Tax time season is here, and if you’re like many rideshare drivers, you’re probably wondering if you can save some money and do your taxes yourself. But can you – or do you need to pay someone? In this article, senior RSG contributor Paula Gibbins reviews FreeTaxUSA, a program and Uber driver tax calculator that seeks to help taxpayers save money on their tax preparation.

When it comes to filing taxes, we all want to save as much money as possible. I researched FreeTaxUSA to see if it really is free and to see if it has everything a rideshare drivers wants and needs for easily filing taxes.

For my first time using this website, it took me about an hour and a half (with all of my documents ready to go) to go through the forms and fill out the needed information, which didn’t seem too bad to me.

Quick links:

- Get started with FreeTaxUSA right now

- Looking for a rideshare CPA to help you with your taxes? Check out our recommended CPA here

- Your ultimate guide to rideshare taxes

First, Is FreeTaxUSA Really Free?

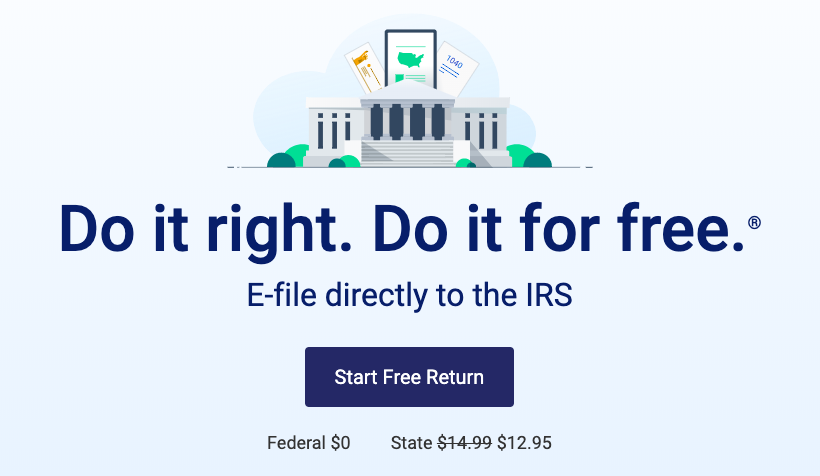

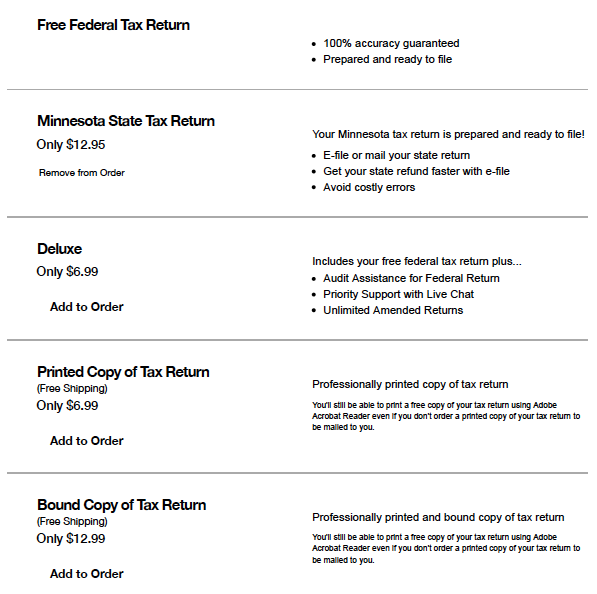

Yes, and no. It is free to file your Federal taxes, and there’s a small fee for filing your state. If you want to get audit protection, it’ll cost you a little bit more and, of course, there are other add-ons that can drive the price up.

However, if you’re just filing your federal and state taxes with FreeTaxUSA, and don’t want the extra frills, FreeTaxUSA will cost you $12.95.

FreeTaxUSA does tell you upfront that only the Federal filing is free, so I do appreciate that clarity right on their home screen:

If you want to save a little extra, get the Rakuten extension. I was offered 25% cashback when I went to the FreeTaxUSA website, and my Rakuten extension noticed.

Want to save even more money on tax software programs? Our Rakuten review here will show you how!

A Review of FreeTaxUSA

I went through the whole process of filing with FreeTaxUSA just to see how intuitive it was, and if it gave answers to questions along the way. Overall, in my review of FreeTaxUSA, I found it was a pretty standard tax filing software program.

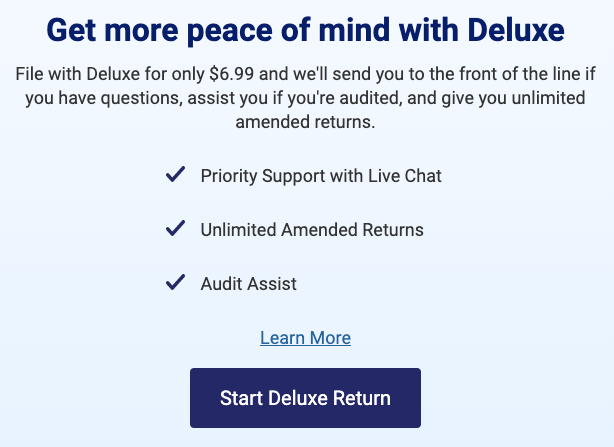

After filling out your identifying information, such as name, Social Security Number (SSN) and address (and your spouse’s, if married and filing jointly), the site asks if you’d like to upgrade to Deluxe.

If you do decide to upgrade with FreeTaxUSA, that will be a $6.99 charge. Deluxe includes priority support for the online live chat feature, audit assist if you’re to get audited, and unlimited amended returns. You don’t have to pay the $6.99 until you file, according to their website.

I skipped Deluxe because I wasn’t really filling it out to the point of submitting. But for audit assist, I wouldn’t mind paying that $6.99 because I wouldn’t know the first thing about being audited if it were ever to happen to me.

From there you fill out all of your Federal information, and here’s where it got a little on the confusing side.

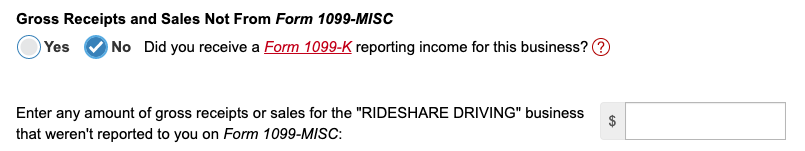

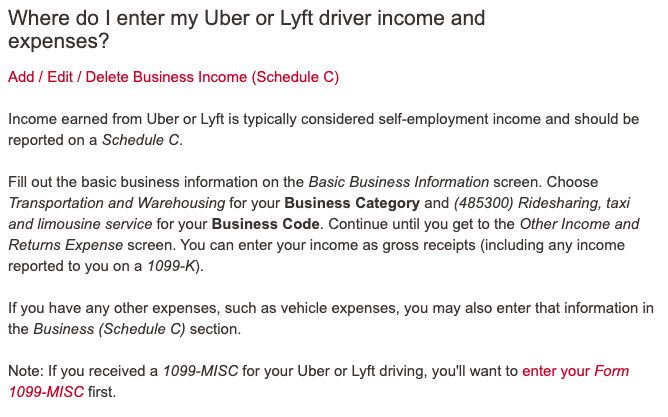

My husband got a 1099-MISC from Uber, so we started with that. From there it had you add up all of your other earnings from a 1099-K and your other gross earnings from rideshare driving and add it to one spot, but it was worded strangely, and I wasn’t very confident I was adding the information in correctly.

You enter your remaining earnings after entering your 1099-MISC, if you had one here. If you click on the question mark, you’ll see this if you say you’re a rideshare driver:

Then, it got easy again and showed me exactly where I needed to enter my mileage information, Uber and Lyft’s fees and all the other expenses I’d want to deduct. All in all, it’s a pretty handy Uber driver tax calculator for a free tax software program!

You can see what all of this information from Uber and Lyft looks like over at our Ultimate Rideshare Tax Guide here.

Once you complete your Federal filings, FreeTaxUSA will show you your projected owed or refund amount in the upper right-hand corner. It’ll then get your state information organized, pulling in as much information as possible from Federal so that state filing goes pretty quickly.

It even has a ‘maximize deduction’ option, where it asks you extra questions about other ways to deduct to get your maximum refund.

The last thing you’ll see is what you’ll owe or get refunded, as well as how much you owe FreeTaxUSA for filing:

Is FreeTaxUSA Safe? Is FreeTaxUSA Legit?

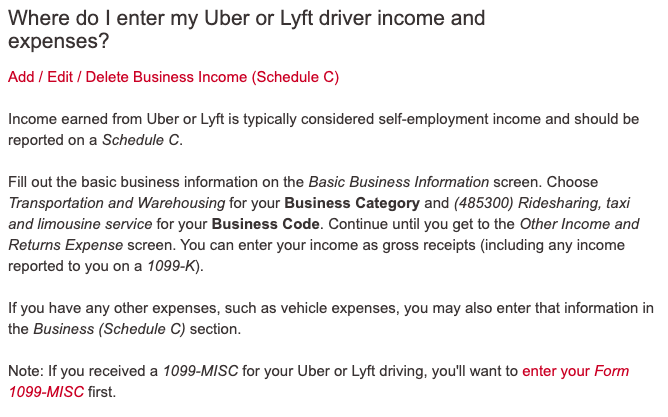

I would say FreeTaxUSA is both safe to use, and legit. FreeTaxUSA also does a good job of looking out for rideshare drivers, too.

At one point when asking about 1099’s, it had a link with information specifically geared toward rideshare drivers, and I found it very helpful. I usually don’t file my own taxes, so I wasn’t sure what information was really needed or where exactly I would file my information.

The Uber driver tax calculator it offers as you go through the program was also very helpful. I found the whole process pretty straightforward, which I appreciate as someone who doesn’t enjoy the tax prep process!

Final Review of FreeTaxUSA

If you’re looking for a way to file that’s 100% free, this isn’t the one for you. There is going to be a fee for filing your state taxes no matter what with FreeTaxUSA. (Note: unless you live in a state with no income tax).

Aside from that, however, I would recommend FreeTaxUSA if you don’t have anything too complicated to get through. It’s mostly straight forward with how and where to put your information for maximum deductions, and even has that extra help specifically geared toward rideshare drivers. And if you want to read about an alternative software, check out our Keeper Tax review.

Drivers, how do you plan on filing your rideshare taxes this year?

-Paula @ RSG