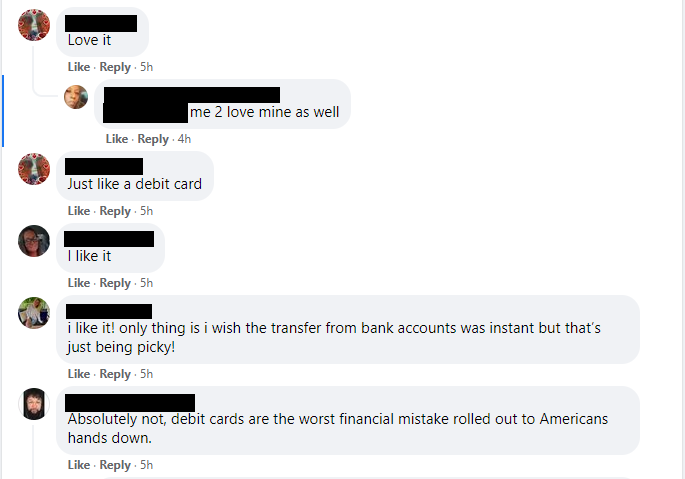

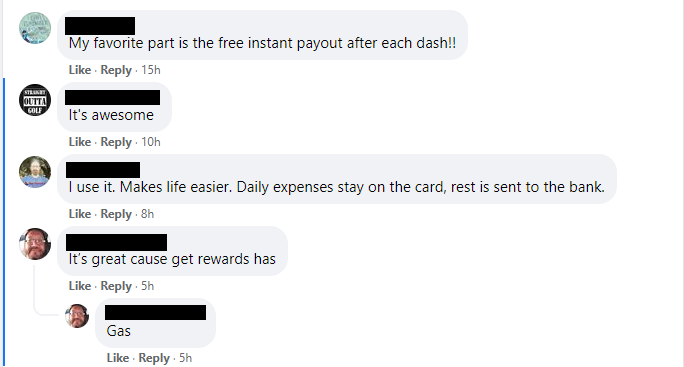

A recent post in a Dasher Facebook group brought these near-universal positive reviews:

(Note on the last comment: if you click the credit card options while at an outside gas pump, it’s more likely to work. Otherwise, it will work fine inside)

Considerations for Using DasherDirect

Not sure if DasherDirect is for you? Some considerations might include:

- It provides an immediate Dasher benefit (free cash out) that may encourage Dashers to choose DoorDash over other delivery or rideshare options. It also matches similar offers provided by the Uber Visa Debit Card and Grubhub.

- The program creates a secondary benefit with 2% cash back on gasoline, an inevitable expense for nearly all Dashers. You can see the flywheel effect. Drivers choose to Dash over other options. They cash out that day’s earnings to their card. They use the debit card portion to support more gas purchases while saving a little money in the process. DoorDash isn’t just the job, it’s now a banking and transactional part of a Dasher’s life. For those who are un- or under-banked, not having a bank account is no longer an impediment to accessing and using their earnings. I think this card is great for those that aren’t really into credit cards or simply don’t have any at the moment. For me, I have at least three other credit cards that give me 3% cashback in gas purchases. So I wouldn’t use DasherDirect’s perk since it is less than my credit cards. However, it is great that I can get all my earnings in one shift instantaneously and not have to wait after working said shift.

- Your data? While you may think this card gives DoorDash access to your spending habits, it actually does not! DoorDash does not get access to that data, nor does DoorDash sell it, per a DoorDash spokesperson.

- DasherDirect also gives cashback for other purchases other than gas. One popular cashback offer they are currently giving is $20 cashback from a Costco membership purchase as seen below. There are many other cashback opportunities offering even more than 2% such as restaurant and food industry places as seen in the second screenshot. Offers vary depending on your location, as these offers are currently being offered in my area.

Bottom Line: DasherDirect Card is an Excellent Way to Save Money on Cashing Out, Gas, and More

The DasherDirect card provides a great alternative for Dashers who want or need to cash out regularly. It eliminates Fast Pay charges, helps you save on gas expenses, and is part of a network of no-charge ATMs.

With many drivers sharing with us that they spend hundreds of dollars per week on gas, DasherDirect will help you save every single time you fill up. Conservatively, if you spend $100 per week on gas (which many of our full-time, fully gas-powered car-driving drivers do), you’d get $2 in cash back every week. It adds up!

Have you heard of the DasherDirect card? Have you used it, or would you use it?

Not a DoorDash driver yet? You can only get access to perks like DasherDirect if you’re a Dasher! Sign up to drive for DoorDash here.