As independent contractors, collecting and filing tax information all falls to us. If you drive for multiple gig companies, it can be stressful collecting everything you need at tax time! In this guide, I’ll walk you through what you need to know about filing taxes as a delivery driver.

For many years, taxes were one of my favorite things to do every year. Filling it out and getting a nice check a few weeks later was amazing. Not only that, but numbers have never scared me; until I started working for myself.

How to File Taxes as a Delivery Driver

My first leap into entrepreneurship was rideshare driving and doing my taxes that year was nerve-wracking. However, doing your taxes as a delivery driver doesn’t have to be scary, or nerve-wracking, or something to put off.

Below, I’ll cover how to handle taxes as a delivery driver for the following top food delivery apps and product delivery services:

Are you a rideshare driver? Check out our Guide to Rideshare Taxes.

Delivery Driver Tax Information to Prepare Ahead of Time

Before we start looking at the different companies and how to get your tax documents from each of them, there are a few things to consider.

Tracking Mileage

First, make sure you are keeping track of your mileage. For 2022 the mileage reimbursement amount is $0.58. This means for every mile you drive, you pay $0.58 less in taxes. That may not seem like much, but in a typical day, you can save $28 – $57 or more depending on how much you drive.

That’s why it is so crucial that you keep track of your miles, not just the ones your courier says you drive, but what you actually drive. My favorite way to do this is to use Gridwise. You start tracking when you start driving and turn it off at the end. It even automatically gets your earnings from whoever you drive with.

Find our full list of the top recommended mileage tracking apps for drivers, and take a look at our video about the best mileage trackers: 5 Best Apps to Track Mileage

Driver Expenses

Another thing to track are expenses directly related to your delivery driving. Things like insulation bags, music services, beverage holders, phones, phone plans, and accounting costs can all be deducted.

You can find a full list of common driver expenses here.

Make Tax Payments

Finally, consider making quarterly tax payments. I know, the last thing you want to do is think about taxes more than once a year, but paying quarterly taxes will make it so you don’t have a huge tax burden at the start of a new year. Not to mention, if your deductions are enough, you may actually get a refund.

DoorDash Taxes

If you earned over $600 with Doordash during the year you will receive a 1099-NEC form from either Paypal or Stripe.

Keep in mind that you had to select your preference before January 22, 2021. If you did not, DoorDash should have emailed you, as well as sent a physical copy in the mail to the information on file.

If you drive for DoorDash they also offer a discount at H&R Block of 20% off all online products and $25 off assistance with a tax professional.

DoorDash is also offering Dashers $20 off TurboTax.

Instacart Shopper Taxes

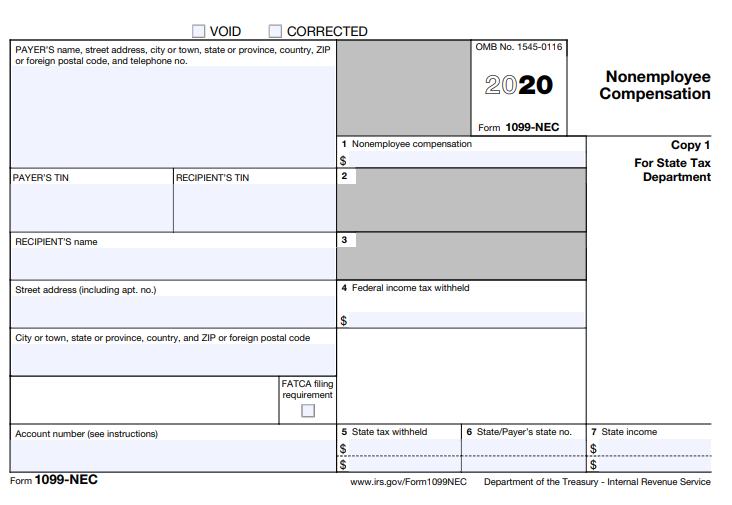

Depending on how much you make with Instacart, you may get a different 1099 form.

If you’re like me, a part time driver, and make more than $600, you’ll get a 1099-NEC form. However, if you drive more often, make over $20,000, and have more than 200 transactions, you’ll likely get a 1099-K form.

Below is an example of what a 1099-NEC form will look like (yours will be filled out by Instacart!)

These forms are very similar in the information they give you, and if you follow the tax forms, they will be really easy to enter.

Instacart does not offer any discounts with any tax services.

Uber Eats Taxes

Uber Eats provides 1099 forms. However, Uber also gives drivers a “Tax Summary”. This summary gives you a detailed breakdown of your annual earnings as well as business-related expenses.

Uber really makes it easy to figure out expenses. On this document, they give you miles you drove, fees for cashing out, tolls, etc.

Though this is great and does help with your taxes, I still think you should track your own deductions and not rely on Uber to give you your deductions. Uber doesn’t track everything!

While your Tax Summary is a great way to start looking at expenses, and better than nothing if you haven’t been tracking them it will help, you’ll still want to start tracking yourself and not rely on Uber’s information solely.

Uber offers free tax services through TurboTax, which saved me $100 this year when I did my taxes.

Postmates Taxes

If you’re driving for Postmates full-time, make over $20,000, and do 200 or more deliveries, you’ll receive a 1099-K.

If you make less than that, but more than $600, you’ll receive a 1099-NEC.

Postmates does not offer couriers any discounts on tax programs.

Amazon Flex Taxes

Amazon is without a doubt one of the biggest companies in the world. As a courier driver with Amazon Flex, like all other courier companies on this list, they will give you a 1099-form based on how much you made.

Amazon also does not have any discount through any tax preparation companies.

How Are You Doing Your Delivery Driver Taxes This Year?

Here at The Rideshare Guy, we recommend that you diversify and drive for multiple companies in order to make the most amount of money. If you follow that advice, taxes can seem like a scary time. But they don’t have to be!

All of the courier companies give you exactly what you need in order to file your taxes, and most give you a discount for tax services. You can also use software like Keeper Tax to help calculate deductions.

If you’re worried about doing your taxes properly, you can use the discounts on tax prep software to walk you through step-by-step how to file properly. I hope this guide to delivery taxes has helped you figure out what you need to collect beforehand and made you feel less stressed about filing your taxes.

How will you file your taxes this year? What tips do you have for someone worried about filing their taxes as an independent contractor?

Looking for more help as a delivery driver? Sign up for Maximum Delivery Profits, Harry’s flagship course for delivery drivers. You’ll learn all about how to maximize your earnings as a delivery driver and how to accurately file delivery taxes.