One aspect of the gig economy that many Chargers overlook when they’re just getting started is taxes. Taxes as an independent contractor might seem scary, but they’re actually pretty simple. Today, we’re going to answer all the questions you may have to make sure you maximize your deductions and minimize your taxes paid as Bird Charger (or Lime Juicer, etc.).

This guide is going to help you with your 2018 taxes (the taxes you will file this year) and there are a few noticeable changes from 2017 so pay attention!

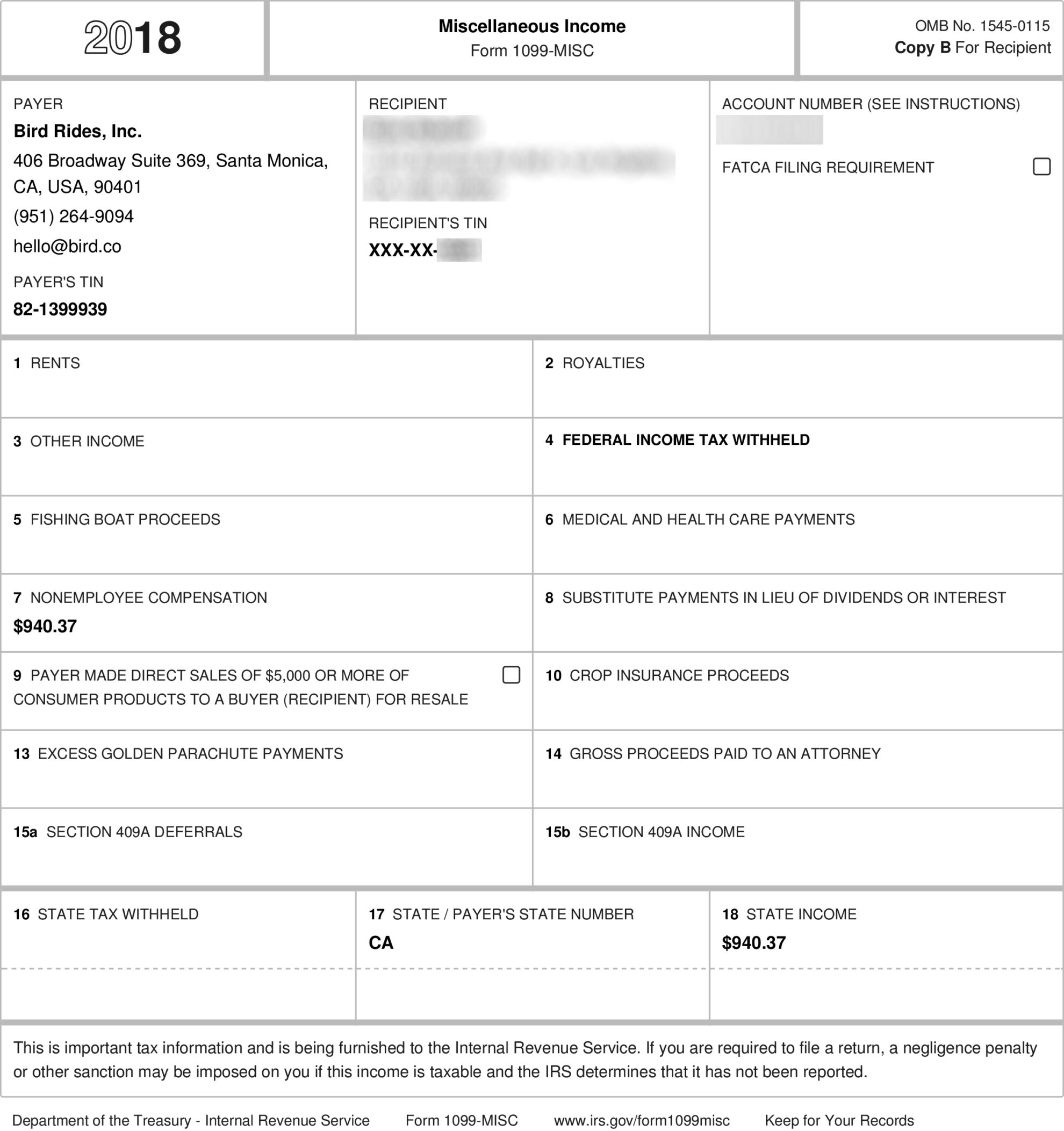

Every year by the end of January, Bird and Lime will send out 1099s for the prior tax year that detail how much you made and how much they paid. Since chargers are independent contractors, all that means for your taxes is that you’ll have to file a Schedule C in addition to your 1040.

So let’s get started and see how to file your taxes as a Bird Charger.

Did You Earn Over $600?

As a charger for Bird or Lime, you are considered a 1099 Contractor. If you’re also an Uber or Lyft driver, you’re familiar with this. If you earned $600 or more, those payments have been reported to the IRS by Bird and Lime. As such, Bird or Lime will send you a 1099 form by mail and/or email. That form will include all the information you need when filing your taxes, i.e. Total Earnings, as well as the cut that Bird or Lime took (which is a significant write off for you).

Deductions

- Did you use your car to pick up scooters? That is a deduction.

- Did you charge the scooters at home? Deduction.

- Did you purchase any additional chargers? Another deduction.

These are just a few examples of charging-related expenses that are considered tax write offs, and in order to save the maximum amount in taxes, you are going to want to claim as many of these expenses as possible. Here is a list of charging-related expenses you can potentially deduct:

Note: If you have additional questions about your specific tax situation, you may want to consult with a tax expert.

- Vehicle – you have the option to deduct a portion of your actual expenses OR the standard mileage deduction (for 2018 it is 54.5 cents per mile)

- Electricity Costs – you can deduct the portion of your monthly electric bill that you used for charging purposes (you can learn more about how much electricity charging requires here)

- Chargers – all of the chargers you purchased are deductible

- Other Equipment – did you purchase anything specifically for the purpose of charging scooters (i.e. gloves, wipes, blankets to lay down in you car)? It’s all deductible

- Phone – you can deduct a portion of the cost of your phone

- Partial Rent (garage) – you can claim the home office tax deduction

Mileage Tracking – Standard Mileage Deduction

We’ve talked about standard mileage rate vs actual expense method before but for most of you, the standard mileage rate will likely make more financial sense (and it will be a lot easier). Just note that if you opt for the standard mileage rate, you must choose to use that in the first year the car is used as a business. In later years, you can then choose either method.

For 2018, the standard mileage rate is 54.5 cents per mile and that basically includes all of the costs to operate your vehicle: gas, depreciation, oil changes, maintenance, repairs, etc. If you used your car to pick up scooters, you can deduct your mileage.

Remember, the actual cost to own and operate your vehicle is not 54.5 cents per mile though. That is the deduction amount that you will get from the IRS. Your actual cost should be a whole lot less, especially if you want to be profitable as a charger.

You will want to make sure to track your mileage either manually or using a mileage tracker.

Using Tax Software

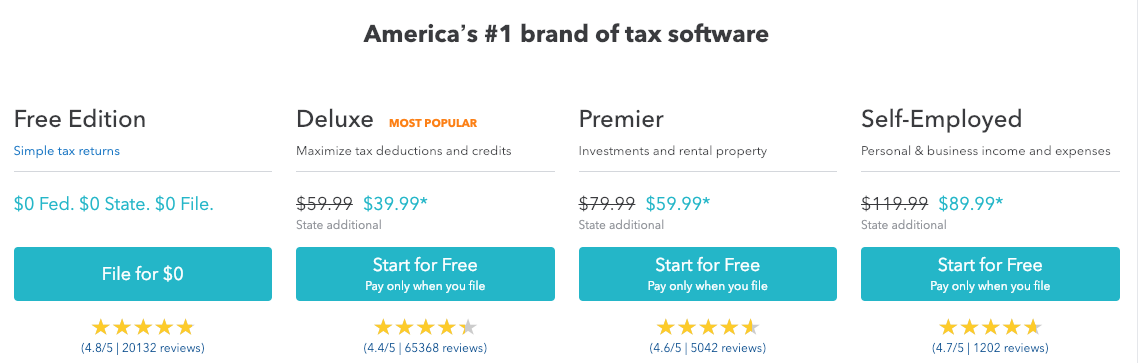

TurboTax

Since Bird and Lime chargers have 1099 income, you’ll need to go with the TurboTax Self-Employed edition. You can learn more about using TurboTax here.

Click here to purchase TurboTax using our affiliate link

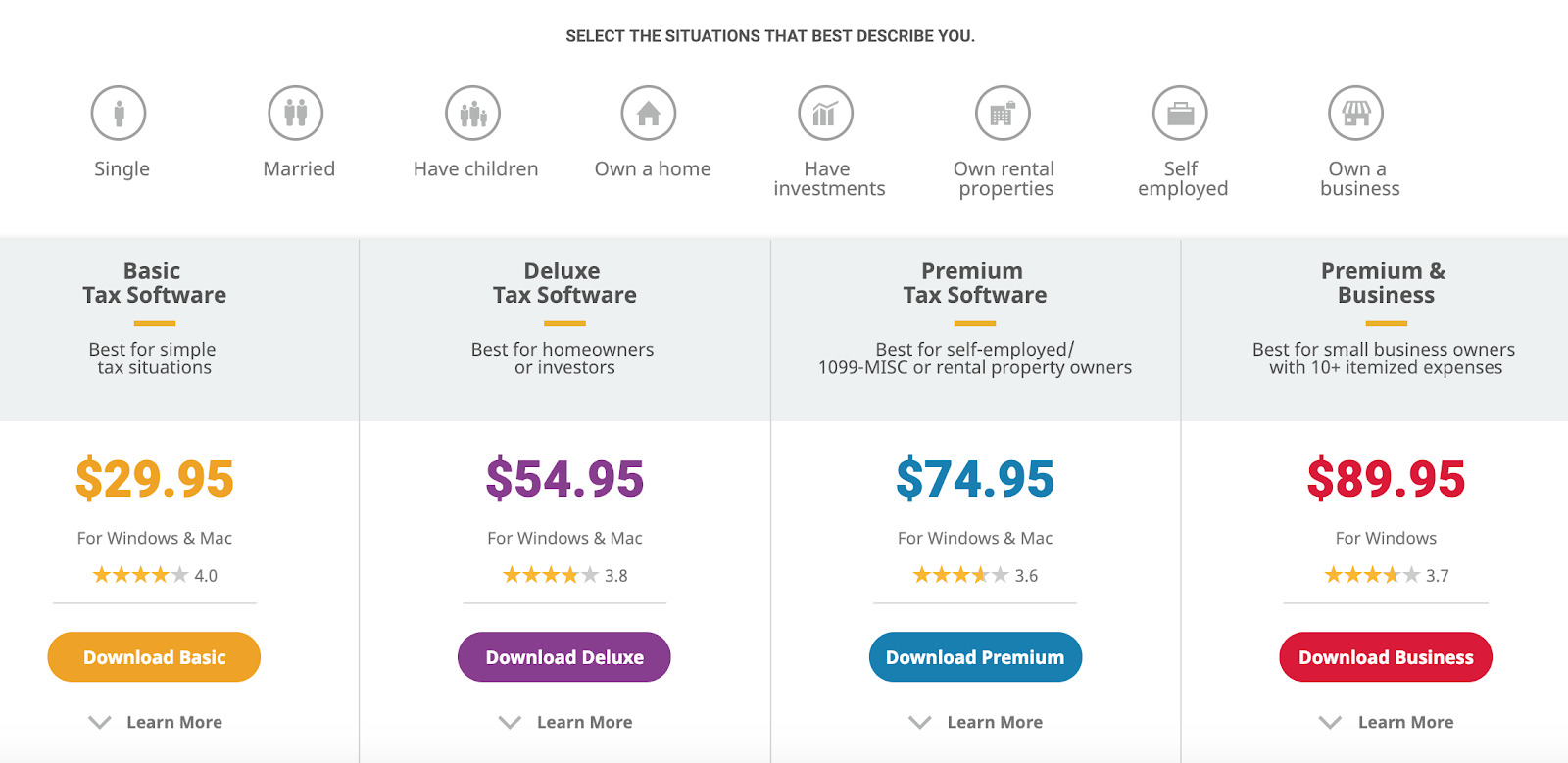

H&R Block Online Software

I haven’t ever used H&R Block for my taxes, but I do have several friends who use the software and find that it’s very similar to TurboTax but at a lower price point. H&R Block also has all of the same auto-import features and both services can actually import each other’s returns from prior years so switching shouldn’t be much of a hassle.

If you end up using H&R Block for your taxes, please consider using our affiliate link and we will get a small cut out of any purchase you make.

Frequently Asked Questions for Bird Charger and Lime Juicer Taxes

I forgot to track my mileage! What can I do?

First of all, don’t panic! If you used your car to pick up and deliver scooters, you can deduct your mileage. But if you forgot to track, that’s okay. We have an easy list of steps you can take to figure out your mileage for the year here.

What about health insurance?

Thank you to reader Paul for this information:

The new tax law provides rideshare drivers, and other self-employed folks, with 2 new opportunities to reduce taxes:

- Qualified Business Income (QBI) — line 9 on the new 1040, a reduction to taxable self-employment income

- Self Employment Health Insurance Deduction — line 29, schedule 1 “Additional Income and Adjustments to Income.”

I expect few self employed people are aware that they can deduct health insurance as a business expense and reduce taxes.

What About 2019 Taxes? How Can I Prepare for Those?

First, make sure you’re tracking your mileage and your expenses (like business purchases, repairs to your car – all those deductions we’ve mentioned above). Accurate record-keeping makes tax filing so much easier!

As far as 2019 taxes, Starzyk CPA recommends,

“Workers will continue to benefit from the lower tax rates and the 20% qualified business deduction going into 2019. The Tax Cuts and Jobs Act is currently not set to expire until the year 2026. Also good news for any workers without health insurance, the penalty for not having minimum essential coverage will be gone starting in 2019. There are currently no major changes that affect how a driver should track their mileage and expenses.”

Readers, do you now have everything you need to go out and do your own taxes as a Bird Charger Lime Juicer? Are there any tax questions you still have or things I missed?

[yasr_overall_rating]

-Joe @ RSG